-

AuthorSearch Results

-

December 17, 2024 at 7:53 pm #16390

In reply to: Forex Forum

December 17, 2024 at 4:47 pm #16386In reply to: Forex Forum

December 17, 2024 at 11:25 am #16365In reply to: Forex Forum

NEWSQUAWK US OPEM

GBP benefits from hot UK wages data, DXY bid amid a tepid risk tone ahead of US Retail Sales

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly in the red, but sentiment has improved a touch since the cash open; US futures modestly lower.

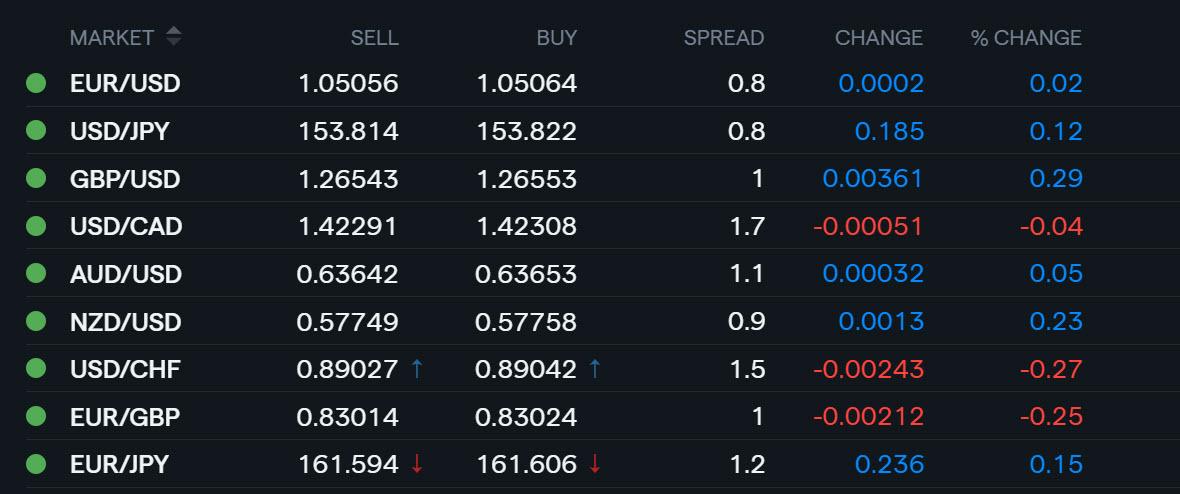

DXY back above 107.00, GBP posted early gains after hot wages data.

Gilts lag as UK wage data essentially removes any chance of a Dec. BoE cut ahead of CPI; USTs a little lower ahead of US Retail Sales.

Commodities succumb to the tepid risk tone and ongoing USD strength.

December 17, 2024 at 11:15 am #16363In reply to: Forex Forum

GBPUSD 4 HOUR CHART – Hot, Hot, Hot

GBPUSD getting a lift after hotter increase in wages in the monthly jobs report dampened expectations of a rate cut at Thursday’s BOE meeting.

To make this more than a retracement, 1.2788 would nheed to be taken out.

Watch GBP crosses, most notably a weaker EURGBP, as they are helping to give GBPUSD a bid.

December 16, 2024 at 4:26 pm #16329In reply to: Forex Forum

December 16, 2024 at 4:01 pm #16325In reply to: Forex Forum

December 16, 2024 at 11:40 am #16318In reply to: Forex Forum

NEWSQUAWK US OPEN

US Market Open: Tepid risk tone weighs on European indices, DXY flat ahead of US PMIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market

4 Things You Need to Know

European bourses are mostly lower; US futures are modestly in the green.

DXY is flat, and GBP strengthens post-PMI while the JPY lags a touch.

EGBs softer with OATs underperforming slightly post-Moody’s downgrade, PMIs in focus.

Crude slips amid a tepid risk tone, metals largely contained.

December 16, 2024 at 10:08 am #16311In reply to: Forex Forum

December 16, 2024 at 9:35 am #16309In reply to: Forex Forum

EURUSD 1 HOUR CHART – 1;05 PATTERN EXTENDED

1.05, which traded Tuesday-Friday last week, has been extended to 5 days in a row on Monday. Range is limited while this pattern continues but the longer it goes on the greater the risk of a directional move once it is broken.

This is similar to the recent USDJPY pattern around 150 and you can see what happened after that pattern was broken,

In the meantime, there is a double top at 1.0524 ahead of resistance at 1.0531-39.

On the downside, 1.0480 blocks last week’s 1.0453 low.

nOTE, THE 2 PILLARS OF EURUSD SUPPORT WERE EURGBP AND EURJPY. EURGBP is weaker today so more of a weight on EURUSD than support. EURJPY is still trading with a bid.

December 13, 2024 at 3:54 pm #16221In reply to: Forex Forum

December 13, 2024 at 1:25 pm #16211In reply to: Forex Forum

Simple algebras

EURJPY = USDJPY X EURUSD

USDJPY stalls on upside, only way for EURJPY to move higher is then via a firmer EURUSD

EURGBP = EURUSD/GBPUSD

GBPUSD stalls on downside, only way for EURJPY to move higher is via a firmer EURUSD

EURUSD LAST AT 1.0518 (FIRMER)… BUT STILL BELOW THE 1.0530-40 RESISTANCE… TEST FOR EURUSD WILL BE WHETHER IT CAN KEEP A BID ONCE ITS DROSSES TOP OUT…. A test it failed yesterday in a similar situation

December 13, 2024 at 11:33 am #16206In reply to: Forex Forum

NEWSQUAWK US OPEN

Risk sentiment improves with havens on the backfoot, DXY around 107.00

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses and US futures are generally firmer with specifics light, diverging from soft APAC trade; AVGO +15%.

DXY trades around 107.00, GBP hit by soft GDP, JPY lags.

Fixed benchmarks in the red post-ECB and ahead of a blockbuster week.

Commodities contained, focus remains on geopols after Russian strikes on Ukrainian infrastructure and Blinken comments.

December 13, 2024 at 9:12 am #16197In reply to: Forex Forum

December 12, 2024 at 3:27 pm #16161In reply to: Forex Forum

December 12, 2024 at 3:19 pm #16160In reply to: Forex Forum

December 12, 2024 at 2:43 pm #16157In reply to: Forex Forum

December 12, 2024 at 2:29 pm #16156In reply to: Forex Forum

December 11, 2024 at 8:30 pm #16131In reply to: Forex Forum

EURGBP MONTHLY CHART – Indicator of EUR weakness

Those who have followed me have seen me say to watch EURGBP for clues if trading EURUSD and/or GBPUSD

Break of .8267 opens the door for the major level at .8200… As this chart shows, .8200 is a 7-year low.

Back above .8250-67 would be needed to postpone the risk

Minor support is at .8225, Wednesday’s low.

December 11, 2024 at 4:25 pm #16107In reply to: Forex Forum

December 11, 2024 at 2:38 pm #16091In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View