-

AuthorSearch Results

-

May 17, 2024 at 1:03 pm #6443

In reply to: Forex Forum

May 17, 2024 at 10:52 am #6424In reply to: Forex Forum

This is one of our most popular articles and on a day like this it is worth showing again, for those who have not read it and as a reminder for those who have read it as well.

Here is a test: Check your emotions and see how a currency feels like it is trdoing when it is above/below the “50” level

eurusd 1,0850 (currently below)

gbpusd 1.2650 (currently above)

audusd .6650 (flirting with it)

My Favorite Trading Secret: The Power of the “50” Level

My Favorite Trading Secret: The Power of the “50” Level

May 17, 2024 at 9:18 am #6417In reply to: Forex Forum

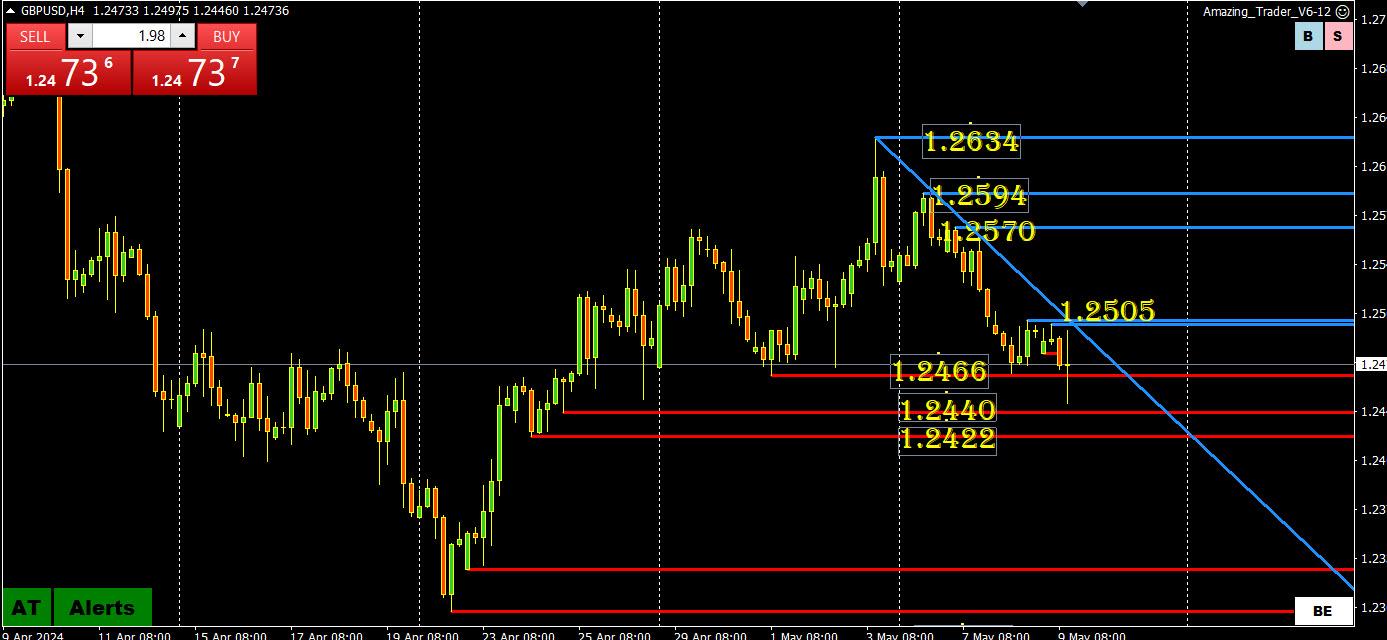

GBPUSD 4 HOUR CHART – LOWER BUT LAGGING

GBPUSD is lower but lagging EURUSD as EURGBP slips.

You can see the importance of 1.2643 as there is a void of supports until 1.2575-85 on this chart. This also means there are no obvious stops to go after until that level.

This suggests using shorter time frame charts to trade this currency.

May 16, 2024 at 4:20 pm #6399In reply to: Forex Forum

May 16, 2024 at 9:49 am #6373In reply to: Forex Forum

GBPUSD DAILY CHART –

GBPUSD tested 1.27, just shy of the key 1.2709 level but has since backed off.

tHE STRAIGHT LONE MOVE UP YESTERDAY LEAVES LITTLE IN THE WAY OF OBVIOUS SUPPORT SO EITHER LOOK AT SHORTER TIME FRAME CHARTS OR USE RETRACEMENT LEVELS.

In this regard, check out our FIBONACCI CALCULATOR and calculate FIBO levels for whatever time frame you are looking at, such as 4 hour chart

May 15, 2024 at 11:12 am #6313In reply to: Forex Forum

May 15, 2024 at 10:57 am #6308In reply to: Forex Forum

GBPUSD 15 MINUTE CHART – TRADING LESSON

You have seen me talk about the influence of cross on spot trading and this is how I look at it using EURGBP to illustrate:.

– When you see a straight line move down as in this chart (I look at the 15 min chart), it suggests there is a real money flow (order) driving, in this case, EURGBP lower.

– So you know GBPUSD is being bought and EURUSD is being sold.

= During this straight-line move, given the current trend, GBPUSD will be supported.

– Once EURGBP finds support, either GBPUSD will lose its strong bid or EURUSD will play catch-up.

– In this case, GBPUSD has lost its bid and slipped once the EURGBP bounced off its low.

If you ever played the game “Hot Potato” you can go with the flow until the music stops (i.e. order is filled)

May 15, 2024 at 10:31 am #6307In reply to: Forex Forum

May 15, 2024 at 10:01 am #6303In reply to: Forex Forum

Given how EURGBP is influencing EURUSD and GBPUSD, it seems like a good time to revisit this insightful article.

How You Can Use Currency Crosses to Trade Spot Forex

May 15, 2024 at 9:45 am #6302

May 15, 2024 at 9:45 am #6302In reply to: Forex Forum

EURGBP 4 HOUR CHART – BACK BELOW .8600

If you trade EURIUSD and/or GBPUSD you need to keep an eye on EURGBP, which is trading lower today.

This, in turn, is helping to give GBPUSD a bid and so far keeping a lid on EURUSD.

Given the trends, the market is having more trouble absorbing the GBPUSD buy side.

May 15, 2024 at 9:09 am #6301In reply to: Forex Forum

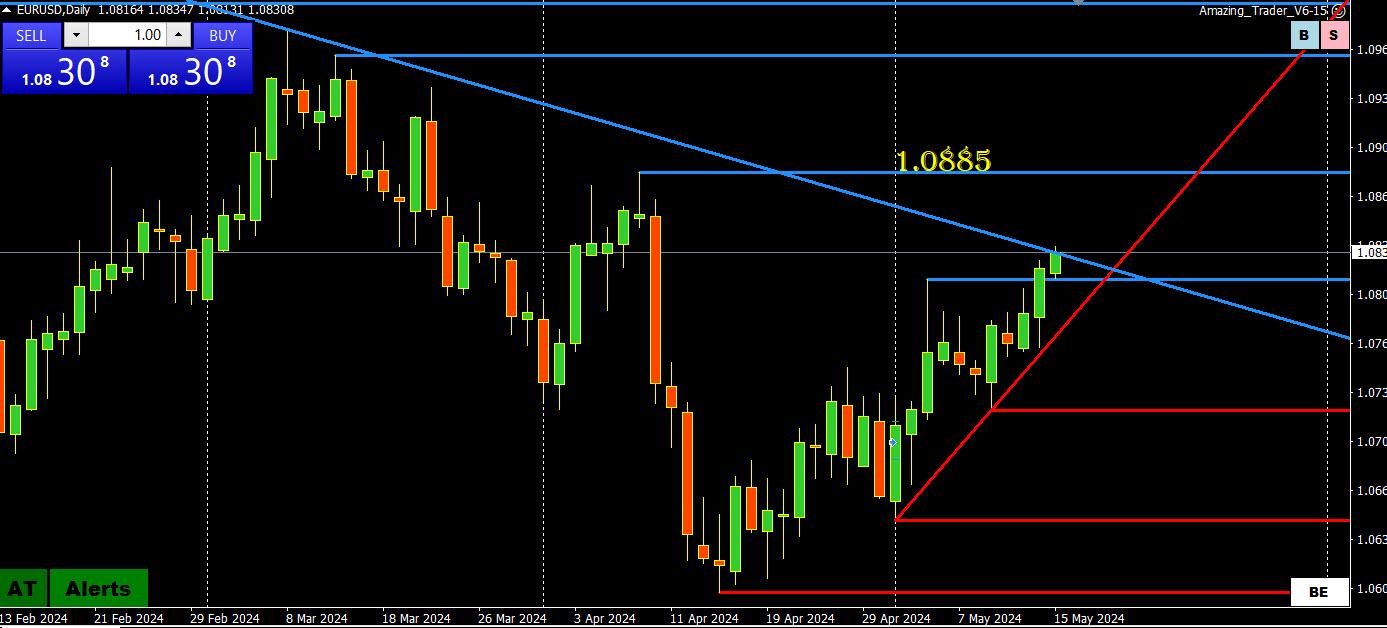

EURUSD DAILY CHART – WATCHING A KEY TRENDLINE

EURUSD: technicals pointing up but so far just nicking its key daily trendline at 1.0831 without a clean break as it lags as it trades softer on various crosses (e.g. EURJPY, EURGBP). A firm break would expose 1.0884 as the next target.

Time now to roll the dice as US data is the next key focus.

May 14, 2024 at 12:03 pm #6224In reply to: Forex Forum

GBPUSD 4 HOUR CHART – 1.25-1.26?

While the earlier fall-off-a-cliff move was unnerving, GBPUSD remains within 1.25-1.26, suggesting the 1.2550 level will dictate its intra-day bias.

As noted earlier, 1.2500-02 is a key level as there is qa voud below it.

On the upside, 1.2570-94 guards the key 1.2634 level.

May 14, 2024 at 8:44 am #6204In reply to: Forex Forum

The only news I saw other than the UK jobs report, which was not the catalyst for the GBPUSD nosedive, was this that came out within the past hour:

BOE Chief Economic Pill says there is still some work to do on the persistence of inflation; not unreasonable;e to believe that over the summer the BOE will see enough confidence to consider rate cuts….Source; Newsquawk.com

If this was the catalyst for the (over?) reaction down in GBPUSD, it is yet another indication of how hyper-sensitive markets are to any news that might impact interest rate cut expectations.

May 14, 2024 at 8:40 am #6203In reply to: Forex Forum

GBPUSD 1-HOUR CHART – LOOKS LIKE IY FELL OFF A CLIFF?

I am using this chart as it looks like GBPUSD fell off a cliff. This may reflect a thin market that has been buying GBPUSD this week.

Whatever the case, the key level on the downside, as pointed out yesterday, is 1.2502 as there is a void of key levels below it. So far, GBPUSD has paused above it.

On the upside, back above 1.2546, at a minimum, would be needed to ease the risk on the downside.

May 13, 2024 at 3:05 pm #6166In reply to: Forex Forum

May 9, 2024 at 4:41 pm #6014In reply to: Forex Forum

May 9, 2024 at 2:04 pm #6006In reply to: Forex Forum

May 9, 2024 at 1:21 pm #6002In reply to: Forex Forum

May 9, 2024 at 12:18 pm #5996In reply to: Forex Forum

EURGBP 4 HOUR CHART – Watch .8600

Looking at this chart, technicals are still pointed up but the range is .8581-.8619, with .8600 as the midpoint.

For me this suggests using .8600 as a barometer of GBP strength (relative term) or weakness.On the upside, a firm break above .8620 would put the major,8744 level in play.

On the downside, a firm break of .8580 would suggest the high is in for now and cooling pressure on GBPUSD.

Likely see support on dips while above .8581.

May 9, 2024 at 12:07 pm #5995In reply to: Forex Forum

GBPUSD 4 HIUR CHART

Break off 1.2466 has so far been unable to reach 1.2422-40. The significance of these levels is below it would open the floodgates on the downside (major support is at 1.2298).

Otherwise, there are two pivotal levels

1.2500-05 on top

and

1.2450 (Power of 50 level) for intra-day trading bias (currently back above it)

As I noted, also loom at EURGBP as an indicator of GBP weakness or noit.

-

AuthorSearch Results

© 2024 Global View