-

AuthorSearch Results

-

August 15, 2024 at 1:54 pm #10557

In reply to: Forex Forum

August 15, 2024 at 12:58 pm #10550In reply to: Forex Forum

August 15, 2024 at 9:59 am #10540In reply to: Forex Forum

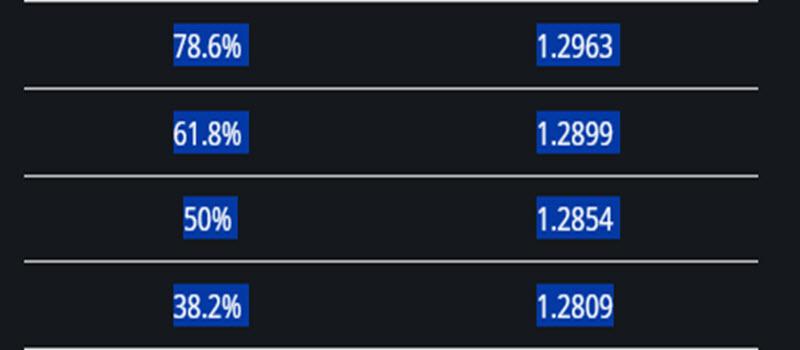

GBPUSD DAILY CHART – 1.2850-00

GBPUSD 1.2850 setting up as the intra-day bias setter with some support coming from a softer EURGBP (after being bid yesterday).

Note the fibo levels, and resistance on this chart, making 1.2850-00 the zone that needs to be overcome to suggest more scope on the upside.

August 14, 2024 at 4:20 pm #10520

August 14, 2024 at 4:20 pm #10520In reply to: Forex Forum

August 14, 2024 at 9:18 am #10486In reply to: Forex Forum

EURGBP 1 HOUR CHART – Tug-of War

.8580 is a pivotal area with the key .8625 high exposed if trading above it

Catalyst today was UK CPI

Note, when two currencies trade in opposite directions vs the USD, like a tug-of-war, it is a sign of real money cross flows driving it.

Market is having more trouble absorbing the EUR buying.

August 14, 2024 at 8:55 am #10482In reply to: Forex Forum

EURUSD WEEKLY CHART – ONLY ONE LEVEL MATTERS

What have you done for me lately?

This came to mind this morning after I nailed the direction and support yesterday (1.0945-50).

Looking across all currencies, the NZD is the big loser (-1.1%) while EURUSD is the outperformer, up while GBP and JPY are down vs. the dollar, providing demand for EUR out of its crosses.

EURUSD

The only level that matters is 1.10 as it just broke its 1.1008 daily resistance with key levels beyond it shown on this chart. I the absence of key nearby levels, 1.1020-50 is a potential resistance zone.

The support zone is 1.0980-00 and 1.0945-50/

Next key focus is on US CPI… tone will be set by 1.10 post-data

August 13, 2024 at 10:18 am #10429In reply to: Forex Forum

August 13, 2024 at 10:12 am #10428In reply to: Forex Forum

August 13, 2024 at 7:43 am #10425In reply to: Forex Forum

Risk on start (stocks up)

GBPUSD tests 1.28 after UK jobs report

JPY trading softer (but USDJPY is still below 148)

EURUSD lagging on EURGBP dip

XAUUSD backing off after testing 2477 resistance (noted yesterday)

Markets seem to be betting on no Middle East escalation assuming Iran will launch its strike

US CPI on Wed is not expected to alter rate cut expectations barring a surprise

August 12, 2024 at 12:10 pm #10388In reply to: Forex Forum

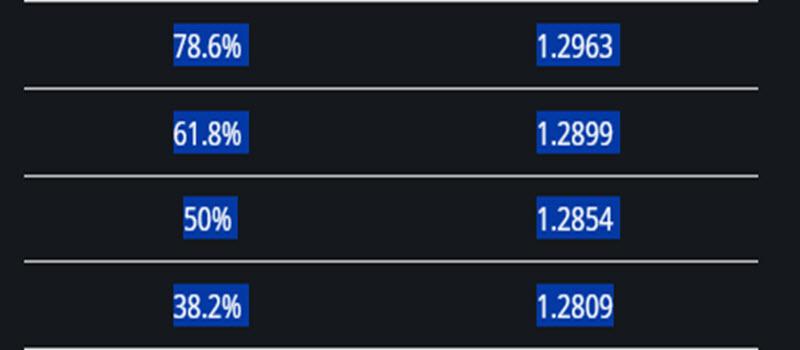

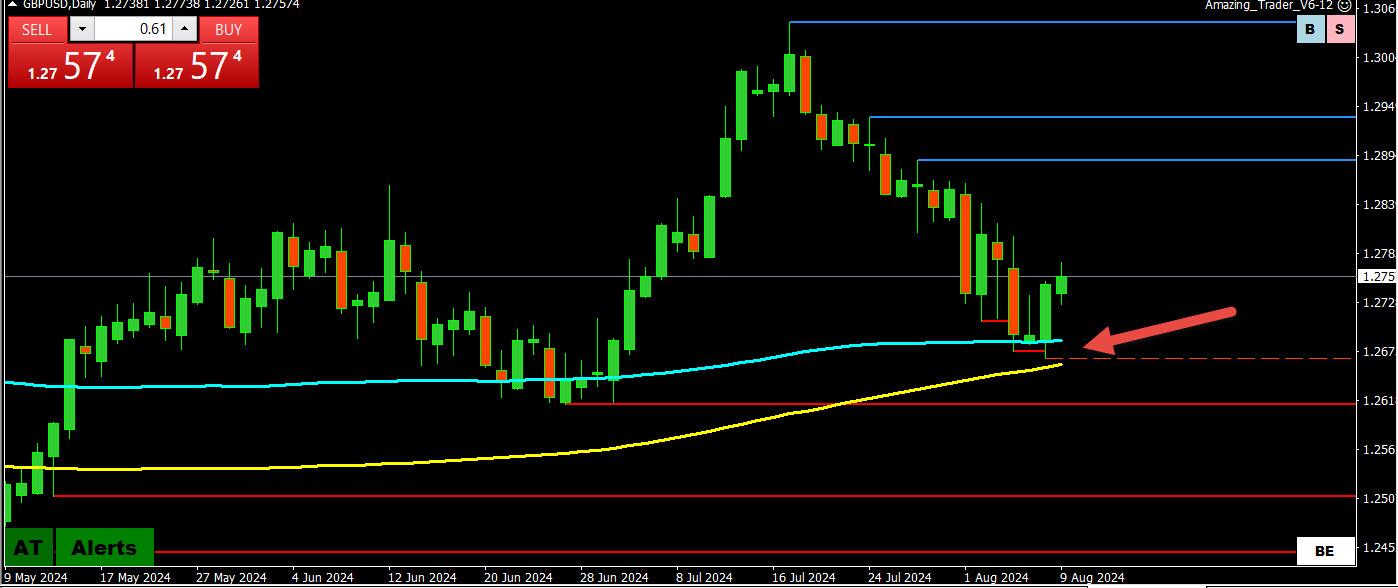

GBPUSD WEEKLY OUTLOOK – MOVING AVERAGES CHECK THE DOWNSIDE

Posted over the weekend (daily chart)

GBPUSD bounce from the 100 (blue) and 200 (yellow) moving average band would need to regain 1.28+ to expose resistance (1.2800-20) and retracement levels as shown below.

On the downside. 1.27 is a pivotal level that needs to trade above to keep a new found bid. Below it is key support is at the 1.2664 low and the major 1.2612 support.

There is a full UK economic calendar this week so the reaction will dictate whether GBPUSD has found a bottom.

GBPUSD retracement levels:

August 10, 2024 at 6:11 pm #10357

August 10, 2024 at 6:11 pm #10357In reply to: Forex Forum

GBPUSD Daily

Resistances : 1.27750 , 1.27850 & 1.28050

Supports : 1.27450 , 1.27250 & 1.26750

After breaking below the Channel Trend line, the same one is now acting as a Resistance -1.28050

It doesn’t mean that we’ll be watching Bears dancing, as it might be just a correction, but if that resistance shows strength, we should be falling one more leg…all the way to the Major Support at 1.24150.

That development can take about 4 days to happen….so it can be traded both ways ( as it is always the case with the Demon )

August 10, 2024 at 2:37 pm #10353

August 10, 2024 at 2:37 pm #10353In reply to: Trading Academy Q&A’s

Robinson – Your USDJPY chart is very good !

Try not to overcomplicate things and as you caught the exact Channel there, stay with it.

One technical explanation : It is a channel , not a Rectangle – Rectangle is Horizontal – here you have a nice angle – so Trend Channel

Your GBPCAD chart is more of Jay’s style, and you did it good – just try not to go predicting next move…it never works as planned…always look for a Wave in creation and Patterns ( we’ll go over that a bit later – first get good in this…and you are getting good J

As for your question : Orderblocks and Fear something…no offence mate, but that is a pure BS believe me – each time you hit something like that, ask about it as you just did , and we will give you a straight answer – like it or not J

August 9, 2024 at 3:11 pm #10316In reply to: Forex Forum

August 9, 2024 at 3:07 pm #10315In reply to: Forex Forum

August 9, 2024 at 1:47 pm #10308In reply to: Forex Forum

EWURGBP bounce off .8550 has given EUEUSD a modest bid while GBPUSD has backed off its earlier high (GBPJPY softer as well).

So it looks like a quiet Friday finish to a choppy week dominated by position squaring/adjustments. Note Japan is closed on Monday.

The focus will be more on stocks than fx so it seems.

August 9, 2024 at 11:02 am #10298In reply to: Forex Forum

August 9, 2024 at 9:23 am #10294In reply to: Forex Forum

If I told you that there was a large order in the market to sell EUR and buy GBP would you be looking to buy EURUSD or sell GBPUSD, do the opposite or step aside as the order gets executed?

This article is worth revisiting

August 9, 2024 at 9:08 am #10292In reply to: Forex Forum

EURGBP DAILY CHART – Retracing after a failed break

This cross was a driver in yesterday’s turnaround day and again early today, boosting GBPUSD while EURUSD lags.

For those trading EURUSD, yesterday’s run through stops at 1.0892 was driven by selling of this cross that saw GBPUSD buying take over after EUREUSD selling did not follow through. (I will post a link to an article on using crosses to trade SpotFX).

Looking at this chart, it has been straight up from a low at .8382 to yesterday’s failed break of .8620 to a high at .8626, leaving no obvious support levels below the market.

So let’s look at retracement levels using our Fibonacci Calculator

August 9, 2024 at 9:01 am #10288

August 9, 2024 at 9:01 am #10288In reply to: Forex Forum

GBPUSD 4 HOUR CHART – Retracement

Once again, thanks to JP for alerting us to the 100 and 200 daily moving average zone yesterday, where GBPUSD found support, helped by the reversal in EURGBP.

The move up is so far just a retracement that would first need to break the trendline and then move through 1.2800-20 to suggest a reversal.

On the downside, look for support if it holds above 1.2735.

Otherwise, look for 1.2750 to set the intra-day tone of trading within 1.27-1.28

August 9, 2024 at 12:22 am #10282In reply to: Trading Academy Q&A’s

-

AuthorSearch Results

© 2024 Global View