-

AuthorSearch Results

-

March 20, 2025 at 2:29 pm #21192

In reply to: Forex Forum

March 20, 2025 at 2:00 pm #21187In reply to: Forex Forum

Higher Tariffs Would Raise Inflation, Slow Growth, ECB’s Lagarde Says

A rise in U.S. tariffs on imports from the European Union that was met with retaliation would weaken economic growth in the eurozone and push inflation higher, European Central Bank President Christine Lagarde said Thursday.

Should the European Union retaliate by raising tariffs on imports from the U.S., growth would be reduced by half a percentage point, while the eurozone’s inflation rate would be raised by the same proportion.

In its most recent forecasts, the ECB saw the eurozone economy growing by 0.9% this year and 1.2% in 2026, while it expected inflation to average 2.3% this year and 1.9% the next.

Lagarde said the inflationary impact would fade over time however, an indication that the central bank likely wouldn’t respond by raising its key interest rate.

The ECB’s analysis of the impact of higher tariffs is similar to that offered by the Federal Reserve, which Wednesday left its key rate unchanged but lowered its growth outlook and raised its inflation projections.

March 20, 2025 at 1:32 pm #21186In reply to: Forex Forum

March 20, 2025 at 1:27 pm #21185In reply to: Evaluation – Daily Trades

March 20, 2025 at 1:26 pm #21184In reply to: Forex Forum

March 20, 2025 at 12:51 pm #21175In reply to: Forex Forum

March 20, 2025 at 11:57 am #21170In reply to: Forex Forum

US OPEN

European risk sentiment slips, USD firmer and Bonds bid post-FOMC

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European risk tone deteriorates with US futures also slumping into the red, potentially driven by EU fiscal focus, post-FOMC pullback and attention returning to tariffs/trade.

USD up vs. peers, Antipodeans lags, EUR slides and GBP eyes BoE.

Bonds are bid post FOMC & as the tone deteriorates, Gilts lead on data & reports around the Spring Statement.

Crude succumbs to the risk-off sentiment, with base metals also heading lower.

March 20, 2025 at 10:00 am #21165In reply to: Forex Forum

EURUSD DAILY CHART – Reversal of fortune but…

Damage not yet fatal

Daily chart shows 1.0822 as the key support, then a void,,, support at 1.0805 is important as well… 1.0805 is last week’s low so a break would create an outside week

Back above 1.0860, at a minimum, would be needed to slow the downside risk … 1.0850 will be pivotal in setting the intra-day tone

Pattern to watch (on Friday)… 1.09 traded for 8th day in a row… Break of this pattern often results in a directional move

March 19, 2025 at 7:46 pm #21148In reply to: Forex Forum

EURUSD 4h – After FOMC

Not much happened , and now we have a following situation:

Supports: 1.08600 & 1.08150

Resistances: 1.09150 & 1.09550

Close tonight above 1.09100 would be kind of Bullish for the coming day. That would create a chance for EUR to hit straight to 1.10200

However, a correction would be way better

I would like to see test of 1.08150 and then Up again…but 1.08600 might be just fine

March 19, 2025 at 6:38 pm #21141

March 19, 2025 at 6:38 pm #21141In reply to: Evaluation – Daily Trades

March 19, 2025 at 6:37 pm #21140In reply to: Forex Forum

March 19, 2025 at 5:38 pm #21137In reply to: Forex Forum

March 19, 2025 at 3:40 pm #21132In reply to: Forex Forum

European rally faces tariff reckoning

Is it a time for some clear thinking ?

· STOXX 600 up 0.1%

· IT firm Softcat pops on results

· Fed rate decision awaited

· Turkish assets tumble

· Wall St futures inch up

· Fast money investors have been a key force behind this year’s strong rally in Europe, and now that real money flows are starting to pour in, tariff risks are back to the fore.

· This could keep volatility high and curb gains near term, say Barclays, pointing to the April 2 deadline by which reciprocal tariff rates in the U.S. are intended to take effect.

· “A ‘worst case’ 25% blanket tariff, should it materialise, would indeed take away most of the growth expected this year in Europe,” says strategist Emmanuel Cau at the UK bank.

· “However, US goods exports are only c.12% of revenues for (the STOXX 600)… And, with tariff losers underperforming notably ytd, some of the risks are arguably priced in.”

· Despite the short-term risks, Cau is upbeat about the long-term as a landmark fiscal reform in Germany will likely boost the broader European growth for 2026 and beyond.

· This could drive “more inflows/rotation”, Cau notes.

· As a result, Barclays has doubled its 2026 EPS growth forecast for the STOXX SXXP to 8%, lifting the year-end target to 580 from 545 – a 4.7% upside to Tuesday’s close.

March 19, 2025 at 3:38 pm #21131In reply to: Forex Forum

EURO 1.0887

–

PUPPY CAME TO REST ATM IN THE HIGHER 1.088″s after majestically failing to pierce N of 1.0950on the larger time frames puppy still in uP trend and still I d be looking to B-o-minorDips

for this puppy to turn in its trand would probably take over 100 – 125 pips dump and stay there.

which raises the Q of what thinng would make the dollar rally thusly

March 19, 2025 at 2:56 pm #21120In reply to: Forex Forum

March 19, 2025 at 2:44 pm #21119In reply to: Forex Forum

March 19, 2025 at 1:04 pm #21109In reply to: Forex Forum

European stocks steady while U.S. futures tick up, Turkish assets tumble

· European stocks little changed, U.S. futures up· Investors focused on tariff and growth concerns

· Turkish assets drop after arrest of Erdogan rival

European shares struggled for direction on Wednesday while U.S. futures ticked up after a selloff on Wall Street, as investors waited for the Federal Reserve rates decision later in the day.

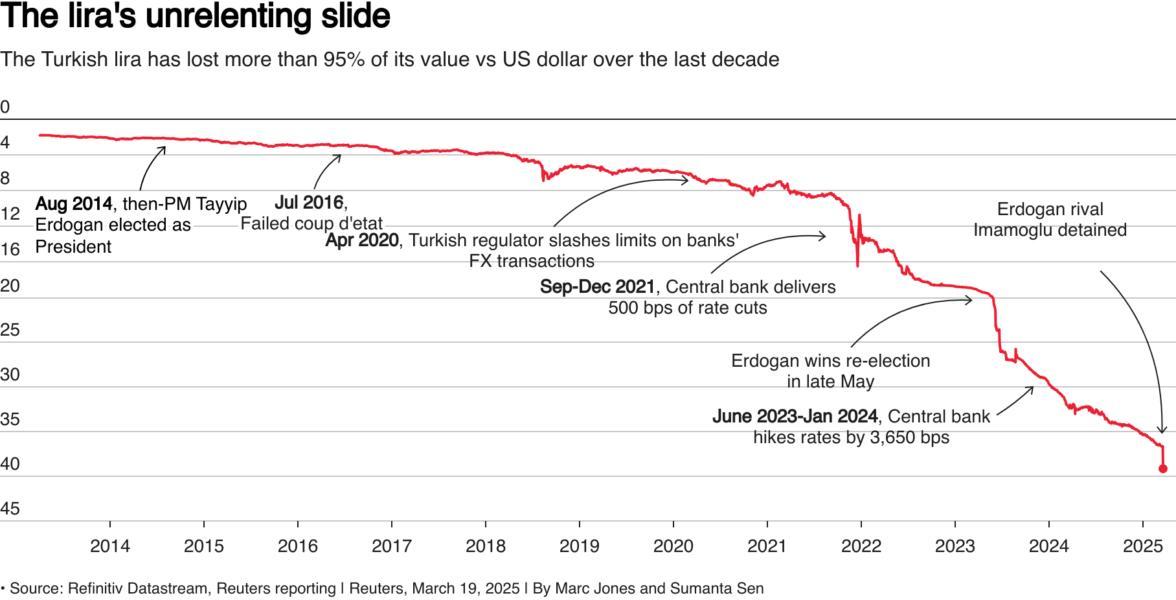

Meanwhile, Turkish stocks, bonds and the lira all slid, helping boost the safe-haven U.S. dollar, after authorities detained President Tayyip Erdogan’s main political rival on Wednesday.

TURKISH SELL-OFF

The Turkish lira slid in its biggest daily fall since the peak of the country’s most recent currency crisis in June 2023 and last traded at around 38 per dollar, down around 4% USDTRY.

Investors ditched Turkish assets after authorities detained Ekrem Imamoglu, the Istanbul mayor, on Wednesday on charges including corruption and aiding a terrorist group. The main opposition party called the arrest “a coup against our next president”.

March 19, 2025 at 12:57 pm #21107

March 19, 2025 at 12:57 pm #21107In reply to: Forex Forum

Dollar rises ahead of Fed; Turkish lira drop reins in G10 currencies

Key points:

· Dollar up, Fed decision key for markets on Wednesday

· Safe haven currencies rise after Turkey lira plunges

· Yen up after BOJ stands pat on rates

· Euro stays near five-month peak on German fiscal reform

The dollar rallied on Wednesday ahead of the Federal Reserve’s decision on interest rates, but retreated from the day’s highs after markets stabilised from an early shock caused by the detention of Turkish President Tayyip Erdogan’s main rival.

March 19, 2025 at 11:55 am #21103In reply to: Forex Forum

US OPEN

USD firmer, EUR and GBP hit by JPY-action on Ueda’s press conference, US futures a touch firmer ahead of FOMC

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses began the session on the backfoot with the risk tone dented as a few potential factors influenced, US futures modestly firmer pre-Fed

USD firmer, EUR and GBP hit by JPY-action on Ueda’s press conference; BoJ itself was as expected, Ueda began balanced but had some hawkish points in his presser

Fixed income initially benefited on the slip in the risk tone but has since eased off best with USTs now slightly softer into the FOMC

Crude remains pressured after Tuesday’s geopolitical developments while Gas has picked up as strikes on energy infrastructure seemingly continue

Ukraine’s Zelensky to speak with US’ Trump on Wednesday and hopes a ceasefire will eventually be implemented

March 19, 2025 at 10:32 am #21101In reply to: Forex Forum

EURUSD 15 MIN CHART – Watch 1.09

Support: 1.0868-73

Resistance 1.0911. 1.0929 (only above it would negate the downside risk)

1.09 has printed except one day when high was 1.0897) 7 days in a row…. Range over this period has been 1.0921-1.0946

While 1.09 is not a magic level, the longer this pattern goes on the greater the risk of a directional move once it is broken.

-

AuthorSearch Results

© 2024 Global View