-

AuthorSearch Results

-

May 9, 2024 at 11:10 am #5994

In reply to: Forex Forum

May 9, 2024 at 10:10 am #5991In reply to: Forex Forum

May 9, 2024 at 1:19 am #5980In reply to: Forex Forum

GBPUSD 4-HOUR CHART – WAITING FOR BOE

The market is expecting a dovish tilt so the surprise would be if the BOE is less dovish.

On this chart 1.2466 on the downside, the trendline and 1.2594 on the upside are levels to watch (major support is not until 1.2298.

But toss technical levels out the door and focus on 1.25 as that will dictate the tone post-BOE

May 8, 2024 at 9:33 am #5926In reply to: Forex Forum

EURGBP 4 HOUR CHART – TRADES SOFT AHEAD OF THE BOE

As noted in the Morning Bid report, The Bank of England announces policy on Thursday, and while no change is predicted this week, dovish bets have risen recently.

This has seen EURGBP firm this week, putting the key .8644 level on the radar as long as it trades above .8581.

Note the EURUSD lag on the USD upside, helped by demand out of its crosses, not only EURGBP but other EUR crosses as well.

May 7, 2024 at 10:06 am #5869In reply to: Forex Forum

With the US economic calendar basically empty of key events this week it is like an addict having a tough time without his/her latest fix.

What we are left with is some revived Fed risk cut expectations as seen by slipping bond yields but little to go after on the dollar downside unless last Friday’s post-US job USD lows are threatened.

Otherwise, a mixed bag with JPY and AUD the underperformers.

EURUSD is holding up while above 1.0752, close to unchanged as it has been the benficaiory of varioius cross flows (note firmer EURGBP).

May 6, 2024 at 9:29 am #5820In reply to: Forex Forum

GBUSD 15 minute CHART – Better bid but consolidating

GBPUSD is a bit of an outperformer so far today (note firmer GBPJPY_ but consolidating with the UK closed today for a holiday/.

As this chart shows, there are layers of support ahead of the pivotal 1.25 level with key resistance above 1.26 (Friday’s high).

This suggests little to go for within a 1.25-1.26 range other than intra-day levels as show on this chart.

May 6, 2024 at 8:54 am #5818In reply to: Forex Forum

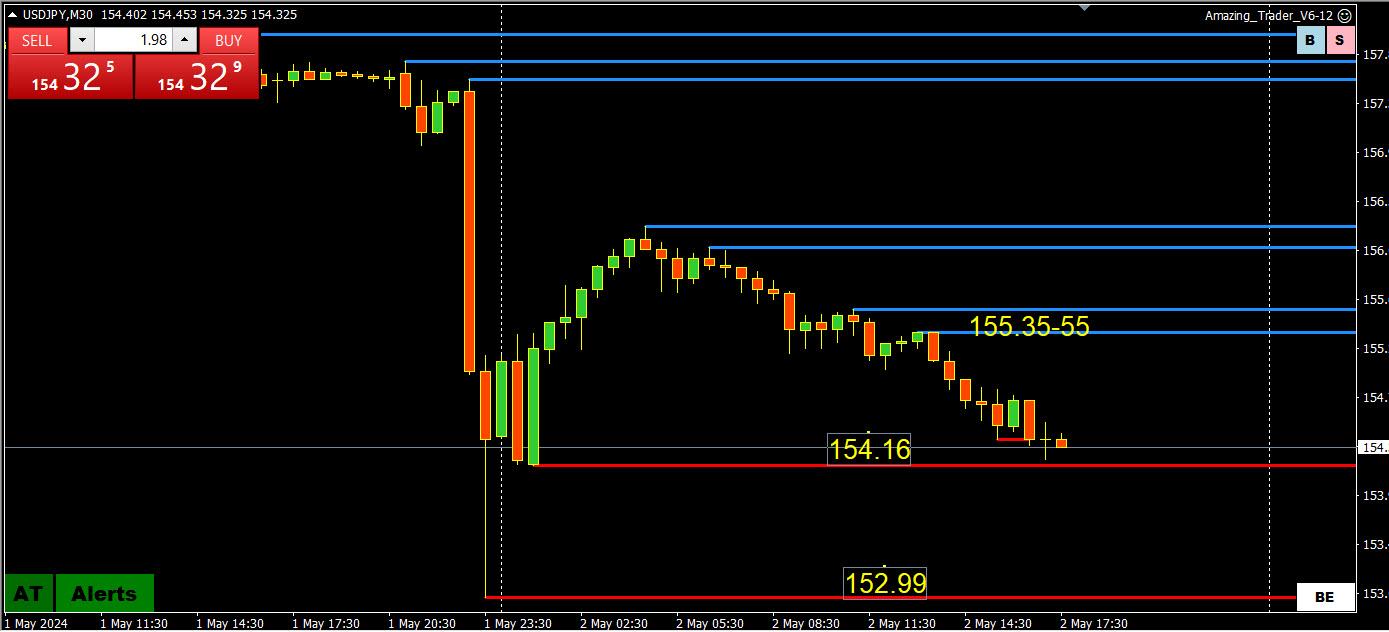

USDJPY 4 HOUR CHART- Is BoJ lurking?

When you see 2 currencies moving in opposite directions vs the dollar you can assume there are real market flows in a cross.

This is the case so far on Monday with USDJPY moving higher and currencies like the EUR, GBP, AUD, etc up (marginally so far) vs the USD.

Given what happened last time Japan was closed for a holiday (i.e. intervention) expect some caution pushing USDJPY higher but if I were in the BoJ’s shoes I would not want to become predictable.

Looking at this chart, the key level is not until above 156 and BoJ will likely want to see USDJPY stay below 155, suggesting 152-155 is sort of a no man;’s land for trading.

May 3, 2024 at 2:15 pm #5674In reply to: Forex Forum

EURGBP 30 Minute Chart – Weighing on GBPUSD

This chart would give chartists nightmares but EURGBP spike higher is why GBPUSD has struggled to hold a bid

May 3, 2024 at 1:10 pm #5667In reply to: Forex Forum

GBPUSD 30 MINUTE CHART – Pattern broken

GBPUSD break of its 6-day pattern pivoting 1.25 has seen a shift in directional risk

This suggests support on dips, strongest if it stays above 1.2577 but as long as it stays above 1.2538

Next hurdle is US Services PMI as this is the last piece of key US data with a quiet calendar next week.

Reminder UK is closed on Monday so this could impact trading.

May 3, 2024 at 9:36 am #5651In reply to: Forex Forum

EURUSD 4 HOUR CHART – PATTERN BROKEN?

Barring a surprise in today’s US data, EURUSD seems set to break an 8-day pattern around 1.07 (similar GBPUSD 6-day pattern around 1,25), which would suggest a shift in directional risk to the upside.

This suggests EURUSD will likely find support on dips as long as 1.07 does not trade, a stronger bid if 1.0735 can become support.

On the upside, a firm break of 1.0753-57 would be needed to put 1.08 in play (note there is little on charts then until a 1.0850 trendline and 1.0884)

May 2, 2024 at 6:57 pm #5638In reply to: Forex Forum

May 2, 2024 at 5:57 pm #5631In reply to: Forex Forum

May 2, 2024 at 3:35 pm #5621In reply to: Forex Forum

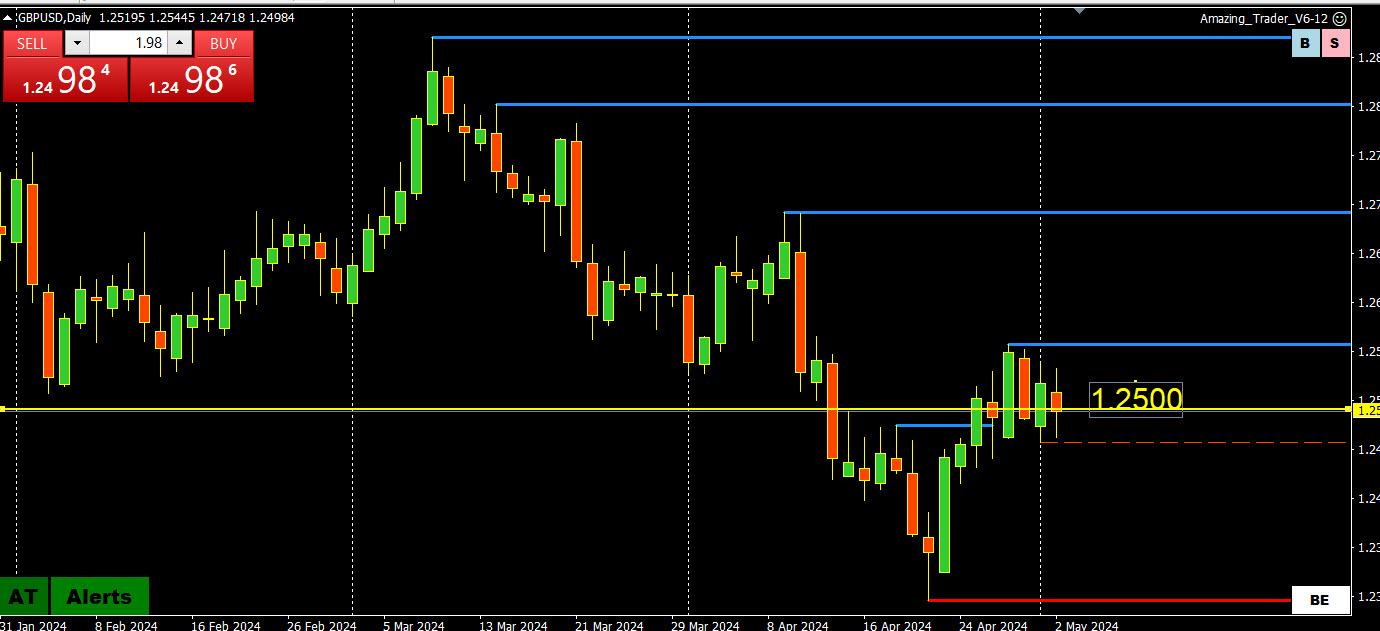

GBPUSD DAILY CHART – 1.25 PATTERN

Similar to the EURUSD 1.07 pattern cited earlier GBPUSD has extended its pattern trading on either side of 1.25 to 6 days in a row today.

Over this period there have been”

3 closes above 1.25

2 closes below 1.25

As I noted in EURUSD, the longer this pattern goes on the greater the chance of a directional move once it is broken.

Note today GBPUSD traded lower, helped by GBPJPY selling but the GBPUSD sell part was more easily absorbed than the USDJPY selling out of the cross (same for EURUSD selling more easily absorbed).

May 2, 2024 at 2:52 pm #5617In reply to: Forex Forum

My note on worker productivity is for the overall, not this report which moderated. Gbp should inevitably begin pricing in Fed rate cut in the near future and target 2800 in my view. Price activity is the sell side this morning but the complementing issues are bid, which is why I am selling euro but trying to position long in Gbp.

May 2, 2024 at 2:49 pm #5616In reply to: Forex Forum

WHEN YOU SEE TWO CURRENCIES TRADE IN OPPOSITE DIRECTIONS VS. THE USD YOIU CAN ASSUME THERE ARE CROSS FLOWS DRIVING THE MARKET.

NOTE TODAY USDJPY IS DOWN, AND EURUSD AND GBPUSD ARE BOTH LOWER.

As explained in the following…

How You Can Use Currency Crosses to Trade Spot Forex

May 2, 2024 at 2:43 pm #5615

May 2, 2024 at 2:43 pm #5615In reply to: Forex Forum

May 2, 2024 at 2:36 pm #5614In reply to: Forex Forum

May 2, 2024 at 1:27 pm #5604In reply to: Forex Forum

Labor productivity saw a slight increase which counters the slight increase in wages paid so it is creating a bit of a stalemate on the data. Hence an initial lack of conviction in markets. That may change as the day transpires. I like the bid in Gbp on dips at least for now. See dow futures trying for 38500+ inevitably. Yields and such favor Usd overall in the bigger picture in my view so selling it is a bit of a contra-position.

May 2, 2024 at 1:19 pm #5603In reply to: Forex Forum

May 1, 2024 at 9:38 pm #5578In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View