-

AuthorSearch Results

-

March 16, 2025 at 10:28 pm #20978

In reply to: Forex Forum

March 14, 2025 at 10:23 pm #20947In reply to: Forex Forum

March 14, 2025 at 6:49 pm #20931In reply to: Forex Forum

Engines can be modified to run on alcoholic beverages which are dirt cheap to make in Europe,.. pennies for a few gallons… So the question of running out of the crude oil in the world is a moot point.

But with a 200% tariff on alcoholic products from Europe then maybe Americans may need to pay 3 dollars per gallon at the pump all over again… alcohol is a clean burning fuel and to prove it just try burning a scotch whiskey without first adding ice.

March 14, 2025 at 5:10 pm #20929In reply to: Forex Forum

Remember … german war toys manufacturers are uP some 200% since President Trump’s inauguration:

Beyond defence: Stocks set to gain from Germany’s economic revolution

… The CDU/CSU and SPD-led coalition unveiled a €500 billion off-budget infrastructure fund—equivalent to 11.6% of GDP in 2024—to be deployed over the next ten years …

March 14, 2025 at 3:20 pm #20924In reply to: Forex Forum

March 14, 2025 at 2:10 pm #20918In reply to: Forex Forum

German stocks lead European shares rally after report of massive debt deal

Key points:· German debt deal needs two thirds majority for plans, vote slated for Tuesday

· STOXX 600 up 0.8%, Germany’s DAX set to erase weekly losses

· UMG falls after Ackman’s Pershing reduces its stake

· Kering plunges after Gucci appoints Demna as artistic director

· BMW falls on soft auto margin guidance for 2025

German shares led a broad rally in European stocks on Friday, after a report of a historic deal to raise state borrowing in the region’s largest economy.

The pan-continental STOXX 600 SXXP climbed 0.8% as of 1200 GMT, with banks (.SX7P) and defence stocks (.SXPARO) among the top gainers, jumping 1.9% and 2.9% respectively. Germany’s benchmark DAX DAX rose 1.9%, erasing its losses for the week.

Conservative Chancellor-in-waiting Friedrich Merz reached an agreement with the Greens on Friday on a massive increase in state borrowing ahead of a parliamentary vote next week, a source close to the negotiations told Reuters. A debt deal compromise was now being examined by finance ministry officials, parliamentary sources said.

March 14, 2025 at 1:07 pm #20908In reply to: Forex Forum

March 14, 2025 at 12:59 pm #20907In reply to: Forex Forum

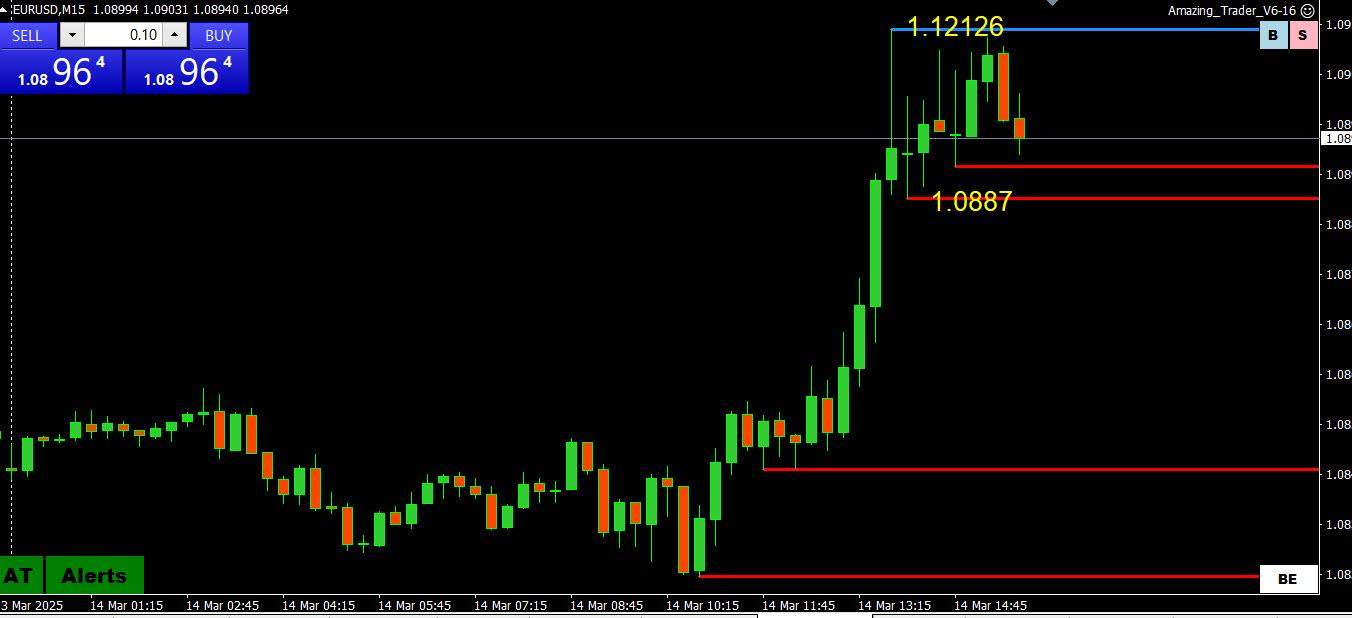

EURUSD 15 MINUTE – Symmetric range

Current range is around 13 pips either side of 1.09 (1.0887-1.0913) … should be some bids below the market by those caught out by the debt news spike BUT on the other side, as the chart shows, it hit a wall at 1.09126

Feels like one of those Fridays unless Trump throws us another tweetstorm comment.

March 14, 2025 at 10:54 am #20899In reply to: Forex Forum

March 14, 2025 at 10:31 am #20897In reply to: Forex Forum

As I have noted, when you see a sharp mkve in USDFJPY while others either lag or diverge, look for the offset currency.

IN this case, it appears to have been in AUD and NZD ad well as into EUR although a firmer EURGBP may be giving EURUSD some support.

Life in a mutti-currency centric (as opposed to a dollar-centric) trading world..

March 13, 2025 at 7:24 pm #20881In reply to: Forex Forum

EURUSD 4h

Pattern proved right – as always – leg down.

Now in real trading, there are few rules while following these type of patterns:

– Trade is active only during the given bar – no extensions or variations

– Whatever profit is seen has to be taken – no hopes , no dreams

Now we have seen here 20 pips of profit, but seems like market has stopped for now.

Personally I take what I get – there is always another one to trade.

There is around hour and half left, but late in game….this is not exactly a good timing for trade.

If everything stays like it is right now till next bar, we’ll have another pattern , but one that gives bad probabilities : 50-50

That is because we don’t have a down trend, but a correction, so question is when is it going to turn up again….

This was just a real time example 😀

March 13, 2025 at 4:52 pm #20871

March 13, 2025 at 4:52 pm #20871In reply to: Forex Forum

March 13, 2025 at 2:56 pm #20867In reply to: Forex Forum

March 13, 2025 at 2:35 pm #20866In reply to: Forex Forum

March 13, 2025 at 2:27 pm #20864In reply to: Forex Forum

March 13, 2025 at 1:37 pm #20860In reply to: Forex Forum

Euro Could Fall as U.S. Recession Fears, German Fiscal Optimism Look Overdone

The euro could weaken in the near-term after its recent rally on U.S. growth concerns and optimism over Germany’s fiscal spending plans, Commerzbank analyst Michael Pfister says in a note. “The market has got a bit ahead of itself in its current assessment.” The U.S. is unlikely to enter a recession as some market participants fear, he says. Rather, growth should remain “quite strong” this year. Furthermore, Germany’s fiscal stimulus proposal probably won’t have an effect on the economy until next year at the earliest, he says. Commerzbank expects the euro to fall to $1.05 by the end of the second quarter from $1.0845 currently.March 13, 2025 at 1:35 pm #20859In reply to: Forex Forum

DAX Slides 1% as Trade War Escalates

Frankfurt’s DAX index extended its losses in afternoon trading, sliding 1% to 22,450, as escalating trade tensions between the U.S. and the EU dampened investor sentiment.

U.S. President Donald Trump threatened to impose 200% tariffs on European wines, champagnes, and other alcoholic beverages after the EU moved to slap a 50% tariff on American whiskey in retaliation for previous U.S. duties on European imports.

Meanwhile, concerns over prolonged conflict in Ukraine deepened after Russia dismissed the proposed U.S. ceasefire deal as merely a “temporary respite,” accusing Washington of imitating peace efforts.

Investors also remained cautious as the German parliament continued debating reforms to the country’s debt brake.

March 13, 2025 at 1:30 pm #20856In reply to: Forex Forum

March 13, 2025 at 12:48 pm #20847In reply to: Forex Forum

March 13, 2025 at 12:02 pm #20840In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View