-

AuthorSearch Results

-

December 11, 2024 at 9:42 am #16066

In reply to: Forex Forum

December 11, 2024 at 9:13 am #16055In reply to: Forex Forum

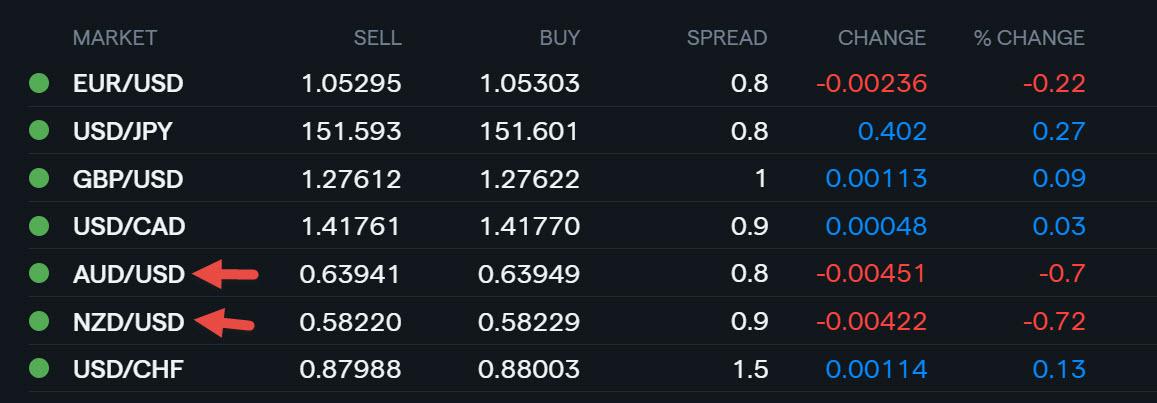

Pivotal level day

EURUSD -.1.05 clearly pivotal after brief break below it (low 1.0488)

AUDUSD – .6350 is pivotal after brief break of major .6358 support (low .6340)

USDJPY 151.50 nand 152 are both pivotal, so far staying below it after trading above it yesterday

GBPUSD- Lagging EURUSD as EURGBP remain soft biut 1.2750 is pivotal here as well

December 10, 2024 at 5:21 pm #16022In reply to: Forex Forum

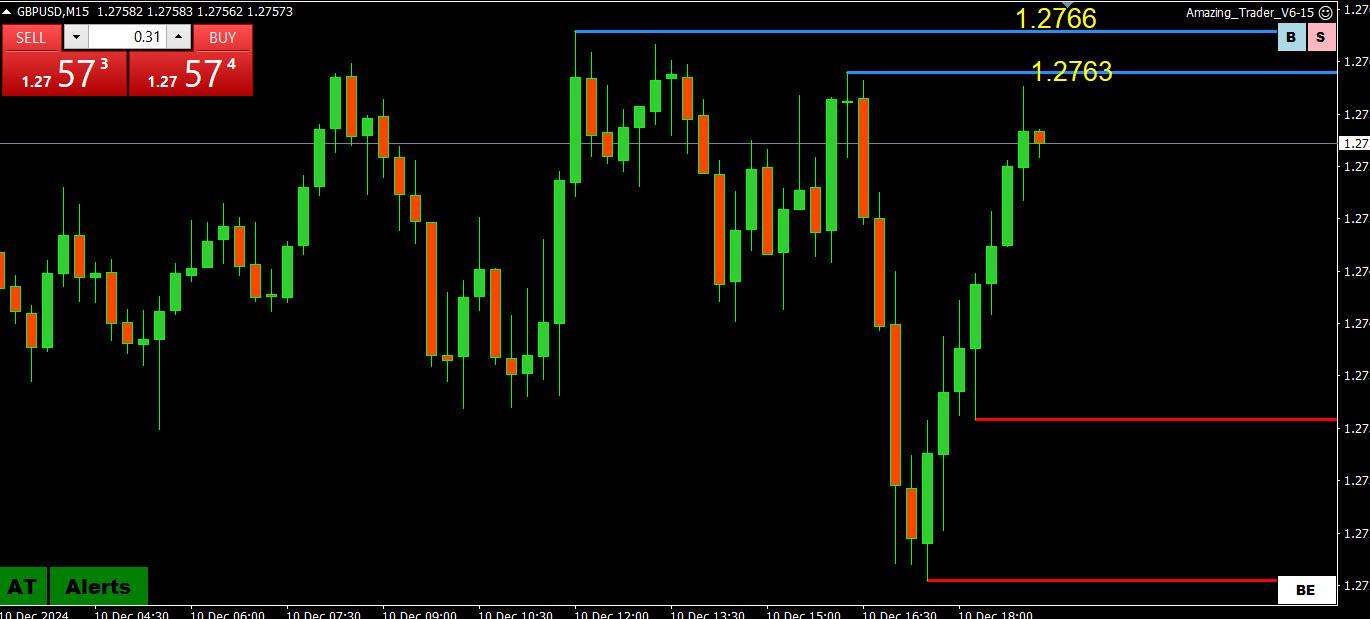

GBPUSD 15 MINUTE – EURGBP driving the bus

Another neat Amazing Trader chart

Algebra 101

EURUSD held 1.05 – for EURGBP to go lower, GBPUSD had to do the work.

December 10, 2024 at 4:55 pm #16020In reply to: Forex Forum

December 10, 2024 at 11:05 am #15991In reply to: Forex Forum

December 10, 2024 at 10:30 am #15988In reply to: Forex Forum

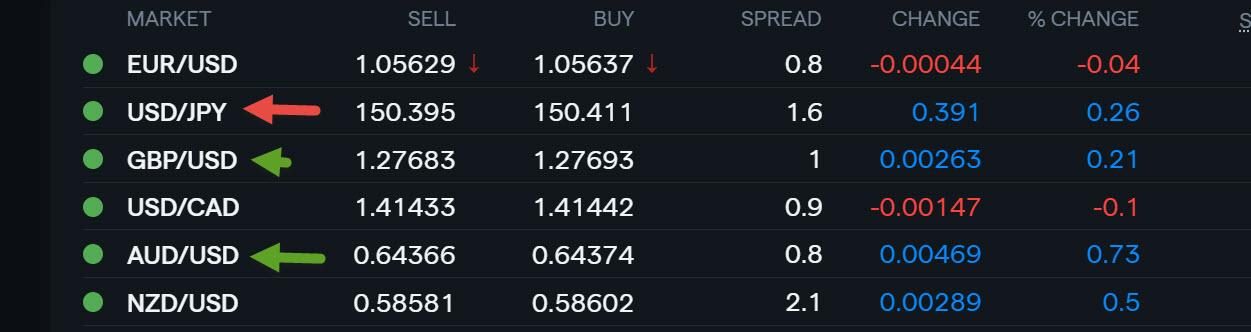

Using my platform as a heatmap

USD is up as market seems to be biding its time ahead of tomorrow’s US CPI

EURUSD still within 1.05-1.06 where Power of 1.0550 sets the bias

USDJPY found support above 150.77… needs to stay above 151.21 to keep a strong bid but t52 a potential obstacle

GBPUSD lagging… note weeaker EURGBP

USDCAD broke its 1.4178 key high but so far not following through

AUDUSD an underperformer (NZDUSD as well), falling after RBA but holding above Monday’s .6372 low

December 9, 2024 at 2:33 pm #15925

December 9, 2024 at 2:33 pm #15925In reply to: Forex Forum

UsdSingapore and UsdHong Kong are laboring and I believe it is due to money flowing into US stocks and out of Bonds since institutions expectedly took their shot in that one last week. For now.

Although Usd is laboring against those cross pairs I am not seeing carryover into EurGbp or EurChf like there is in the majors and so am not yet enthused about the buy side there. Would need to see more. Money is flowing into those two but the horizon is under pressure.

December 9, 2024 at 10:00 am #15909In reply to: Forex Forum

December 6, 2024 at 4:55 pm #15829In reply to: Forex Forum

December 5, 2024 at 8:39 pm #15748In reply to: Forex Forum

EURUSD DAILY CHART – WHY IS THE EURUSD BID

If you look at various EUR crosses it will give you a clue why RURUSDD is bid.

The most obvious is EURGBP but if you fig deeper , look at others such as EURBTC (BTCUSD last at 98300 after hitting a record high at 104000 while EURUSD is near its high for the day).

I am not privy to the flows other than flows other than observi8ng short EUR positions being unwound.

Chart wise, key levels are at 1.0550 and 1.0610 but watch its crosses for a clue..,

December 5, 2024 at 2:36 pm #15696In reply to: Forex Forum

December 4, 2024 at 12:11 pm #15582In reply to: Forex Forum

NEWSQUAWK US OPEN

US futures tilt higher ahead of Powell & European paper awaits French no confidence vote

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly trading in positive territory; US futures tilt higher ahead of Powell and a busy data slate.

USD is broadly firmer vs. peers, AUD lags post-GDP, and GBP was weighed on by commentary from BoE’s Bailey who said he sees four 25bps cuts in 2025; a move which has since pared.

European paper awaits French no confidence vote at 15:00 GMT.

Crude holds an upward bias, WSJ reports that Saudi aims to keep oil prices elevated rather than chase market share; XAU/base metals are subdued amid the slightly firmer dollar.

December 4, 2024 at 11:18 am #15580In reply to: Forex Forum

December 3, 2024 at 4:01 pm #15511In reply to: Forex Forum

Michael – regarding your post on bias shift in Euro, not today in my view but I see growing conditions for that to filter in as soon as tomorrow, I posted this yesterday …. “I see some conditions that point toward EurGbp pulling up toward 8400 in coming days”.

The cross is doing it just not the major yet.

December 3, 2024 at 2:27 pm #15495In reply to: Forex Forum

December 2, 2024 at 7:17 pm #15433In reply to: Forex Forum

December 2, 2024 at 6:33 pm #15432In reply to: Forex Forum

December 2, 2024 at 10:54 am #15395In reply to: Forex Forum

November 29, 2024 at 4:07 pm #15281In reply to: Forex Forum

November 29, 2024 at 10:40 am #15265In reply to: Forex Forum

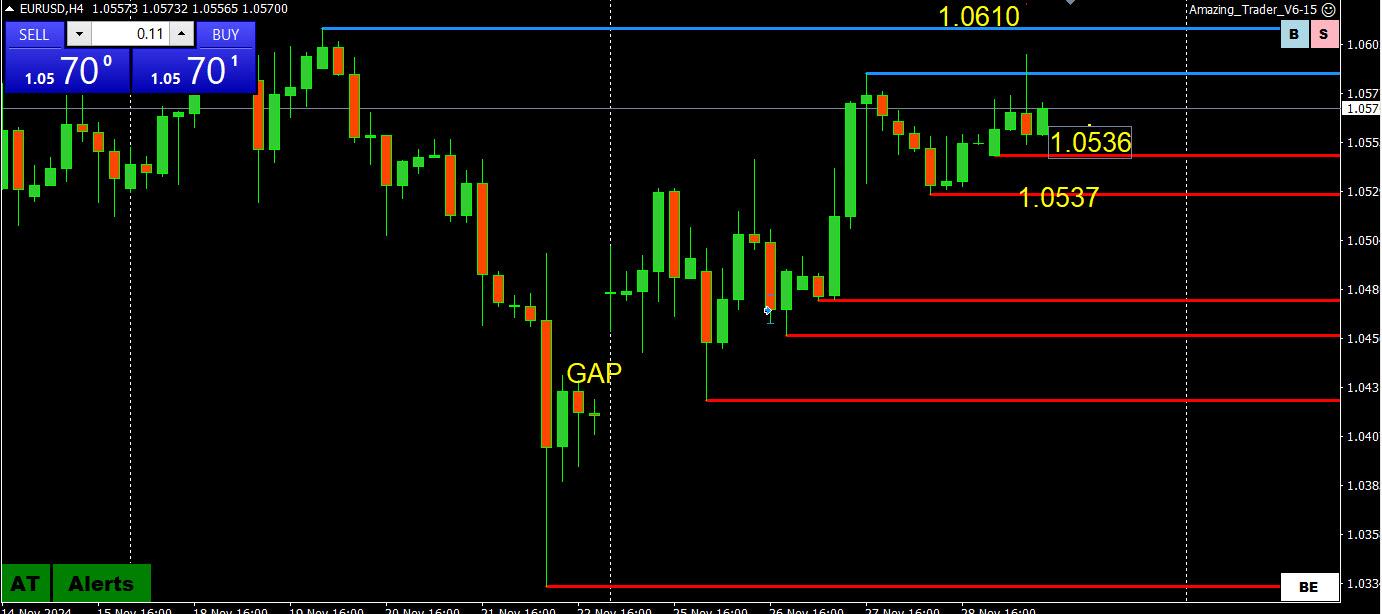

EURUSD 4 HOUR CHART – Month end

Finds a bid IF it can stay above 1.0550 but would need to break 1.0610 to make this more than a retracvement, note the word IF

Note this is month end (and not a normal one due to the US quasi holiday) where EURGBP flows are often an influence so keep an eye on this cross.

-

AuthorSearch Results

© 2024 Global View