-

AuthorSearch Results

-

March 12, 2024 at 12:42 am #2856

In reply to: Forex Forum

March 12, 2024 at 12:37 am #2855In reply to: Forex Forum

GBP – That 2790 survived so far increases probabilities of a back fill toward 2850 and if that survives then down it goes. If 2770 hits and lingers this pair is likely to target 1.2700 in my view. Anything in the middle of that is horseplay in my view. It is a matter of the market finding fair value with all factors considered. Smaller picture the activity is on the sell side, a bit larger picture it is still bid.

March 11, 2024 at 8:49 pm #2850In reply to: Forex Forum

GBPUSD 1-HOUR

CHART

CHARTThe GBPUSD chart speaks for itself. All you need to look at is one level.

1.28 briefly tested, will dictate whether this retreat turns into a correction.

Trendlines on both sides form a wedge closer to the downside but so far untouched.

UK jobs report and US CPI on Tuesday so a fasten your seatbelt day

March 11, 2024 at 5:30 pm #2847In reply to: Forex Forum

Read earlier that Claude Erb, a former commodities portfolio manager at TCW Group, plots bitcoin’s actual price over the past decade along with Erb’s application of Metcalfe’s Law with the result being a fair value of $35,000 for Bitcoin.

Side note, some ideas for orders I tried to post earlier but it would not post for some reason – buy side AudChf 5790 – Buy side AudCad 8900 – Sell side GbpChf 1260 – GbpUsd Buy side 2812 or lower – AudUsd buy side 6594 or lower – UsdJpy sell side 147.10 or higher –

March 9, 2024 at 8:37 pm #2743In reply to: Forex Forum

GBPUSD – Week ahead

Resistances ( Targets ) at 1.30850 and previous high at 1.31450

Supports 1.28200 and 1.27350

It is very difficult to predict exact moves week ahead, but let me try :

Pull back is a Must, but depending is it going to continue a bit more up on Monday and then pull back, or first Pull back and then Up will decide its fate in the near future.

For the Cable to continue surging , pull backs are the way – any extended Rally Up might end up in tears ( like an Irish story )

Weekly Chart

March 8, 2024 at 5:55 pm #2723

March 8, 2024 at 5:55 pm #2723In reply to: Forex Forum

March 8, 2024 at 5:32 pm #2722In reply to: Forex Forum

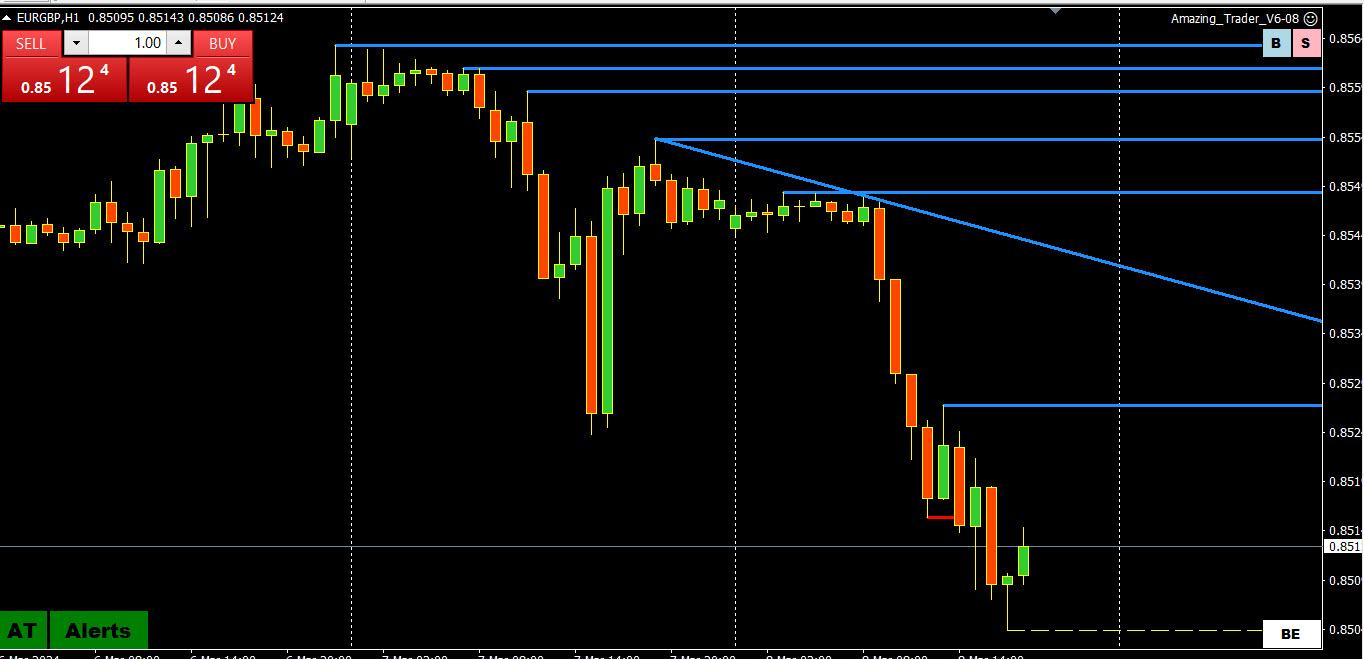

EURGBP 1 Hour Chart

If you trade EURUSD and/or GBPUSD you should keep an eye on EURGBP.

Currently, blue AT lines are dominating, indicating either GBP strength or EURUSD is not as strong as charts show (same for other EUR crosses) and pointing the risk to the downside

Whatever the case, EURGBP .8500 is the current line in the sand.

I have a video on file how to use crosses to trade spot. Contact me if you would like a copy.

March 8, 2024 at 3:09 pm #2708In reply to: Forex Forum

Long Usd vs Singapore Dollar and Mexican Peso filled almost at absolute bottom post data, will hold for fun. At times I trade crosses approaching data to stay out of wild activity. I’m riding a Gbp/Chf from Wednesday at 1.2225 and am likely to exit any time here, see it settling around 1.1250 around end of day likely. Light positions. Bailed last night on Aud and Gbp sells with a squeaky gain, didn’t look good at all, those were testers. Still see Usd pulling up a bit overall but obviously the dynamic has shifted to the sell side.

March 8, 2024 at 2:59 pm #2705In reply to: Forex Forum

March 8, 2024 at 2:23 pm #2702In reply to: Forex Forum

March 8, 2024 at 2:18 pm #2701In reply to: Forex Forum

March 8, 2024 at 9:58 am #2691In reply to: Forex Forum

March 8, 2024 at 9:34 am #2690In reply to: Forex Forum

March 7, 2024 at 8:36 pm #2683In reply to: Forex Forum

March 7, 2024 at 5:30 pm #2668In reply to: Forex Forum

March 7, 2024 at 5:02 pm #2660In reply to: Forex Forum

March 7, 2024 at 1:47 pm #2647In reply to: Forex Forum

There is not point in trading Yen today if you missed the sell. Gold is strong and so intently focused on Aud. With the weight of data today, although the spreads are wide, preference for the day is GbpChf and UsdChf. If intent on trading Eur (soviet pair) suggest using buy and/or sell stops and lock in fast.

March 7, 2024 at 12:13 pm #2631In reply to: Forex Forum

March 6, 2024 at 1:06 pm #2540In reply to: Forex Forum

March 6, 2024 at 4:33 am #2529In reply to: Forex Forum

GBPJPY Analysis: Current Levels and Potential Scenarios

After an unsuccessful attempt to surpass the 191.30 resistance, GBPJPY is currently testing the 190.20 support level.

A breach beneath this support could prompt a further decline towards the 189.02 support level, with a potential target zone around 188.00.

Nevertheless, as long as the 189.20 support remains intact, there is a possibility of a renewed ascent towards retesting the 191.30 resistance. A breakout above this level could signify the continuation of the uptrend originating from 185.21, with the subsequent target likely situated around the 193.00 area.

-

AuthorSearch Results

© 2024 Global View