-

AuthorSearch Results

-

May 1, 2024 at 11:47 am #5526

In reply to: Forex Forum

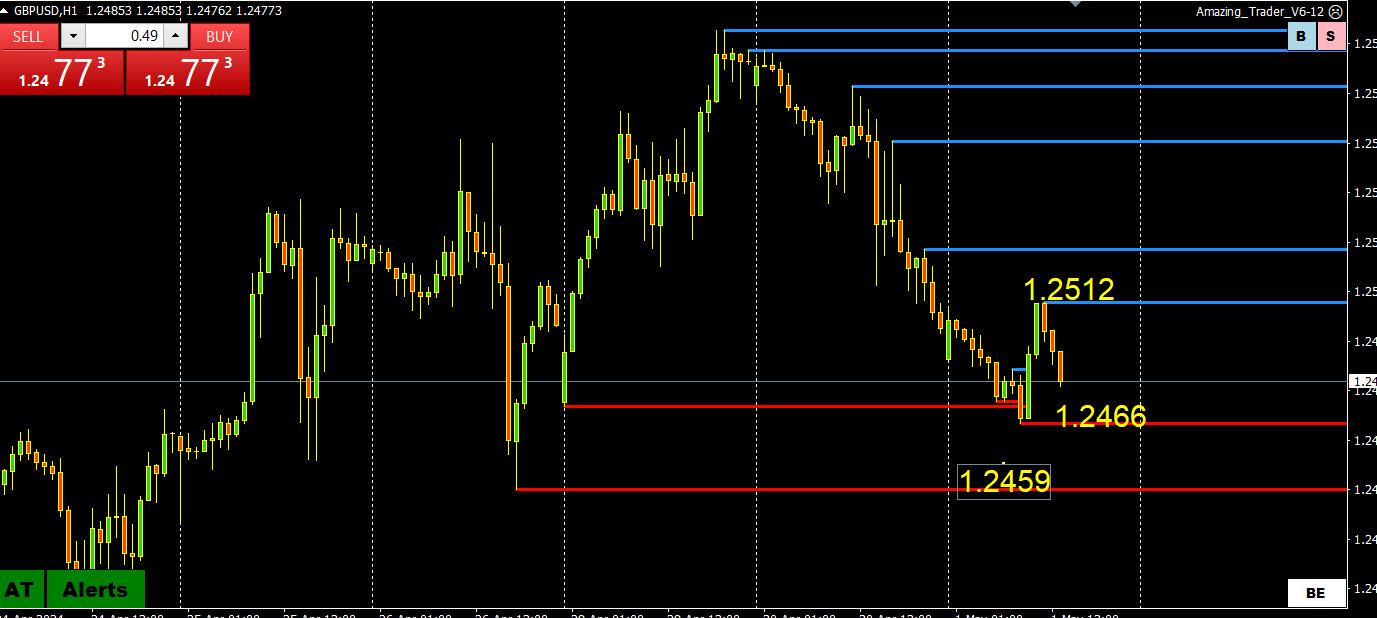

GBPUSD 1 HOUR CHART

Blue Amazing Trader lines dominating but would need to get through 1.2450 (Power of 50 level) to accelerate the downside and shift the focus from 1.25 but….

only back above 1.25 would slow the risk..

GBPUSD has been an underperformer with some pressure coming from a bounce in EURGBP,which in turn is giving EURUSD some support).

April 30, 2024 at 2:15 pm #5473In reply to: Forex Forum

April 30, 2024 at 1:35 pm #5460In reply to: Forex Forum

April 30, 2024 at 11:45 am #5445In reply to: Forex Forum

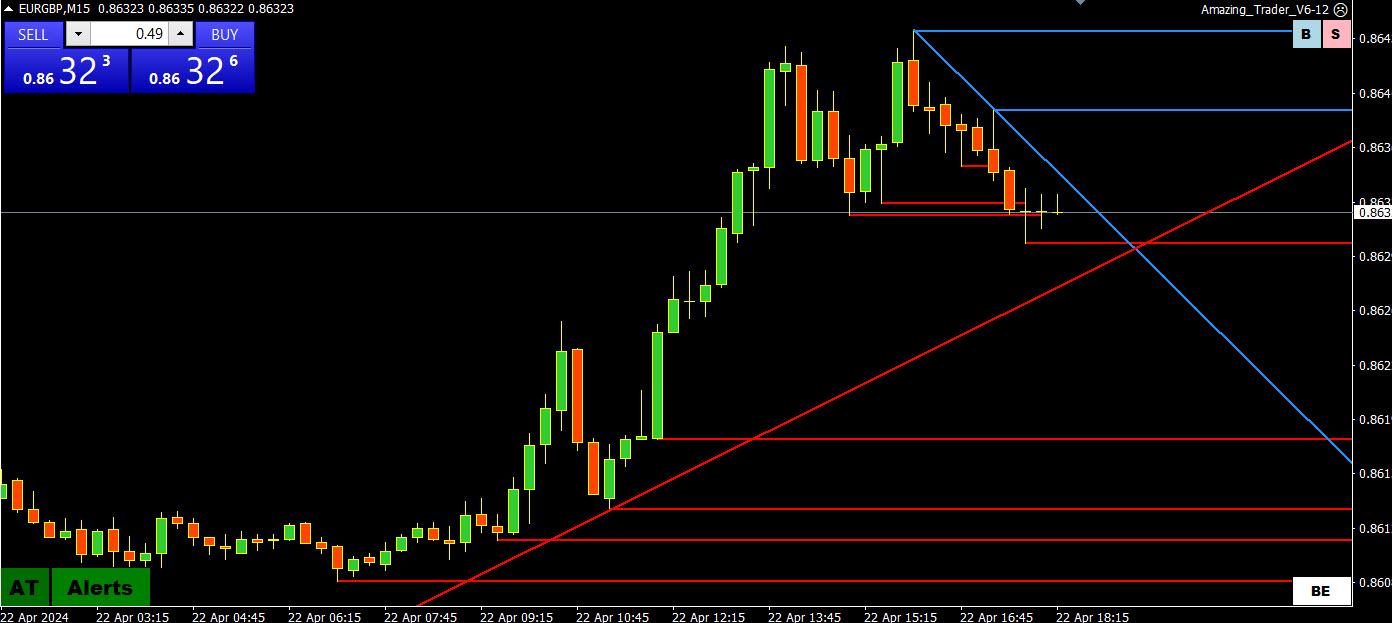

EURGP 30 MIN – Now faces resistance

Following up on my earlier post where looming support proved too tough and now EURGBP is facing resistance at the .8561 level cited in that post. So far .8555 resistance is holding, needing to stay above .8545 to keep its bid.

Take note of the two red Amazing Trader (AT) lines highlighted, otherwise known as an AT Directional Indicator, signaling a potential shift in directional risk that played out.

April 30, 2024 at 9:25 am #5435In reply to: Forex Forum

EURUSD POPS => EUR CROSSES POP (SEE EURGBP)

Month end or news (Flash GDP beats forecasts)

April 30, 2024 at 8:51 am #5434In reply to: Forex Forum

EURGBP 4 HOUR CHART – MONTH END

As I noted, there are often some erratic month-end flows in EURGBP, especially around the 4 PM London fixing.

EURGBP has been under downward pressure (note blue AT lines) to start the week with key supports looming below at .8520 and the key .8484-.8502 lows (not shown on this chart).

April 30, 2024 at 7:51 am #5432In reply to: Forex Forum

EURUSD 1 HOUR CHART – STUCK IN A RANGE?

EURUSD has been stuck so far for a second day within a 1.0674-1.0753 range set last Friday with attention mainly on the JPY after BoJ interventions and verbal threats overnight.

Range so far this week 1.0686-1.0734

As I noted yesterday, it is month end, and while not an exact science the theory says if US stocks are lower on the month there is USD buying to adjust forex hedges. As I said this is not an exact science so just something to keep an eye on.

Also, month end often sees EURGBP erratic swings so watch into the 4 PM London fixing as it can impact EURUSD and GBPUSD.

Otherwise, markets seem to be on hold ahead of the FOMC decision tomorrow.

April 29, 2024 at 5:07 pm #5414In reply to: Forex Forum

Covered calls are bid for stocks as well as some other facets, but some internals are not solid so it appears to me that the bid in stocks in moderately on the apprehensive side but bid so far. Dxy withstood the overnight selling but has to clear 106.05 and hold to accelerate in my view, otherwise the 105 area might be seen. I’m looking to sell GbpUsd around 2600 but am biased long overall until the tune changes. Staying on the bid in AudUsd and crosses on pullbacks and believe it might temporarily stall around 6600 in both spot and futures.

April 26, 2024 at 9:45 am #5237In reply to: Forex Forum

April 25, 2024 at 9:08 am #5169In reply to: Forex Forum

GBPUSD 4-HOUR CHART – REVERSAL OF FORTUNE

GBPUSD, which fell sharply to end last week on shifting interest rate cut expectations has reversed course as the market reassesses that outlook.’

This saw UK 10-year bond yield rise 9BPS to close yesterday at the highest level for the year.

Combine that with JPY weakness and a sharp GBPJPY rise, you can see why there has been a GBPUSD reversal.

GBP is also firmer on other crosses (e.g. EURGBP is lower as well).

Looking at this chart, it needs to hold 1.2497 *=(suggests 1.25 as well) to maintain a strong bid although support is seen as long as it stays above 1.2423.

April 23, 2024 at 12:07 pm #5058In reply to: Forex Forum

Thanks to Newsquawk.com for broadcasting the comments from BOE’s Pill that sent GBP higher.

As you can see it was worth sharing it on the forum.

April 23, 2024 at 11:17 am #5056In reply to: Forex Forum

April 23, 2024 at 11:08 am #5055In reply to: Forex Forum

You have seen me post one of my favorite blog articles. The Power of 50. Look at current rates

GBPUSD 1.2350

EURUSD 1.0655

AUDUSD .6450 April 23, 2024 at 10:24 am #5051

April 23, 2024 at 10:24 am #5051In reply to: Forex Forum

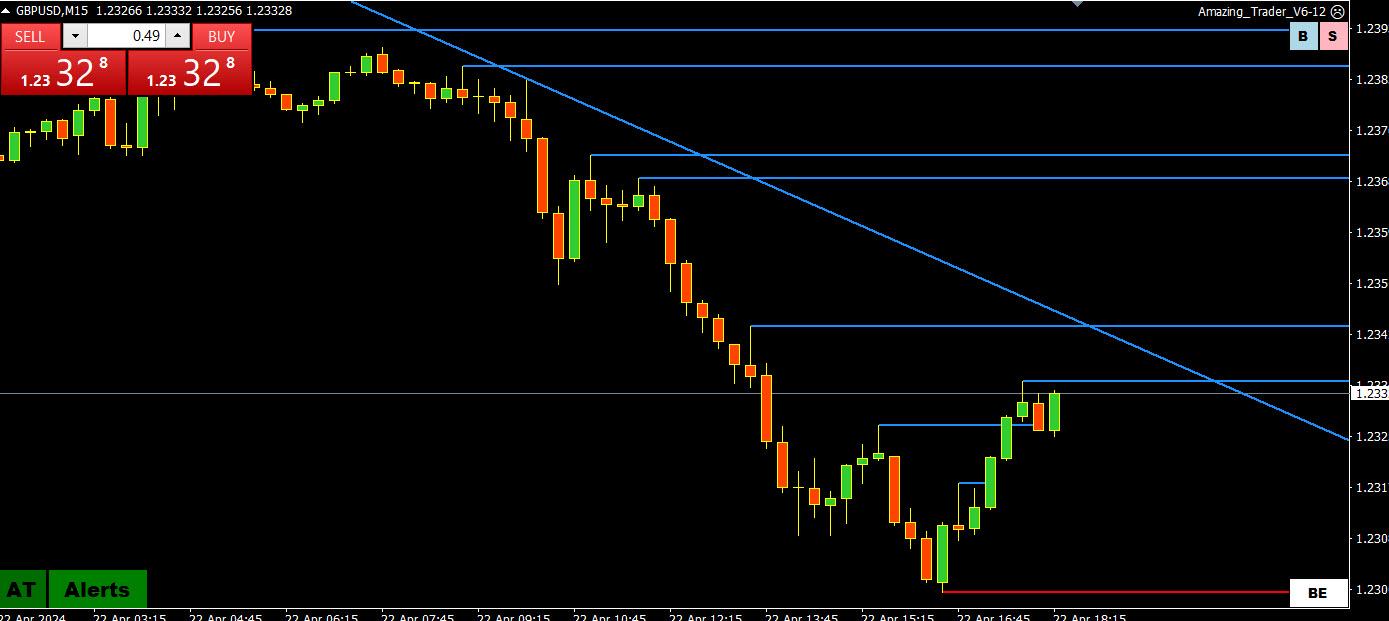

GBPUSD 30 MINUTE CHART -1.23-1.24

GBPUSD getting a pop from its flash PMI but not enough to take out 1.2399

This leaves GBPUSD consolidating within 1.23-1.24

Expect a mgnetic 1.2350 to be pivotal and set its intra-day boas.

What has taken some pressure off the downside is EURGBP buying pressures easing.

April 22, 2024 at 3:28 pm #5011In reply to: Forex Forum

April 22, 2024 at 3:23 pm #5010In reply to: Forex Forum

April 22, 2024 at 1:32 pm #4999In reply to: Forex Forum

April 22, 2024 at 12:11 pm #4997In reply to: Forex Forum

April 22, 2024 at 9:47 am #4993In reply to: Forex Forum

EURGBP DAILY CHART – BREAKOUT MODE

The key level on this chart is .8715, now needing to hold the,8620 break to expose it.

On the downside, it keeps a risk on the upside as long as it stays above .8550, stronger while above the.8585 breakout level.

Even if you don’t trade EURGBP you can use it as a clue to trade GBPUSD and EURUSD as I explain in

‘

‘How you Can Use Currency Crosses to Trade Spot ForexApril 22, 2024 at 9:40 am #4991In reply to: Forex Forum

GBPUSD WEEKLY – HOW LOW CAN IT GO?

I had to go to the weekly chart to find the next key level that is not until 1.2035.

That may be a reach as it would imply a much stronger dollar but that is what this chart shows following the break of 1.2499

If trading the GBPUSD, keep an eye on EURGBO as this was the flow that sent it lower on Friday.

‘

. -

AuthorSearch Results

© 2024 Global View