-

AuthorSearch Results

-

March 25, 2025 at 5:38 pm #21398

In reply to: Forex Forum

March 24, 2025 at 6:06 pm #21319In reply to: Forex Forum

March 24, 2025 at 4:39 pm #21318In reply to: Forex Forum

This is a good time to revisit this blog article

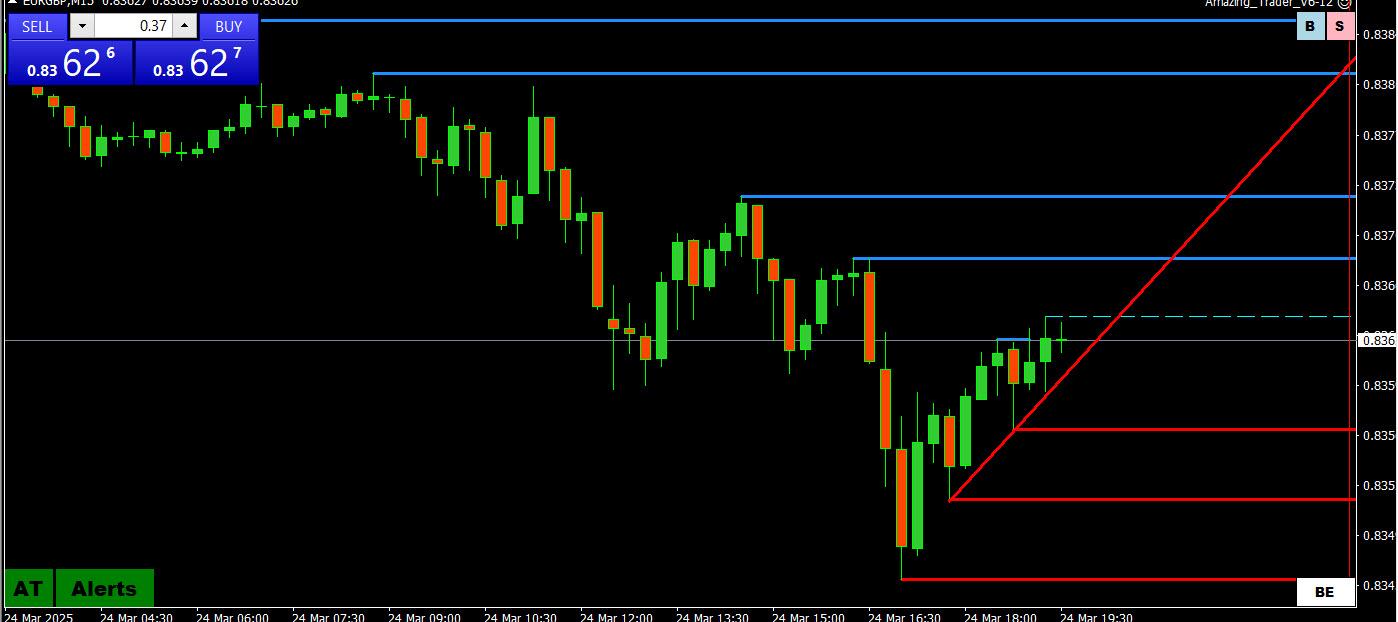

Note in the chart posted below how EURGBP found support, bounced and how GBPUSD, initially boosted by this selling of this cross, lost its bid.

March 24, 2025 at 3:37 pm #21312In reply to: Forex Forum

Notice how GBPUSD lost its bid after a sell order in EURGBP was filled.

EURUSD initially bounced on the bounce in EURGBP (last .8362 vs an .8345 low).

EURUSD has since followed GBPUSD lower with a lag, moving back below 1-08 so far holding above the earlier 1-0790 low.

Sojeep an eye on this crossw as you can see how crosses can give a clkue to what isa driving the spot market.

March 23, 2025 at 1:18 pm #21273In reply to: Forex Forum

GBPUSD

Daily Supports: 1.28850, 1.28500 & 1.28050

Daily Resistances: 1.29300, 1.29700 & 1.30100

Weekly Supports: 1.28850, 1.28500, 1.27750 & 1.26600

Weekly Resistances: 1.30150, 1.30450 & 1.30800

March 20, 2025 at 8:47 pm #21219

March 20, 2025 at 8:47 pm #21219In reply to: Evaluation – Daily Trades

March 20, 2025 at 8:20 pm #21215In reply to: Forex Forum

March 20, 2025 at 8:19 pm #21214In reply to: Forex Forum

March 20, 2025 at 12:40 pm #21174In reply to: Forex Forum

March 20, 2025 at 11:57 am #21170In reply to: Forex Forum

US OPEN

European risk sentiment slips, USD firmer and Bonds bid post-FOMC

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European risk tone deteriorates with US futures also slumping into the red, potentially driven by EU fiscal focus, post-FOMC pullback and attention returning to tariffs/trade.

USD up vs. peers, Antipodeans lags, EUR slides and GBP eyes BoE.

Bonds are bid post FOMC & as the tone deteriorates, Gilts lead on data & reports around the Spring Statement.

Crude succumbs to the risk-off sentiment, with base metals also heading lower.

March 20, 2025 at 10:32 am #21168In reply to: Forex Forum

March 19, 2025 at 11:55 am #21103In reply to: Forex Forum

US OPEN

USD firmer, EUR and GBP hit by JPY-action on Ueda’s press conference, US futures a touch firmer ahead of FOMC

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses began the session on the backfoot with the risk tone dented as a few potential factors influenced, US futures modestly firmer pre-Fed

USD firmer, EUR and GBP hit by JPY-action on Ueda’s press conference; BoJ itself was as expected, Ueda began balanced but had some hawkish points in his presser

Fixed income initially benefited on the slip in the risk tone but has since eased off best with USTs now slightly softer into the FOMC

Crude remains pressured after Tuesday’s geopolitical developments while Gas has picked up as strikes on energy infrastructure seemingly continue

Ukraine’s Zelensky to speak with US’ Trump on Wednesday and hopes a ceasefire will eventually be implemented

March 18, 2025 at 12:19 pm #21056In reply to: Forex Forum

March 17, 2025 at 10:18 pm #21046In reply to: Forex Forum

March 17, 2025 at 10:31 am #20990In reply to: Forex Forum

GBPUSD 4H

Is this a start of run to 1.32 ?

Supports: 1.29400 & 1.29300

Resistances: 1.29750 & 1.29900

We’ve been watching a consolidation from 12th March and it is starting Up again.

Now I don’t want to bother you with details, but one is very important – how Cable is going to close this bar – for more advances I prefer somewhere around 1.29500 and then for the new high.

Worst case scenario is if it closes close to the previous high – than expect a pull back towards MA’s

March 14, 2025 at 12:00 pm #20902

March 14, 2025 at 12:00 pm #20902In reply to: Forex Forum

US OPEN<

Spot Gold makes a fresh record high above USD 3000/oz & sentiment lifts ahead of Trump Executive Orders and UoM

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

Stocks gain with sentiment lifted after a strong Chinese session overnight and after the recent market turmoil.

USD mixed vs. peers, GBP soft post-GDP, JPY weighed on by Rengo data, which showed average wage hike less than demands.

Gilts gap higher on soft growth data while JGBs lift on Rengo.

Spot gold makes a fresh record high above USD 3,000/oz; crude oil and base metals benefit from the risk tone.

March 14, 2025 at 10:31 am #20897In reply to: Forex Forum

As I have noted, when you see a sharp mkve in USDFJPY while others either lag or diverge, look for the offset currency.

IN this case, it appears to have been in AUD and NZD ad well as into EUR although a firmer EURGBP may be giving EURUSD some support.

Life in a mutti-currency centric (as opposed to a dollar-centric) trading world..

March 13, 2025 at 12:48 pm #20847In reply to: Forex Forum

March 10, 2025 at 9:11 am #20628In reply to: Forex Forum

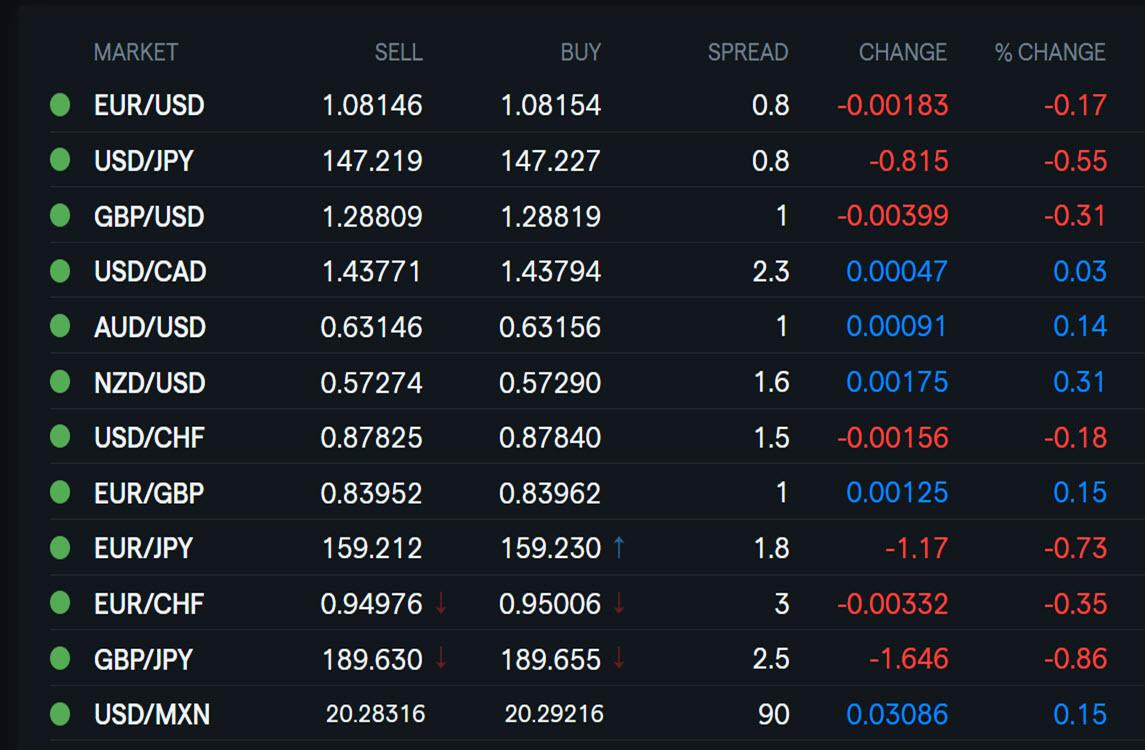

Using my platform as a HEATMAP

Mixed start to the week

EURUSD backing off towards (but still above) 1.08.… USDJPY weaker ==> EURJPY weaker (GBPJPY as well) asa JPY gets safe haven flows.

AUDUSD, NZDUSD a touch firmer, USDCAD about unchanged

Tariffs, trade war risk, recession talk weighing on US equities

The Savvy Trader was ahead of the curve when he wrote this article’

Is the U.S. headed for a recession by the Savvy Trader?

Light calendar so another headline watching day after Trump weekend comments (scroll below) added to a risk off mood

March 6, 2025 at 4:20 pm #20525In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View