-

AuthorSearch Results

-

March 19, 2025 at 9:53 am #21099

In reply to: Forex Forum

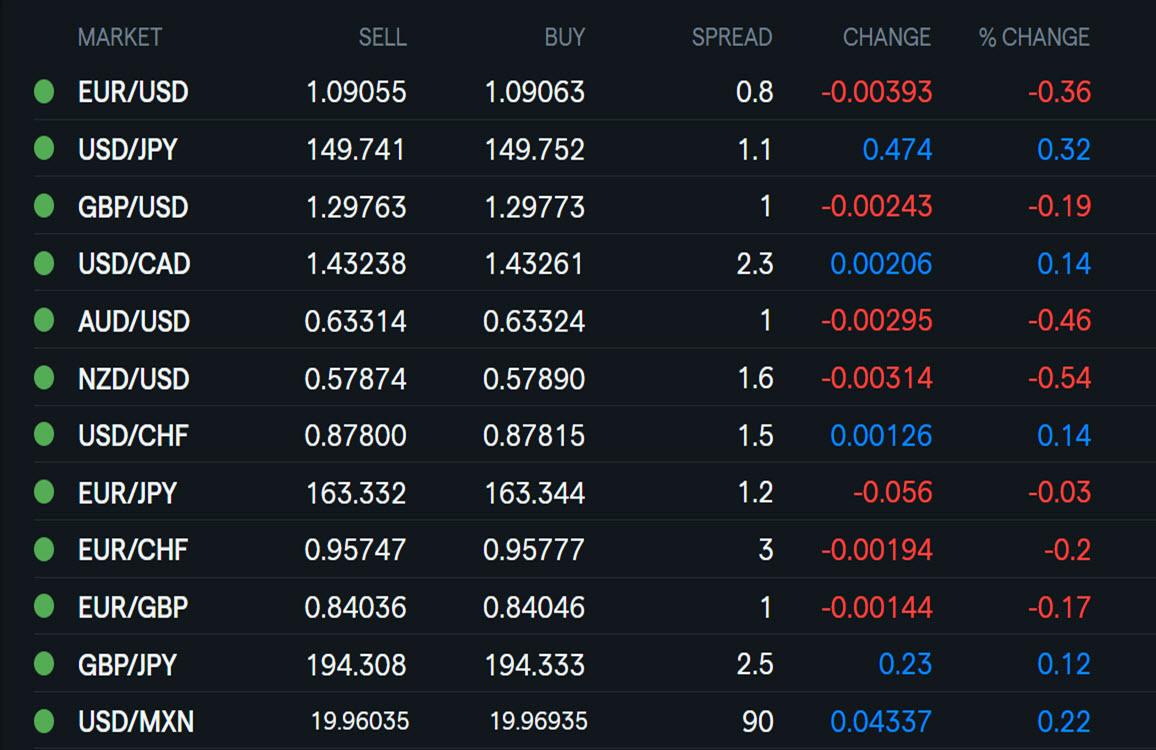

Using my platform as a HEATMAP shows

… the dollar trading firmer

EURUSD back to 1.09 for the 7th day in a row after running stops to a low at 1.0873. Note a failure again to make a serious run above 1.0950 (this time paused below it).

Perhaps some disappointment the Trump-Putin call did not result in a full ceasefire

USDJPY 150 briefly tested (high 150.02) after the BoJ kept policy steady

Turkish lira smashed following arrest of chief political rival

XAUUSD consolidating after surging to another record high yesterday

Looking ahead… Fed day today… see detailed FOMC preview

March 18, 2025 at 5:57 pm #21087In reply to: Forex Forum

euro 1.0947

puppy, on longer time bars, looks to be having a solid run uP. Hoever it has yet to pop over 1.1065

it may need to test 1.0875/50 and if the test would hold maybe re-charge for new run uP for 1.1065 amd beyond.

A “successful” ukrainian war resolution should be euro-positive to some degree.

March 18, 2025 at 5:30 pm #21084In reply to: Forex Forum

U.S. stocks fall as Fed convenes, euro wavers as Germany passes debt reform

· Israeli strikes on Gaza revives Middle East tensions

· U.S. housing starts, industrial output surprise to the upside

· Safe-haven flows keep gold above $3,000

· Wall Street turned lower and gold surged to record highs on Tuesday as Israeli airstrikes on Gaza revived geopolitical jitters and the U.S. Federal Reserve gathered to discuss monetary policy amid growing economic uncertainty.

· A vote by Germany’s parliament to overhaul government spending caused the euro to waver, although it also sent European stocks higher and boosted German shares to near-record highs.

· Even so, all three major U.S. stock indexes were lower in early trading, with weakness in tech-related megacap stocks dragging the tech-laden Nasdaq down the most.

March 18, 2025 at 5:03 pm #21082In reply to: Forex Forum

See if you can apply the lesson from reading this article to others (hint: EURUSD making a fresh run at its upsaide)

March 18, 2025 at 4:47 pm #21081In reply to: Forex Forum

March 18, 2025 at 4:35 pm #21080In reply to: Forex Forum

Trump-Putin call ends… stocks getting a very modest bump, EURUSD holding its bid

March 18, 2025 at 3:43 pm #21078

March 18, 2025 at 3:43 pm #21078In reply to: Forex Forum

March 18, 2025 at 3:04 pm #21076In reply to: Evaluation – Daily Trades

March 18, 2025 at 1:43 pm #21070In reply to: Forex Forum

March 18, 2025 at 12:45 pm #21060In reply to: Forex Forum

March 18, 2025 at 12:23 pm #21057In reply to: Forex Forum

…” 500-billion-euro fund for infrastructure”…

–

the traditionally getting-into-debt german is suddenly markets’ darling for sticking its nations neck into a 500-billion euro over next few years debt noose, by some enthusiasts’ calculations to be ballpark 3-4% of GDP.ieeha, economics and peace prize for president trump goading the german thusly ?

euro 1.0918 as I type, on the longer time frame euro still in strong up trend shouls see S on dips into high 1.08 region if seen

March 18, 2025 at 12:11 pm #21055In reply to: Forex Forum

Early EURUED gains (whiuch failed abiove 1,0950) may have been in anticipation of this vote

Parliament to vote on 500-billion-euro fund for infrastructure

Also to vote on easing of strict borrowing rules

Conservatives, SPD and Greens expect to reach majority

Measures would mark tectonic shift in spending(Reuters summary)

March 18, 2025 at 9:44 am #21052In reply to: Forex Forum

TIME TO REVISIT THIS ARTICLE AS EURUSD FOCUS IS ON 1.0950

EURUSD HIGH 1.0954 => LAST 1.0944

My Favorite Trading Secret: The Power of the “50” Level

March 18, 2025 at 8:44 am #21050In reply to: Forex Forum

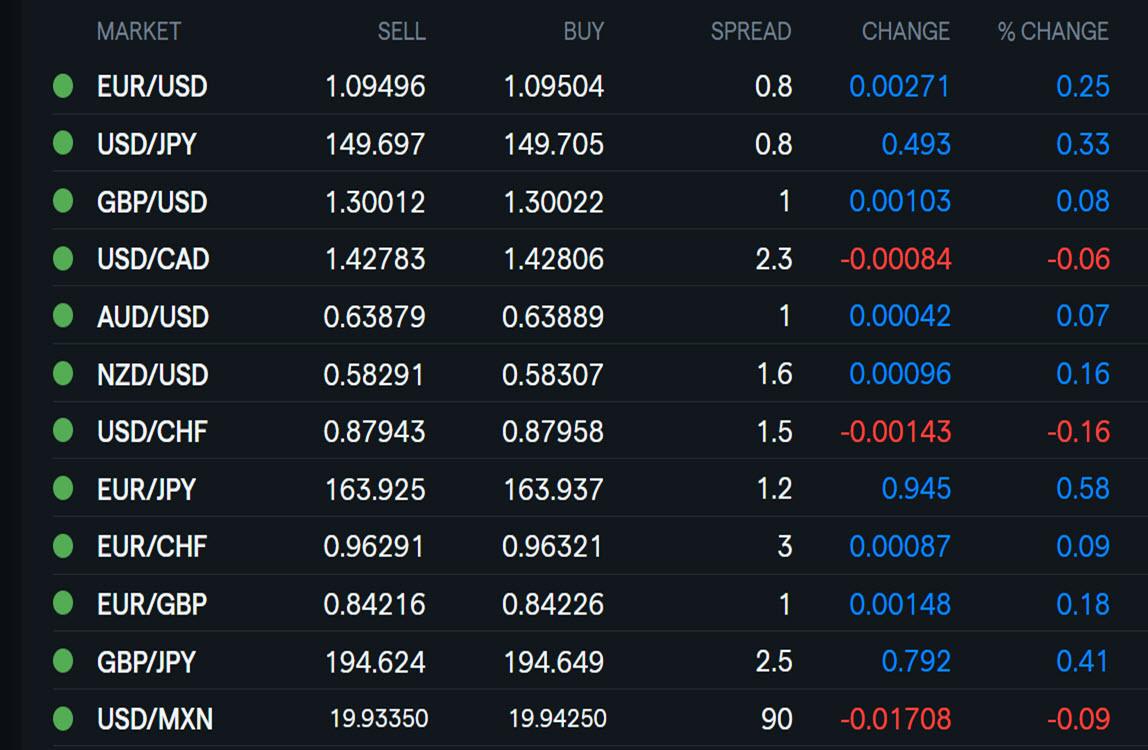

Using my platform as a HEATMAP shows

… the dollar trading weaker except vs. a weaker JPY (USDJPY came within spitting distance but backing off after being unable to test 150).

EURUSD break of 1.0947-50 would need to hold to put 1.10 on the radar.

Middle East heating up, supporting oil and gold but little signs of stress elsewhere.

XAUUSD extends record high above 3005.

US stocks steady and seeing if they can build on a 2- day rally

Looking ahead,

Trump-Putin call today

entral bank meeting deluge starts on Wednesday

March 17, 2025 at 10:09 pm #21044In reply to: Forex Forum

March 17, 2025 at 3:03 pm #21009In reply to: Forex Forum

DLRx 103.20 = key Support here

–

every political chicken is screaming “tariff = uncertainty”China is an economic basket case screaming that IT needs 100% tariff of its cars OFF (in europ, US, canada)

why ? it needs work for its peasants … all the while interest on its deficits and debt are running astronimically exponential . Europe is being “thankful” to donald for forcing it into “investing” billions into military spending, calling it an economic boost.In the meantime on deck this week:

Fed, BoE, BoJ, BCCh — players are expecting all to stay pat

players appear to give some odds SNB will cut 25March 17, 2025 at 1:02 pm #21000In reply to: Forex Forum

March 17, 2025 at 11:19 am #20994In reply to: Forex Forum

US OPEN

US equity futures are softer & Crude bid after Trump orders strikes in Yemen; US Retail Sales due

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

• US Senate voted 54-46 to pass the stopgap funding bill to keep the government funded through September 30th.

• European bourses modestly firmer whilst US futures are in negative territory.

• USD is a touch softer ahead of a risk-packed week; Antipodeans benefit from Chinese data and as China unveiled a plan to boost weak consumption.

• EGBs bid with OATs leading after Fitch while Bunds await fiscal updates.

• Gas deflates after US President Trump said he will speak with Russia’s President Putin on Tuesday and may have something to announce on Ukraine-Russia talks by Tuesday.March 17, 2025 at 10:17 am #20989In reply to: Forex Forum

EURUSD DAILY CHART – 5 days in a row

Past 5 days trading around 1.09 except one day when the high was 1.0897 (close enough)

Range over this period has been 1.0822=-1.0947… midpoint is 1.08845 as a reference level.

Next directional move will be dictated by whether 1.09 becomes a solid support or resistance…. looking at this chart shows either uptrend out of steam so consolidting

March 16, 2025 at 10:57 pm #20981In reply to: Forex Forum

Interview with The Sunday Times Luis de Guindos, Vice-President of the ECB, 16 March 2025

…we need to consider the uncertainty of the current environment, which is even higher than it was during the pandemic.

You said the uncertainty now is even greater than during the pandemic. How would you characterise it? What are the big unknowns at the moment?

First, the policies of the new US Administration. There’s a lot of talk about tarif…

-

AuthorSearch Results

© 2024 Global View