-

AuthorSearch Results

-

February 26, 2025 at 5:23 pm #20137

In reply to: Forex Forum

February 26, 2025 at 1:08 pm #20123In reply to: Forex Forum

February 25, 2025 at 8:03 pm #20087In reply to: Forex Forum

XAUUSD – Gold

Gold came very close to the support at 2880.00

Now I have seen some crazy moves in my carrier, but never really an instant come back from a dive like this.

It is possible of course, but Pattern wise – if tomorrow Gold hits straight up again, and doesn’t break to the new high , it will be just mere dying fish reaction – and then it will start downwards.

It was overdue for a decent correction for quite some time, so let’s see how it develops.

Supports: 2880.00, 2805.00 & 2735.00

Resistances: 2915.00, 2935.00 & 2955.00

February 25, 2025 at 1:41 pm #20062

February 25, 2025 at 1:41 pm #20062In reply to: Forex Forum

February 24, 2025 at 2:08 pm #20018In reply to: Forex Forum

February 24, 2025 at 10:16 am #19993In reply to: Forex Forum

Using my platform as a HEATMAP

Dollar close to unchanged after post-German election trading.

Focus on the EU and EURUSD after the German election results were about as expected.

Initial positive reaction was partly driven by hope a new government would remove the debt brake and more spending would boost the Econ. Perhaps on second thought is the reality of trying to put together and then govern with a three party coalition from opposite sides of the political spectrum.

EURUSD is back to square one after failing to hold 1.05+

Modest bounce in USDJPY but still below 150

European and US stocks up

Gold up modestly

Light data day

February 24, 2025 at 10:14 am #19992In reply to: Forex Forum

February 24, 2025 at 9:13 am #19987In reply to: Forex Forum

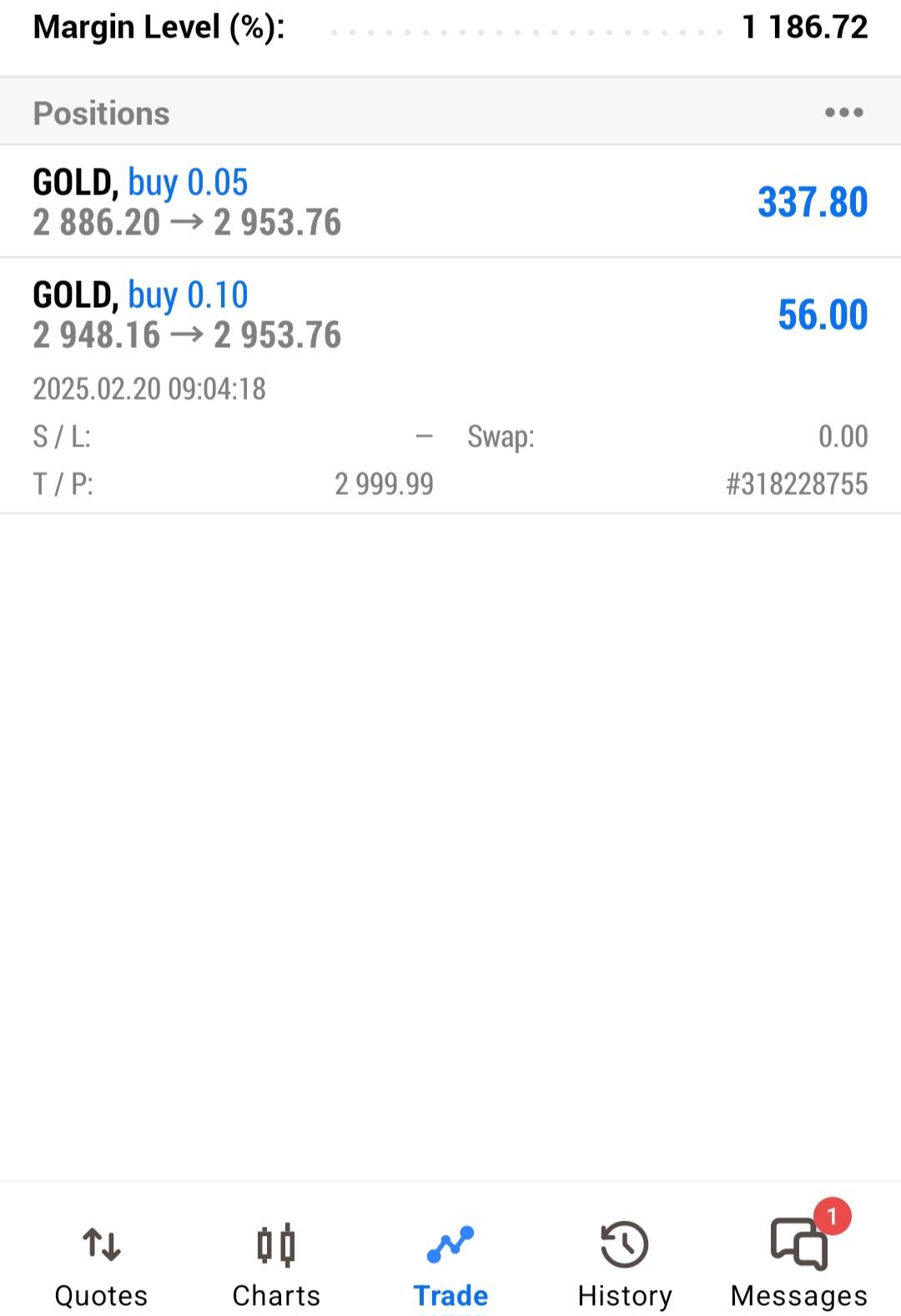

XAU/USD (GOLD) was at an all high price of 2955 as at lastweek Friday. From there it went bearish to the price at 2918 area. It has slowly climbed back and it is now at 2947 area. I see it getting to resistance point at 2955 and further breaking above it to 2980 area.

The Metal Gold is a bullish one. It has been steadily on the climb since 1996 and it is not yet tired of climbing. Let’s Trade carefully with tight Stoploss/Takeprofits. Do not risk more than 2-5% of your Capital. A word is enough for the wise.

Thanks,

TOPNINE.February 21, 2025 at 7:29 pm #19944In reply to: Forex Forum

What have I been saying about the target at USD$3000.40 and since when?. Just see how they do a copy and paste. The reporters have no analytical skills as an analyst and cannot hire analysts because SEBI had them shuttered… so how would a reporter be so accurate on a call like that? it’s obviously by plagarism.

Gold prices are in melt-up mode. Will the rally hit the USD3,000 wall?

https://economictimes.indiatimes.com/prime/money-and-markets/gold-prices-are-in-melt-up-mode-will-the-rally-hit-the-usd3000-wall/primearticleshow/118367454.cmsFebruary 21, 2025 at 7:25 pm #19943In reply to: Forex Forum

Gold ETFs offer up to 40% return in 1 year. Are you a gold bug?

By Surbhi Khanna, Feb 20, 2025, 12:13:00 PM IST

https://economictimes.indiatimes.com/mf/analysis/gold-etfs-offer-up-to-40-return-in-1-year-are-you-a-gold-bug/articleshow/118409198.cmsFebruary 21, 2025 at 7:25 pm #19942In reply to: Forex Forum

Gold ETFs turned Rs 10,000 monthly SIP into over Rs 9 lakh in 5 years. Did you miss the gold rush?

By Surbhi Khanna Feb 19, 2025, 01:23:00 PM IST

https://economictimes.indiatimes.com/mf/analysis/gold-etfs-turned-rs-10000-monthly-sip-into-over-rs-9-lakh-in-5-years-did-you-miss-the-gold-rush/articleshow/118381281.cmsFebruary 21, 2025 at 7:24 pm #19940In reply to: Forex Forum

As gold prices soar by Rs 8,300 per 10 gram in 2025, here’s how to buy jewellery via SIP

By Shivendra Kumar Feb 18, 2025, 12:45:00 PM IST

https://economictimes.indiatimes.com/markets/stocks/news/as-gold-prices-soar-by-rs-8300-per-10-gram-in-2025-heres-how-to-buy-jewellery-via-sip/articleshow/118349978.cmsFebruary 21, 2025 at 9:58 am #19900In reply to: Forex Forum

Using my platform as a HEATMAP

Dollar is firmer after yesterday’s sell-off

Led by USDJPY which had bounced back above 150 but remains below yesterday’s 150.91 breakdown level.

Only news I have seen is a pushback by several officials on rising JGB yields (10 year hit a 15+ year high)

EURUSD backed off from 1.05 awaiting Sunday’s German elections…. 1.0450 = neutral while within 1.04-1.05

Stocks steady after yesterday’s sell offs.

Gold extended its retreat from yesterday from a new record high but so far contained after testing 2918 support (low 2917).

Highlights:

Flash EZ and UK PMIs

Japan CPI (hotter but ignored)

See our Economic Calendar for upcoming US data

TGIF

February 20, 2025 at 9:32 pm #19890In reply to: Forex Forum

XAUUSD – Gold

New day – new high – and again just marginally higher.

To explain about these marginally higher highs – what it means?

It means that there are no stops above it – once there are no stops ( orders) interest to move higher is fading .

Without some serious news/fundamental reason it is now going to be very difficult to push it further Up.

Once stops are placed below 2.900 , it is going to become very interesting to start bidding lower….

Then it is going to be interesting – is Support at 2.870 going to hold, or deeper correction will be on cards.

February 20, 2025 at 3:16 pm #19872

February 20, 2025 at 3:16 pm #19872In reply to: Forex Forum

February 19, 2025 at 8:00 pm #19816In reply to: Forex Forum

XAUUSD – GOLD 4h

Here comes one hypothetical situation – kind of training session…in real time and for real money.

Let’s say one is Long Gold , waiting to see his/her profit target at 3.000 ( stubborn one :D, and missed to take a profit at previous highs ( seen it three times close to 2950.00)

Now what to do?

First to calculate if trailing stop at 2900.00 might work for him/her.If not, a tricky job is in front of us – for Gold to continue Up and reach a new high, 2935.00 has to be taken out in next two ( 2 ) hours.

If not taken out and this bar closes below 2935.00 , next leg will be down ( 95% chance)

I said two days ago that Top on Gold is being formed – when it comes to tops , after such a prolonged rally ( started on January 1st of this year ) few pips up or down do not matter – what matters is a formation – pattern that repeats every time , and it is becoming clear that without a decent correction this Rally is no more….

Now the rule is : once you miss the exit point / profit target , you have to bail out at best , even if at the end it moves in your direction more then you expected – you cannot afford another mistake – one is already done .

So, watch closely how it develops in next two hours and if it doesn’t go over 2935.00 start acting – you have enough time to think till then.

If you can live with the trailing stop at 2900.00 you can take your chance and in case Gold closes tonight above it, there is a chance of another leg up with a possible target at 3010.00

As long as you can exit your position with the profit , do not risk to have a loss at the end because you are hoping for another chance.

February 19, 2025 at 6:00 pm #19808

February 19, 2025 at 6:00 pm #19808In reply to: Forex Forum

February 19, 2025 at 10:24 am #19779In reply to: Forex Forum

Using my platform as a HEATMAP

Mixed USD, new record high for GOLD

EURUSD soft below 1.0450, EUR weak on crosses (e.g. vs JPY,GBP)

USDJPY failed again above 152 but downside so far contained…US bond yields tick higher again

Highlights;

Trump vows 25% tariffs on imported cars, pharmaceuticals, semiconductor chips… deadline April 2

UK inflation hotter than expected

Trump push for Ukraine peace deal, tariffs unsettles Europe but DAX unfazed

February 18, 2025 at 8:19 pm #19756In reply to: Forex Forum

CIO on squawk box

Gold rally driven by countries ‘starting to give hesitance’ in owning U.S. treasuries: CIO — on cnbcinteresting postulations

BUT … scratching my noggin … where (in NY) have I seen treasury buyers (who, which one) …

fly over and ask: how would you like us to not just go on strike BUT also start to sell your crap paper ?I know some here on the forum fondly remember *.”

February 18, 2025 at 5:16 pm #19740In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View