-

AuthorSearch Results

-

January 27, 2025 at 7:24 am #18459

In reply to: Evaluation – Daily Trades

January 26, 2025 at 5:24 pm #18423In reply to: Forex Forum

January 24, 2025 at 7:07 pm #18375In reply to: Forex Forum

January 24, 2025 at 5:24 pm #18374In reply to: Forex Forum

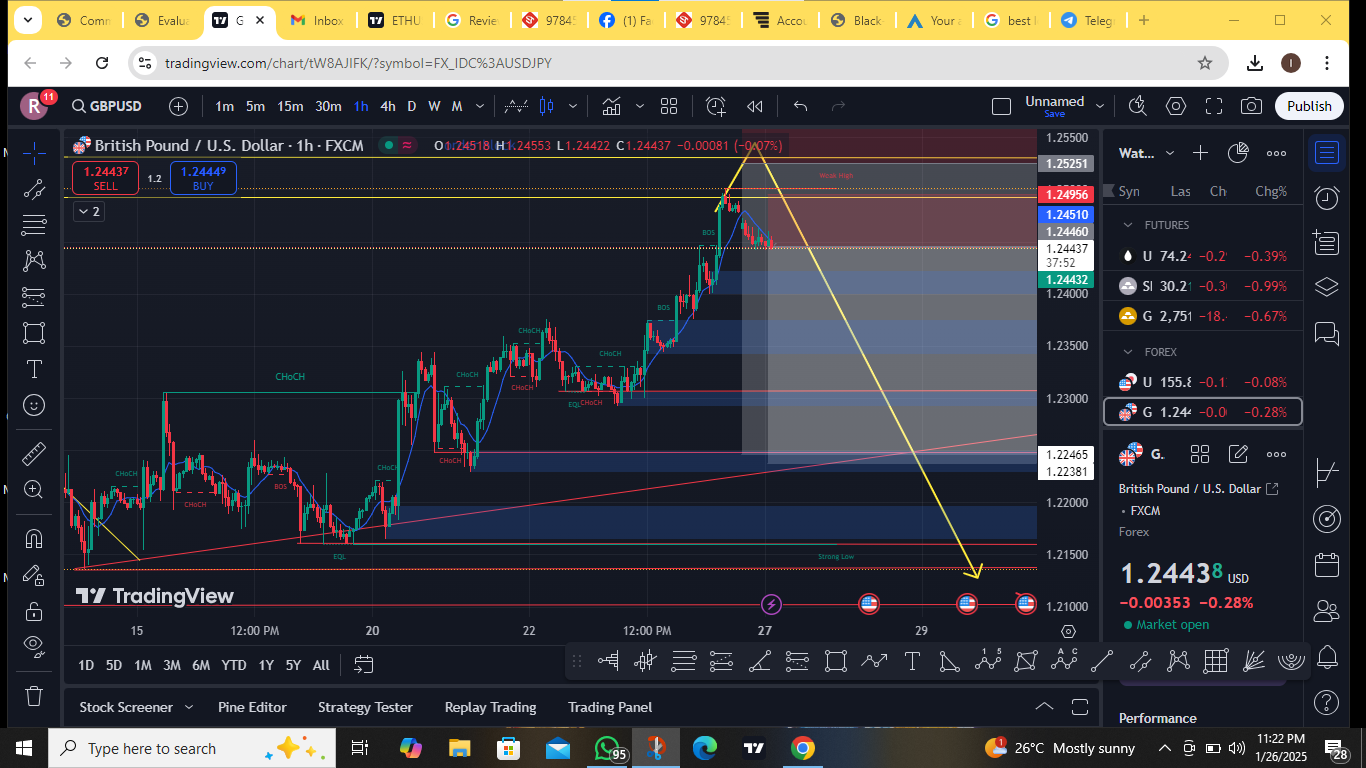

GBPUSD Daily / 4h

Cable broke the long term downtrend line ( from September 2024.)

Now the real hurdle is at 1.26050 – that was the channel support trendline and if it manages to break above it and stay there, new universe opens – leading all the way till 1.38.

But let’s focus for now on coming days…

It has to stay above 1.23350 to be able to form a real bottom.

With the current situation , you have to be aware that chances are 50-50 for tomorrow – it can continue with next leg up, but also it is very possible to retrace back to MA – 1.23850

It just doesn’t pay to play with that kind of probability, unless you entered the position below 1.23850 – then you can risk it – stop on zero and leave it be.

January 22, 2025 at 3:57 pm #18228

January 22, 2025 at 3:57 pm #18228In reply to: Forex Forum

A driving flow today remains EURJPY, which is close to testing the 162.89 level cited earlier.

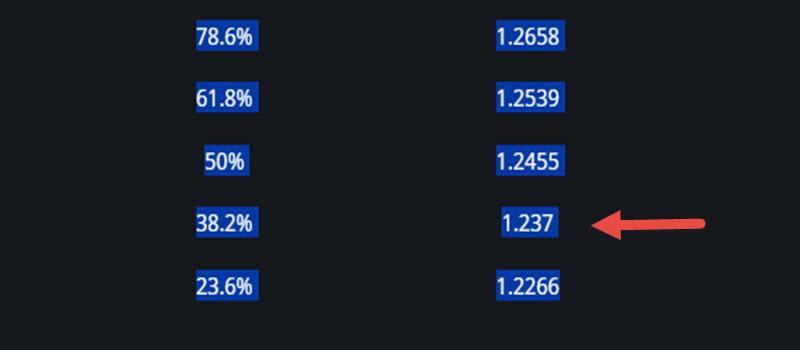

Unlike earlier, though, market is following the path of least resistance by pushing USDJPY higher as EURUSD lags. EURUSD lag is also coming from a firmer EURGBP, which is weighing on GBPUSD (after completing a 38,2% retracement earlier.

January 22, 2025 at 11:26 am #18206In reply to: Forex Forum

January 22, 2025 at 10:56 am #18204In reply to: Forex Forum

January 20, 2025 at 10:14 am #18083In reply to: Forex Forum

Using my platform as a HEATMAP shows

A market on hold waiting for the inauguration of President Trump and a slew of executive orders to follow.

For the FX market, the focus will be on anything related to tariffs but I have not seen any talk of it in the press.

The heatmap, meanwhile, shows the EURUSD as an outperformer with the GBP and JPY lagging out of respective EUR crosses.

The main action has been in cryptos with BTCUSD surging higher to a new record high (marginally so far). The $Trump memecoin has been the talk of the press but I will leave my opinion on something that has no intrinsic value for another time.

Otherwise US markets are closed today, liquidity is thin and it is now just a wait until the new Trump era begins.

January 17, 2025 at 11:23 am #17998In reply to: Forex Forum

NEWSQUAWK US OPEN

Stocks edge higher, JGBs lag on further BoJ sources, UK Retail sales weigh on GBP

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses grind higher, US futures modestly in the green.USD marginally firmer, JPY softer and GBP knocked lower by disappointing retail sales.

JGBs lag slightly on further BoJ reports, Gilts gapped higher on Retail Sales.

Mixed trade in the base metal complex but crude stays firm.

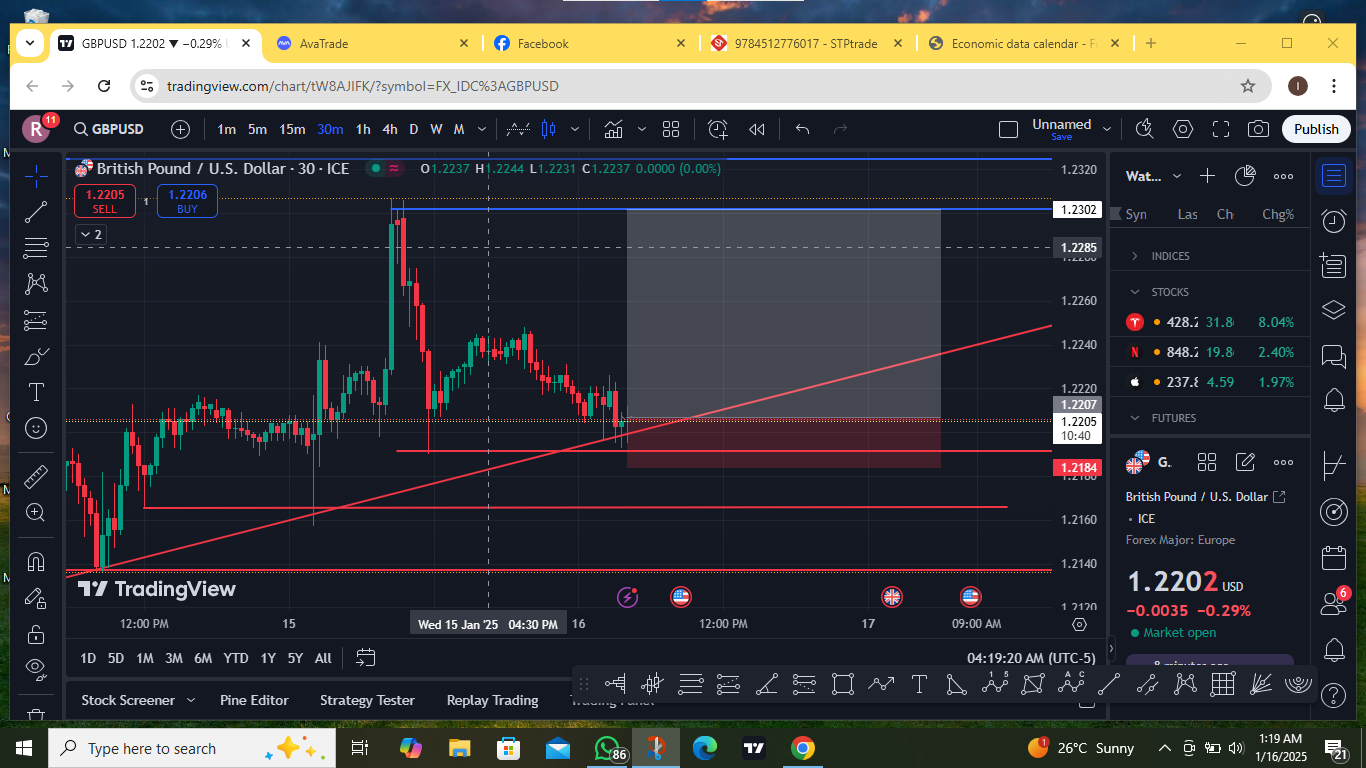

January 16, 2025 at 8:10 pm #17945In reply to: Evaluation – Daily Trades

January 16, 2025 at 9:25 am #17881In reply to: Evaluation – Daily Trades

January 15, 2025 at 4:29 pm #17830In reply to: Forex Forum

January 15, 2025 at 4:03 pm #17822In reply to: Forex Forum

January 15, 2025 at 2:28 pm #17817In reply to: Forex Forum

THe old adage “it’s not the news but the reaction that counts” plaYed true to form today… US 10 year last at 4.663%

USDJPY remains the outperformer, GBPUSD and AUD/NZD 2nd in line.

See earlwr USDJPY poST… TESTING NEXT SUPPORT

EURUSD up with a lag, would need to clear 1.0358 to accelerate the upside.

January 15, 2025 at 11:34 am #17809In reply to: Forex Forum

NEWSQUAWK US OPEN

USD softer ahead of US CPI, Gilts gap higher on cooler UK inflation

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

Stocks hold modest gains, FTSE 100 outperforms post-CPI; US bank earnings due.

DXY lower ahead of US CPI, GBP resilient in the wake of soft inflation metrics, JPY leads.

Gilts inflated by CPI, JGBs dented by Ueda & USTs await CPI.

Choppy trade in crude while precious metals tilt higher and base metals trade mixed.

January 14, 2025 at 10:41 am #17758In reply to: Forex Forum

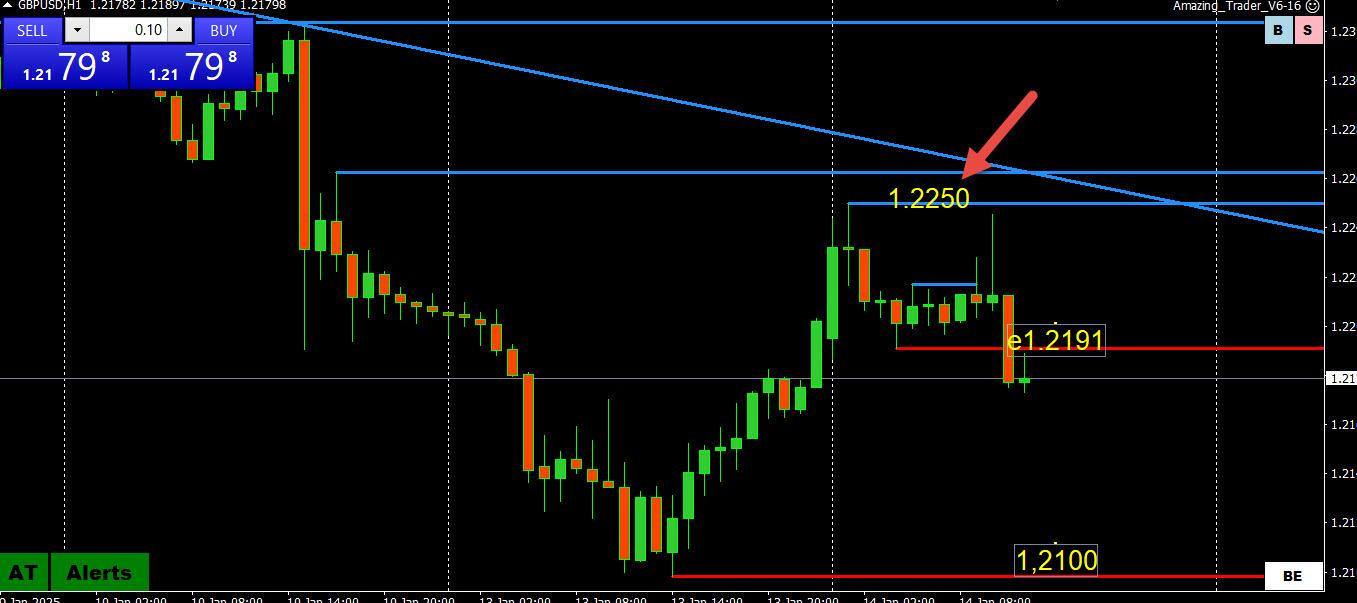

GBPUSD 1 HOUR CHART – Power of 50

What caught my eye Is not only the double top but it hit the wall at 1.2250 (Suggest reading My Favorite Trading Secret: The Power of the “50” Level)

To keep it really simple, 1.22 will set the tone

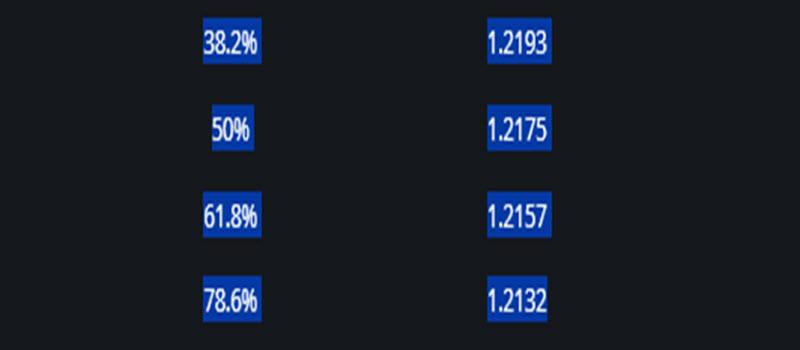

On the downside, while the bounce is just a retracement of the broader trend, here are FIBOs the other way for 1.2100 => 1.2250 as there is no obvious support otherwise on this chart until 1.21.

January 14, 2025 at 10:19 am #17757

January 14, 2025 at 10:19 am #17757In reply to: Forex Forum

January 13, 2025 at 3:45 pm #17714In reply to: Forex Forum

January 13, 2025 at 12:32 pm #17702In reply to: Forex Forum

NEWSQUAWK US OPEN

DXY tops 110, Gilts hit another contract low & crude in focus amid Gaza ceasefire reports

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

Equities continue to slip in a continuation of the downside seen following the strong NFP report.

DXY is stronger and briefly topped 110.00, GBP remains the underperformer.

Fixed benchmarks weighed on in a continuation of the post-NFP trade, Gilts hit another incremental contract low.

Crude surges on US-Russia oil sanctions, with some choppiness surrounding Gaza ceasefire talks.

January 13, 2025 at 12:06 pm #17692In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View