-

AuthorSearch Results

-

October 29, 2024 at 11:15 am #13593

In reply to: Forex Forum

October 29, 2024 at 10:30 am #13589In reply to: Forex Forum

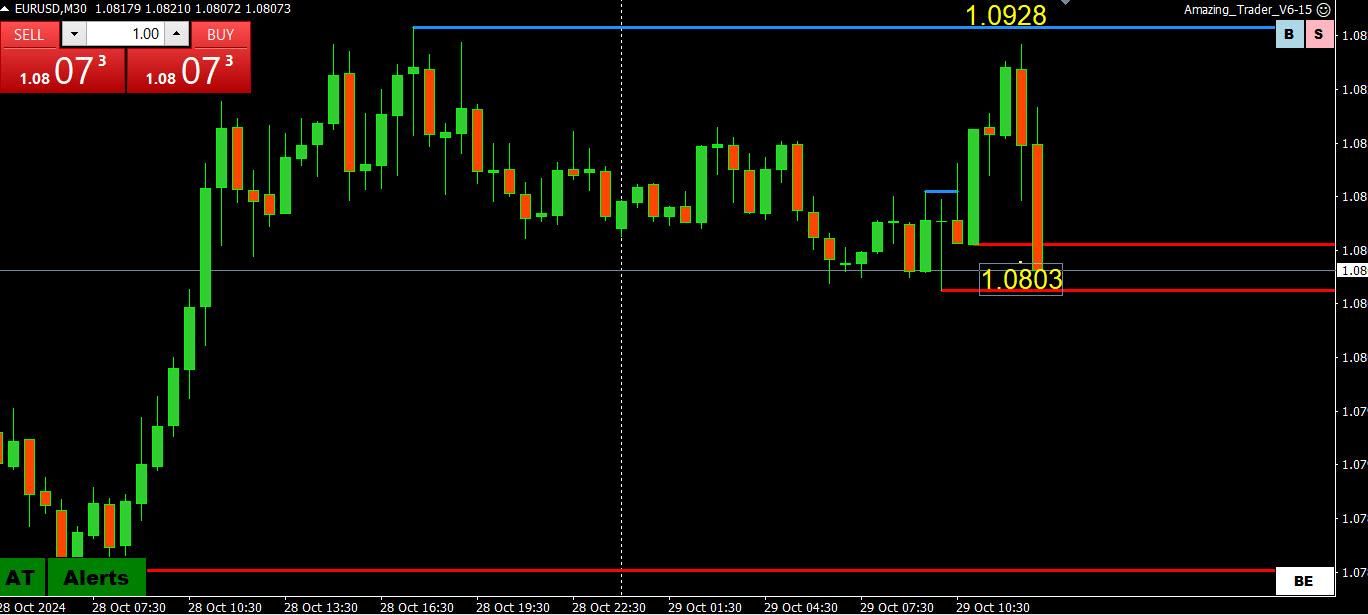

EURUSD 30 MINUTE CHART – Will 1.08 trade again?

As noted in the eek ahead and again yesterday, my view is to treat moves to the upside as retracements unless 1.0839 is firmly taken out.

See this chart and how the Amazing Trader resistance line held.

Now we see if 1.08 can exert a magnetic pull as it enters a 1.0800-10 support zone.

Note how EUR crosses have undercut the earlier EURUSD bid (e.g. EURJPY held resistance, EURGBP dips).

October 29, 2024 at 9:27 am #13585In reply to: Forex Forum

EURJPY 4 HOUR CHART – Retests the high

JPY weakness following Japanese elections is providing offset support to currencies such as the EUR and GBP while upporting USDJPY.. Curious that AUD has not benefited.

As for EURJPY, yesterday’s 166.08 high has been re-tested and its significance is there is little on the upside for another 9-10 big figures. This makes 166,08 a key level.

Note this follows yesterday’s bounce from just above the bottom of the ipoening week gap.

October 29, 2024 at 8:12 am #13579In reply to: Forex Forum

EURUSD 4 HOUR CHART – FOCUS ON 1.08

Current consolidation range is 1.0761-1.0839, a symmetric 39 pip range either side of 1.08.

1.08 has printed 4 days in a row coming into today… see if this pattern can be extended or broken.. a break of this type of pattern often sends a directional signal.

So, 1.08 is clearly pivotal and will dictate the tone going forward.

October 28, 2024 at 10:57 am #13520In reply to: Forex Forum

Newsquawk US OPEN

Equities lifted and oil sinks as traders digest Israel’s limited strike on Iran

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are on a firmer footing, traders garnering optimism following the relatively moderate Israeli attack on Iran, which saw the former avoid hitting energy/nuclear facilities; US futures also benefit.

USD is mixed, losing vs EUR & GBP but significantly stronger vs JPY after the Japanese general election which has seen the ruling coalition lose its parliamentary majority.

Bonds are pressured by the removal of geopolitical risk premia, but have lifted off lows in recent trade given the continued pressure in oil prices.

Crude gapped lower overnight and has continued to slip since the European cash open; Brent Jan’25 currently at lows of USD 71/bbl. XAU/base metals are also pressured.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

Cancel anytime – free for 7 days

October 28, 2024 at 9:31 am #13506In reply to: Forex Forum

EURUSD 4 HOUR CHART – 1.08 PATTERN

EURUSD extending its trading pattern around 1.,08 to 4 days in a row a it consolidates above last week’s 1.0761 high.

To further highlight the 1.08 pattern, the current range is 39 pips either side of it (1.0761-1.0839)\

To suggest momentum for a run at 1.0761, 1.0782 swould need to be broken.

October 28, 2024 at 9:07 am #13504In reply to: Forex Forum

EURJPY 4 HOUR CHART – MIND THE GAP

Opening week gap here as well to Friday’s 154.40iush close

Support starts at last week’s 155.02 high through 154,70 (today’s low).

Chart hows a big void above 155,02 so us today;s high as initial reistance.

Less chance to see BoJ intervening in EURJPY and buying of this cross may be one flow supporting the EURUSD>

October 26, 2024 at 10:05 am #13469In reply to: Forex Forum

October 25, 2024 at 5:41 pm #13462In reply to: Forex Forum

A CTA in San Diego California (Southern California Naval Base and beautiful city) reminded me long ago that “markets overshoot.” I am of the opinion that may apply to today’s price activity in some currencies but the dominant trend of say a week time frame has not been broken for them. UsdChf included, where the dominant trend is still the sell side even with the overshoot.

In my view EurUsd remains a buy and has not even overshot the trend yet. I really hope Geo events do not change that because it would also mean stocks get pummeled along with a lot of people’s net stock worth. Fridays tend to have that dynamic quite a bit.

October 25, 2024 at 5:05 pm #13459In reply to: Forex Forum

October 25, 2024 at 4:46 pm #13453In reply to: Forex Forum

October 25, 2024 at 4:32 pm #13447In reply to: Forex Forum

October 25, 2024 at 3:54 pm #13444In reply to: Forex Forum

October 25, 2024 at 3:37 pm #13442In reply to: Forex Forum

JP and I were chatting offline about our short EURUSD positions

It started out with an AT Directional Indicator pattern indicating up episode was likely over and risk was shifting to the downside.

I said with no stops above EURUSD 1.0838 (only sellers), it seemed to be a matter of patience before moving lower using the logic that

Trend is down

‘

Once positions are trimmed/adjusted ahead of the weekend Who is going to go long EURUSD ahead of the weekend?Just so this is not taken a a post in hindsight, I posted yesterday and again earlier to treat a move up as a retracement unless 1.0838 is firmly taken out.

October 25, 2024 at 2:28 pm #13439

October 25, 2024 at 2:28 pm #13439In reply to: Forex Forum

The best position of the day since the time horizon will run out on the buy side of everything versus Yen, Euro, Sterling, other would be the sell side of UsdChf. Already short there and holding into the close. Tremendous Geo risk at present.

I tend to have a smidge more insight in Geo risk matters due to my background than a lot of people but even simply being aware of what is crossing newswires you can see how dangerous the waters are at present.

October 25, 2024 at 1:46 pm #13436In reply to: Forex Forum

What is working for me since very early this morning pre-US stock open is the buy side of everything versus Yen. I abandoned the EurUsd short from yesterday very early after weaving in and out of other pairs to make it whole but decided to not re-enter Euro. I don’t expect the risk on attitude to stick as the session grows older. There is immense Geo risk right now.

The euphoria is related to some earnings, Trump apparently body slamming Harris in financial sector/Executive/other polls and other conditions not economic related, because those numbers are not stable.

October 25, 2024 at 1:40 pm #13435In reply to: Forex Forum

October 25, 2024 at 12:21 pm #13431In reply to: Forex Forum

October 25, 2024 at 10:33 am #13421In reply to: Forex Forum

Newsquawk US Open

US futures are bid & DXY is flat ahead of US data & Fed speak

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses hold a slight positive tilt after initially opening on a modestly weaker footing; US futures are entirely in the green.

Dollar is flat ahead of Durable Goods, JPY was fairly unreactive to mixed Tokyo CPI.

USTs are flat but directionally in-fitting with the pressure seen in Bunds, sparked by strong German Ifo metrics

.

Crude is very modestly firmer but ultimately within a contained range, XAU/base metals are pressured.Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

October 25, 2024 at 9:20 am #13417In reply to: Forex Forum

EURUSD 4 HOUR CHART – Resistance holding

As noted a couple of times yesterday, treat the move up as a retracement unless 1.0838 is firmly taken out.

High so far 1.08374… dead on at an Amazing Trader resistance line

Otherwise, EURUSD keeps a bid while above 1.08 but runs the risk of a magnetic pull towards it if 1.0838 is not firmly taken out.

Just in case resistance level 1.0873

-

AuthorSearch Results

© 2024 Global View