-

AuthorSearch Results

-

September 14, 2024 at 1:46 pm #11658

In reply to: Forex Forum

September 13, 2024 at 2:19 pm #11620In reply to: Forex Forum

September 13, 2024 at 11:08 am #11605In reply to: Forex Forum

Sept 13 (Reuters) – A look at the day ahead in U.S. and global markets by Amanda Cooper.

What a difference a day makes. Just 24 hours ago, investors were coming to terms with the idea that a half-point rate cut next week from the Federal Reserve was unlikely and a quarter-point drop was much more in line with a soft-landing scenario.

A couple of articles by closely followed Fed correspondents in the Financial Times and the Wall Street Journal overnight, along with comments from influential former Fed official Bill Dudley, have been enough to flip those assumptions on their head. It’s now pretty much 50/50 as to whether the Fed goes 25 basis points or 50 on Sept. 18.

September 13, 2024 at 8:06 am #11596In reply to: Forex Forum

September 12, 2024 at 6:58 pm #11591In reply to: Forex Forum

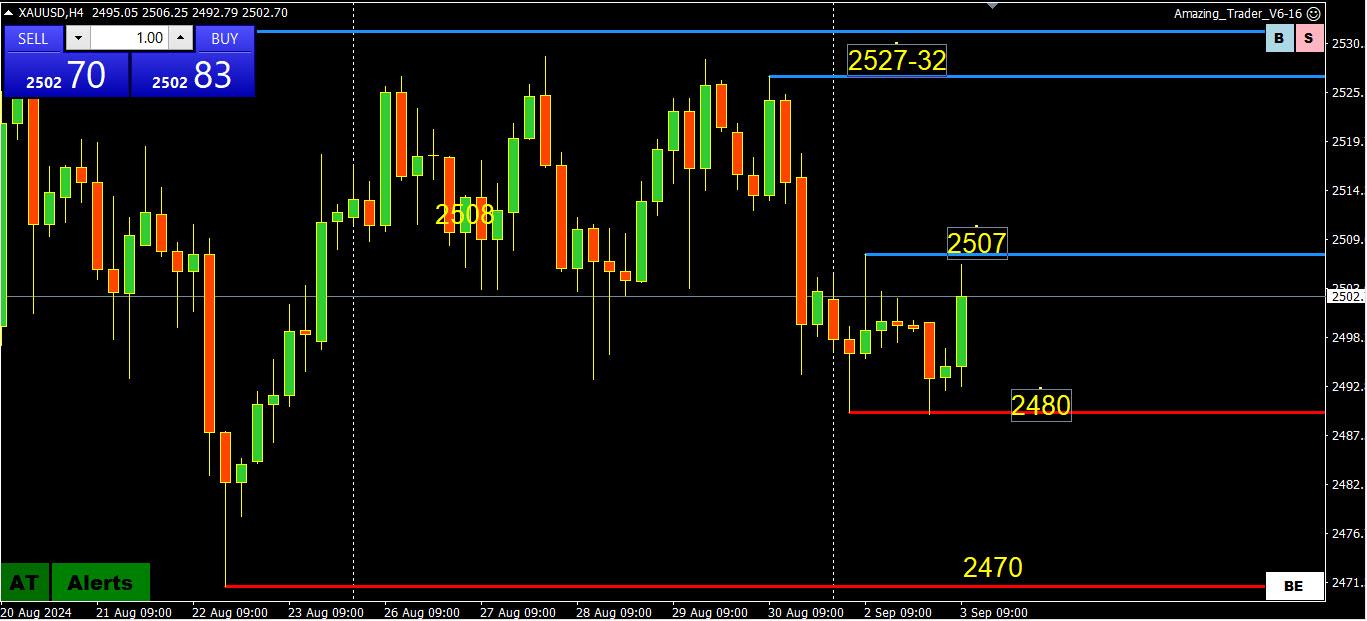

XAUUSD – Gold

Supports : 2530.00 , 2500.00 & 2470.00

Resistances : 2590.00 , 2620.00 & 2730.00

If what we have seeing in last two months was a consolidation phase, this might be a start of the Rally.

Two levels come to mind in that case : 2750 & 2850

Mind you, market has no brains – I still remember Gold at 250 ( yes, didn’t miss a zero here – two hundred and fifty ), and at that time I had a problem calming down some big clients , forcing them to hold on their gold ( physical ) .

Now in this time of uncertainty , what better then Gold ?

September 12, 2024 at 3:43 pm #11579

September 12, 2024 at 3:43 pm #11579In reply to: Forex Forum

September 12, 2024 at 2:18 pm #11575In reply to: Forex Forum

September 12, 2024 at 1:57 pm #11573In reply to: Forex Forum

September 12, 2024 at 1:14 pm #11570In reply to: Forex Forum

September 12, 2024 at 1:01 pm #11568In reply to: Forex Forum

September 9, 2024 at 5:43 pm #11475In reply to: Forex Forum

September 9, 2024 at 5:29 pm #11474In reply to: Forex Forum

September 4, 2024 at 3:48 pm #11280In reply to: Forex Forum

September 3, 2024 at 9:29 am #11206In reply to: Forex Forum

September 1, 2024 at 4:49 pm #11174In reply to: Forex Forum

BTC DAILY CHART – GLASS HALF EMPTY OR HALF FILLED

i t may be a matter of looking at your glass half empty or half full after BTC held a test below 50K but failed to get back above 65K.

Personally, if I was a BTC bull (for the record I do not trade cryptos) I would be disappointed that it has not been a safe haven that followed gold to a record high

In any case, the current range is just outside 55K-65K with 60K clearly pivotal in setting its trading tone.

August 30, 2024 at 9:35 pm #11165In reply to: Forex Forum

Goldilocks market?

Summary

Economic data supports expectation of 25 bps cut in September

Marvell jumps after forecast beats estimates

Ulta Beauty tumbles following annual forecast trim

S&P 500 +1.01%, Nasdaq +1.13%, Dow +0.55%

Aug 30 (Reuters) – Wall Street stocks rose and the Dow scored a second consecutive all-time closing high on Friday, with Tesla and Amazon climbing after fresh U.S. economic data raised expectations that the Federal Reserve will cut interest rates modestly in September.

August 23, 2024 at 11:32 am #10847In reply to: Forex Forum

Gold related stocks I view and/or participate in have option/futures/forward/counter/other metrics dominant on the buy side entering the NY session.

Eu metrics are heavily weighted to the sell side.

U/Y metrics are balanced and flattening with one exception which is heavily dominant on the buy side.

August 22, 2024 at 11:08 pm #10840In reply to: Forex Forum

For consideration regarding real economics according to the respected source Resume Builder:

1. 4 out of 10 jobs posted in the US in 2024 were “fake.”

2. 3 out of every 10 jobs in 2024 had roles that were not “real.”

This, added to the BLS not reporting almost 1 million job losses in the last report, and the continued high inflation in real terms not “how its doing the last two years” is not the rosy picture some are painting.

Result:

1. Buy military defense, gold, energy dividend, AI, and staple stocks.

2. Bonds/notes.

3. Less performance related currencies.

4. Coffee and Booze related commodities.

August 21, 2024 at 1:10 pm #10772In reply to: Forex Forum

Referencing GV and JP posts below:

1. Democrats and their propaganda arm which is no longer a FED but is the FED, will try to just ignore the almost 1 million job losses they hid from plain sight, knowing their faithful cheerleaders only hear the headline releases and not the nasty realities under the hood such as labor participation rate, and hope the matter evaporates in favor of other weighty issues on the airwaves. Some people refuse to believe they have been celebrating and glorifying con artists.

2. Perusing the mix of economic and geopolitical matters dominating the airwaves it is evident that there has been such an incredible mess across the board that it became an aimless chase of which matter of the moment is the worst/best for causation of price activity. Which has now settled into catatonia.

3. Bottom line is a highly dysfunctional cesspool of political and economic agendas and practices across continents.

What matters now is what matters to the portfolios of Goldman Sachs and SaxoBank, who were on Bloomberg last night voicing their disgust, and how they approach adjusting their risk exposure. My experience with those entities is they have already largely done that far ahead of the curve as a responsible employment of “just in case” hedging allocations.

The market is more numb now to sudden dramatic events of most kinds and is in search of legitimate prospects to chase.

USD was receiving follow up flows pre-Asian session last night to prop the Dollar which I capitalized on if you read my post from Asia last night. They are rebalancing some Dollar exposure to strengthen in spots as much has been priced in with relation to interest rate reduction in the US. Amazingly, this time the banks are behaving far more legitimately than politicians taking your money like Greta Thornburg selling a coming ice age.

August 21, 2024 at 2:15 am #10754In reply to: Forex Forum

Rode the short all day from early US and hit the bid at 155.00 even, prime t/p is 145.90 to be safe. The Asian session bias is at equilibrium at 145.25 and non-committal to breaching 145.60 or 144.90 decisively headed into the second half. Europe should be interesting.

Of interest to me is how democrats/FED are going to explain away the almost 1 million job losses they just confessed to that they hid from plain sight. Saxo Bank and Goldman just publicly voiced the same interest in an explanation on Bloomberg.

-

AuthorSearch Results

© 2024 Global View