-

AuthorSearch Results

-

October 8, 2024 at 1:55 pm #12584

In reply to: Forex Forum

There are times when 1 + 1 = 3

This feels like one of them in the absence of fresh economic news

Middle East tensions simmer with Israel reprisal vs Iran looming at any time

US bond yields up, stocks up – no ign of risk off

Commodity currencies still struggling – sign of risk off

‘

GOLD unable to catch a safe haven bidAs for FX, use the anti-dollar EURUSD 1.10 as a USD strength/weakness indicator…. last at 1.0975

October 8, 2024 at 9:51 am #12575In reply to: Forex Forum

XAUUSD DAILY CHART

Since setting a record high 9 days ago, XAUUSD has traded either side of 2650 in the following 8 days.

This is clearly the pivotal level, especially if you view the current range at 2600-2700.

‘

GOLD has been aa disappointment in that it is not benefiting from safe haven flows but it remains to be seen if it is just biding its time, In any case, 2650 will eventually dictate whether the current move is just a pause or the start of a retracement,October 7, 2024 at 7:35 am #12524In reply to: Forex Forum

It’s Monday – quick summary

Israel-Hezbollah heating up

US Stocks turn down..

Dollar up a touch except vs JPY

USDJPY paused below 149.37 and is down sharply but still above 148

EUEUSD came within a hair of testing 1.0049, stays on the defensive as long as it stays below 1.10

Gold so far not benefiting from geopolitical risks… continues to pivot 2650… see update below

October 3, 2024 at 1:56 pm #12430In reply to: Forex Forum

XAUUSD – Gold Daily

Supports : 2630.00 , 2620.00 & 2600.00

Resistances : 2675.00 , 2685.00 & 2710.00

As long as 2630.00 support holds, we can see aggressive move Up towards 2800.00 area.

If 2620.00 lost, we’ll be watching deeper correction.

Above mentioned Resistances are projections based on previous Upticks and Bullish angle.

October 2, 2024 at 3:17 pm #12399

October 2, 2024 at 3:17 pm #12399In reply to: Forex Forum

October 1, 2024 at 4:50 pm #12352In reply to: Forex Forum

October 1, 2024 at 1:35 pm #12328In reply to: Forex Forum

September 27, 2024 at 10:49 am #12144In reply to: Forex Forum

September 26, 2024 at 9:59 am #12089In reply to: Forex Forum

XAUUSD 4 HOUR CHART

Consolidating between 2650-2570 (record high) for 2 days… given the strength of this move, there are not likely to see a lot of stops above the high bid… keeps a bid as long a 2650 trade.

Risk on/risk off does not seem to influence gold so watch to see if can extend its record high… if not then it would need to break below 2650 to suggest anything more than a pause.

September 23, 2024 at 6:40 pm #11977In reply to: Forex Forum

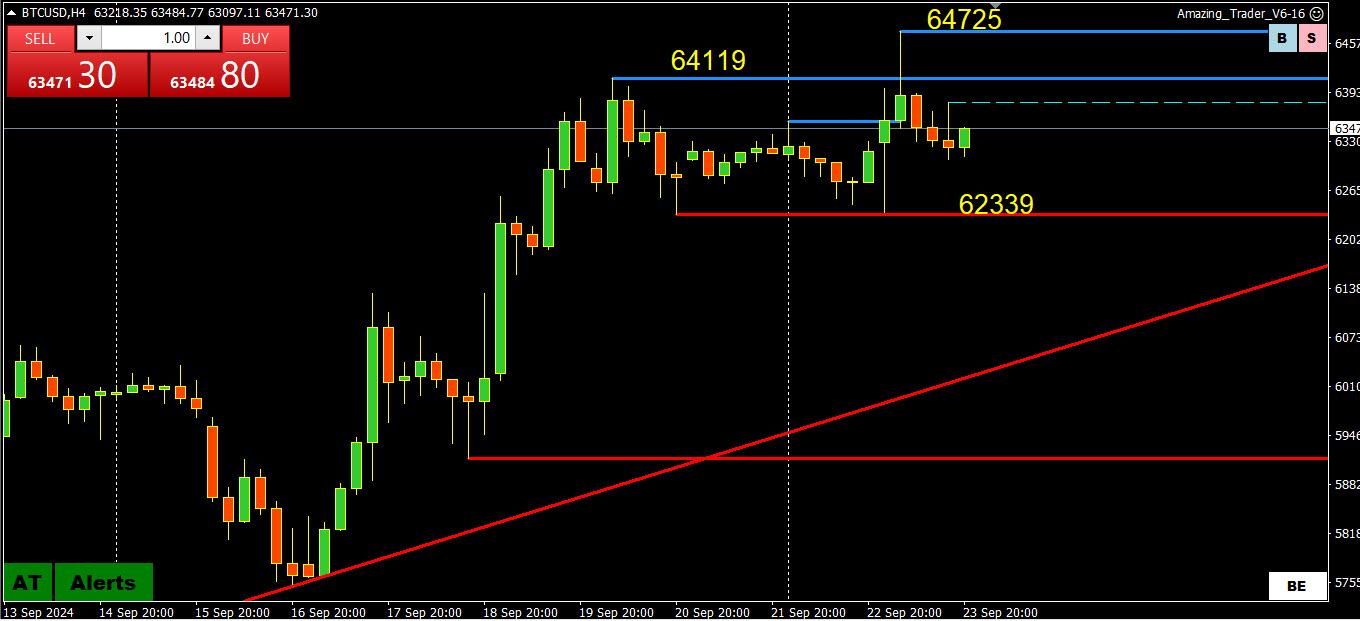

BTC 4 HOUR CHART – GLASS HALF FULL OR EMPTY?

Those trading BTC are likely frustrated watching GOLD trade to new record highs while this crypto strugglres to build momentum..

While technicals are tilted more to the upside, to suggest a shift in target to 70K it would have to solidly take out 65-66k

Otherwise, expect more chop while it stays within 60-65K.

September 20, 2024 at 8:10 am #11884In reply to: Forex Forum

September 20, 2024 at 6:52 am #11883In reply to: Forex Forum

September 19, 2024 at 9:25 pm #11881In reply to: Forex Forum

Gold – XAUUSD Daily

Supports : 2575.00 , 2560.00 & 2530.00

Resistances : 2600.00 , 2610.00 , 2620.00 & 2640.00

This might look to you as a perfect pattern for next move Up, but I have to warn you that it is NOT.

It is at best 50-50 chance

I am not saying Gold won’t continue up in coming days, but that I wouldn’t expect it to happen tomorrow.

Plus there is something off with it – so let’s see how it develops…

September 19, 2024 at 9:10 pm #11879

September 19, 2024 at 9:10 pm #11879In reply to: Forex Forum

September 18, 2024 at 6:06 pm #11820In reply to: Forex Forum

September 18, 2024 at 4:46 pm #11809In reply to: Forex Forum

September 18, 2024 at 1:31 pm #11792In reply to: Forex Forum

September 17, 2024 at 8:47 pm #11776In reply to: Forex Forum

Nasdaq – NDX

Nasdaq composite: Once again, it’s make-or-break for breadth

Dow futures up slightly, S&P 500 slip, Nasdaq 100 off ~0.5%Sep NY Fed Manufacturing index 11.5 vs -4.75 estimate

Euro STOXX 600 index off ~0.1%

Dollar down; bitcoin off ~2; gold edges up; crude up >1%

U.S. 10-Year Treasury yield ~flat at ~3.66%

NASDAQ COMPOSITE: ONCE AGAIN, IT’S MAKE-OR-BREAK FOR BREADTH

The Nasdaq composite IXIC is still down more than 5% from its record highs. That said, the tech-laden index is on a five day win streak, and just posted its biggest weekly rise since early-November 2023.September 16, 2024 at 9:10 am #11689

The Nasdaq composite IXIC is still down more than 5% from its record highs. That said, the tech-laden index is on a five day win streak, and just posted its biggest weekly rise since early-November 2023.September 16, 2024 at 9:10 am #11689In reply to: Forex Forum

September 16, 2024 at 4:28 am #11683In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View