-

AuthorSearch Results

-

August 1, 2024 at 9:17 pm #9949

In reply to: Forex Forum

August 1, 2024 at 4:00 pm #9926In reply to: Forex Forum

The S/P 500 Strategic Commodities Index is beginning to trade under its equilibrium slightly and so when it arrives around certain areas which would coincide with Gold pricing 2470 to 2480 that is a zone I expect to see some more robust buy side activity in Gold again. (Got your back JP)

JP – regarding the FED…one has to. In similar fashion to the value of the US Dollar itself. The Dollar is backed by the confidence that the market has in future economic performance. Not Gold (there is not enough store to sustain the US economy for more than 48hrs even in war time). The FED impacts markets with their views on confidence. So the FED is viewed as both cause and effect. The problem is the accounting. When I was majoring in accounting I proved to the instructor that the books could be cooked without affecting the balance sheet during finals. I got an A on the final but was flunked for disproving actuary out of spite by the instructor lol.

That is what the FED has been doing of late.

August 1, 2024 at 2:37 pm #9919In reply to: Forex Forum

July 31, 2024 at 8:09 pm #9883In reply to: Forex Forum

XAUUSD – Gold Daily

Gold posts record-high finish, lifted by Fed rate-cut hopes, Middle East violence

Gold futures settled sharply higher Wednesday, with prices marking a fresh record-high finish, as expectations for a U.S. interest-rate cut in the coming months and violence in the Middle East lifted the precious metal’s investment appeal.

“Heightened Middle East tensions and hopes for Fed rate cuts have restored gold” back above the psychologically important $2,400 level

Technical view : Channel Support held and now we have to see how it will react on previous high 2483.68 and if above next hurdle is at 2.600

Bullish as bullish can be 😀

July 31, 2024 at 1:59 pm #9845

July 31, 2024 at 1:59 pm #9845In reply to: Forex Forum

I would like to see AudUsd 6450 or lower to provide an opportunity to load up on the buy side for 6650. That pair and Gold have stable fundamentals. People thought I was far fetched a month ago when UsdJpy was in pure buy mode and I said we would hit 153 or even 150 in coming weeks. Are we there yet?

July 30, 2024 at 5:12 pm #9811In reply to: Forex Forum

July 29, 2024 at 4:11 pm #9751In reply to: Forex Forum

July 26, 2024 at 4:32 pm #9684In reply to: Forex Forum

Over a $50 Trillion demand increase is expected for H2 of this year in Gold. If your preference is stocks instead of futures or spot correlated currencies, but you want to spread your allocation with relation to gold related holdings, consider defense related stocks which significantly require gold for product production. An example would be Raytheon, which builds missiles and radar systems among other things, or other entities involved with satellites or other dependent systems. Its also a decent addition to hedge against sudden market shocks.

Q: Do I suspect pending sudden shocks looking outward? A: Very stupid and bad people exist.

July 25, 2024 at 6:47 pm #9656In reply to: Forex Forum

Yesterday I suggested a very low priced stock for stock enthusiasts with not much money to work with, GROY. A gold stock. The delta is 100%. Today there ratio of calls to puts is 329% in favor of the calls (buy side). This stock does tend to move in a somewhat decent fashion with gold itself. Food for thought.

July 25, 2024 at 12:01 pm #9630In reply to: Common Sense Trading

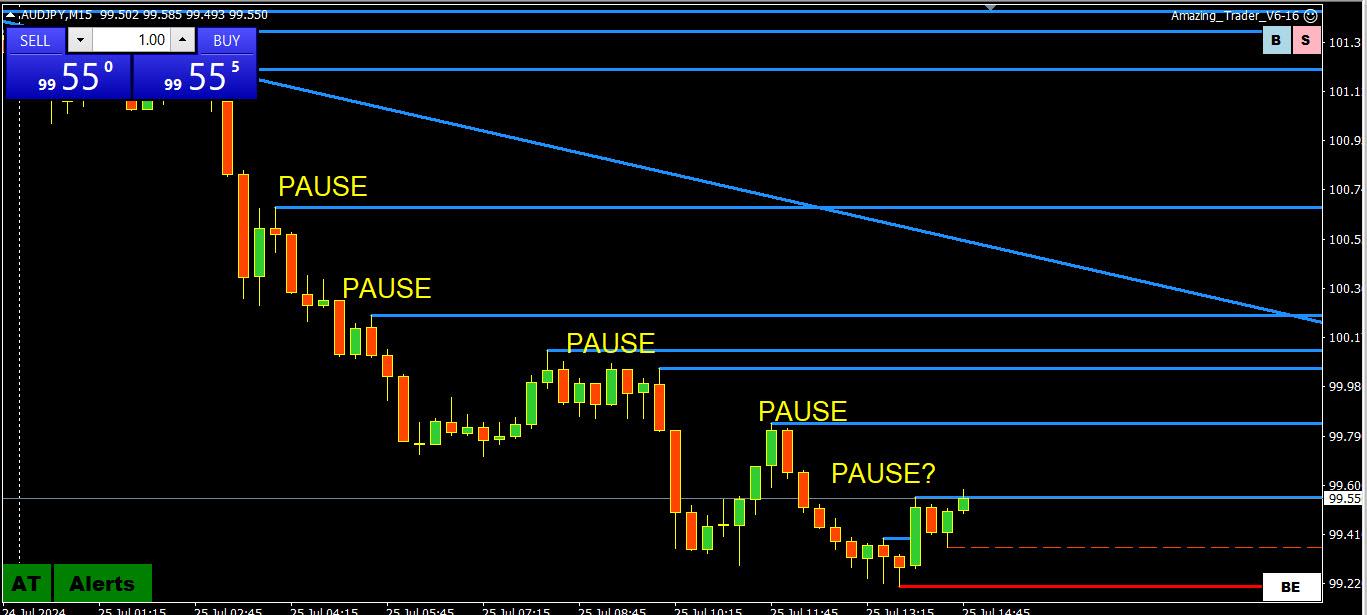

What is a Liquidating Market and How to Trade It

Not all markets should be treated the same. It is therefore tmportant to identify whether you are in a trend, correction, consolidation or what I call a liquidating market.

What is a liquidating market?

A liquidating market is one where the flows are looking to exit positions and not add to existing ones.

For example, take the current market where short JPY carry trade positions (we will discuss carry trades) are unwinding in forex, gold, stocks. One of the lead in fx is AUDJPY, which is down 11 days in a row. See this 15 minute chart from July 25, 2024 and not how at each pause, there is a minor uptick followed by a push to fresh lows.

So the question is once you recognize the market is in a liquidating mode, how do you trade it?

IDENTIFYING THE TYPE OF MARKET YOU ARE IN IS ONE OF MY KEY FOREX TRADING TIPS.

The way these types of markets tend to trade is that they move in spurts as orders get executed and positions liquidated. Once the order is done, you may see some backing and filling as selling (as in the above case) is done and bottom pickers come in. (and vice versa when short positions are liquidated).

This often gives a false sense of a bottom as the market backs away from the low until the next wave of sell orders. This squeezes those trying to pick a bottom as they get stopped out by fresh selling and a new low.

Much depends on whether key technical levels get triggered as this can accelerate the move and bring in fresh selling. Liquidating markets will eventually exhaust themselves and finally reach a bottom, either by a key technical level holding or by the selling just running out of steam.

How to trade a liquidating marker

The way to trade a liquidating market is either to sell (or buy as the case may be) on the backing and filling but that is often difficult as it is hard to find a nearby stop if the chart is like a one-way street.

Another way is to put a stop entry at the low or high to go with the next wave of sell (or buy =0 order liquidations.

The other way is to wait it out and only go against the move if you sense it has completely lost steam.

However, the tendency is to buy at each pause, hoping to catch the falling knife after a new low. The danger in this approach is that by the time a low is in place you may be too beaten up to catch the bottom.

The key point is to recognize the type of market you are in and that the hardest trade is often the right trade. The easy and in this case the wrong trade is to buy the easy to get filled at what looks like an attractive level trade.

Note I used a market that is liquidating long positions as an example. The same principle applies to when short positions get liquidated.

July 24, 2024 at 6:28 pm #9602In reply to: Forex Forum

I believe we should see Bitcoin futures at 6040 in coming weeks though there is decent potential to see 6800 or higher prior. Enjoyed the Ether ETF rolling out the other day. Any participation in crypto on my part at this stage is purely speculative due to them not yet being mature instruments. I realize that upsets the average GenZ and Millennial anarchist who wants them to replace to US Dollar so they can feel like they changed the world and are oh so smart, but those are just the facts. They should transform to being more viable financial instruments over time like moth larvae somewhat in around 2 years from now. Ultimately Stablecoin will dominate the pool of fringe crypto’s in various respects.

On another note I like the buy side of Gold stocks and if you don’t have much money then GROY (Gold Rty Group) from the 1.30’s or perhaps even 1.40’s is decent R/R you can live with even if it doesn’t go your way right away.

July 22, 2024 at 7:57 am #9443In reply to: Trading Academy Q&A’s

Thank you Jay & Bobby, I hope my question, and answer helps others as that was the main point of it.Bobby is right that you need to know the pair you are trading, but I have done this for 20 years now and my Wife has more than that…so we cover many markets between us and monitor different methods, multiple strategies and communicate across the desk like in a firm. It is the only way we can stay competitive in this business.

We trade like Jay said, kind of old school some would say, see what is moving, instantly spot what that means about where the flows are, be aware of the day/week of the month regarding Options and key scheduled news, figure out if the flows are going to continue into the next session i.e. will europe to NY continue direction after a pullback or will NY reverse the direction.

If there is surprise geopolitical news or comments and the market moves quickly, you have to know if the move should be faded (usually if its just a comment and the move goes against the flow as it can be creating an opportunity to add even though they make it look like a reversal) and you have to be aware of multiple time frames, especially you have to know where the DXY is trading, where we are in Futures regarding time of month/quarter/year and also what are Bonds doing…oh and what have been the ranges this month, are they nearing their average or do they need a good move to complete their monthly move which can then be faded.

Putting all this together means we were able to jump into USDCAD Long and Short for 40 pips on Friday in what was a very small range day in Euro.Basically you have to love the game, right?Like just now, im writng this…wife says “check gold, im scalp long @2400”), I glance at it, see its at a level of interest and jump in, best signal service there is! (one of many trades so if it doesnt work out its ok, especially as we dont do much before NY session on Mondays, sometimes nothing until after London Fix (Fix is also something you need to be aware, Time of Day…)

Thank you Jay and Bobby for creating this place, I hope you get as much interest as it deserves.

CheersAlanJuly 19, 2024 at 8:23 pm #9396In reply to: Forex Forum

July 19, 2024 at 4:53 pm #9383In reply to: Common Sense Trading

A taste of things to come

Look at this chart and you get a taste of what you will see here going forward.

This is a chart with my Amazing Trader program running on it. It is the definition of a liquidating marlket.

Note the top 2 blue lines, the first indication of a potential top and change in direction.

Often after a third line, you will see an acceleration, in this case to the downside and you can see what followed.

This is a 4 hour chart but the same patterns work on any time frame, 5. 15. 30 etc.

Now let me tie this together.

Do you remember what I said about the importance of the high and low of the day or time frame chart.

This is the only level where there are stops to run., If the market cannot break to a new high or low, it will lose interest on that side and probe the other side in search of stops.

This is what happened in gold after breaking to a new record high.

This is a simple and common sense way of looking at trading. You can use any charting application to apply it. I find The Amazing Trader is the clearest way to identify a pattern.

We will cover the finer details in a later discussion/

July 19, 2024 at 3:48 pm #9377In reply to: Forex Forum

July 19, 2024 at 12:59 pm #9369In reply to: Forex Forum

July 18, 2024 at 10:27 am #9291In reply to: Forex Forum

Catastrophically stupid – in hindsight

Former Goldman, Blackstone analyst gets 28-month prison sentence for insider trading

NEW YORK (Reuters) – A former Goldman Sachs and Blackstone analyst was sentenced to 28 months in prison on Wednesday for insider trading, after admitting that his conduct was “catastrophically stupid.”

July 17, 2024 at 7:53 pm #9282In reply to: Forex Forum

XAU/USD: Gold Soars to Record Above $2,480 on Rate Cut Hopes

· Gold prices blast to new record.· Bullion hits all-time high of $2,480.

Gold XAUUSD is on a tear. The precious metal hit an all-time record of $2,480 per ounce during the Asian session Wednesday as traders were feeling confident to pile their long bets. Optimism over the Federal Reserve’s interest rate cuts is back after a slew of favorable economic data and the man himself striking an upbeat tone on inflation — Jay Powell said Monday that the Fed is happy with the inflation’s downward trajectory.

July 17, 2024 at 11:33 am #9252

July 17, 2024 at 11:33 am #9252In reply to: Forex Forum

July 17, 2024 at 10:26 am #9244In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View