-

AuthorSearch Results

-

April 2, 2025 at 10:22 am #21853

In reply to: Forex Forum

US OPEN

Cautious risk tone ahead of reciprocal tariff updates on ‘Liberation Day’

Good morning USA traders, hope your day is off to a great start! Here are the top 6 things you need to know for today’s market.

6 Things You Need to Know

US “Liberation Day”: US President Trump to announce reciprocal tariffs at 16:00EDT/21:00BST on Wednesday; US Commerce Secretary Lutnick speaks at 08:30EDT/13:30BST

USTR has reportedly prepared “an across-the-board tariff on a subset of nations that likely would not be as high as the 20% universal tariff option”, according to WSJ.

Stocks move lower as markets await reciprocal tariff updates on “Liberation Day”.

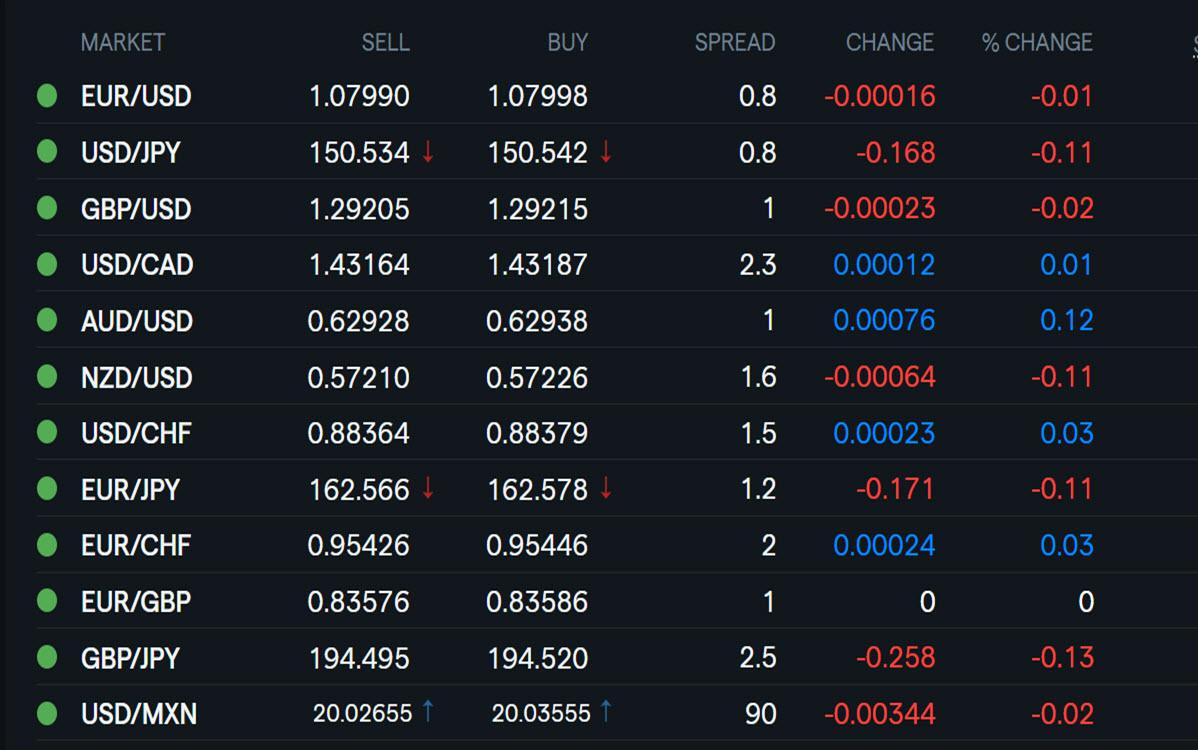

USD steady, Antipodeans outperform whilst Havens lag a touch.

Bonds largely in a holding pattern as we await the Rose Garden speech.

Crude is incrementally lower whilst spot gold prices remain underpinned by haven demand.

April 1, 2025 at 7:56 pm #21839In reply to: Forex Forum

April 1, 2025 at 4:04 pm #21822In reply to: Forex Forum

Stocks rise, gold at record as investors await Trump tariff clarity

Bond yields fall, yen gains as safe havens garner demand

Spot gold hits record high at 3,148.88 per ounce

Oil eases from 5-week high as traders weigh slowdown risks

Global stocks rose on Tuesday following Wall Street’s overnight gains, while gold hit an all-time peak and Treasury yields fell as markets awaited details of U.S. President Donald Trump’s reciprocal tariffs.

The Japanese yen held firm, as did the Swiss franc, as traditional haven assets drew demand.

At the same time, the risk-sensitive Australian dollar rebounded after the Reserve Bank of Australia left interest rates steady, as widely expected, but warning of “pronounced” global uncertainty.

Investors are nervously awaiting April 2, a day Trump has dubbed “Liberation Day”, when he has promised to unveil a massive reciprocal tariff plan.

The Office of the U.S. Trade Representative released its annual report on foreign trade barriers on Monday, which contained scores of other countries’ policies and regulations it regards as trade barriers.

Yet it was unclear how the 397-page report will impact Trump’s reciprocal tariff plans.

April 1, 2025 at 9:31 am #21781In reply to: Forex Forum

Gold Hits Fresh Record as U.S. Tariffs Loom

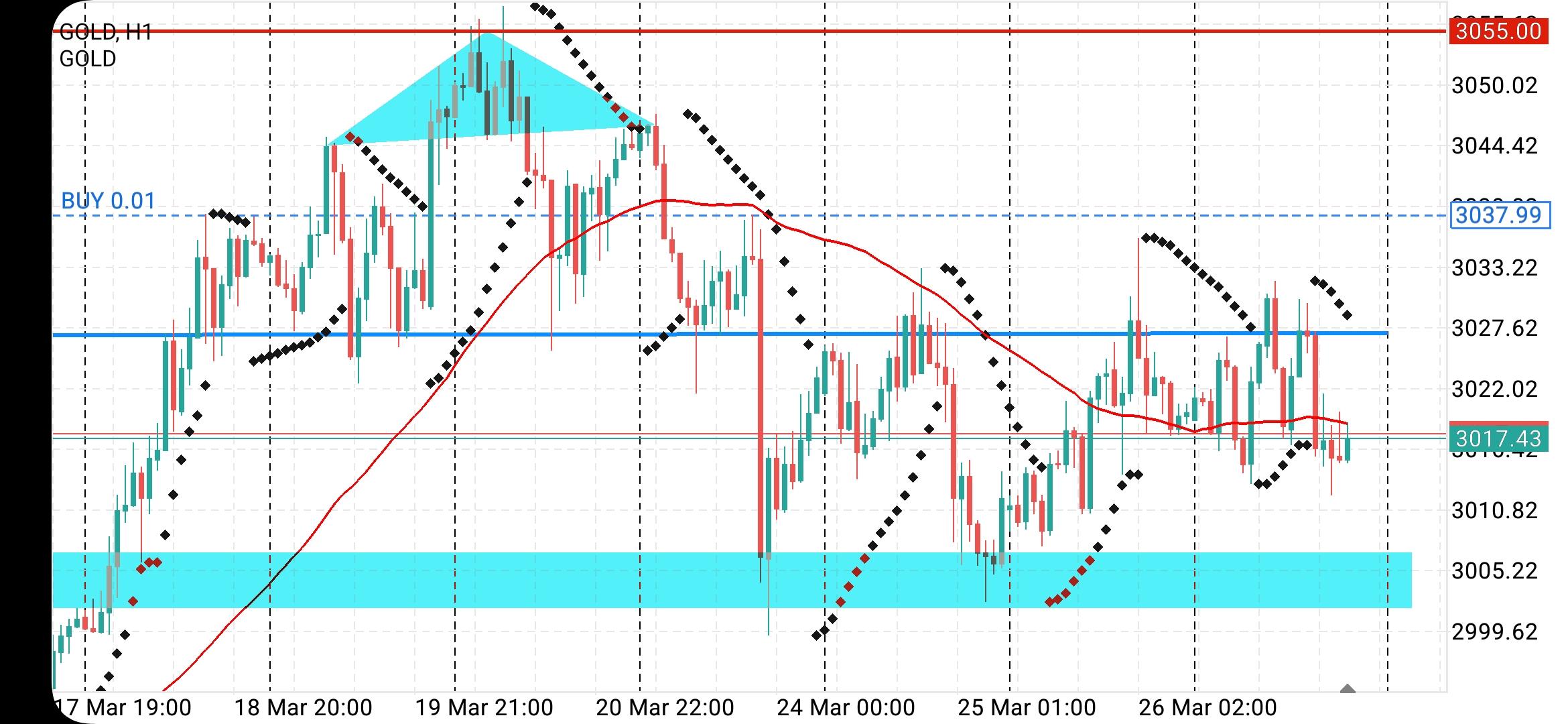

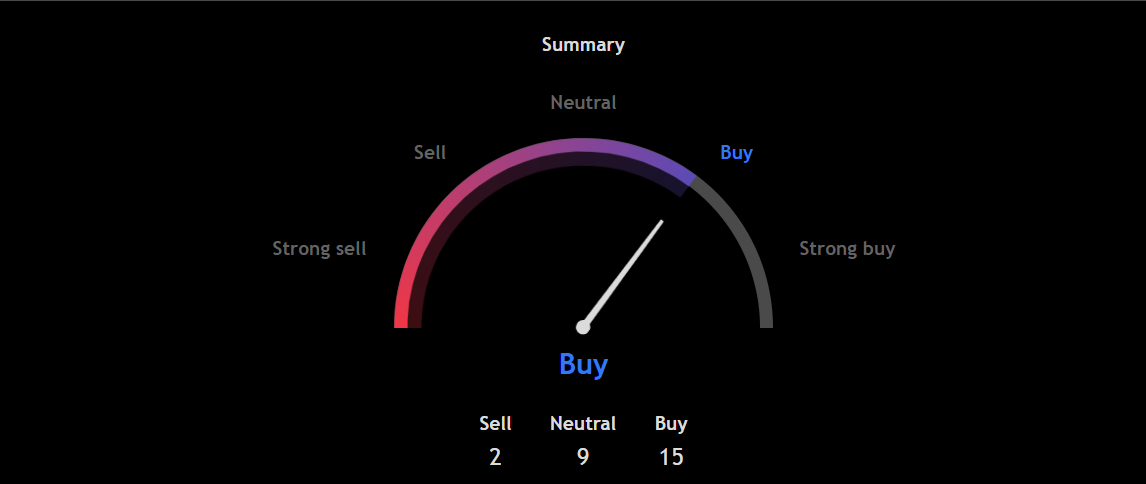

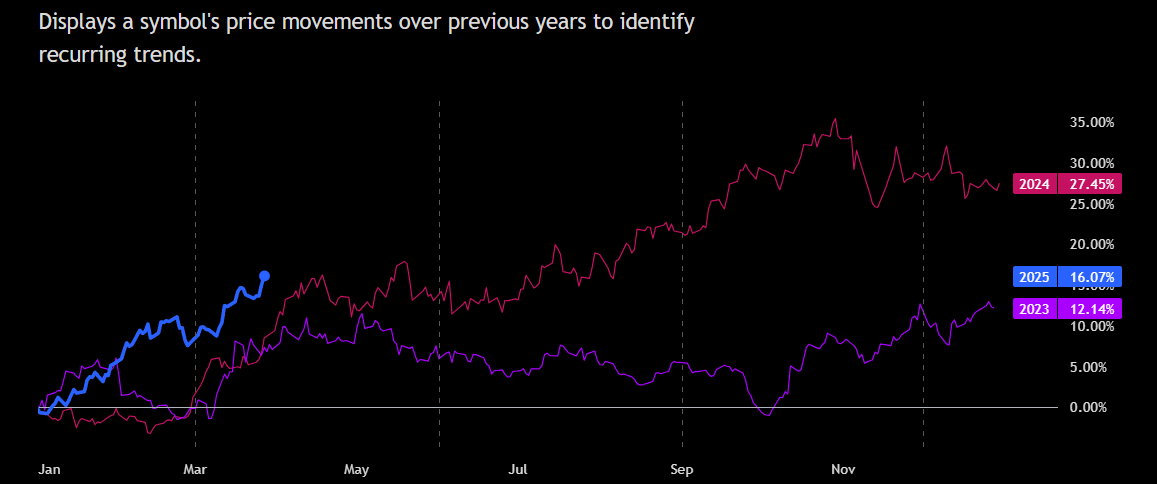

Gold prices extend their rally on Tuesday, hitting a fresh record as fears of a widening trade war ahead of U.S. President Trump’s tariff rollout drive a rush toward the safe-haven asset. In early trade, futures rise 0.3% to $3,159.30 a troy ounce, after reaching a high of $3,177 a troy ounce earlier. “Given the general risk-off tone and stagflationary fears, gold put in its best quarterly performance since 1986,” analysts at Deutsche Bank Research say. Gold is up more than 19% so far this year, as fears of an escalating global trade war and central-bank buying boost its appeal as a hedge against geopolitical and economic instability. Traders are now bracing for Trump to unveil reciprocal tariffs on U.S. trading partners on Wednesday, fearing that the new levies could hurt global growth and drive up inflation.Gold Technicals:

April 1, 2025 at 9:09 am #21777

April 1, 2025 at 9:09 am #21777In reply to: Forex Forum

Using my platform as a HEATMAP shows

… a calm before the Liberation Day storm

Dollar more or less steady and cautious

EURUSD 1.08 has traded for 8th day in a row

USDJPY backed away from 150 but still well above yedterday’s 148.70 low

U.S. bond yields lower (10 year 4.18%)

U.S. stocks cautious

Gold sets another record high

Looking ahead, US ISM PMI

March 31, 2025 at 2:21 pm #21742In reply to: Forex Forum

March 31, 2025 at 11:49 am #21703In reply to: Forex Forum

Stocks slide. Bonds, gold buoyed as tariffs stoke recession fears

STOXX 600 falls 1.7%, U.S. futures lower

Nikkei dives over 4%

Trump says US tariffs to cover all countries

Flight to safety buoys bonds, gold hits record

Major global share markets fell sharply on Monday and gold surged to another new record after U.S. President Donald Trump said tariffs would essentially cover all countries, stoking worries a global trade war could lead to a recession.

Seeking any safe harbour from the trade storm, investors piled into sovereign bonds and the Japanese yen and pushed gold prices to another all-time high.

Brent BRN1! rose 0.8% to $74.24 a barrel, while U.S. crude CL1! added 0.4% to $69.65 per barrel as U.S. President Trump has threatened secondary tariffs on buyers of Russian oil if he felt Moscow was blocking efforts to end the war in Ukraine.

“For the first time in years, we find ourselves genuinely worried about risk assets,” said head of rates markets at Barclays.

March 31, 2025 at 11:44 am #21701In reply to: Forex Forum

Gold Soars Above $3,100 on Tariffs, Geopolitical Turbulence

“Gold is one of the best-performing major commodities this year, driven by trade frictions, economic uncertainty, central bank buying, and inflows into ETF [exchange-traded funds] holdings,” ING commodities strategists Ewa Manthey and Warren Patterson said. “We see uncertainty over trade and tariffs continuing to buoy gold prices.”

Major banks have raised their price forecast for the yellow metal this month, with Goldman Sachs saying it now sees it at $3,300 an ounce at the end of the year from $3,100 previously on stronger-than-expected ETF inflows and sustained central-bank demand.

March 31, 2025 at 11:37 am #21700

March 31, 2025 at 11:37 am #21700In reply to: Forex Forum

March 31, 2025 at 9:28 am #21687In reply to: Forex Forum

XAUUSD DAILY CHART – NEXT TARGET?

Soars to another record high (3128) as Trump Liberation (reciprocal tariff) Day looms.

The surge in GOLD should be setting off alarmw in the White House but it is falling on deaf ears,

No reason to guess at a top so if I had to try, I would put 3150 and 3200 on the radar. In the meantime, use the new rexord high (3128) as the key resistance.

On the downside, 3057 is closest key area so 3080-3100 needs to hold to keep an uber bid.

March 31, 2025 at 9:14 am #21685In reply to: Forex Forum

Using my platform as a HEATMAP shows

Risk off… stocks down, bonds up, gold soars…and..

… dollar mixed.. JPY up on safe haven flows… AUD, CAD, NZD down.. EUR and GBP not far from unchanged

What caught my eye in EURUSD was a failure at 1.0850 (high 1.0849)

Looking ahead: German CPI, Chicago PMI… month/quarter end

… April 2 reciprocal tariffsMarch 30, 2025 at 8:55 pm #21675In reply to: Forex Forum

March 29, 2025 at 4:26 pm #21664

Global Synchoronity between central banks to bring about a global stagflationary environment… to de-dollarize into CBDC which is repegged and counter pegged to dollar via gold, of which the plan is to make dollar become worthless but it’s not possible for them to shake up the dollar as a reserve… so they first buy large amounts of gold…

They are going to fuck with my status quo and suffer consequences of their own doings.

If they feel adventurous enough to do that then it’s better for them to go jump into the sea rather than try to tamper with the reserved status,…

They have done some real damage to the franc’s safe haven status already.

March 28, 2025 at 2:13 pm #21624In reply to: Forex Forum

GOLD (XAU/USD) is currently at price 3086.87 at exactly 3pm here in Nigeria. From my speculation and Analysis Gold is soaring for a higher reach. I see it getting to price range 3096, at least . I have said it before and we all know that Gold is a Bulllish Metal so there is more bias of Gold buying than selling.

If Gold eventually sells (go bearish) it is usually Temporary before it resumes it former bullish position. Gold got to its highest point today at price 3086, and its lowest point was 3053.51

Let us keep an eye on this Metal as it moves swiftly in the market. Let’s all be guided by using a 1-5% Capital risk and a 1:2/3 risk/ reward ratio.

A word is enough for the wise.Thanks,

TOPNINE.March 27, 2025 at 6:59 pm #21558In reply to: Forex Forum

March 27, 2025 at 4:12 pm #21555In reply to: Forex Forum

Stocks dip, gold hits record, after Trump’s latest tariff salvo

Auto stocks fall on latest Trump tariff shotDollar up against Canadian dollar, Mexican peso

Gold hits record high

Global stocks dipped and gold hit a record high on Thursday in the wake of U.S. President Donald Trump’s latest tariffs that expanded the trade war to auto imports.

Trump announced 25% tariffs on all vehicles and foreign-made auto parts imported into the United States late on Wednesday, scheduled to take effect on April 3. This weighed on Japan’s Nikkei <.N225> and South Korea’s KOSPI KOSPI stock markets.

Countries around the globe threatened retaliatory tariffs.

U.S. stocks shook off initial declines and were roughly unchanged while automakers slumped. General Motors GM tumbled about 8%, while Ford F dropped more than 4%, reflecting concerns about the impact on their supply chains. U.S.-listed shares of Stellantis STLAM fell about 3%.

The Dow Jones Industrial Average DJI rose 20.71 points, or 0.05%, to 42,478.39, the S&P 500 SPX climbed 6.42 points, or 0.12%, to 5,718.66 and the Nasdaq Composite IXIC advanced 21.25 points, or 0.09%, to 17,920.27.

March 27, 2025 at 10:11 am #21514In reply to: Forex Forum

This is 11AM Nigerian time and the day is bright. GOLD (XAU/USD) is at price 3040. The market is set up for a bullish run . It reached to a high at price 3038 this early morning before retracing. it went bearish to the price range at 3026.62 and has since begun an upward movement. it is at 3040 area now and ready for a fresh bullish movement to price range at 3042.

Let us take a few pips and save the money in the bag. A 1-5% profit target should suffice. Don’t over leverage your Account. A word is enough for the wise.

Thsnks,

TOPNINE.March 26, 2025 at 7:39 pm #21491In reply to: Forex Forum

March 26, 2025 at 6:02 pm #21484In reply to: Forex Forum

March 26, 2025 at 2:59 pm #21472In reply to: Forex Forum

fwiw, from a post on ZH

“A Negative Surprise”: Goldman Warns Market Expectations For Trump’s April 2 Reciprocal Tariffs Are Far Too Optimistic“Trump plans to announce his “reciprocal” tariff policy on April 2. Recent media reports suggest a more benign approach, but we believe the risks lean toward an initial tariff announcement that negatively surprises markets, for two reasons.”

March 25, 2025 at 7:01 pm #21402In reply to: Evaluation – Daily Trades

-

AuthorSearch Results

© 2024 Global View

who’s the best trader in here

who’s the best trader in here

keep buying gold

keep buying gold