-

AuthorSearch Results

-

November 1, 2024 at 6:18 pm #13821

In reply to: Forex Forum

November 1, 2024 at 5:00 pm #13817In reply to: Forex Forum

November 1, 2024 at 1:40 pm #13803In reply to: Forex Forum

November 1, 2024 at 1:15 pm #13800In reply to: Forex Forum

November 1, 2024 at 12:41 pm #13796In reply to: Forex Forum

November 1, 2024 at 11:14 am #13793In reply to: Forex Forum

NEWSQUAWK US OPEN

‘

Equities firmer following strong AMZN/INTC results & DXY gains ahead of US NFPGood morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

Click below to read the full report and listen to the guys doing the podcast.

4 Things You Need to Know

European bourses are entirely in the green alongside modest strength in US futures following post-earning strength in Amazon/Intel & ultimately outmuscling losses in Apple.

Dollar is firmer, CHF sinks after the region’s inflation data and JPY pares recent strength.

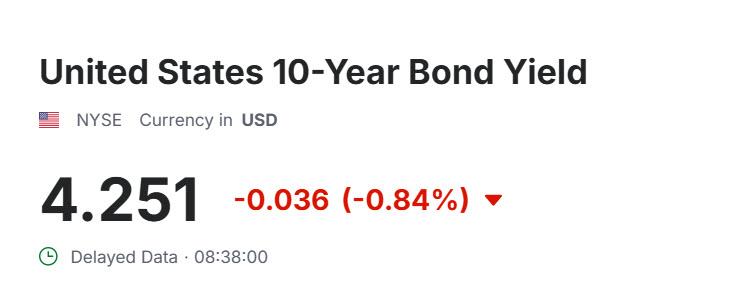

Gilts continue to underperform with benchmarks generally softer pre-Payrolls.

Crude is lower as risk-premium returns into the weekend though participants have NFP to navigate first.

November 1, 2024 at 10:36 am #13790In reply to: Forex Forum

November 1, 2024 at 9:07 am #13788In reply to: Forex Forum

EURUSD 1 HOUR CHART – WAITING FOR NFP

Market is biding its time waiting for the US jobs report,

A sharp price in EURGBP yesterday helped give EURUSD a bid and it has backed off today as the cross eased back.

1.09 should be tough on top, back below 10840-50 would be needed to shift the focus back to 1.08,

Oct NFP:

A weak jobs # is expected following a sharp rise in Sept BUT NFP will likely be distorted by the hurricanes and strikes,

October 31, 2024 at 6:16 pm #13764In reply to: Forex Forum

October 31, 2024 at 3:37 pm #13757In reply to: Forex Forum

October 31, 2024 at 3:11 pm #13750In reply to: Forex Forum

October 31, 2024 at 2:43 pm #13749In reply to: Forex Forum

EURGBP DAILY CHART – BONDS SLIDE, GBP FOLLOWS

I said keep an eye on EURGBP for month end but did not expect the bond vigilante to attack and see that pPIll over to the GBP.

Either that or it is month end flows but whatever the case, the Oct high at .8434 and Sept high at 8463 are at risk should .8505 become support.

October 31, 2024 at 2:27 pm #13747In reply to: Forex Forum

October 31, 2024 at 12:41 pm #13738In reply to: Forex Forum

October 31, 2024 at 10:06 am #13732In reply to: Forex Forum

October 31, 2024 at 8:50 am #13722In reply to: Forex Forum

October 30, 2024 at 8:41 pm #13715In reply to: Forex Forum

EURGBP 4 HOUR CHART – REVERAL OF FORTUNE

I feel like a parrot repeating to keep an eye on EURGBP if trading EURUSD and/or GBPUSD.

EURGBP’s rebound from a failure to test .8295 yesterday, which lifted EURUSD while ultimately weighing on GBP{USD, would need to take out .8380-88 to expose .8405.

Otherwise, look for .8350 to remain pivotal in setting the tone while it trade .8300-.8400..

Month end

EURGBP tends to be one of the more active month end flows, often on both sides at different times, so keep an eye on it Thursday, including its impact on EURUSD and GBPUSD.

October 30, 2024 at 8:36 pm #13714In reply to: Forex Forum

EURUSD 4 HOUR CHART PATTERN BROKEN

The break of a 5 day pattern where 1.08 traded each day is a bullish indicator but with some caution as demand seemed to come more from its crosseS, specifically EURGBP, than vs the USD

1.0971=73, the 200 day mva and key resistance.is A tough obstacle to 1.09.

Otherwise, would need to stay above 1.0839 to keep a bid.

October 30, 2024 at 5:56 pm #13704In reply to: Forex Forum

October 30, 2024 at 5:40 pm #13703In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View