-

AuthorSearch Results

-

March 13, 2025 at 7:35 pm #20882

In reply to: Forex Forum

XAUUSD 4h

Resistance at 2985.00 holds its ground for now.

Supports move to 2965.00 & 2950.00

Unless we see a correction towards these supports, I don’t see a reasonable trade right now.

There is one possibility – for Gold to hold above 2980.00 overnight and continue straight up tomorrow – high risk trade.

March 13, 2025 at 4:25 pm #20870

March 13, 2025 at 4:25 pm #20870In reply to: Forex Forum

XAUUSD – Gold

March 11. : This is starting to look like a very nice Bullish Formation.

All time high at 2956.29 in my opinion is not going to stop it this time

So here we are….2980.00 New High and resistance at the same time.

If Gold manages above it today/tomorrow, we’ll have a rally straight to 3100.00 ( 3090.00 to be exact)

Supports: 2950.00, 2935.00 & 2905.00

March 13, 2025 at 3:42 pm #20869

March 13, 2025 at 3:42 pm #20869In reply to: Forex Forum

March 13, 2025 at 11:12 am #20839In reply to: Forex Forum

US OPEN

US equity futures are mixed & USD steady ahead of US PPI & geopolitical updates

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses opened lower but have gradually picked up; US futures are modestly lower/flat.

USD is steady ahead of PPI metrics, fleeting EUR softness as German political tensions mount.

Bunds are modestly lower awaiting the Bundestag debate while USTs look to PPI and shutdown developments.

Industrial commodities softer on tariff woes; spot gold inches closer to all-time-highs

.

March 12, 2025 at 1:18 pm #20790In reply to: Forex Forum

I am using Daily charts when giving a general direction and sometimes even Clear signals, but for those you have to wait sometimes for days…

It is possible to trade DAX, Gold, Bitcoin on small time frames, but I use very small time frames…15 min and smaller.

But be aware that only high liquidity pairs are behaving nicely….

March 12, 2025 at 1:13 pm #20789In reply to: Forex Forum

March 12, 2025 at 1:05 pm #20785In reply to: Forex Forum

March 12, 2025 at 1:04 pm #20783In reply to: Forex Forum

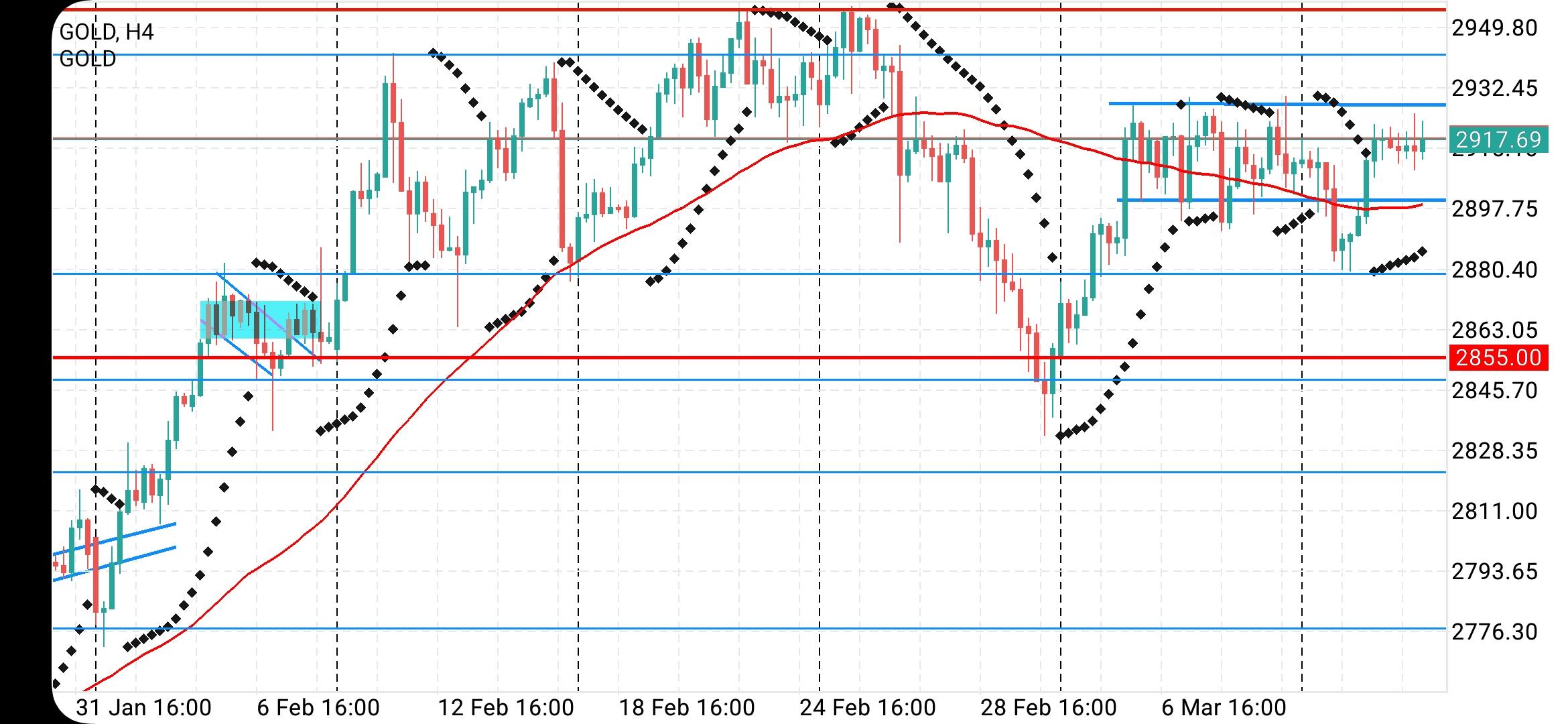

XAU/USD: Gold Sits Steady Above $2,900 as Focus Shifts to Looming Inflation Data

Key points:· Gold prices hug flatline

· Inflation report looms

· Where are rates going?

Gold prices XAUUSD held steady around $2,915 per ounce Wednesday morning with traders getting ready to be hit by the latest inflation report out of the US. Gold bugs can’t complain — their shiny stuff is doing numbers on the chart and the upcoming inflation data could stir things up even more.

The consumer price index USCPI dropping today is expected to show prices increased 2.9% in February. Oddly, analysts expect to see a pullback as January’s inflation pace was 3.0%.

If inflation turns out to be higher than expected, then the Fed might reassess its plans of cutting borrowing costs. Some analysts go as far as to predict that inflation could soar so much the Fed could be prompted to hike interest rates.

Rates staying where they are or even possibly moving higher could be detrimental to gold, because it’s a non-yielding asset and it may lose its appeal as a safe-haven in a market environment of higher interest rates.March 12, 2025 at 12:09 pm #20776In reply to: Forex Forum

US OPEN

US equity futures higher & USD incrementally gains ahead of US CPI; JPY modestly lags

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

· European bourses are in the green as sentiment in the complex improves; US futures are also higher with the NQ slightly outperforming.

· USD is a little firmer ahead of US CPI data, JPY lags peers.

· Bonds are bearish overall amid supply, inflation updates & German fiscal developments.

· Oil and base metals firmer, gold trades sideways ahead of US CPI.

March 11, 2025 at 8:13 pm #20759In reply to: Forex Forum

March 11, 2025 at 10:25 am #20728In reply to: Forex Forum

After seeog this headline, Hedge funds unwinding risk as in early days of COVID, Goldman Sachs says, I s thought of this blog article, which is worth revisiting. as the stock market meltdown is a classic example of a liquidating market.

What is a Liquidating Market and How to Trade It?

March 10, 2025 at 8:29 pm #20697In reply to: Forex Forum

Indian Customs // Thankyouthankyouthankyou!!! Gotta love em’!!!

smuggler “starlet” caught by customs with gold strapped to her body… starlet throws tantrums in court… top cop step father distances himself… international gold smuggling racket…

Over all the authorities have seized 17 crore + or 170 million

watch?v=UYM_KiNR-SA

March 10, 2025 at 12:45 pm #20638In reply to: Forex Forum

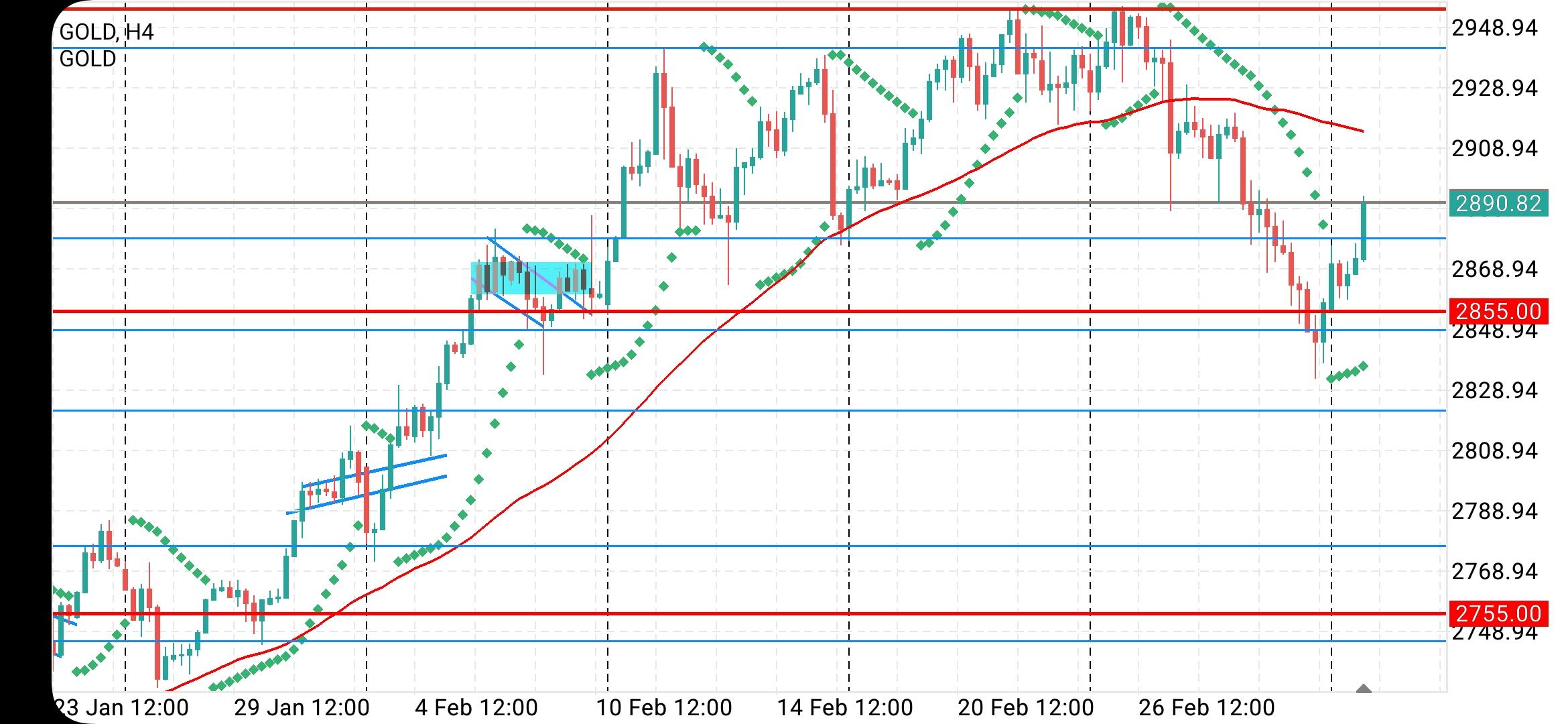

XAUUSD – Gold

Resistances: 2920.00, 2930.00 & 2960.00

Supports: 2895.00, 2880.00 & 2830.00

Gold tried for 5 days to go back above the previous support trendline – now Resistance, but failed.

Now we should see test of Supports – Ideally it should have a nice correction all the way to 2765.00, but 2830.00 would do the job as well…

March 7, 2025 at 10:01 pm #20599

March 7, 2025 at 10:01 pm #20599In reply to: Forex Forum

March 3, 2025 at 8:53 pm #20358In reply to: Forex Forum

March 3, 2025 at 5:19 pm #20349In reply to: Forex Forum

March 3, 2025 at 1:23 pm #20332In reply to: Forex Forum

March 3, 2025 at 10:14 am #20317In reply to: Forex Forum

A good morning to you this 3rd day of March 2025. The time is 11am and the mood is good. GOLD (XAU/USD) opened at price 2854 and has since midnight been on a long bias. The metal got to its highest point at price 2877 this moening and has since retraced to the lowest price at 2858.

From the price action i’m projecting a further buy bias to the rice area of 2884 at least. The gold is a buy metal and i see a further push upwards this week. Let’s see how it goes.

Please let’s be careful with out lot sizes and not place more than between 2-5% on any Trade. Protect your capital. A word is enough for the wise.

Thanks,

TOPNINE.February 27, 2025 at 1:42 pm #20172In reply to: Forex Forum

February 27, 2025 at 9:41 am #20162In reply to: Forex Forum

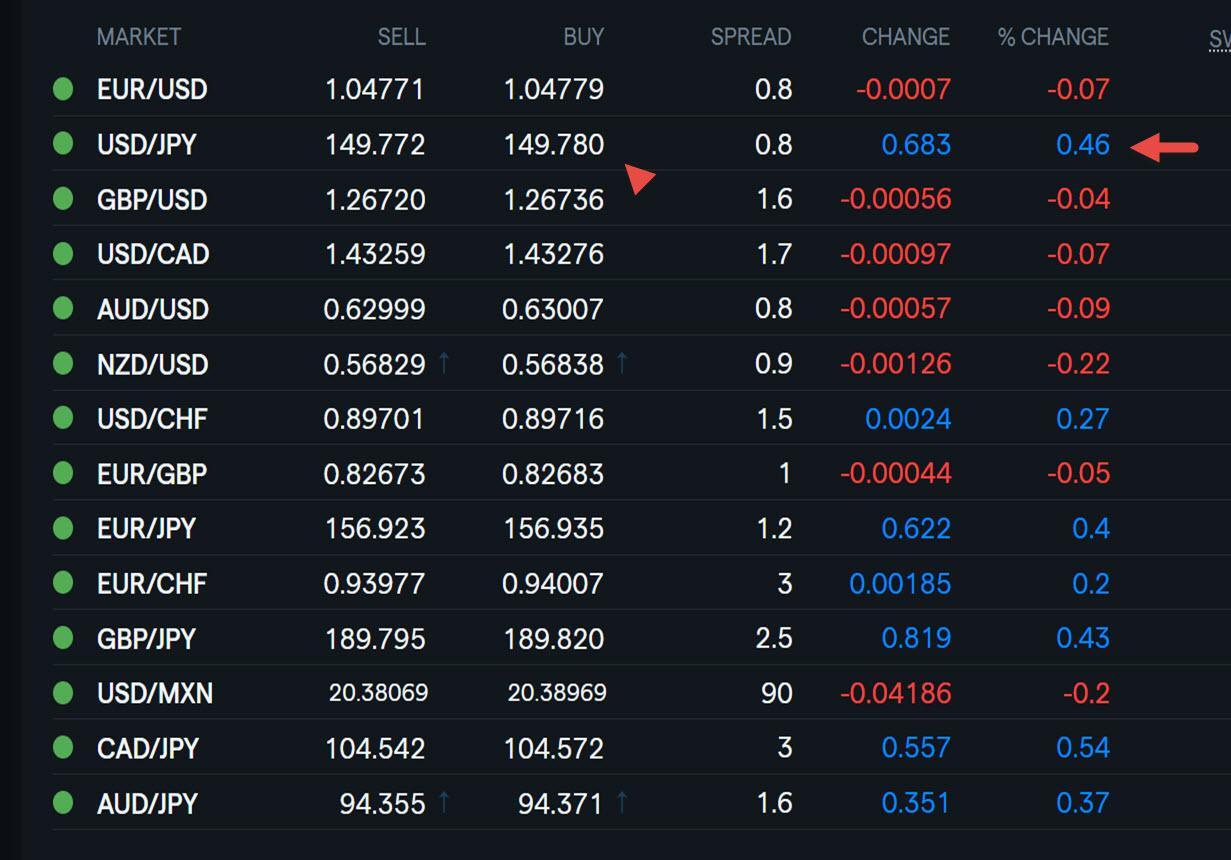

Using my platform as a HEATMAP shows

The dollar trading a touch firmer day before month end gyrations.

EURUSD yet to print 1.05 and extend its 5 day pattern around this level

USDJPY the outperformer after again finding support in the 148s but is still below 150.

Elsewhere

Gold is weaker

US bond yields are up after a sharp fall to 4.25% (10 yr) yesterday

Stocks up a touch

Watch for

US economic data durable goods 2nd GDP revision, weekly jobless claims) : see our Economic Daya Calendar

Trump speak: Watch headlines on tariffs after conflicting talk yesterday on Mexico and Canada

Trump due to speak in the morning and then an afternoon presser with the UK PM

-

AuthorSearch Results

© 2024 Global View

still consolidating

still consolidating