-

AuthorSearch Results

-

October 4, 2024 at 2:41 pm #12472

In reply to: Forex Forum

October 4, 2024 at 12:25 pm #12452In reply to: Forex Forum

October 4, 2024 at 9:52 am #12448In reply to: Forex Forum

GBPUSD 4 HOUR CHART – BOUNCE OFF THE LOW

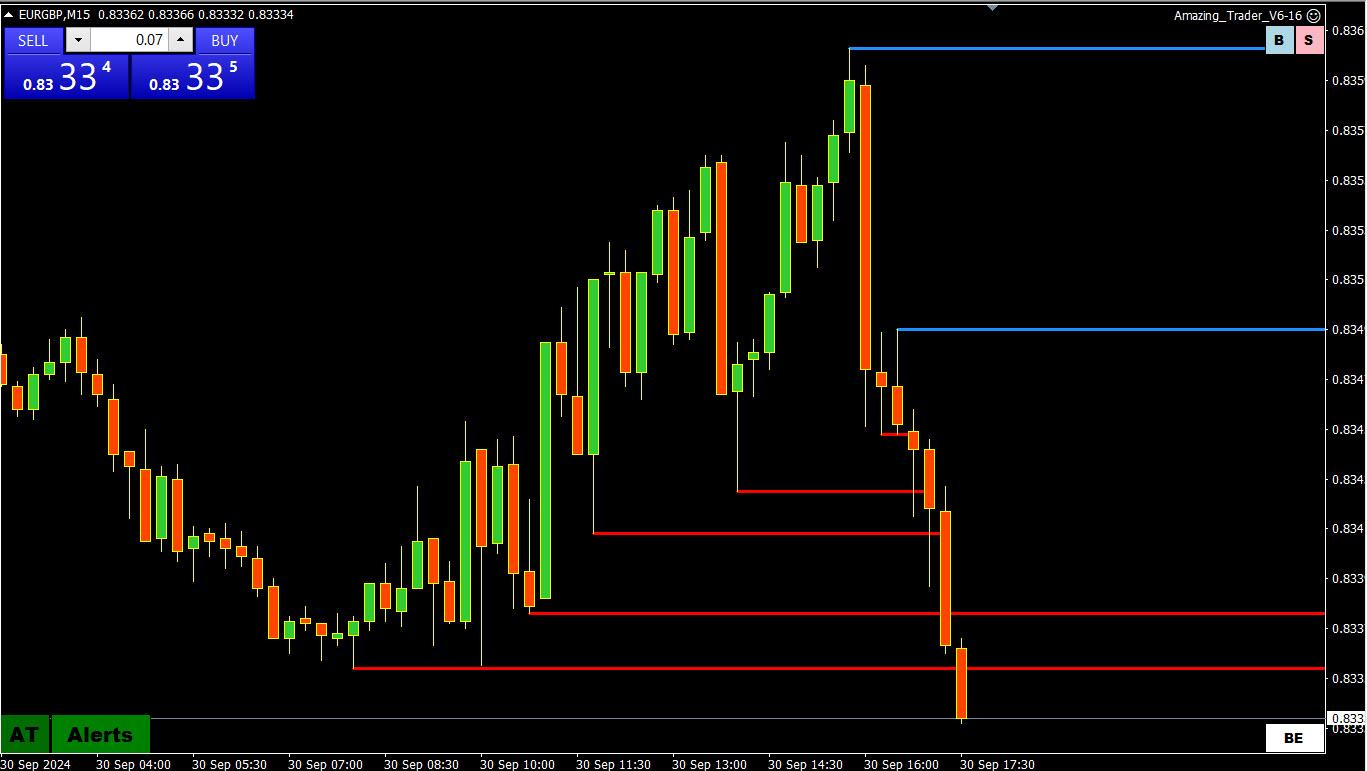

If you are looking for the flow behind the GBPUSD bounce, look at EURGBP (lower).

Given the sharp move down yesterday, see below for retracement levels using our Fibonacci Calculator as potential resistance levels. In any case, 1.32 is pivotal (5-% at 1.3198) on the upside. Otherwise, roll the dice, NFP is up next..

October 3, 2024 at 4:17 pm #12438

October 3, 2024 at 4:17 pm #12438In reply to: Forex Forum

October 3, 2024 at 12:50 pm #12428In reply to: Forex Forum

US Data was only slightly disappointing.

Among the holidays today which include National No Sugar Day, National Poetry Day, Bring Your Bible To School Day, and National Wide Awake Day, it is officially National Buy British Day. That certainly must support my earlier observation about some metrics and neural conditions being strong on the buy side of GbpUsd.

So that pair simply must go up.

October 3, 2024 at 12:19 pm #12426In reply to: Forex Forum

October 2, 2024 at 6:36 pm #12402In reply to: Forex Forum

October 2, 2024 at 9:48 am #12376In reply to: Forex Forum

October 1, 2024 at 4:50 pm #12352In reply to: Forex Forum

October 1, 2024 at 11:29 am #12318In reply to: Forex Forum

GBPUSD Daily

Supports : 1.32700 , 1.32450 & 1.31850

Resistances : 1.33450 , 1.33600 & 1.33850

Bullish angle has been lost, and only question is if this is going to be a correctional phase or full blown downtrend.

Monthly and weekly charts are more in favour of a correction and continuation of the Uptrend later on.

October 1, 2024 at 10:54 am #12315

October 1, 2024 at 10:54 am #12315In reply to: Forex Forum

GBPUSD 4 HOUR CHART – Tests key support

EURUSD leading, GBPUSD following with a lag (note EURGBP)

1.3310 tested and remains key support.

Back above 1.3350-69 would be needed to deflect the risk.

As noted in our Weekly FX Chart Outlook</a>

On the downside, 1.3310 is the make or break level, keeping the risk on the high while above it.

Logic says for GBPUSD to make a serious break to a new high, EURUSD would need to establish above 1.12 and/or EURGBP would need to make another leg down.

September 30, 2024 at 2:45 pm #12281In reply to: Forex Forum

September 30, 2024 at 1:36 pm #12278In reply to: Forex Forum

GBPUSD Daily

Supports : 1.33650 , 1.33450 & 1.33100

Resistances : 1.34250 , 1.34350 & 1.34950

Cable is struggling for 5 days already with the top and using some Thumb analysis we can expect start of a correction, unless it takes out today 1.34350.

However, Close tonight above 1.33850 would leave an opportunity for one more leg Up and test of 1.34950.

September 30, 2024 at 1:33 pm #12277

September 30, 2024 at 1:33 pm #12277In reply to: Forex Forum

September 30, 2024 at 11:03 am #12272In reply to: Forex Forum

September 30, 2024 at 10:38 am #12265In reply to: Forex Forum

September 30, 2024 at 9:19 am #12258In reply to: Forex Forum

September 30, 2024 at 8:46 am #12255In reply to: Forex Forum

GBPUSD 1 HOUR CHART _ Month end or more?

Bounce from 1.3373 double bottom

As posted in our Weekly FX Chart Outlook

GBPUSD remains an outperformer, trading at a level not seen since early 2022.

With the next key level not until above 1.37, use the most recent high (1.3434) as key resistance.

On the downside, 1.3310 is the make or break level, keeping the risk on the high while above it.

Logic says for GBPUSD to make a serious break to a new high, EURUSD would need to establish above 1.12 and/or EURGBP would need to make another leg down.

September 27, 2024 at 4:02 pm #12188In reply to: Forex Forum

Food for thought.

1. Why would you pay attention to a “bias indicator” based on the total of retail customers of a brokers client base knowing the vast majority of retail traders are wrong and lose their money? Nice gimmick.

2. A well known and highly frequented FX “advisor” frequently quoted in news feeds, primarily to retail audience noted very early this morning before the action really hit that “UsdChf is trading flat, best to stay away.” Why? Would it not be better to learn how and why to be active in it successfully? The pair dropped over 100 points in a short period of time. They don’t know what they are doing beyond average in my opinion. They do have solid informational value if you are novice.

3. Why would you not listen to a highly skilled and very kind former bank Trader like Jay Meisler instead? Or a former in demand CTA such as myself or the other actual and very skilled former bank traders who frequently post here in GVI?

I sold UsdJpy right before it collapsed last night in late Asia. I have been long AudUsd since yesterday. I have been short UsdChf since yesterday against a lot of opinions to be long US Dollar. I have been long GbpUsd since yesterday. Picking away at EurJpy on both sides the entire way. You won’t find that with Youtube or TikTok gurus or the aforementioned not as stellar as advertised advisory sources which are popular.

You will find it here in GVI.

Disclaimer – I am not paid by GVI or under contract with GVI in any fashion. I am simply commenting in the hope of being helpful and enjoy the input from others here.

September 27, 2024 at 1:37 pm #12174In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View