-

AuthorSearch Results

-

January 13, 2025 at 11:33 am #17690

In reply to: Forex Forum

EURUSD WEEKLY CHART – Another Sticky Zone

Similar to GBPUSD, to keep it simple, 1,00-at risk if below 1.02

Why I call 1.00-1.02 a sticky zone is the importance of 1.00 as a MEGA MAJOR psychological level as it is parity. Beyond that is a back hole on a monthly chart to .9500.

At a minimum, 1.0200-50+ would be needed to slow what feels like an inevitable run at parity.

January 13, 2025 at 9:56 am #17686In reply to: Forex Forum

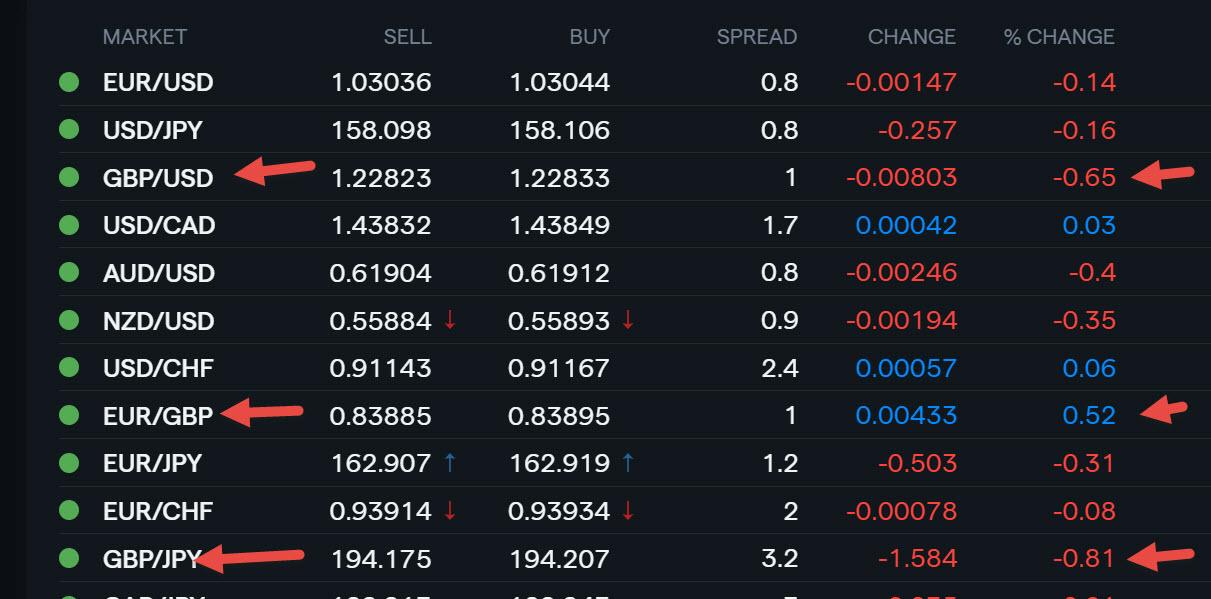

GBPUSD WEEKLY CHART – Sticky Zone

To keep it simple, 1,20 at risk while below 1,22

Why I call 1.20-1.22 a sticky zone isa the importance of 1.20 as a MAJOR psychological level and then a void to 1.18…1 ,2034 is the weekly chart support but pivotal big figures, such as 1.20 is clearly more important.

Looking at a 4 hour chart, any bounce not that fails to reach 1.2321 (bot the risk at the moment) should be treated as a retracement.

January 13, 2025 at 9:30 am #17685In reply to: Forex Forum

January 13, 2025 at 12:17 am #17678In reply to: Forex Forum

AnonymousIf You believe Cable can recover from here on….

You will change Your mind as You see this link from London

Short term 1.21 GBPUSD is Support

January 10, 2025 at 11:27 am #17562In reply to: Forex Forum

NEWSQUAWK US OPEN

USTs and futures subdued ahead of US NFP; JPY boosted by BoJ source report

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses trade choppy, US futures edge lower ahead of the US NFP report.

USD eyes NFP, JPY boosted by BoJ source report, GBP unable to recoup lost ground.

Fixed income a touch lower ahead of US jobs data, Gilts continue to underperform.

Crude soars on geopolitical updates, Industrial commodities bolstered by Chinese commentary

January 10, 2025 at 11:22 am #17560In reply to: Forex Forum

January 10, 2025 at 10:14 am #17555In reply to: Forex Forum

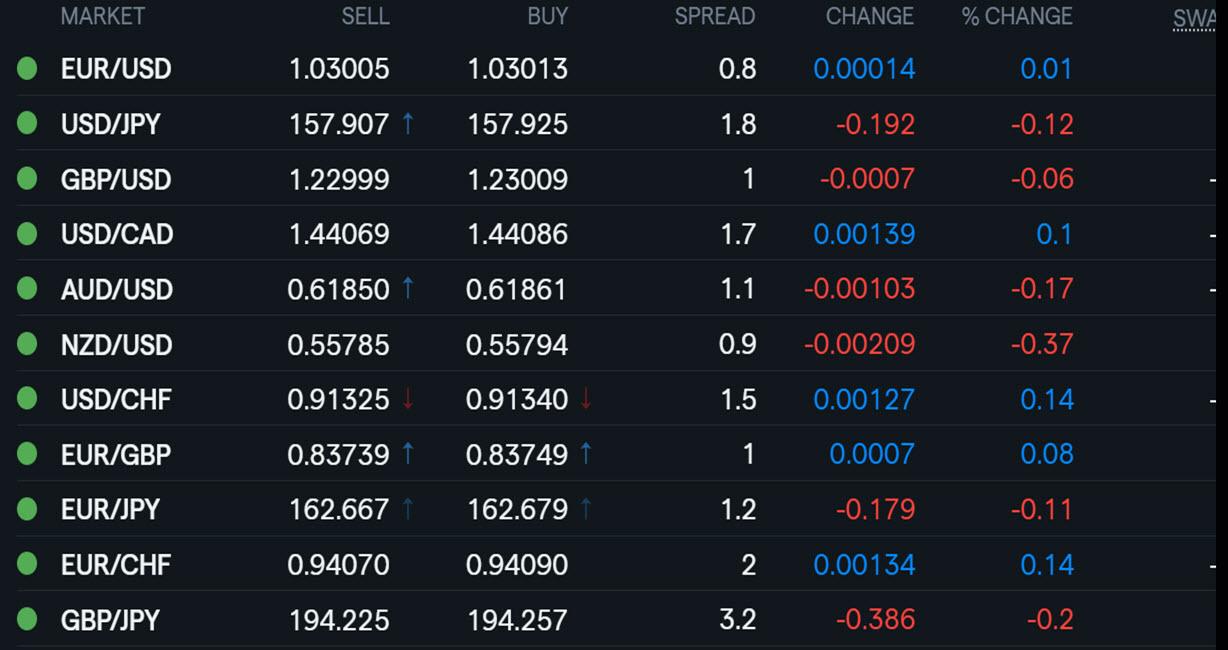

Using my Platform as a HEATMAP shows

Markets on hold awaiting the US jobs report in 3+ hours

GS and Citi calling for a weaker report …

But not showing up in bonds, where yields have edged higher

To keep it simple, watch big figures to guide the respective tones post-data

EURUSD 1.03

USDJPY 158** (traded 4 days in a row)

GBPUSD 1.23

USDCAD 1.44

AUDUSD .62**

**More significant big figures than the others

January 9, 2025 at 3:47 pm #17515In reply to: Forex Forum

January 9, 2025 at 1:32 pm #17412In reply to: Forex Forum

January 9, 2025 at 10:19 am #17403In reply to: Forex Forum

January 9, 2025 at 10:12 am #17402In reply to: Forex Forum

GBPUSD MONTHLY CHART – IS THE BOE IN

If I was the BOE I would be looking to slow the bond inspired sell-off by covertly intervening in GBPUSD.

The key level to defend is 1.2232 (and 1.22) as a firm break would expose 1.20

Low 1.2238… back above 1.23 is needed to slow the risk

Watch UK bonds nd EURGBP for clues

January 9, 2025 at 10:02 am #17400In reply to: Forex Forum

Using my platform as a HEATMAP

The attack on GBP continues although it has come off its lows. If I was the BOE, I would be in covertly to prevent a full-scale panic.

EURUSD continues to find support out of EURGBP but so far niot enough to get through 1.-320-25

…. And US jobs report is yet to come… NO US data today due to the Day of Mourning

Be aware that the start of a new year often sees false starts and choppy trading as markets slowly return to full

January 8, 2025 at 4:32 pm #17357In reply to: Forex Forum

January 8, 2025 at 2:31 pm #17348In reply to: Forex Forum

January 8, 2025 at 2:02 pm #17347In reply to: Forex Forum

January 8, 2025 at 1:49 pm #17346In reply to: Forex Forum

January 8, 2025 at 11:42 am #17335In reply to: Forex Forum

January 8, 2025 at 11:24 am #17330In reply to: Forex Forum

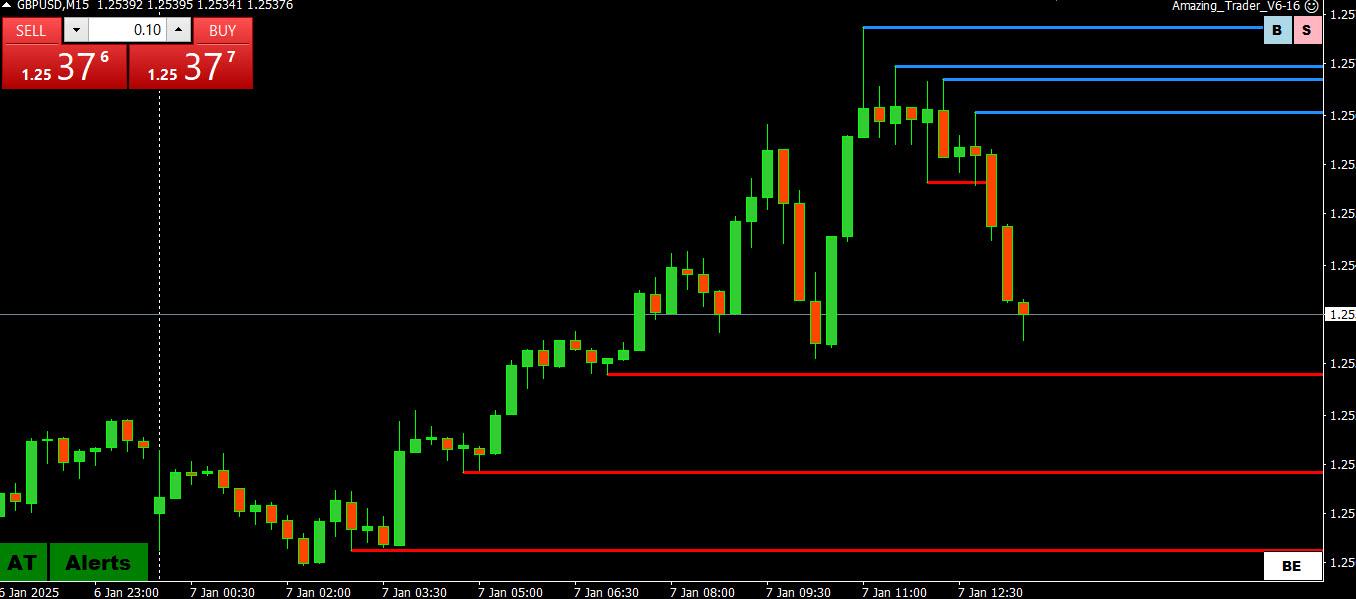

January 7, 2025 at 11:38 am #17263In reply to: Forex Forum

These Amazing Trader 15 mibute charts speak for themselve… both reacting to bearish patterns, and now approaching initial target supports.

EURUSD

GBPUSD

January 6, 2025 at 10:33 am #17211

January 6, 2025 at 10:33 am #17211In reply to: Forex Forum

Using my platform as a Heatmap shows the USD lower vs all but the JPY, so you can see what cross flows are helping to drive the price action today.

To suggest anything more than typical start of year trading, EURUSD 1.0375 and/or GBPUSD 1.25+ would need to be regained.

USDJPY 158 remains pivotal as above it opens the door for 1.50.

US stocks up, bond yields up (ust a few bps) , GOLD down

How markets end tge week will be more important than how they start out.

-

AuthorSearch Results

© 2024 Global View