-

AuthorSearch Results

-

November 2, 2024 at 3:11 pm #13825

In reply to: Forex Forum

Weekend musings

We wanted to buy the EurUd dip (but never felt that we had reached a level that we were extremely confident of a genuine bottom)

However it is possible we reached one in Cable. If so then the surprise trade would be to move back through theUsd moveto some half way point before reassessing

That is why I just said the EurUsd and GbpUsd could move 200 pips back up but did not infer nor include UsdJpy in that

UsdJpy was bid up on a spurious conjecture that the US would no longer drop rates or would only do 1/4. (It has to be said the dot plot never suggested a 1/2 anyway but the stock market wanted an excuse whether it need one or not

So add in the political climate (in Japan) where the gamble of a snap election has just as it did in the UK failed dramatically and we have the ingredients of uncertainty where anything short(ish) term in UsdJpy could happen. why not a 4 or 500 pip range in one day ?

November 1, 2024 at 2:31 pm #13810In reply to: Forex Forum

November 1, 2024 at 1:40 pm #13803In reply to: Forex Forum

November 1, 2024 at 10:36 am #13790In reply to: Forex Forum

November 1, 2024 at 9:07 am #13788In reply to: Forex Forum

EURUSD 1 HOUR CHART – WAITING FOR NFP

Market is biding its time waiting for the US jobs report,

A sharp price in EURGBP yesterday helped give EURUSD a bid and it has backed off today as the cross eased back.

1.09 should be tough on top, back below 10840-50 would be needed to shift the focus back to 1.08,

Oct NFP:

A weak jobs # is expected following a sharp rise in Sept BUT NFP will likely be distorted by the hurricanes and strikes,

November 1, 2024 at 8:56 am #13787In reply to: Forex Forum

GBPUSD 1 MONTH – NEW MONTH, NEW BALL GAME?

GBP sold off yesterday on a plunge in the bond market (higher yields) and today it seems to be benefiting from the higher yields. So price action suggests month end flows may have been a factor in the ell off.

Whatever the case, it was a straight line move from 1.2999 to 1.2851.

For today 1.2880-85 needs to hold to keep the bid.

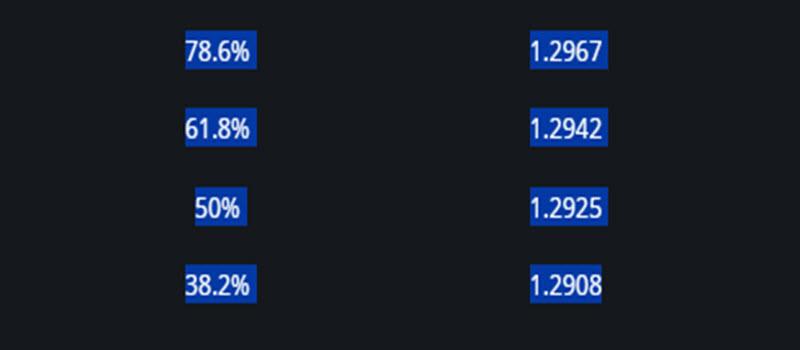

On the upside, no resistance other than the day high so treating the move up as a retracement, use FIBOS as possible levels

From our Fibonacci Calculator

October 31, 2024 at 9:54 pm #13782

October 31, 2024 at 9:54 pm #13782In reply to: Forex Forum

October 31, 2024 at 3:35 pm #13755In reply to: Forex Forum

GBPUSD 5 MINUTE CHART – POWER OF 50

in the absence of nearby support, 1.2950 is checking the freefall. Res at the former 1.2995 support.

Time to revisit this popular blog article

My Favorite Trading Secret: The Power of the “50” Level

October 31, 2024 at 3:11 pm #13750

October 31, 2024 at 3:11 pm #13750In reply to: Forex Forum

October 31, 2024 at 2:43 pm #13749In reply to: Forex Forum

EURGBP DAILY CHART – BONDS SLIDE, GBP FOLLOWS

I said keep an eye on EURGBP for month end but did not expect the bond vigilante to attack and see that pPIll over to the GBP.

Either that or it is month end flows but whatever the case, the Oct high at .8434 and Sept high at 8463 are at risk should .8505 become support.

October 31, 2024 at 2:10 pm #13743In reply to: Forex Forum

October 31, 2024 at 12:41 pm #13738In reply to: Forex Forum

October 31, 2024 at 12:29 pm #13737In reply to: Forex Forum

GBPUSD Daily

Supports : 1.29750 , 1.29400 & 1.29150

Resistances : 1.30000 , 1.30400 & 1.30650

Scenario Bullish :

– Cable needs to overcome 1.30500 in next 48h and to stay above it

– Support at 1.29400 must not be broken

– Upticks would change to Up moves ( higher highs, but also higher lows )

Scenario Bearish :

– Resistance at 1.30400 holds and moves lower to 1.30200

– Support at 1.29400 lost

– New low reached – below 1.29050

Right now both scenarios are possible based on the Pattern .

If we close tonight above 1.29800 probability will rise in a favour of Bullish scenario.

October 31, 2024 at 9:41 am #13728

October 31, 2024 at 9:41 am #13728In reply to: Forex Forum

October 31, 2024 at 8:50 am #13722In reply to: Forex Forum

October 30, 2024 at 8:41 pm #13715In reply to: Forex Forum

EURGBP 4 HOUR CHART – REVERAL OF FORTUNE

I feel like a parrot repeating to keep an eye on EURGBP if trading EURUSD and/or GBPUSD.

EURGBP’s rebound from a failure to test .8295 yesterday, which lifted EURUSD while ultimately weighing on GBP{USD, would need to take out .8380-88 to expose .8405.

Otherwise, look for .8350 to remain pivotal in setting the tone while it trade .8300-.8400..

Month end

EURGBP tends to be one of the more active month end flows, often on both sides at different times, so keep an eye on it Thursday, including its impact on EURUSD and GBPUSD.

October 30, 2024 at 8:36 pm #13714In reply to: Forex Forum

EURUSD 4 HOUR CHART PATTERN BROKEN

The break of a 5 day pattern where 1.08 traded each day is a bullish indicator but with some caution as demand seemed to come more from its crosseS, specifically EURGBP, than vs the USD

1.0971=73, the 200 day mva and key resistance.is A tough obstacle to 1.09.

Otherwise, would need to stay above 1.0839 to keep a bid.

October 30, 2024 at 5:56 pm #13704In reply to: Forex Forum

October 30, 2024 at 5:32 pm #13702In reply to: Forex Forum

October 30, 2024 at 2:14 pm #13687In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View