-

AuthorSearch Results

-

November 18, 2024 at 10:36 am #14523

In reply to: Forex Forum

EURUSD 4 HOUR CHART – NO SURPRISE

It should come as no surprise to see EURUSD gravitate back to 1.0550, which is the bias setting level while within 1.05-1.06

Note firmer EUR crosses (e.g. EURJPY, EURGBP) giving EURUSD support but not enough to break the key 1.0593 level.

So let’s call it consolidation of the downtrend where only a break of 1.0590-00 would shift the risk from 1.0495-10.

November 17, 2024 at 10:10 pm #14513In reply to: Forex Forum

November 17, 2024 at 3:23 pm #14478In reply to: Forex Forum

November 14, 2024 at 7:36 pm #14434In reply to: Forex Forum

November 14, 2024 at 6:49 pm #14432In reply to: Forex Forum

November 14, 2024 at 3:40 pm #14424In reply to: Forex Forum

EURUSD 30 MINUTE CGART – NEXT LEVEL TESTED AND HOLDING

Just so you know this level was posted well in advance early this morning

For day traders, it is a Power of 50 day with 1.0550 likely to set the tone.Otherwise, a move above 1.0577 would be needed to slow the threat to key targets at 1.0500-15 and the major one at 1.0446.

November 14, 2024 at 3:22 pm #14423In reply to: Forex Forum

November 14, 2024 at 3:06 pm #14422In reply to: Forex Forum

EURUSD 30 MINUTE AMAZING TRADER CHART

Chart speaks for itself with levels posted in prior update…BUT INTRA-DAY 1.0550 IS BACK TO THE BIAS SETTING LEVEL

November 14, 2024 at 2:41 pm #14421In reply to: Forex Forum

November 14, 2024 at 2:23 pm #14420In reply to: Forex Forum

November 14, 2024 at 12:54 pm #14410In reply to: Forex Forum

November 14, 2024 at 12:45 pm #14409In reply to: Forex Forum

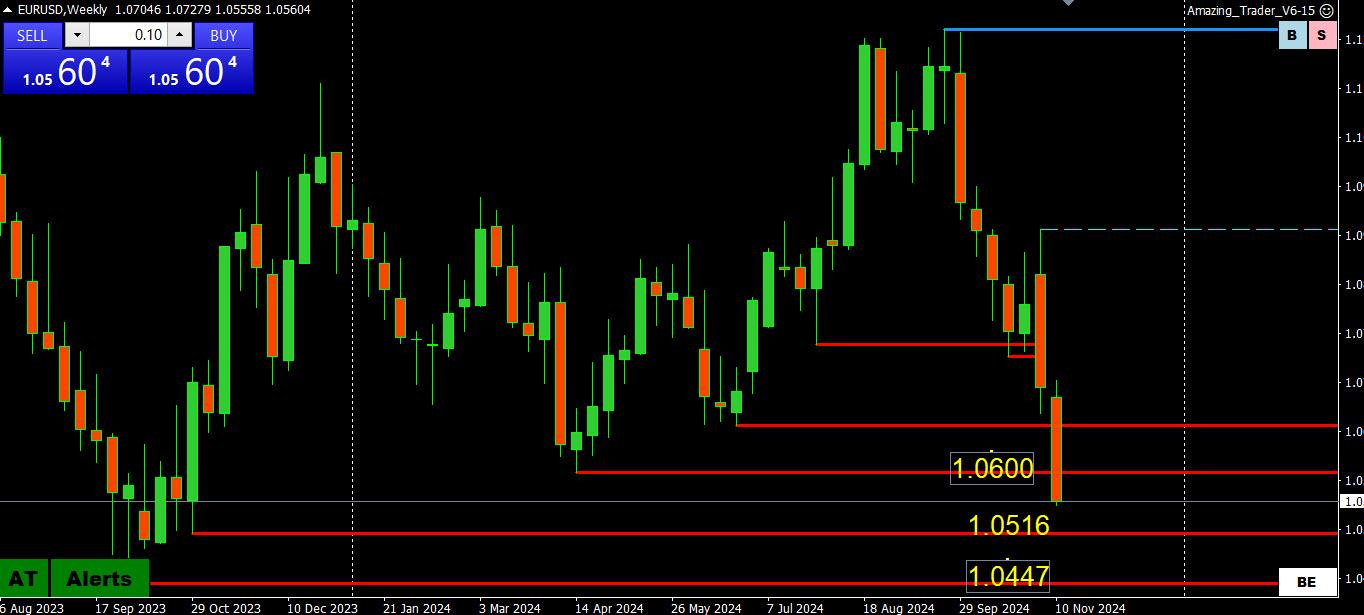

EURUSD Monthly

To be able to understand what is going on with this pair, I am first going to show you Monthly chart.

Obviously it is in a long lasting Downtrend.

That Support channel line below is hypothetical – based on historical behaviour and angle that has to hold for it to be able to go Up again.

It can hold, it can give a way – I don’t know – depends on million factors in the near future – but it will give you an idea what is really going on.

November 14, 2024 at 11:46 am #14407

November 14, 2024 at 11:46 am #14407In reply to: Forex Forum

November 14, 2024 at 11:27 am #14404In reply to: Forex Forum

NEWSQUAWK US OPEN

European equities higher, ASML +5.6% after confirming 2030 outlook, DXY topped 107 ahead of Powell

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain with clear outperformance in the Euro Stoxx 50, lifted by gains in ASML +5.2% after it reiterated its 2030 sales outlook; US futures are modestly firmer whilst the RTY outperforms.

Dollar continues to extend gains having surpassed 107.00, USD/JPY tops 156.00.

Bonds are subdued with slight underperformance in Gilts ahead of Fed Chair Powell and BoE Governor Bailey.

Metals succumb to the Dollar strength while crude trades choppily in a tight range.

November 14, 2024 at 10:48 am #14402In reply to: Forex Forum

November 14, 2024 at 10:07 am #14398In reply to: Forex Forum

November 14, 2024 at 9:44 am #14392In reply to: Forex Forum

November 14, 2024 at 8:45 am #14389In reply to: Forex Forum

EURUSD 1 HOUR CHART – POWER OF 50

Question is whether EURUSD needs another failed retracement to make a run at 1.05 or will 1,0500-50 prove to be a sticky zone.

For day traders, it is a Power of 50 day with 1.0550 likely to set the tone.

Otherwise, a move above 1.0577 would be needed to slow the threat to key targets at 1.0500-15 and the major one at 1.0446.

November 13, 2024 at 6:39 pm #14371In reply to: Forex Forum

November 13, 2024 at 4:35 pm #14360In reply to: Forex Forum

EURGBP 1 HOUR CHART – Chart speaks for itself

You have seen me focus on this cross as a clue to trading EURUSD and/or GBPUSD o I will let the chart speak for itself to explain the weak EURUSD and lagging GB=PUSD.

As I haver offered before, feel free to contact me (link in the top menu bar) if you want me to elaborate.

-

AuthorSearch Results

© 2024 Global View