-

AuthorSearch Results

-

October 30, 2024 at 2:09 pm #13686

In reply to: Forex Forum

GBPUSD 15 MINUTE – Roadmap

Similar to EURUSD, this is one way to use The Amazing Trader

1.2977 break => 1.3002 => If 1.3002 become upport then 1.3027 come on the radar

October 30, 2024 at 1:29 pm #13680In reply to: Forex Forum

GBPUSD 15 Minute Chart -Intra-day resistance

You can see where 1.2977 resistance comes from… it is an >Amazing Trader (AT) chart level and its importance is based on AT logic

A break of this level would confirm the end of the down episode (it is also the initial target for the bounce off the low)

October 30, 2024 at 1:11 pm #13679In reply to: Forex Forum

October 30, 2024 at 12:53 pm #13677In reply to: Forex Forum

October 30, 2024 at 11:30 am #13669In reply to: Forex Forum

Newsquawk US Oprn

US futures mixed, GOOGL beats, DXY lower ahead of US ADP, PCE Prices/GDP Advance & GBP awaits Budget

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.5 Things You Need to Know

European bourses opened in negative territory and continued to trundle lower as the morning progressed, Tech lags post-AMD

Stateside, futures are firmer but only modestly so with Alphabet supporting as AI bolstered cloud performance

DXY briefly dipped below the 104.00 mark, EUR aided by hawkish-data while GBP awaits the budget

USTs continue to gain after Tuesday’s 7yr into Refunding, Bunds weighed on by data

Crude firmer after the surprise inventory draw with specifics otherwise somewhat light, XAU at another ATH

Try Newsquawk for 7 Days FreeNot signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

Cancel anytime – free for 7 days

October 30, 2024 at 11:30 am #13670In reply to: Forex Forum

Newsquawk US Oprn

US futures mixed, GOOGL beats, DXY lower ahead of US ADP, PCE Prices/GDP Advance & GBP awaits Budget

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.5 Things You Need to Know

European bourses opened in negative territory and continued to trundle lower as the morning progressed, Tech lags post-AMD

Stateside, futures are firmer but only modestly so with Alphabet supporting as AI bolstered cloud performance

DXY briefly dipped below the 104.00 mark, EUR aided by hawkish-data while GBP awaits the budget

USTs continue to gain after Tuesday’s 7yr into Refunding, Bunds weighed on by data

Crude firmer after the surprise inventory draw with specifics otherwise somewhat light, XAU at another ATH

October 30, 2024 at 10:47 am #13665In reply to: Forex Forum

EURGBP 30 MINUTE CHART – REAL MONEY BUYINH

EURUSD 1.0835

GBPUSD 1.2974

EURGBP .8351Scroll down for a EURGBP update… also resistance at .8352,66,83

Note when you see a one-way move such as the one today in EURGBP it Suggests rea; money buying ahead of the UK budget announcement.. see preview

October 30, 2024 at 9:30 am #13660In reply to: Forex Forum

October 30, 2024 at 9:20 am #13659In reply to: Forex Forum

EURUSD 4 HOUR CHART – Bullish or not?

Current Pattern: 5 days in a row seeing the 1.08 level trade… while a break of this pattern would send a bullish signal EURUSD would need to make a firm move above 1.0873 to confirm.

Look for 1.0850 to now be pivotal.in setting the day tone.

Back below 1.0839 would cool the risk if it fails to become support.

If you are looking for a flow driving EURUSD demand, look at a EURGBP chart.

October 29, 2024 at 11:00 pm #13656In reply to: Forex Forum

October 29, 2024 at 10:51 pm #13655In reply to: Forex Forum

October 29, 2024 at 1:49 pm #13604In reply to: Forex Forum

October 29, 2024 at 1:12 pm #13600In reply to: Forex Forum

October 29, 2024 at 12:50 pm #13598In reply to: Forex Forum

October 29, 2024 at 12:16 pm #13596In reply to: Forex Forum

October 29, 2024 at 12:03 pm #13595In reply to: Forex Forum

October 29, 2024 at 11:26 am #13594In reply to: Forex Forum

October 29, 2024 at 10:30 am #13589In reply to: Forex Forum

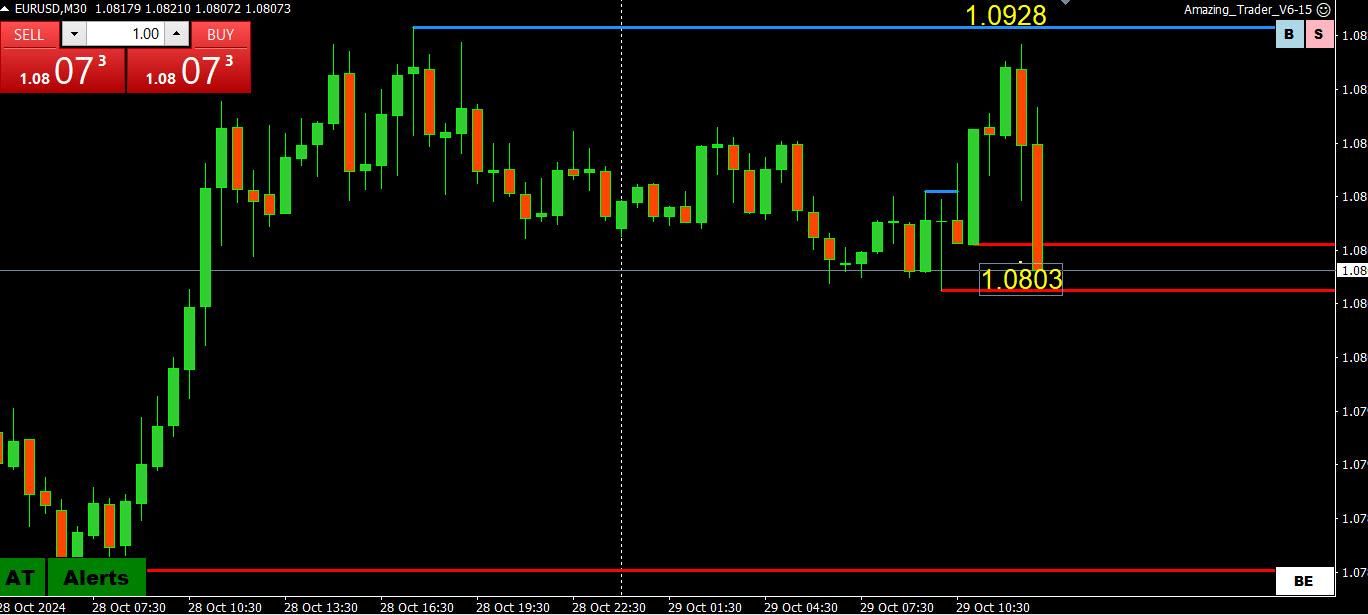

EURUSD 30 MINUTE CHART – Will 1.08 trade again?

As noted in the eek ahead and again yesterday, my view is to treat moves to the upside as retracements unless 1.0839 is firmly taken out.

See this chart and how the Amazing Trader resistance line held.

Now we see if 1.08 can exert a magnetic pull as it enters a 1.0800-10 support zone.

Note how EUR crosses have undercut the earlier EURUSD bid (e.g. EURJPY held resistance, EURGBP dips).

October 29, 2024 at 9:27 am #13585In reply to: Forex Forum

EURJPY 4 HOUR CHART – Retests the high

JPY weakness following Japanese elections is providing offset support to currencies such as the EUR and GBP while upporting USDJPY.. Curious that AUD has not benefited.

As for EURJPY, yesterday’s 166.08 high has been re-tested and its significance is there is little on the upside for another 9-10 big figures. This makes 166,08 a key level.

Note this follows yesterday’s bounce from just above the bottom of the ipoening week gap.

October 28, 2024 at 10:57 am #13520In reply to: Forex Forum

Newsquawk US OPEN

Equities lifted and oil sinks as traders digest Israel’s limited strike on Iran

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are on a firmer footing, traders garnering optimism following the relatively moderate Israeli attack on Iran, which saw the former avoid hitting energy/nuclear facilities; US futures also benefit.

USD is mixed, losing vs EUR & GBP but significantly stronger vs JPY after the Japanese general election which has seen the ruling coalition lose its parliamentary majority.

Bonds are pressured by the removal of geopolitical risk premia, but have lifted off lows in recent trade given the continued pressure in oil prices.

Crude gapped lower overnight and has continued to slip since the European cash open; Brent Jan’25 currently at lows of USD 71/bbl. XAU/base metals are also pressured.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

Cancel anytime – free for 7 days

-

AuthorSearch Results

© 2024 Global View