-

AuthorSearch Results

-

March 22, 2024 at 9:55 am #3455

In reply to: Forex Forum

GBUSD DAILY CHART – Bailey turns dovish

The old trading adage that it’s the reaction to news more than the news itself that matters held true in the GBPUSD as it took another leg down after dovish comments from BOE Bailey in an FT article. Price moves (note firmer EURGBP as well) underscore how interest rate cut expectations are driving these markets.

I had to go to the daily chart to find potential support levels on the downside, So far, an AT support at 1.2578 is holding, below it there is one level ahead of the pivotal 1.25.

Hard to chase after a big move but it trades soft below the lower end of intra-day resistance is at 1.2645-75,.

Take a look at the 2 blue AT lines on the daily chart, the failure to test the 2nd line, and how the risk turned to the downside.

March 21, 2024 at 2:34 pm #3421In reply to: Forex Forum

EURGBP 15 Minute Chart – Whipsaw

How to define whipsaw in trading:

Whipsaw in trading describes a sharp increase or decrease in an asset’s price, which goes against the prevailing trend. Whipsaw is different to other reversals because it is characterized by a sudden change in an asset’s momentum shortly after a trader has opened their position.

Today: EURGBP fell to its low after weak EZ flash PMIsand then turned bid after the BOE monetary policy decision

This is a whipsaw

Meanwhile, the chart does not show the key level on top, which is at .8576 (high so far .8573)

On the downside, expect support if .9550 holds.

March 21, 2024 at 10:01 am #3400In reply to: Forex Forum

March 21, 2024 at 8:12 am #3395In reply to: Forex Forum

March 21, 2024 at 8:07 am #3394In reply to: Forex Forum

March 20, 2024 at 2:58 pm #3345In reply to: Forex Forum

What there seems to be especially in eur/usd and to some degree gbp/usd is a lack of desire to commit. The weaker links (jpy and chf) are easier to punch down on so there in lies the path of least resistance. That said I don’t get the feeling there are that many people that have been short jpy for months or even weeks…..

March 19, 2024 at 7:37 pm #3311In reply to: Forex Forum

March 19, 2024 at 7:23 pm #3310In reply to: Forex Forum

GBPJPY DAILY CHART

I had to go to the daily chart looking for a chart level.

All that is left is a breakout above 191.191.32 as support and a monthly resistance above 185.

The key support area is distance at 187.94 as seen on this chart.

In a market like this look for the new high to act as a key resistance.

Be o alert in GBP as CPI, expected to dip, will be released overnight.

‘

March 19, 2024 at 3:23 pm #3291In reply to: Forex Forum

March 19, 2024 at 12:33 pm #3272In reply to: Forex Forum

March 19, 2024 at 10:07 am #3254In reply to: Forex Forum

March 18, 2024 at 2:07 pm #3164In reply to: Forex Forum

March 18, 2024 at 10:54 am #3151In reply to: Forex Forum

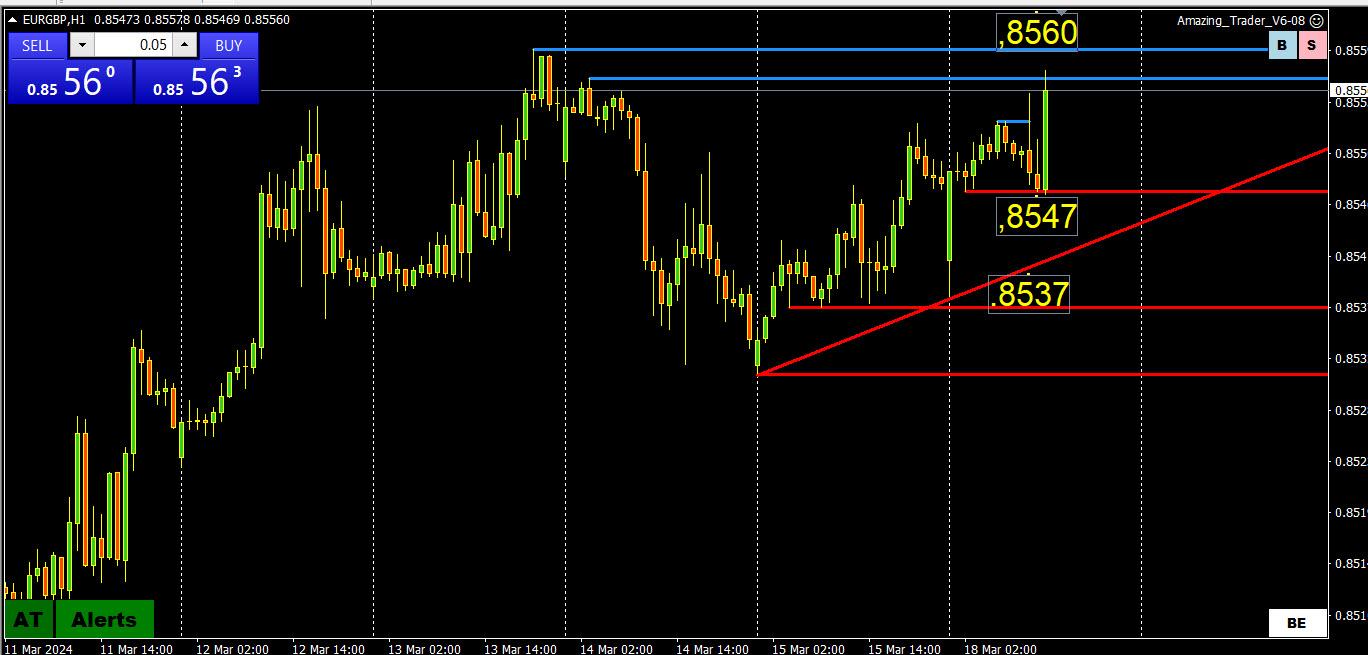

EURGBO 1 HOUR CHART

Flows into EUR crosses seem to be behind the better EURUSD tone (testing 1.09,) in a market biding its time ahead of key monetary policy decisions this week.

This created a tug-of-war with the USD caught in the middle.

One of the crosses is a firmer EURGBP (in a tight range), so far pausing just below .8560 resistance, which stands in the way of the .8578 level, the top of the current range.

It looks like this cross finds a bid on dips as long as it stays above .8545-50.

March 16, 2024 at 11:52 am #3101In reply to: Forex Forum

March 14, 2024 at 12:17 pm #2997In reply to: Forex Forum

March 13, 2024 at 3:07 pm #2944In reply to: Forex Forum

March 12, 2024 at 7:25 pm #2914In reply to: Forex Forum

March 12, 2024 at 4:39 pm #2897In reply to: Forex Forum

March 12, 2024 at 3:55 pm #2889In reply to: Forex Forum

I like the discourse. Currency traders have a lot of spirit. In the spirit of viewing cross currencies, I am very dialed in on GbpChf this week and believe the hard sell to the 1170 area on the data did not compromise the average true range of the bigger picture and see decent probabilities for the pair to search for fair value back toward 1250. That would transfer to other Sterling pairs of course. So the plan for me today was to close everything last night and hope for a failed downward strike, which we got this time. So I am looking for the pair to run out of gas a bit higher than current market.

March 12, 2024 at 9:52 am #2860In reply to: Forex Forum

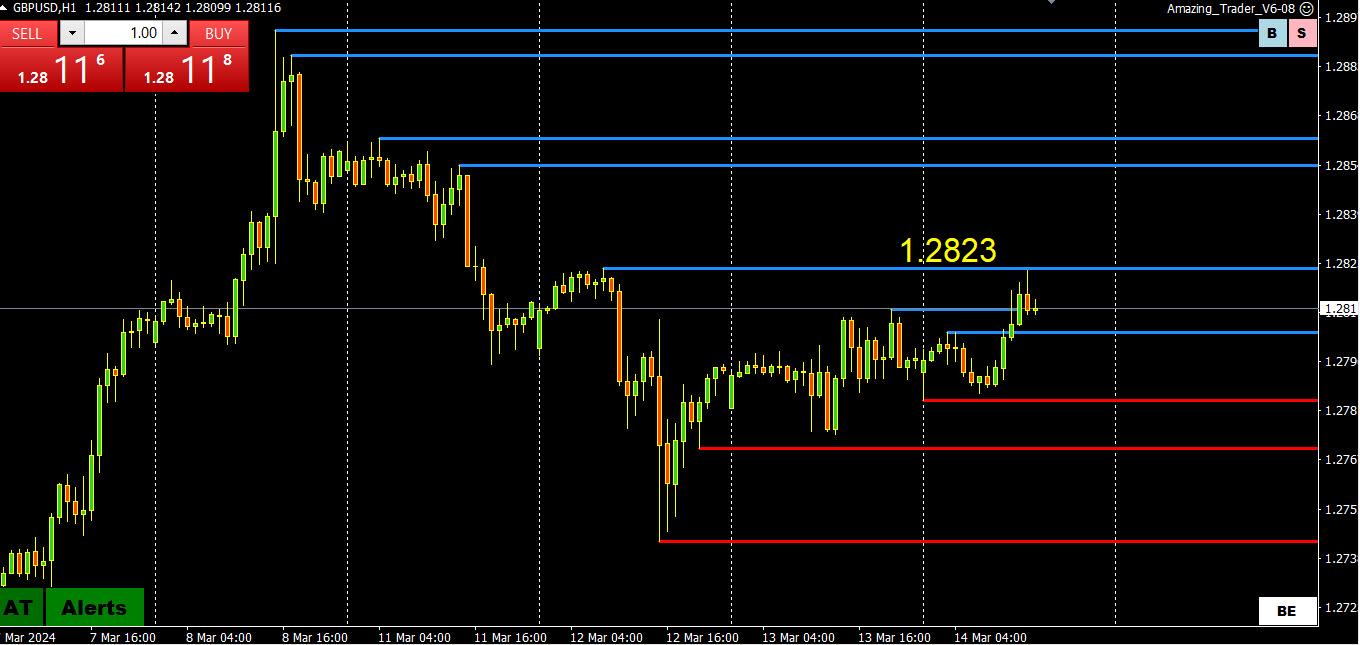

GBPUSD 4 HOUR Chart

As noted yesterday, 1.28 is the only level to watch as it will dictate whether GBPUSD corrects further. Note the 2 blue AT lines whuch indicate a potential change in direction that played out.

This chart shows little until 1.2722 so expect the 1.2750-80 zone to be a key one as only a break below the lower end would shift thf focus from 1.28

NOTE

UK labor report showed a slight moderation

EURGBP bounce gave a clue to GBPUSD vulnerable downside

Bew ball game after US CPI later on

-

AuthorSearch Results

© 2024 Global View

GBPUSD

GBPUSD RE my weekly signal GBPUSD

RE my weekly signal GBPUSD

GBPUSD signal for the coming week:

GBPUSD signal for the coming week: