-

AuthorSearch Results

-

September 27, 2024 at 1:16 pm #12161

In reply to: Forex Forum

September 26, 2024 at 4:12 pm #12120In reply to: Forex Forum

September 26, 2024 at 3:39 pm #12117In reply to: Forex Forum

September 26, 2024 at 3:23 pm #12113In reply to: Forex Forum

September 26, 2024 at 12:44 pm #12100In reply to: Forex Forum

September 26, 2024 at 9:40 am #12088In reply to: Forex Forum

GBPUSD 4 HOUR CHART – Bounced but…

Bounce from 1.3310 helped by firmer crosses (e.g. vs EUR)

One change from yesterday is that deck is cleared of buy sop until the 1,3420 high.’

On the downside, key level is the 4 hour trendline (see chart)

This leaves GBP in sort of limbo if it stays between 1,33-1,34

Key focus in Fed speakers, Weekly jobless claims, US PCE tomorrow (typically would suggest a limited USD upside ahead of it).

September 25, 2024 at 1:32 pm #12056In reply to: Forex Forum

September 25, 2024 at 11:09 am #12043In reply to: Forex Forum

September 25, 2024 at 9:47 am #12039In reply to: Forex Forum

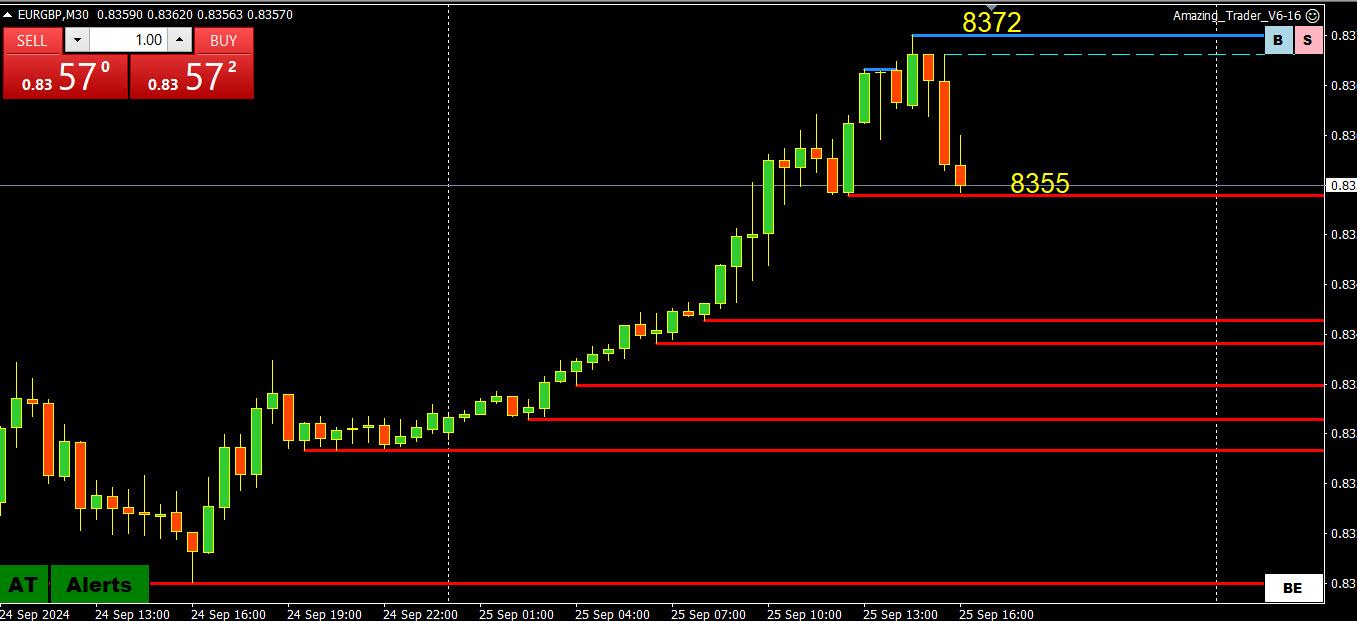

EURGBP 4 HOUR CHART – BOUNCE FROM MULTI-YEAR LOW

If trading EURUSD and GBPUSD, it pays to keep an eye on EURGBP, which is firmer today… weighing on GBPUSD while EURUSD follows with a lag

This follows a bounce from ,8317, lowest level since early 2022.

Supports: .8339, .8317

Resistance: .8389 (this week’s high)

September 25, 2024 at 9:37 am #12038In reply to: Forex Forum

September 24, 2024 at 9:13 pm #12033In reply to: Forex Forum

September 24, 2024 at 10:26 am #12002In reply to: Forex Forum

September 24, 2024 at 9:52 am #11998In reply to: Forex Forum

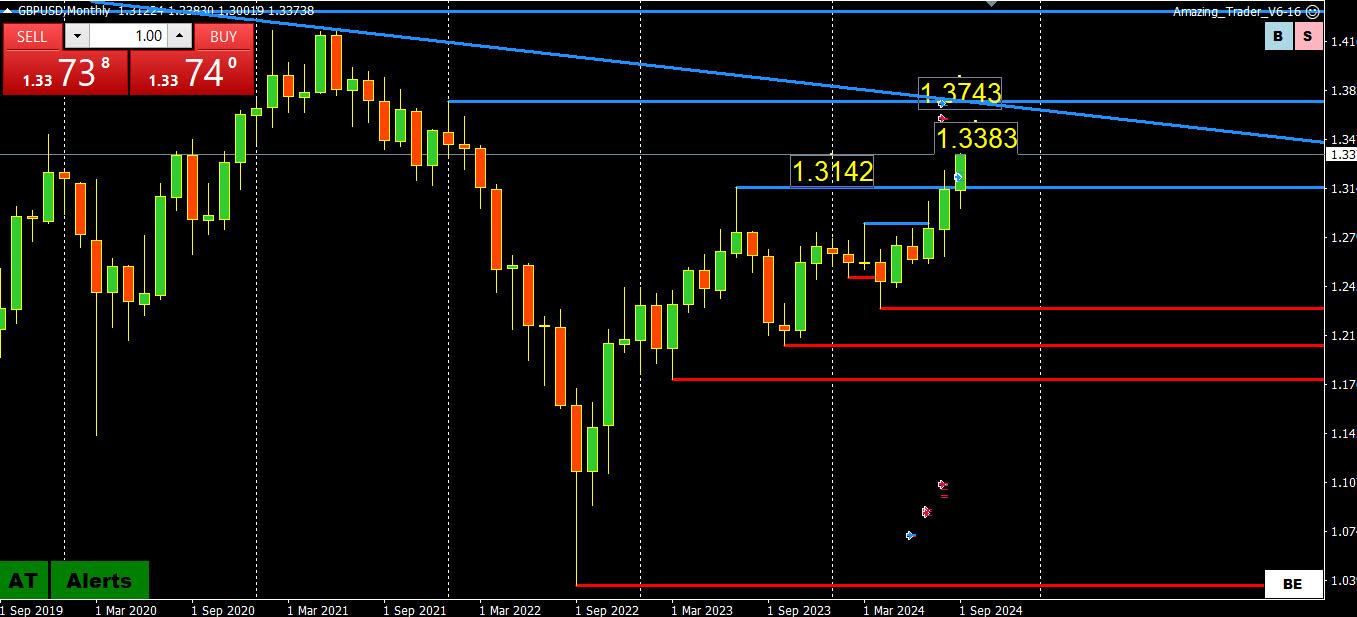

GBPISD MONTHLY CHART – New high

GBPUSD extended its high to 1.3383, highest level since early 2022.

With the next key level not until above 1.37, use the most recent high as the closest key resistance.

To dent the upward momentum, Monday’s low at 1.3248 would need to be broken.

Note, keep an eye on EURGBP (downtrend), and the tug-of-war between a lagging EURUSD and a firmer GBPUSD

September 23, 2024 at 2:09 pm #11968In reply to: Forex Forum

September 23, 2024 at 2:06 pm #11967In reply to: Forex Forum

September 23, 2024 at 10:21 am #11954In reply to: Forex Forum

September 23, 2024 at 8:10 am #11948In reply to: Forex Forum

GB[USD 4 HOUR CHART – Follows weaker EURUSD

GBPUsD dragged down by EURUSD as it follows with a lag (note weaker EURGBP).

Key support is at 1.3219 as we await the UK flash PMI

As note in Newsquawk Week Ahead September 23-27th

UK FLASH PMI (MON): Expectations are for September’s services PMI to decline to 53.5 from 53.7, manufacturing to hold steady at 52.5, leaving the composite at 53.5 vs. prev. 53.8. As a reminder, the prior report saw the services print rise to 53.7 from 52.5, and manufacturing rise to 52.5 from 52.1, leaving the composite comfortably in expansionary territory at 53.8 vs. prev. 52.8.

September 21, 2024 at 9:20 pm #11938In reply to: Forex Forum

New week, new ball game!

Similar to last week, how the coming week ends will be more significant than how it starts out. In this regard, the dollar is ending on its back foot (except vs JPY) although only the GBP and AUD broke fresh ground to the upside.

Now, let’ take a look at key levels to watch in the week ahead.

September 20, 2024 at 12:04 pm #11896In reply to: Forex Forum

I posted 2 charts at the start of the week a an alert that something might be brewing in JPY crosses after USDJPY failed to hold the break below 140.

The two charts were GBPJPY and EURJPY, the former turning out to become the strongest move.

Whether it was some fund manager dipping his/her toes into a carry trade or just the move up in JPY exhausting itself, or a hidden hand stemming the tide below 140, you can see what has happened since.

‘

As for USDJPY, it would probably need to move above 145 to suggest anything more than a retracement.GBPJPY 4 HOUR CHART

EURJPY DAILY CHART

September 20, 2024 at 10:34 am #11891

September 20, 2024 at 10:34 am #11891In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View