-

AuthorSearch Results

-

November 11, 2024 at 9:48 am #14244

In reply to: Forex Forum

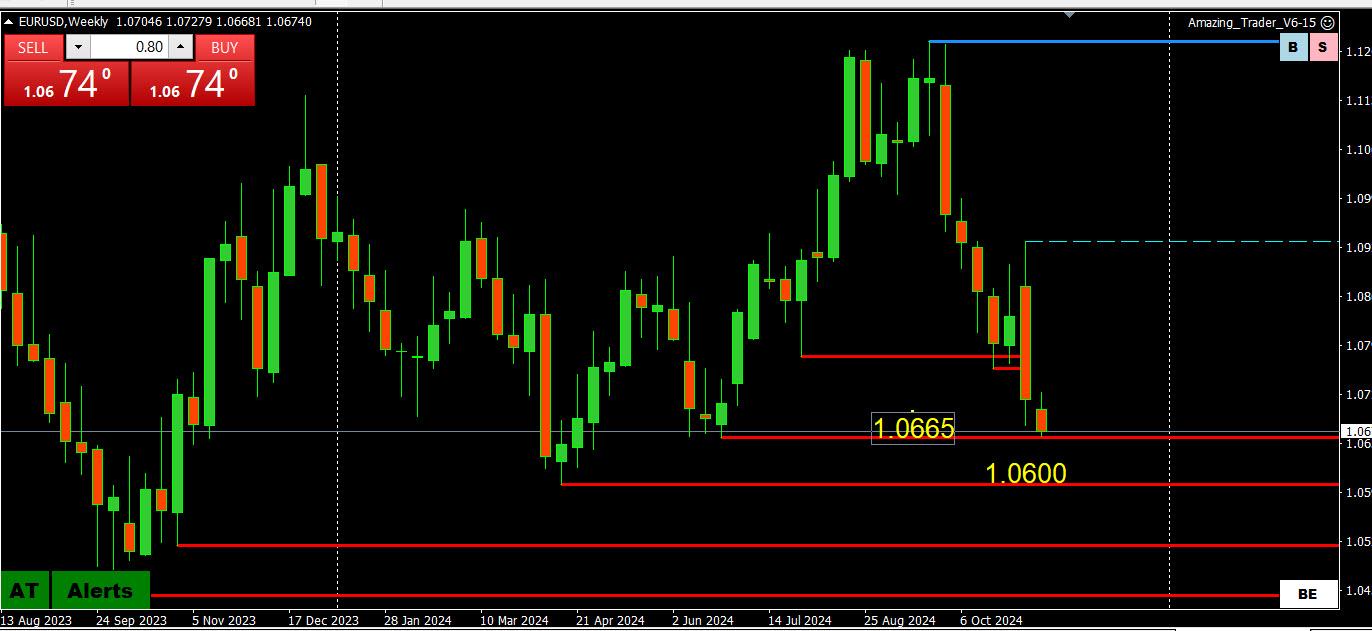

EURUSD WEEKLY CHART – EXTENDS LOW

As posted in our Weekly FX Chart Outlook

Most at risk is EURUSD, which found support below 1.06 on 2 days but failure to hold 1.08+ on the retracement keeps a risk on 1.0665 and 1.0600 should the 1.0682 be broken.

Extend low, pause so far just above 1.0665 (low 1.0668)

November 10, 2024 at 11:32 pm #14237In reply to: Forex Forum

November 8, 2024 at 8:46 pm #14200In reply to: Forex Forum

Good finish for the dollar but…

EURUSD found support again below 1.07, with a higher low

AUDUSD found support just below .6562 support (cited earlier)

EURGBP tested just below .8295, thus the GBPUSD lag

USDJPY did not join the buy USD party although it bounced from a 152.14 double bottom

US500 traded above 6000, watch the close vs. this pivotal target

‘

November 8, 2024 at 4:57 pm #14197In reply to: Forex Forum

November 8, 2024 at 4:19 pm #14196In reply to: Forex Forum

November 8, 2024 at 1:55 pm #14189In reply to: Forex Forum

November 8, 2024 at 11:26 am #14171In reply to: Forex Forum

NEWSQUAWK US OPEN

China-related assets slide as MOFCOM disappoints

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are entirely in the red, with sentiment hit after China’s NPC press conference disappointed markets; US futures remain flat.

DXY is slightly firmer, with the JPY strong whilst the Antipodeans lag given the lack of fresh stimulus measures from China.

Bonds are on a firmer footing, with modest outperformance in Gilts and as USTs await Fed speak from Bowman & Musalem.

Crude oil, XAU and base metals are all on the backfoot, following the underwhelming Chinese NPC press conference.

November 8, 2024 at 11:05 am #14169In reply to: Forex Forum

EURUSD 1 HOUR CHART – KEEP IT SIMPLE

To keep it simple, 1.08 is the buy/sell; bias indicator that will dictate whether the retracement has legs or the downside stays at risk.

To negate this retracement attempt and shift the focus back to the lows, 1.0746 would need to be broken.

On the upside, a move above the 61,8% level (1.0840) would be needed to shift the focus back to 1.09

Note the 2 blue Amazing Trader lines drawn off 1.0824, which indicated a change in the directional risk (back to the downside) has so far paused above 1.0746.

Current intra-day range 1.0760-90, too tight to last.

November 7, 2024 at 2:03 pm #14127

November 7, 2024 at 2:03 pm #14127In reply to: Forex Forum

November 7, 2024 at 1:28 pm #14122In reply to: Forex Forum

USD is trading lower

Logic says and easy to say with hindsight

Trading on what Trump might do (e.g. tariffs) when he doesn’t take office for another 2 months and has yet to choose a cabinet is a bit of a stretch so a retracement should not be a surprise.

Scroll below for updates with some FIBO levels in EURUSD and USDJPY.

November 7, 2024 at 11:54 am #14120In reply to: Forex Forum

NEWSQUAWK US OPEN

Bunds under pressure following German coalition collapse; FOMC & BoE due

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are modestly firmer across the board, with US futures also slightly higher, but ultimately taking a breather following the significant strength in the prior session.

Dollar is giving back recent gains, Antipodeans outperform attempting to claw back post-election losses amid resilience in China.

USTs are a touch firmer awaiting today’s FOMC meeting, Bunds are the clear underperformer after the German coalition collapses.

Crude is modestly weaker, paring back some of gains seen in the prior session; XAU benefits from the softer Dollar and base metals gain amid positive price action in China overnight.

November 7, 2024 at 10:55 am #14117In reply to: Forex Forum

November 7, 2024 at 8:59 am #14113In reply to: Forex Forum

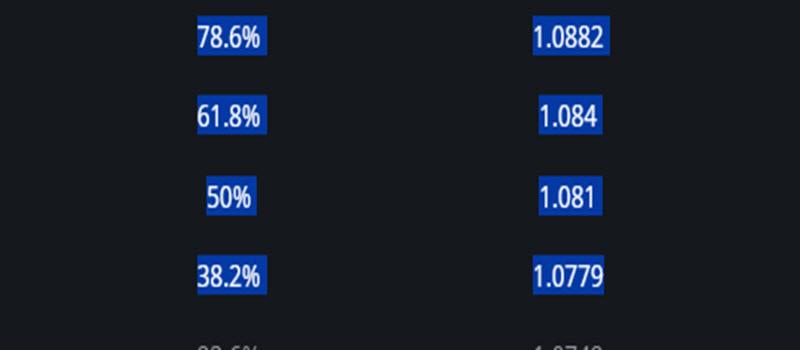

EURUSD 1 HOUR CHART – RETRACING

What caught my eye is the 1.0781 resistance a it coincides with a 38.2% retracement, which blocks the 1.0794 level.

Expect a limited upside unless 1.0800-10 is regained.

Given the straight line move down, use FIBOS as potential levels of resistance.

FIBOS 1.0937-1.0682

November 6, 2024 at 5:51 pm #14077

November 6, 2024 at 5:51 pm #14077In reply to: Forex Forum

November 6, 2024 at 5:06 pm #14075In reply to: Forex Forum

November 6, 2024 at 3:30 pm #14072In reply to: Forex Forum

November 6, 2024 at 2:49 pm #14062In reply to: Forex Forum

November 6, 2024 at 1:06 pm #14046In reply to: Forex Forum

November 6, 2024 at 11:59 am #14043In reply to: Forex Forum

NEWSQUAWK US OPEN

Election results indicative of Trump Presidential & Senate victory; House too close to call.

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US Presidential Election results are indicative of a Trump victory and Republicans taking the Senate; House is too close to call.

Equities soar with clear outperformance in the RTY with Trump poised to win the US election; Novo Nordisk +7.1% benefits after posting strong Q3 Wegovy sales.

Dollar flies higher, DXY topped 105.00, before paring back to a current 104.90; EUR & JPY the clear underperformers amongst the G10s.

USTs pressured and Bunds bolstered by the Trump Trade; US curve markedly steeper, attention on the House result to see if this continues

A soft session for the crude complex, pressured by the firmer Dollar and Trump’s known stance on US drilling/supply; XAU softer, base metals dented but awaiting China stimulus details

November 6, 2024 at 9:40 am #14036In reply to: Forex Forum

EURUSD 4 HOUR CHART – TRUMP TRADE PART 3 – HIGHER DOLLAR

Use today’s low (1.0703) as first area of support with 1.0685 and 1.0600 below it.

Back above 1.0780-00 would be needed to slow the risk

If I was a central bank I would have been in covertly to restore some order.

Note my warning that a stop may nit be a stop,

-

AuthorSearch Results

© 2024 Global View