-

AuthorSearch Results

-

November 25, 2024 at 1:16 pm #14988

In reply to: Forex Forum

November 25, 2024 at 12:00 pm #14968In reply to: Forex Forum

NEWSQUAWK US OPEN

Stocks firm, USD pressured & USTs bid on Trump’s Treasury appointment

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses & US futures begin the week on the front-foot, as markets welcome the nomination of Scott Bessent as Trump’s Treasury Secretary.

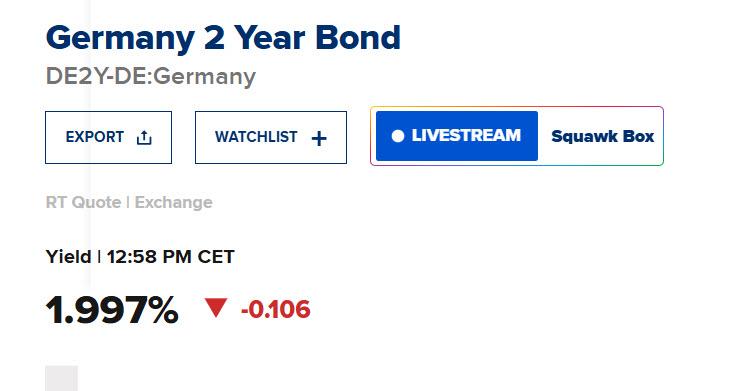

USD pressured and USTs bid following this, with the DXY sub-107.00 and the US yield curve bull-flattening FX peers generally benefit from the USD pressure, JPY outperformed overnight on favourable yield action and approval of Japanese stimulus

Crude in the red on Bessent, Israel-Lebanon and Iranian updates, Gas outperforms. XAU slipped below USD 2700/oz before recovering while base metals follow the tone though China performance capped

Try Newsquawk for 7 Days Free

November 25, 2024 at 10:31 am #14963In reply to: Forex Forum

November 25, 2024 at 10:00 am #14959In reply to: Forex Forum

EURUSD 1 HOUR CHART MIND THE GAP

As I noted in this article

Markets tend to factor in the worst and hope for the best. This is certainly true for tariffs as what shape they turn out to be will have an impact on the dollar, bonds and other markets as well.

This was the case to start what is not a normal week due to the upcoming US Thanksgiving Day holiday as seen by the opening week gap higher.

Levels to watch are clear, 1.0449-1.0551.

This suggests a firm break oof 1.0450 would be need to expose the gap while a firm break of 1.0500 would suggest a greater squeeze on shorts.

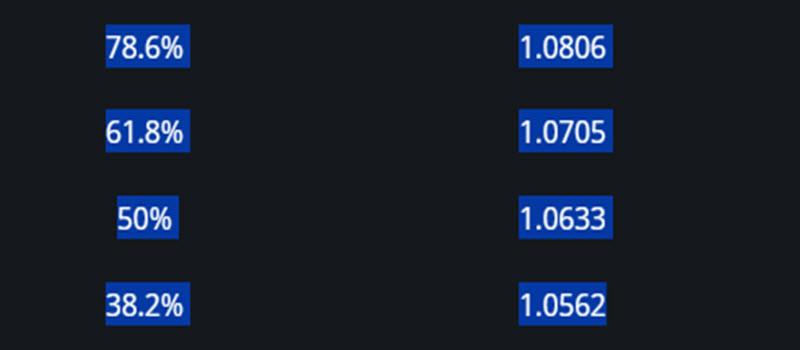

Looking at this as a retracement, here are FIBOS for 1.0935=1.0332 USING OUR fIBONACCI cALCULATOR

November 24, 2024 at 11:26 pm #14955

November 24, 2024 at 11:26 pm #14955In reply to: Forex Forum

November 24, 2024 at 10:21 pm #14947In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Germany’s Ifo business climate index is expected to decline slightly to 86.0 in November from 86.5 in October, indicating a modest drop in business morale. In the U.S., the S&P Case-Shiller house price index may show a slowdown in annual home price inflation, decreasing to 5.2% from 5.9%, while the FHFA house price index is projected to rise by 0.2% month-on-month. Consumer confidence is anticipated to improve in November, but new home sales are forecasted to decrease to an annual rate of 725,000 in October due to higher mortgage rates.

New Zealand’s Reserve Bank is likely to cut the official cash rate by 50 basis points to 4.25% amid lower inflation and an economic slowdown. In the U.S., pending home sales are expected to drop by 1.8%, and Germany’s consumer price index is estimated to rise by 0.2% monthly and 2.3% annually in November.

In Japan, payrolls are projected to rise for the 27th consecutive month, with unemployment steady at 2.4%. Industrial production is forecasted to increase by 3.9% month-on-month and 2.1% year-on-year. The Eurozone’s Harmonized Index of Consumer Prices flash estimate for November is expected to show headline inflation at 2.3% and core inflation at 2.8%, up from the previous month.

Econoday

November 24, 2024 at 9:56 pm #14943In reply to: Forex Forum

Yen futures trended down all of last week (strength in UsdJpy). What I would like to see is a drop toward 153.80 so I can get on the buy side again and if it holds so will I.

EurJpy is going in the opposite direction of UsdJpy and for many a good reason. Fundamentals matter and Europe’s economic ideologies are failing again albeit gradually. Socialism is a wonderful idea because not everyone can work and people need help. It has never worked however. Hopefully some better ideas come about in years to come.

The US is about to go on an economic eruption unless it is sabotaged.

November 23, 2024 at 7:02 pm #14933In reply to: Forex Forum

I would just like to comment regarding the price behavior of Thursday and Friday of this week.

A lot of people were waiting to pounce on a perceived bottom in Euro, Sterling, Swiss, and EurJpy at what amounted to mass positioning at a 6 month low being run through by a very aggressive sword.

Even a lot of professionals were hit hard there when markets fired through it like an out of control train.

So the question many ask is .. well then what use are pivots and if you only go with momentum or a combination you still don’t know positively what the outcome will be so what do I do?

1. Don’t become top and bottom happy.

2. Don’t think momentum is the only way to go.

3. Never convince yourself you are perfect if you go on a long win streak.

Answer: Pick those spots but be fleet of foot to adjust when necessary even when it means taking a small loss and immediately going with the reverse of what you thought would transpire.

I have been at this for a long time and have dealt with a lot of CTA’s on a personal level. I was one, albeit small.

If you wish to converse I am very receptive and helpful and can be reached through Jay with Global View by email.

November 23, 2024 at 4:30 pm #14917In reply to: Forex Forum

There is a light economic calendar in the coming week but it pays to look ahead after the way the EURUSD reacted to the weaker PMIs on Friday

NewsquawkWeek Ahead:Highlights 25 th-29nd November 2024

November 22, 2024 at 8:04 pm #14894In reply to: Forex Forum

Very simply Yen is in a buy cycle and UsdJpy is not. I would love to see futures dip again to start next week for another solid entry in spot. EurJpy is not moving with UsdJpy well and so for that one remains a good sell. Maybe long term. You really do benefit from at least paying attention to fundamentals.

November 22, 2024 at 4:04 pm #14889In reply to: Forex Forum

November 22, 2024 at 3:48 pm #14888In reply to: Forex Forum

November 22, 2024 at 3:18 pm #14886In reply to: Forex Forum

GBPUSD WEEKLY CHART -8 down weeks in a row

EURGBP at .8310 says GBPUSD is being pulled along for the ride by the falling EURUSD.

It has been 8 down weeks in a row so until/unless this pattern changes, it will stay in a sell mode but dependent on EURUSD for direction.

Key focal point is 1.25, solidly below it would be needed to put 1.2444 and the 1.2298 2024 low in play.

1.0220/1.2298 = .,8310

November 22, 2024 at 2:39 pm #14885In reply to: Forex Forum

November 22, 2024 at 2:17 pm #14884In reply to: Forex Forum

November 22, 2024 at 1:56 pm #14883In reply to: Forex Forum

November 22, 2024 at 1:47 pm #14882In reply to: Forex Forum

These comments have seen the CHF weaken, now the wordt performer vs the USD on the day. EURUSD may be getting some support from EURCHF.

Source. Newsquawk.com

November 22, 2024 at 12:58 pm #14878In reply to: Forex Forum

November 22, 2024 at 12:02 pm #14877In reply to: Forex Forum

November 22, 2024 at 11:56 am #14876In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

Darkening skies over Europe’s economy, trade and politics sent the euro plummeting to its lowest in two years – just 3% from dollar parity – as post-election U.S. crypto optimism sees Bitcoin flirt with $100,000 for the first time.

Morning Bid: Euro/dollar stares at parity, Bitcoin eyes $100k

-

AuthorSearch Results

© 2024 Global View