-

AuthorSearch Results

-

May 22, 2024 at 5:08 pm #6668

In reply to: Forex Forum

May 22, 2024 at 3:25 pm #6654In reply to: Forex Forum

May 22, 2024 at 2:29 pm #6644In reply to: Forex Forum

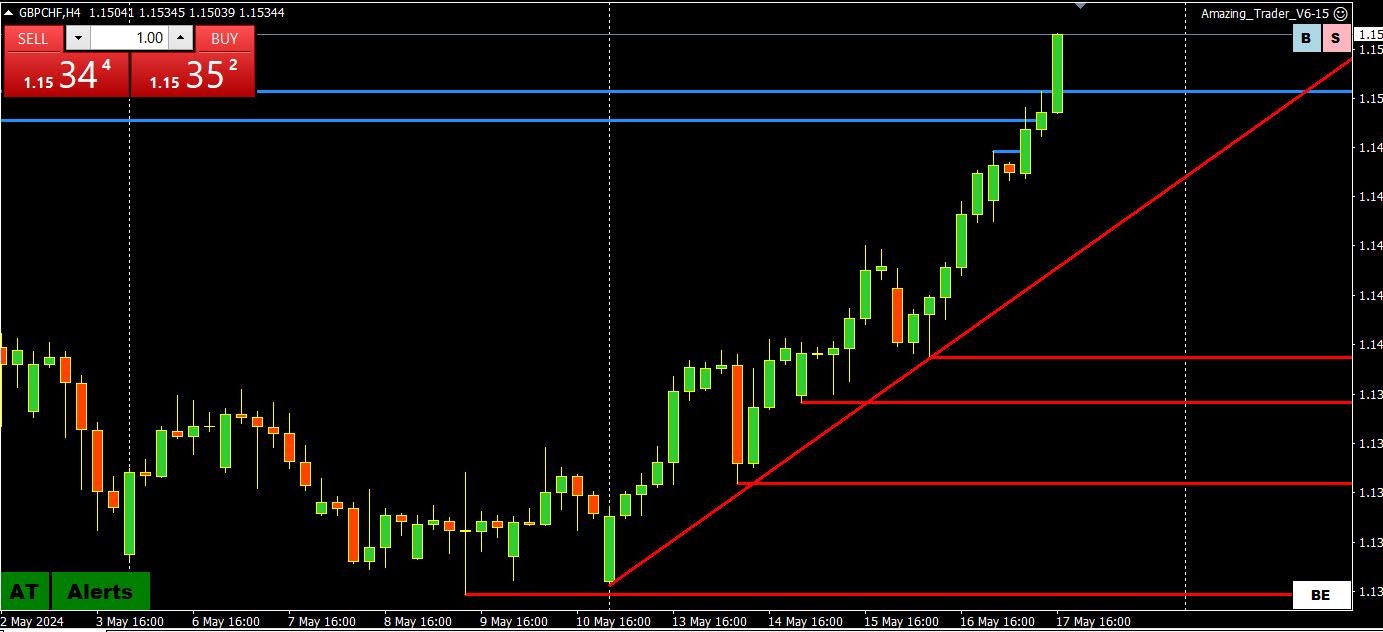

So far not much of a reaction in GBP but be on alert

Rumours of a snap election are growing in Westminster following the announcement of a possible summer contest.A Cabinet meeting has senior Conservatives clearing space in their diaries, with some suggesting a reshuffle might instead be in the offing, with Jeremy Hunt’s position as chancellor at risk.

Adding to mounting speculation, the foreign secretary David Cameron has cut his trip to Albania short to attend this afternoon’s urgent meeting expected around 4pm….

May 22, 2024 at 2:12 pm #6640In reply to: Forex Forum

May 22, 2024 at 11:03 am #6627In reply to: Forex Forum

May 22, 2024 at 8:31 am #6618In reply to: Forex Forum

GVI 8:13

At 1.2728 GBP is now backed off 50% of reaction to earlier inflation stickiness.

—IF u d like chuckle:

IMF says BOE should cut bank rate by 50-75 bps this year

Traders are currently seeing two rate cuts for the BOE, with the first one currently baked in for August. But a move in June might be…

22 hours agoBoE will consider IMF’s call for more press conferences, Bailey says

Bank of England Governor Andrew Bailey said on Tuesday that the central bank would consider a proposal by the International Monetary Fund…

14 hours agoBoE’s Bailey: Thinks Next Move on Rates Will Be a Cut

BoE’s Bailey: Thinks Next Move on Rates Will Be a Cut BANK OF ENGLAND’S BAILEY SAYS HE WILL CONSIDER IMF RECOMMENDATION OF MORE MPC PRESS…

14 hours agoLONDON, May 21 (Reuters) – Britain’s once towering inflation rate looks set to fall close to the Bank of England’s 2% target on Wednesday,…

10 hours agoBOE Urges Markets to Prepare for Big Rise in Repo Operations

6 hours agoMay 22, 2024 at 8:13 am #6615In reply to: Forex Forum

May 22, 2024 at 7:46 am #6614In reply to: Forex Forum

UK inflation falls less than expected, dashing June rate cut hopes

GBPUSD needs to hold above 1.2726 to maintain the breakout.

May 22, 2024 at 1:01 am #6609In reply to: Forex Forum

May 21, 2024 at 10:33 pm #6601In reply to: Forex Forum

The key event overnight will be the release of UK CPI. It comes out before UK markets open and will be a test for GBPUSD’s recent strength.

Click below for a detailed preview.

May 21, 2024 at 3:16 pm #6583

May 21, 2024 at 3:16 pm #6583In reply to: Forex Forum

May 21, 2024 at 2:15 pm #6569In reply to: Forex Forum

EURGBP 4 HOUR CHART – FACING KEY SUPPORT

If the market was concerned about an expected sharp drop in headline UK inflation tomorrow it is showing no signs of it.

You can see by the blue AT laffer lines pointing down that EURGBP is coming in range of key support at .8526.

Key support is at .8484-.8502 below it.

Note one reason why EURUSD has been trading soft and GBPUSD bid are flows in this cross.

May 21, 2024 at 9:27 am #6544In reply to: Forex Forum

GBPUSD 1 HOUR CHART – bID DESPITE LOOMING CPI

Logic would normally say GBP should be trading on the soft side ahead of what is forecast to be a sharp drop in CPI to be reported on Wednesday.

So far, this has not been the case but keep this in mind as the day winds on.

Meanwhile, GBPUSD is maintaining its bid while above 1.2696 with 1.2720 guarding key resistance at 1.2726. Above this level, there is a void until 1.28+

May 20, 2024 at 9:55 am #6501In reply to: Forex Forum

GBPUSD DAILY CHART – TESTING A KEY RESISTANCE

GBPUSD has tested 1.2708 and as can be seen on this chart is a key resistance.

On the downside (not shown on this chart() a key support is at 1.2643, but 1,27 will likely be the bias setter ahead of a busy week for UK data.

In this regard, CPI will be the highlight, and logic says forecasts for a sharp drop should at some point cap GBPUSD”s upside ahead of it.

May 19, 2024 at 5:23 pm #6487In reply to: Forex Forum

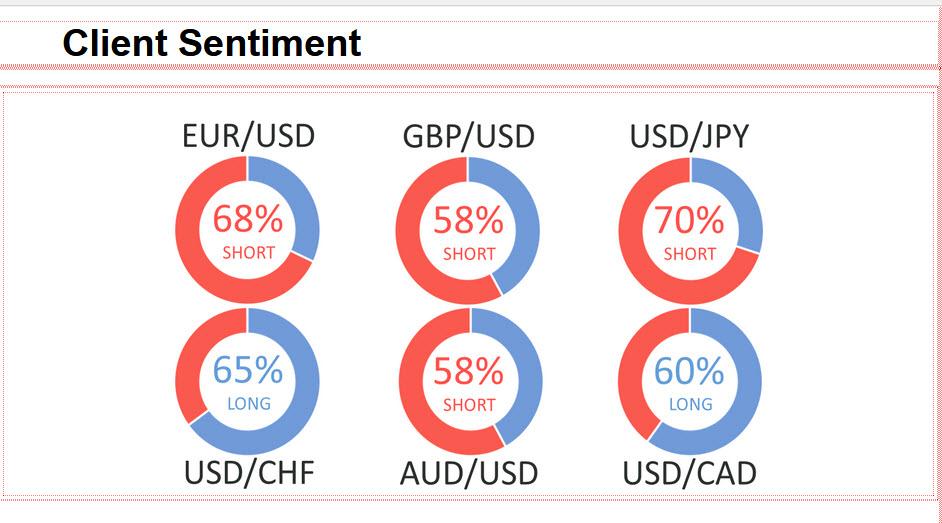

According to IG

According to IGA majority of IG traders are long US dollar against key currencies like EUR and GBP after soft CPI inflation data led to substantial dollar weakness on Wednesday of last week. In USD/JPY, however, 70% of IG traders with open positions are short as the pair continues to trade above 150.00—not far from historic highs.

May 18, 2024 at 11:11 am #6472

May 18, 2024 at 11:11 am #6472In reply to: Forex Forum

USDX DAILY CHART – WHERE ARE THE FLOWS GOING?

While the US Dollar Index (USDX) closed about unchanged, the currency market traded mixed with EURUSD closing about unchanged, GBPUSD higher, and the CHF and JpY weaker. The star of the day was gold.

CLOSE VS PRIOR % CHANGE

EURUSD 1..0869 VS 1.0865 +.03

USDJPY 155.65 VS 155.414 +.15

GBPUSD 1.2701 VS 1.2672 +.22

USDCAD 1.3615 VS 1.3612 -.02

AUDUSD 6692 VS .6682 +.16

USDCHF .9092 VS .9061 +.34

XAUUSD 2515 VS 2377 +1.55Do the math.

GBPJPY was the outperformer with GBPJPY coming in second.

XAUUSD outperformed all currencies with a wide margin and weakness in JpY and CHF suggests there might have been XAUJPY and XAUCHF carry trades involved.

May 17, 2024 at 4:12 pm #6458In reply to: Forex Forum

May 17, 2024 at 4:06 pm #6457In reply to: Forex Forum

May 17, 2024 at 2:54 pm #6454In reply to: Forex Forum

May 17, 2024 at 1:22 pm #6445In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View