-

AuthorSearch Results

-

July 12, 2024 at 10:22 am #9020

In reply to: Forex Forum

July 12, 2024 at 10:01 am #9017In reply to: Forex Forum

GBPUSD 4 HOUR – MARCHING FOR 1.30?

GBPUSD so far extending its high by one pip tp the “50” level (1.2950)

Should 1.2950 become support, expect a run towards 1.30

Major technical target remains at 1.3141 following the break of 1.2893

Downside contained as long as it trades above 1,29

Note GBP strength on its crosses as well

July 12, 2024 at 9:35 am #9015In reply to: Forex Forum

July 11, 2024 at 5:45 pm #8986In reply to: Forex Forum

GBPCHF 4H

Kind of a strange choice of instrument for me – Yes, it has never crossed my mind to play with this cross 😀

But one of our new members brought it up to my attention, so I added some of my own recipe to it and Voila…

Robinson saw it on time and together we are now bringing it up to your attention.

Supports at : 1.15350 , 1.15100 & 1.14950

Resistances at : 1.15550 , 1.15750 & 1.16200

We should start paying attention to it….

Thank you Robinson for this little gem 😀

July 11, 2024 at 2:56 pm #8970

July 11, 2024 at 2:56 pm #8970In reply to: Forex Forum

July 11, 2024 at 11:16 am #8947In reply to: Forex Forum

July 11, 2024 at 10:22 am #8935In reply to: Forex Forum

July 10, 2024 at 9:57 pm #8915In reply to: Trading Academy Q&A’s

July 10, 2024 at 7:08 pm #8900In reply to: Forex Forum

GBPJPY DAILY CHART – ALL GREEN CANDLES

Look at this Chart as it speaks for itself.

As I have noted, when two currencies move in oppoitte directions like today (GBP up, JPY down), there is real money driving the moves.

Closest support is just below 205.

This also makes it difficult for the BoJ to intervene as it is more than just a USDJPY move.

July 10, 2024 at 4:54 pm #8895In reply to: Forex Forum

Had a brief call with someone I respect tremendously yesterday (Jay) regarding EurGbp. My metrics show the pair remaining offered on buy cycles toward 8450/60 area for now.

On Crypto and the FED and Stablecoin – It is difficult to substantiate the thought that all crypto vehicles will be buried once the use of Stablecoin is established, but the ones that survive will be Bitcoin and a few that help the poor in poor countries, or offer something solidly unique and useful within realistic value of use.

A lot of talk from politicians regarding bank stability should a shock arise during the Powell testimony. As I noted yesterday, major US banks recently roundingly passed stress tests and technology is improving. The one issue concerning me is the effect of a major cyber attack should it occur and/or flat out war with the US and another major power(s), which one would think is unlikely unless some insane person gains access to terrible weaponry. Otherwise the banking industry looks strong.

July 10, 2024 at 3:45 pm #8894In reply to: Forex Forum

GBPUSD DAILY CHART – EMBRACE THE RETRACE

The reality of trading is that trends often need a retracement, even a minot one before it can make a run at a new high (or low).

This seems to have been the case with GBPUSD, which still needs to Get through 1.2846 to challenege the key target at 1.2860.

Note EURUSD lag as EURGBP retreats further from .8460 tested yesterday (last .8428).

July 10, 2024 at 2:25 pm #8882In reply to: Forex Forum

July 10, 2024 at 1:44 pm #8878In reply to: Forex Forum

July 10, 2024 at 11:21 am #8858In reply to: Trading Academy Q&A’s

July 10, 2024 at 9:55 am #8851In reply to: Forex Forum

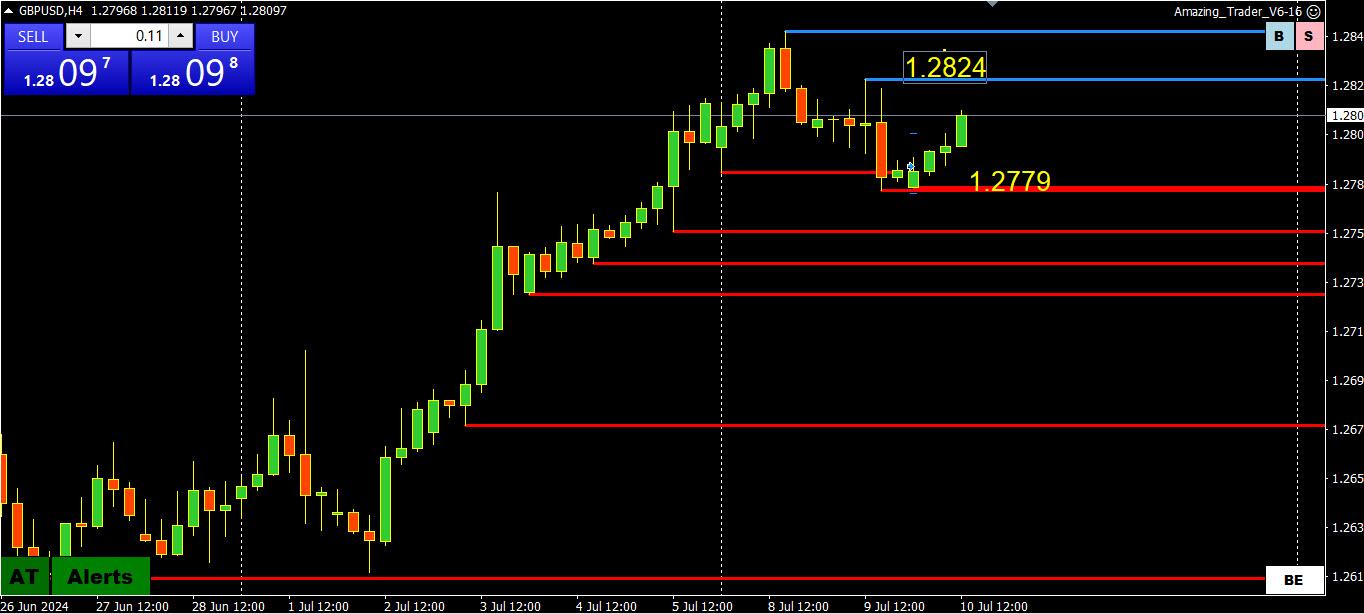

GBPUSD 4 HOUR CHART – WATCH 1.28

Whatever orders were behind the GBPUSD retreat seem to have run their course (look at GBP crosses, including EURGBP which has backed off after .8460 resistance held).

Key levels:

1.2824, above puts the 1.2846 high in play

1.2779, below it extends the retracement

1.2800, sets the tone

July 9, 2024 at 5:00 pm #8826In reply to: Forex Forum

GBPUSD UPDATE – RETRACEMENTS?

Retracement levels

1.2756 = 38.2%

1.2729 – 50%July 9, 2024 at 3:37 pm #8819In reply to: Forex Forum

July 9, 2024 at 3:14 pm #8814In reply to: Forex Forum

July 9, 2024 at 9:42 am #8777In reply to: Forex Forum

July 8, 2024 at 5:12 pm #8743In reply to: Forex Forum

One of those Mondays…Here is my Power of 50 article as GBPUSD, EURUSD, AUDUSD and USDJPY all paused around or shy of respective 50 levels in what turned into a slow drip, paint drying session.

FWIW the softer GBPUSD tine appears toi be coning from EURGBP buying.

-

AuthorSearch Results

© 2024 Global View

The GBPCHF I posted during the day was an amazing movement</p>

The GBPCHF I posted during the day was an amazing movement</p>