-

AuthorSearch Results

-

April 16, 2024 at 5:32 pm #4709

In reply to: Forex Forum

April 16, 2024 at 5:18 pm #4702In reply to: Forex Forum

April 16, 2024 at 5:01 pm #4701In reply to: Forex Forum

April 15, 2024 at 2:04 am #4587In reply to: Forex Forum

April 13, 2024 at 5:33 pm #4534In reply to: Forex Forum

April 13, 2024 at 3:06 pm #4530In reply to: Forex Forum

GVI 08:17 / the week-end is still young.

Did you bag the $100 bux on short Gold ?

–

curtesy cnn this sat 13th morning:

– Revolutionary Guards seized the vessel near the Strait of Hormuz, state media reported

– US expects Iran to carry out direct attack on Israel, sources say, as Biden warns ‘don’t’

– What an Iranian attack on Israel would mean for the US, according to retired general (hahaha)April 13, 2024 at 11:44 am #4524In reply to: Forex Forum

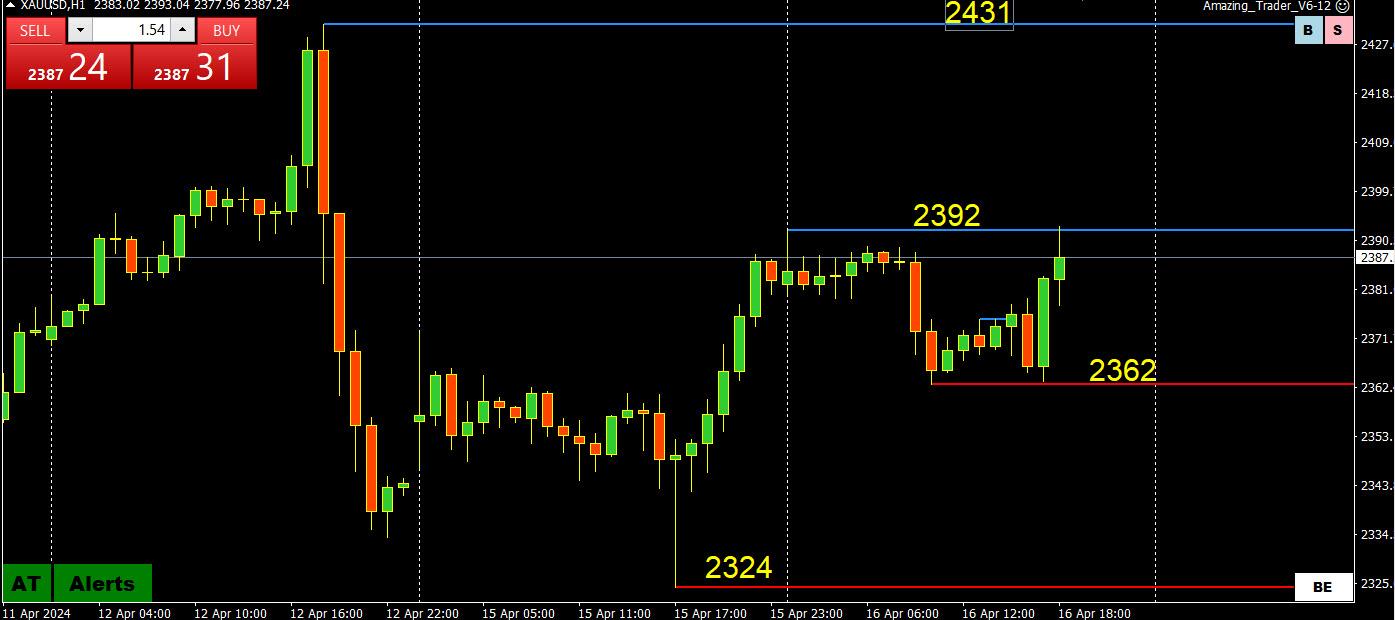

xAUUSD 4 HIUR CHART – NEW HIGH BUT THEN….

This is the second Friday that gold traders have seen a bloodbath, the last time trying to pick a top and this time sseeing a 4% drop after setting another record high.

The price action is not fatal to this relentless bull run, dependent on 2318 holding as support to keep the retreat from turning into a full-scale retracement.

What has changed is that moves up in XAUUSD will nort run into stops unless a new high is made.

April 12, 2024 at 8:17 pm #4511In reply to: Forex Forum

April 12, 2024 at 3:01 pm #4489In reply to: Forex Forum

DLRx 105.72

–

one would have to be somehow handicapped not to see the DLR romping and rampaging accorss the boad (except maybe vs the yen)as players are likely gaming a few energy vectors:

– goodly yield spread

— eyeballing and anxiously re-pricing FED gang miscalutations about inflation bumps

— GOLD continues to look uP (i.e. good) as is energy in form of oilsome thanks has to go to wild media headlines about harsh diplomacy between Israel and Iran for at least some portion of players running into dlrs thinking “haven”.

on deck

10:00 – U o M sentiment and U o M 1yr inflation

13:00 – schmid yaks about “econ Outlook”

14:30 – bostic yaks about housing

15:30 – daly chitchats at firesideearlier this morn collins prognosticateg that she sees no urgency to cut rates (and eyeballs two cuts in 2024)

I am biased BoD DLRx (and some dlr crosses)

April 11, 2024 at 6:42 pm #4426In reply to: Forex Forum

April 11, 2024 at 6:14 pm #4423In reply to: Forex Forum

April 11, 2024 at 6:00 pm #4420In reply to: Forex Forum

So what does that matter with currencies you ask? I asked so many times we lost count. Australian Dollar tends to move with Gold and Canadian Dollar tends to react with Oil. But it is not a perfect correlation. There is only one true correlation. Elevate your sense of markets. For example, when I was a CTA I would pull up Reuters front page first thing just to gauge the MOOD out there. Some people call that juvenile, but guess what, they apologize to you years later. Ultimately you have to make decisions. And everyone is on the hook. I found if you are not having fun, you are missing some things. When it gets fun, you are making money, but do not get arrogant. Always accept input. It is your choice of who or what to listen to. Don’t let the animated shock jockies touting 100000000000000 % gains fool you. I worked with some of them. Half ended up in handcuffs in major banks. Your trading has to be pure. You have to know you can. You have to feel you can. And you have to do it right. Then it gets good.

April 10, 2024 at 7:15 pm #4369In reply to: Forex Forum

April 10, 2024 at 4:13 pm #4346In reply to: Forex Forum

April 10, 2024 at 2:53 pm #4334In reply to: Forex Forum

April 10, 2024 at 2:03 pm #4319In reply to: Forex Forum

April 9, 2024 at 3:30 pm #4264In reply to: Forex Forum

April 9, 2024 at 3:19 pm #4262In reply to: Forex Forum

April 9, 2024 at 1:58 pm #4254In reply to: Forex Forum

THIS IS THE QUESTION BEING ASKED AS XAUUSD (GOLD) CONTINUES ITS RELENTLESS CLIMB TO NEW HIGHS. SEE WHAT MIGHT COME NEXT IN THIS EXCLUSIVE BLOG ARTICLE

Just today Gold has hit it’s new record high of All Times – 2365.34 $ per Ounce.

In the past year, it has surged roughly 16%, and just in the past month 5.6%

April 9, 2024 at 11:33 am #4246In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View