-

AuthorSearch Results

-

November 13, 2024 at 4:15 pm #14357

In reply to: Forex Forum

November 13, 2024 at 1:34 pm #14346In reply to: Forex Forum

November 13, 2024 at 11:45 am #14340In reply to: Forex Forum

NEWSQUAWK US OPEN

Dollar & USTs flat ahead of US CPI and a slew of Fed speakers

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly on a modestly firmer footing; US futures are incrementally lower ahead of US CPI.

Dollar is flat, JPY marginally underperforms with USD/JPY briefly topping 155.00.

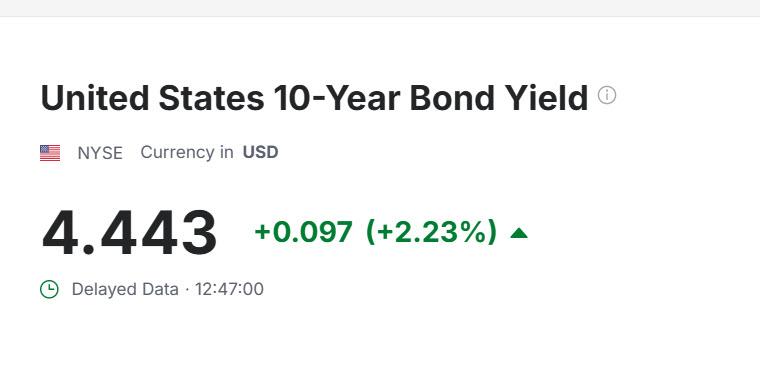

USTs are incrementally firmer and ultimately in stasis ahead of US CPI; Gilts continued to underperform.

Crude and precious metals gain but base metals remain subdued.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

November 13, 2024 at 10:22 am #14336In reply to: Forex Forum

EURUSD 1 HOUR CHART – WAITING FOR US CPI

This chart is very clear…

1.0630 is a key resistance… BUT would need become support and then renew 1.0665 (former support) to shift risk away from 1.06

Extended low by 2 pips to 1.0593, suggests there were not a lot of stops below yesterday’s 1.0594 low….still at risk as long as it trades below 1.0630

November 12, 2024 at 9:34 pm #14332In reply to: Forex Forum

November 12, 2024 at 5:49 pm #14324In reply to: Forex Forum

November 12, 2024 at 5:09 pm #14323In reply to: Forex Forum

November 12, 2024 at 4:41 pm #14322In reply to: Forex Forum

November 12, 2024 at 4:11 pm #14321In reply to: Forex Forum

November 12, 2024 at 2:12 pm #14315In reply to: Forex Forum

November 12, 2024 at 1:23 pm #14312In reply to: Forex Forum

November 12, 2024 at 10:29 am #14300In reply to: Forex Forum

November 12, 2024 at 10:24 am #14299In reply to: Forex Forum

EURUSD WEEKLY CHART – TARGETS

As I have been noting, target were at 1.0665 and 1.0600.

As youc an see by this chart, should 1.0600 be firmly broken, then 1.0500-15 and the 2023 high at 1.0446 would come on the radar.

On the upside, back above 1.0630 (yesterday’s high_ and 1.0665 would be needed to ease the risk.

November 11, 2024 at 2:53 pm #14263In reply to: Forex Forum

November 11, 2024 at 1:55 pm #14262In reply to: Forex Forum

November 11, 2024 at 1:50 pm #14261In reply to: Forex Forum

November 11, 2024 at 1:03 pm #14258In reply to: Forex Forum

November 11, 2024 at 11:59 am #14256In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

The dollar continues to feed on a mix of post-election tariff and tax cut speculation, China’s struggle with deflation and Germany’s simmering political crisis – with the euro plumbing its lowest levels in almost five months.

Even with bond markets effectively shut on Monday for the Veteran’s Day holiday, the dollar built on last week’s election-related surge – spurred by Friday’s reports, later denied by other sources, that protectionist Robert Lighthizer had already been asked to be President-elect Donald Trump’s new trade chief.

Morning Bid: Post-Election Dollar Revs Up, China Battles Deflation

November 11, 2024 at 11:20 am #14249In reply to: Forex Forum

NEWSQUAWK US OPEN’

Equites gain & DXY bid with the Trump Trade still at play; Crude slumps amid constructive geopolitical updates

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.

Equities are entirely in the green, with a strong European morning thus far; the RTY outperforms.\

DXY is on a firmer footing with the Trump Trade still in action, JPY underperforms following the BoJ SOO which highlighted the lack of urgency to hike.

Bonds are mixed, with Bunds firmer amid suggestions that Chancellor Scholz could bring forward a vote of no-confidence; Treasury cash trade is closed on account of US Veterans Day.

Crude slips on comments by Hezbollah that there are negotiations to stop the war; XAU/base metals are hampered by the stronger Dollar and softer-than-expected Chinese inflation metrics overnight.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

Cancel anytime – free for 7 daysNovember 11, 2024 at 10:56 am #14247In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View