-

AuthorSearch Results

-

November 27, 2024 at 7:00 pm #15214

In reply to: Forex Forum

November 26, 2024 at 4:10 pm #15110In reply to: Forex Forum

November 26, 2024 at 3:12 pm #15100In reply to: Forex Forum

November 26, 2024 at 12:30 am #15055In reply to: Forex Forum

I just closed sell side positions of EurJpy, EurUsd, AudUsd, UsdSingapore, and a buy side UsdChf right here, and a sell EurGbp all in the money. These levels as I type are areas where I believe there may be adjustment flows and so it is back to a game of patience. Prefer buy side of US Dollar and the sell side of everything else so a matter of waiting for these markets to rebalance a bit.

Had a sell USdPeso but did not fill, not confident we see decent re-entry levels until tomorrow.

Honor the Dollar.

November 25, 2024 at 1:07 pm #14986In reply to: Forex Forum

GBPUSD Weekly

– Major Support was violated last week, but pair closed above it

– To continue Down it has to decisively break below and stays below

– On the other hand – if this was a Correction , time wise it might be end of it

– Cable tends to have sharp turns – so be aware

Supports : 1.25350 , 1.24850 & 1.23850

Resistances : 1.26050 , 1.26500 & 1.27150

November 25, 2024 at 10:31 am #14963

November 25, 2024 at 10:31 am #14963In reply to: Forex Forum

November 22, 2024 at 3:18 pm #14886In reply to: Forex Forum

GBPUSD WEEKLY CHART -8 down weeks in a row

EURGBP at .8310 says GBPUSD is being pulled along for the ride by the falling EURUSD.

It has been 8 down weeks in a row so until/unless this pattern changes, it will stay in a sell mode but dependent on EURUSD for direction.

Key focal point is 1.25, solidly below it would be needed to put 1.2444 and the 1.2298 2024 low in play.

1.0220/1.2298 = .,8310

November 22, 2024 at 10:46 am #14870In reply to: Forex Forum

November 21, 2024 at 10:01 am #14791In reply to: Forex Forum

And then I look at a EURUSD chart, as EUR is oner of the underperfrormers.

Waht catches my eye here is a failure just above 1.0655. I also take a Look at a EURJPY chart and as alwats EURGBP to see what is driving the EURUSD.

EURUSD 1 HOUR CHART – 1.05 looms

Yet another run at 1.05 where support is at 1.0496-1.0506.

November 21, 2024 at 9:52 am #14790In reply to: Forex Forum

I ther look at currency charts where the action is.

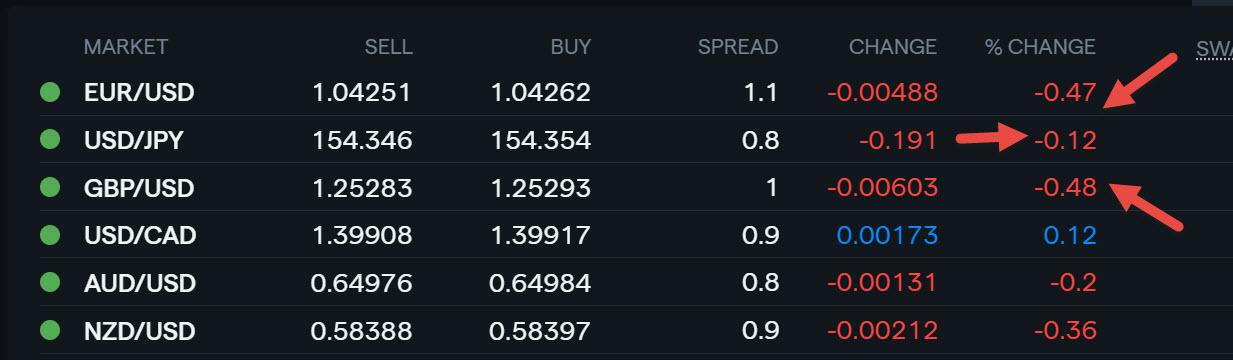

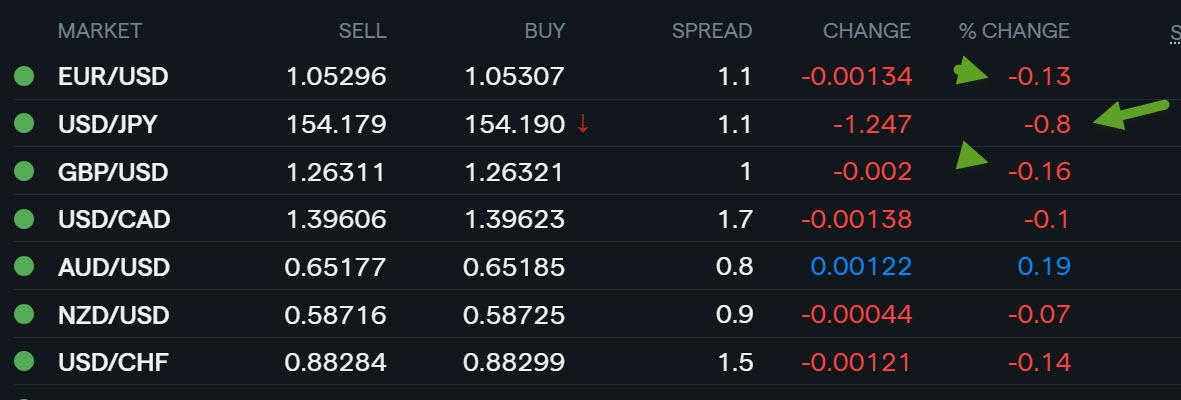

When I see a sharp move in one direction in USDJPY there is generally an offset in another currency (in this case EUR and/or GBP)._

USDJPY 4 HOUR CHART

What catches my eye is the break of 154.52 (suggests using 154.50)… use it as an intra-day bias indicator

November 21, 2024 at 9:24 am #14786In reply to: Forex Forum

November 20, 2024 at 12:17 pm #14705In reply to: Forex Forum

November 20, 2024 at 9:26 am #14695In reply to: Forex Forum

The first item on my checklist when I start the day is to look at bond yields,

So far today UK yields up the most after UK CPI (touch higher than expected), US (note USDJPY correlation with firmer US yields) and German yields up the least (note EURUSD down after failure to hold 1.06+ and weaker EURGBP)

10 Year bond yield snapshot

November 19, 2024 at 4:16 pm #14659

November 19, 2024 at 4:16 pm #14659In reply to: Forex Forum

November 18, 2024 at 1:44 pm #14532In reply to: Forex Forum

November 18, 2024 at 11:20 am #14526In reply to: Forex Forum

November 18, 2024 at 10:36 am #14523In reply to: Forex Forum

EURUSD 4 HOUR CHART – NO SURPRISE

It should come as no surprise to see EURUSD gravitate back to 1.0550, which is the bias setting level while within 1.05-1.06

Note firmer EUR crosses (e.g. EURJPY, EURGBP) giving EURUSD support but not enough to break the key 1.0593 level.

So let’s call it consolidation of the downtrend where only a break of 1.0590-00 would shift the risk from 1.0495-10.

November 14, 2024 at 9:36 am #14391In reply to: Forex Forum

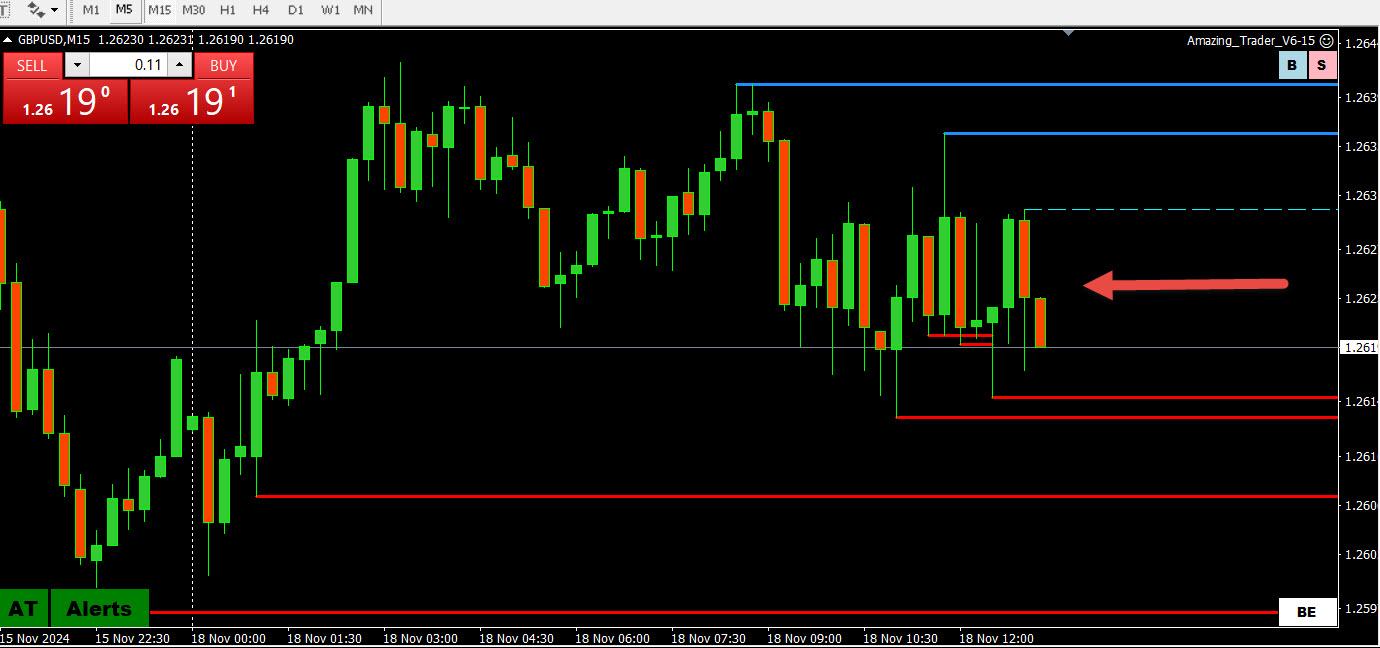

GBPUSD DAILY CHART – KEY SUPPORT LOOMS

The Trump Trade is sparing no victims, and this includes GBPUSD, which would put the key 1.2612 on the radar while below 1.2664.

For day traders, use 1.2650 (Power of 50) as a pivotal level as GBPUSD seems to be more of a follower than a leader. .

Resistance starts at 1.2695.

November 13, 2024 at 4:35 pm #14360In reply to: Forex Forum

EURGBP 1 HOUR CHART – Chart speaks for itself

You have seen me focus on this cross as a clue to trading EURUSD and/or GBPUSD o I will let the chart speak for itself to explain the weak EURUSD and lagging GB=PUSD.

As I haver offered before, feel free to contact me (link in the top menu bar) if you want me to elaborate.

November 13, 2024 at 4:15 pm #14357In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View