-

AuthorSearch Results

-

April 4, 2024 at 2:38 pm #4034

In reply to: Forex Forum

Viewing gains in EurJpy and Sterling as solid buy side waves against the larger sell side momentum. Hence am short against Yen again in Eur and Usd, while in on the sell side light in GbpUsd but not as confident in that one so observing intently. It appears my preference this week has been the risky venture of counter trading. Noting the yield and hoping it doesn’t decouple with Dxy like it has done more than usual in recent days.

April 3, 2024 at 10:55 am #3945In reply to: Forex Forum

April 2, 2024 at 2:27 pm #3909In reply to: Forex Forum

April 2, 2024 at 10:20 am #3892In reply to: Forex Forum

EURUSD 15 MIN CHART

It is only a 20 pip range so far, too tight to last. Price action is typical for the start of a quarter, especially this one after a 4 day weekend, as the market re-liquifies.

As the chart shows, 2 red AT lines drawn off the low indicate a shift in risk to the upside that has seen a move up but faces resistance at 1.0744.

Not seen on this chart, the gap in price after the ISM report yesterday is to 1.0772. The key target on the downside remains at 1.0694.

Note while steadying vs the dollar, EUR is trading soft on some of its crosses (e.g. eurgbp, eurcad)

April 1, 2024 at 4:55 pm #3874In reply to: Forex Forum

March 29, 2024 at 12:46 pm #3783In reply to: Forex Forum

March 28, 2024 at 3:31 pm #3754In reply to: Forex Forum

March 28, 2024 at 9:49 am #3737In reply to: Forex Forum

AUDJPY 4 HOUR CHART – SHORT JPY POSITIONS BEING UNWOUND

USDJPY IS ABOUT UNCHANGED WHILE THE USD IS FIRMER VS OTHER PAIRS

AUD AND NZD ARE WEAKEST, EUR THEN GBP AND CAD ARE NEXT

WHAT DOES THIS TELL YOU?

JAPANESE INTERVENTION THREAT IS BEING TAKEN SERIOUSLY AHEAD OF A LONG HOLIDAY WEEKEND AS SHORT JPY (CARRY TRADE?) CROSSES ARE BEING UNWOUND

ON THIS CHART AUDJPY NEEDS TO TRADE BACK ABOVE.9842 OR RISK STAYS ON THE DOWNSIDE

March 27, 2024 at 1:34 pm #3679In reply to: Forex Forum

March 26, 2024 at 5:31 pm #3649In reply to: Forex Forum

March 26, 2024 at 4:51 pm #3642In reply to: Forex Forum

March 26, 2024 at 2:36 pm #3634In reply to: Forex Forum

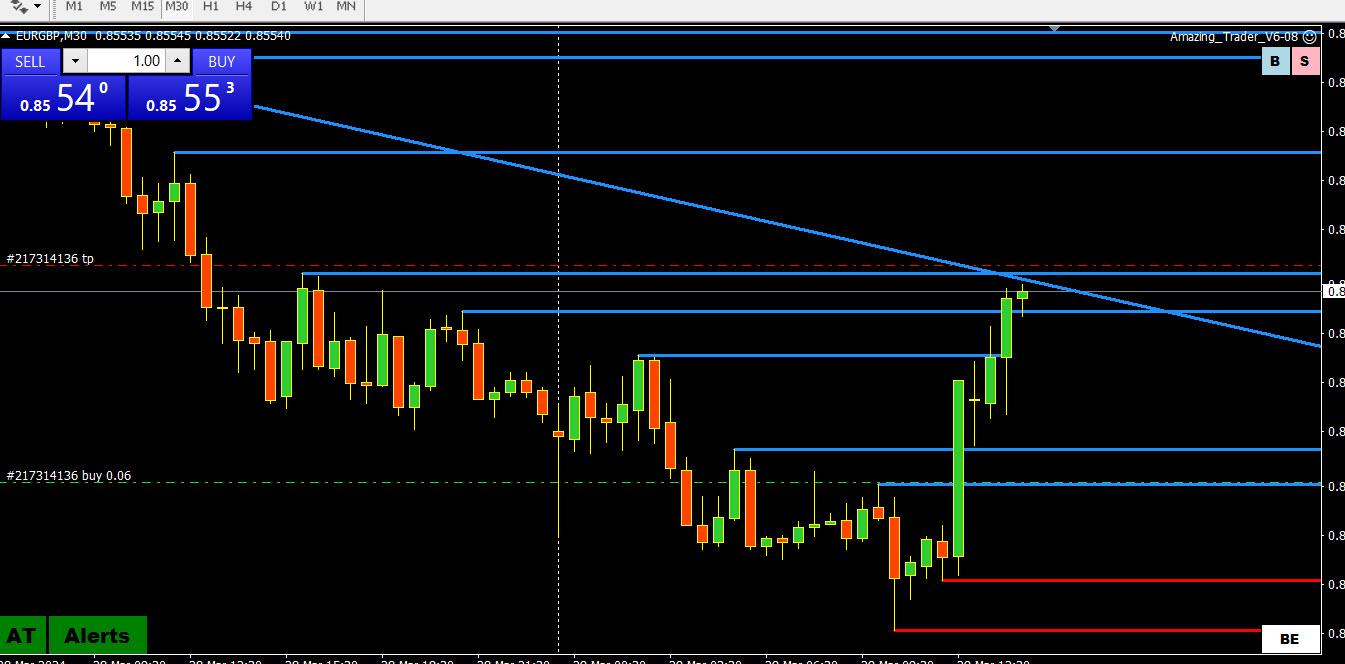

EURGBP 4 HOUR CHART – Bid but consolidating

I am posting a 4-hour chart to show the key level at.8602

Offset GBP selling out of this cross is one reason why GBPUSD failed to test 1.2674 (cited earlier) – contact me if you want a further explanation of how this works. It also gave a bid to EURUSD, which has so far been unable to test 1.0868 (cited earlier) despite demand from this cross.

See chart for support levels.

March 26, 2024 at 11:20 am #3620In reply to: Forex Forum

GBPUSD 4 HOUR CHART – Pre-Easter trading continues

GBPUSD remains in a retracement mode and as this chart shows key levels are not until the trendline and 1.2803

Immediate resistance is at 1.2675, an inviting but so far elusive target..

Support at 1.2632 needs to hold to keep thoughts away from 1.26.

March 25, 2024 at 6:42 pm #3602In reply to: Forex Forum

March 25, 2024 at 5:36 pm #3596In reply to: Forex Forum

March 25, 2024 at 12:09 pm #3567In reply to: Forex Forum

GBPUSD 4 HOUR CHART

GBPUSD bounce off its 1.2574 low is so far just a retracement. To suggest a low is in, 1.2675 would need to be taken out, Currently, resistance at 1.2524 is being tested but this is only a minor level.

Note, EURGBP has backed off from .8600 and this has eased some of the selling pressure on GBPUSD.

March 22, 2024 at 1:30 pm #3478In reply to: Forex Forum

EURGBP DAILY CHART – TRENDLIUNE TESTED

EURGBP tested its trendline at .8602, holding and taking some pressure off GBPUSD for now

Key res is at .8620.

Breakout above .8577 makes this first support that needs to hold to keep .8600 in play

Note, markets have pushed up expectations of a BOE rate cut to June, which has weighed on GBP

March 22, 2024 at 11:39 am #3465In reply to: Forex Forum

March 22, 2024 at 11:15 am #3462In reply to: Forex Forum

March 22, 2024 at 10:27 am #3457In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View