-

AuthorSearch Results

-

March 25, 2025 at 6:56 pm #21400

In reply to: Forex Forum

Stocks edge up, US dollar dips as tariff uncertainty weighs

Dollar dips after hitting three-week high

Stocks rise modestly after strong rally

German business sentiment improves

Global stocks were slightly higher on Tuesday, after a sharp rally in the prior session on hopes U.S. President Donald Trump would take a more measured approach on tariffs than feared, while the dollar eased from a three-week high.

European shares paced the advance, while stocks on Wall Street oscillated between modest gains and declines in the wake of a sharp climb on Monday after Trump indicated that not all of his threatened levies would be imposed on April 2 and some countries may get breaks.

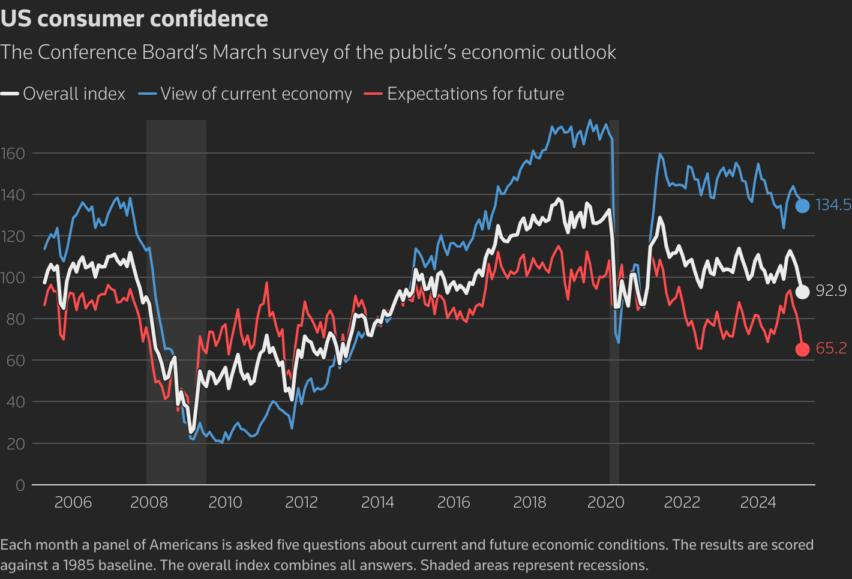

After initially opening higher, U.S. stocks lost ground after a reading on consumer confidence from the Conference Board fell 7.2 points to 92.9 in March, below the 94.0 estimate, the latest in a string of sentiment readings that have shown cooling.

March 25, 2025 at 5:38 pm #21398

March 25, 2025 at 5:38 pm #21398In reply to: Forex Forum

March 25, 2025 at 5:27 pm #21397In reply to: Forex Forum

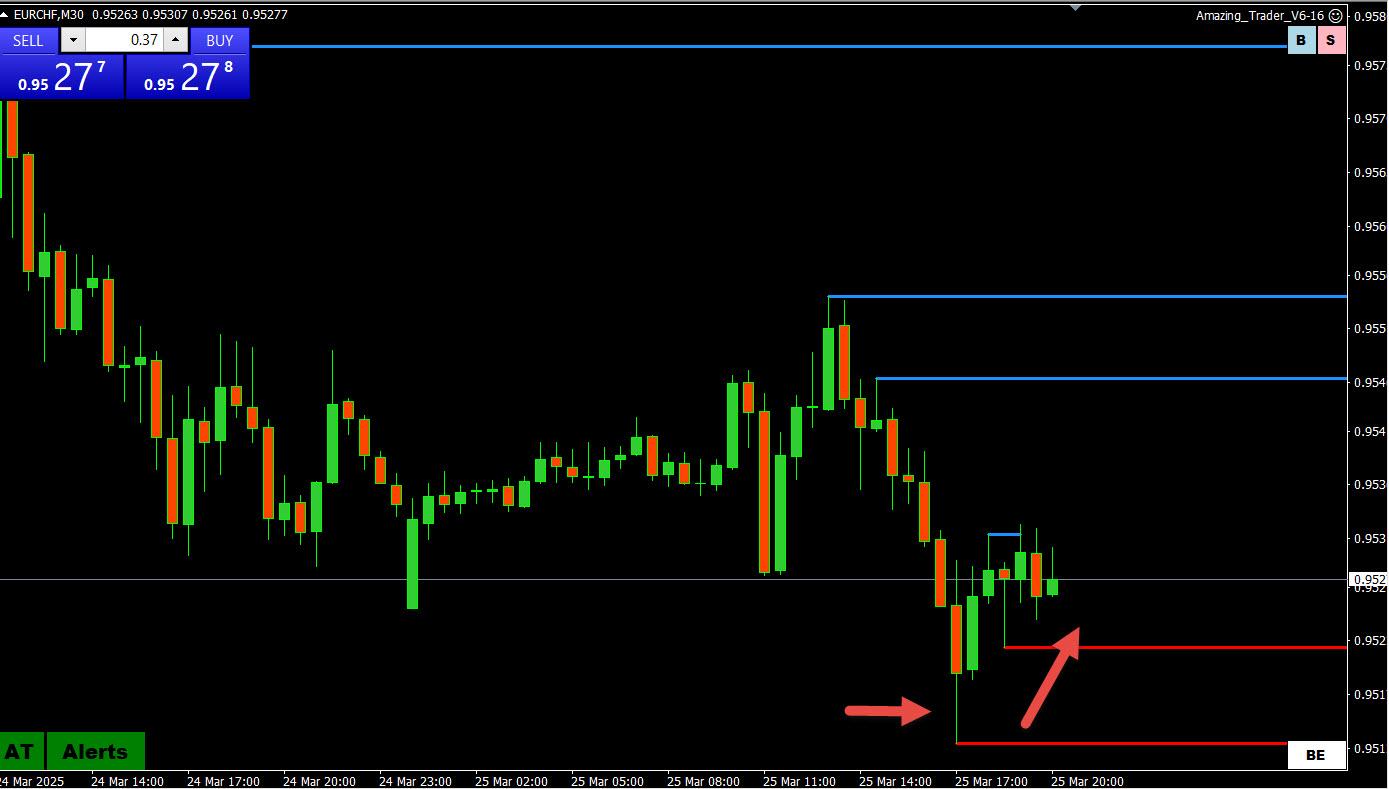

EURJPY 30 MIN – Dominant flow today

Note the price action in EURUSD 1.0810 ( vs. dip to 1.0799) and USDJPY 149.80 (vs 149.53 low) after whatever real money sell order was apparently filled and EURJPY bounced off its low.

As I have also noted, when USFJPY makes a sharp move and another currency lags badly or diverges, it is more often than not the result of an offset from a JPY cross.

Feel free to ask if this is not clear.

March 25, 2025 at 4:12 pm #21396In reply to: Forex Forum

March 25, 2025 at 3:08 pm #21394In reply to: Forex Forum

March 25, 2025 at 3:00 pm #21393In reply to: Forex Forum

March 25, 2025 at 2:15 pm #21381In reply to: Forex Forum

March 25, 2025 at 1:51 pm #21376In reply to: Forex Forum

March 25, 2025 at 1:00 pm #21364In reply to: Forex Forum

March 25, 2025 at 12:51 pm #21361In reply to: Forex Forum

March 25, 2025 at 12:15 pm #21353In reply to: Forex Forum

European shares rise after German business morale improves in March

Baloise gains after results, lifts insurer sectorEnergy stocks track oil prices higher after Venezuela tariffs

German business sentiment rises in March, Ifo survey shows

STOXX 600 up 0.4%

European shares rose on Tuesday after a German survey indicated business sentiment improved in the region’s largest economy, days after a historic debt deal aimed at boosting stagnating growth.

The pan-European STOXX 600 index SXXP was up 0.4% at 0910 GMT. Most regional stocks markets rose, led by a 0.9% gain in Spanish stocks IBC, followed by an 0.8% advance in French shares PX1.

Energy stocks (.SXEP) jumped 1.1% as oil prices firmed for the fifth day on supply concerns after the U.S. announced tariffs on countries that buy Venezuelan crude.

Swiss insurer Baloise BALN advanced 6% to the top of the STOXX 600 after reporting a 60.6% surge in its 2024 profit. The broader insurers index (.SXIP) firmed about 1%.

A survey from Munich-based Ifo Institute showed the business climate index rose to 86.7 in March, in line with economists’ forecast, up from 85.2 the previous month.

Germany’s plans to invest hundreds of billions of euros in defence and infrastructure have led to upgrades for the euro zone economy, contributing to European equities outperforming their U.S. counterparts so far this year.

Investors are also keeping an eye on U.S. trade policy that has roiled global markets.

March 25, 2025 at 12:07 pm #21351In reply to: Forex Forum

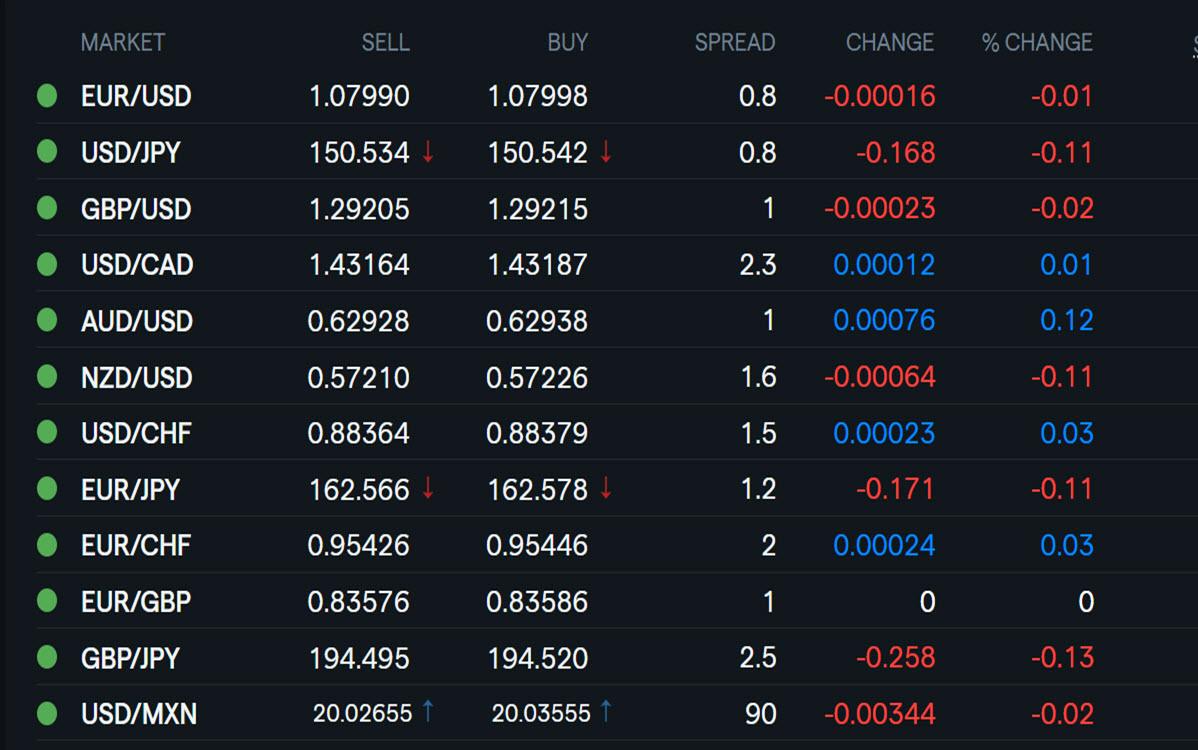

Data and tariff talk lift dollar to three-week high

The dollar ticked up to an almost three-week high on Tuesday after some strong U.S. services data and cautious optimism on the tariff front.

President Donald Trump said not all of his threatened levies would be imposed on April 2 and some countries may get breaks, which helped the mood on Wall Street overnight by soothing some fears about a possible slowdown in U.S growth.

The U.S. dollar index DXY notched a fifth straight session of gains, rising 0.15% to 104.46, its highest since March 5.

Meanwhile the euro EURUSD slipped to $1.0777, around its lowest in three weeks, and was last down 0.1%.

A strong services component in S&P Global’s flash U.S. PMI figures on Monday alongside a rotation back into Wall Street stocks helped push up U.S. bond yields, which supported the dollar.

The dollar has rebounded somewhat after falling to a five-month low in mid-March as Trump’s stop-start tariff campaigns dented company and investor confidence and darkened the outlook for U.S. growth.

The view that tariffs are unambiguously bullish U.S dollar has been challenged by the price action in 2025, and so even when we get the information on what tariffs look like next week, it will be hard to know what we are supposed to do.

March 25, 2025 at 11:58 am #21349In reply to: Forex Forum

<p style=”text-align: center;”>

</p>

</p>

US OPENEuropean bourses positive despite lower US futures, DXY veers lower and Crude climbs on Venezuelan tariffs

Good morning USA traders, hope your day is off to a great start!

Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump sanctioned Venezuelan oil. Elsewhere, India has proposed the removal/reduction of tariffs

European bourses defied the lead from futures and opened in the green, US futures in the red but only modestly so and hold onto the bulk of Monday’s gains

DXY steady throughout the morning but most recently at a session low to the benefit of peers across the board, EUR also aided by Ifo

Fixed benchmarks in the red, weighed on by Ifo and supply; USTs await Fed speak

Crude bid in an extension of Monday’s action, TTF softer on Ukraine updates while Gold has inched to fresh highs

<p style=”text-align: center;”>Try Newsquawk for 7 Days Free</p>March 25, 2025 at 11:48 am #21347In reply to: Forex Forum

EURUSD 4h

Supports: 1.08100, 1.07950 & 1.07750

Resistances: 1.08300, 1.08550 & 1.08900

Current momentum Up

As long as below 1.08550 daily direction is Down

Looking at 2-3 days period, EUR can spike up to around 1.09200 and then turn down again.

If above 1.09200 targets 1.10850

Personally, I would like to see this correction going all the way to 1.06850 before Up again.

March 25, 2025 at 9:37 am #21340

March 25, 2025 at 9:37 am #21340In reply to: Forex Forum

Using my platform as a HEARMAP shows

…the dollar trading close to unchanged after briefly extending its rebound overnight.

EURUSD 1.08 is the bias setting level…. what caight my eye is the low (1.0777) poauxed above the 1.0765 ley support/target. .

XAUUSD a touch firmer after holding iff another run at 3000

US equities consolidating and so far not following through on yesterday’s rally.

Light news day… headline watch remains on the next Trump tariff comment

March 25, 2025 at 7:45 am #21334In reply to: Forex Forum

March 24, 2025 at 4:39 pm #21318In reply to: Forex Forum

This is a good time to revisit this blog article

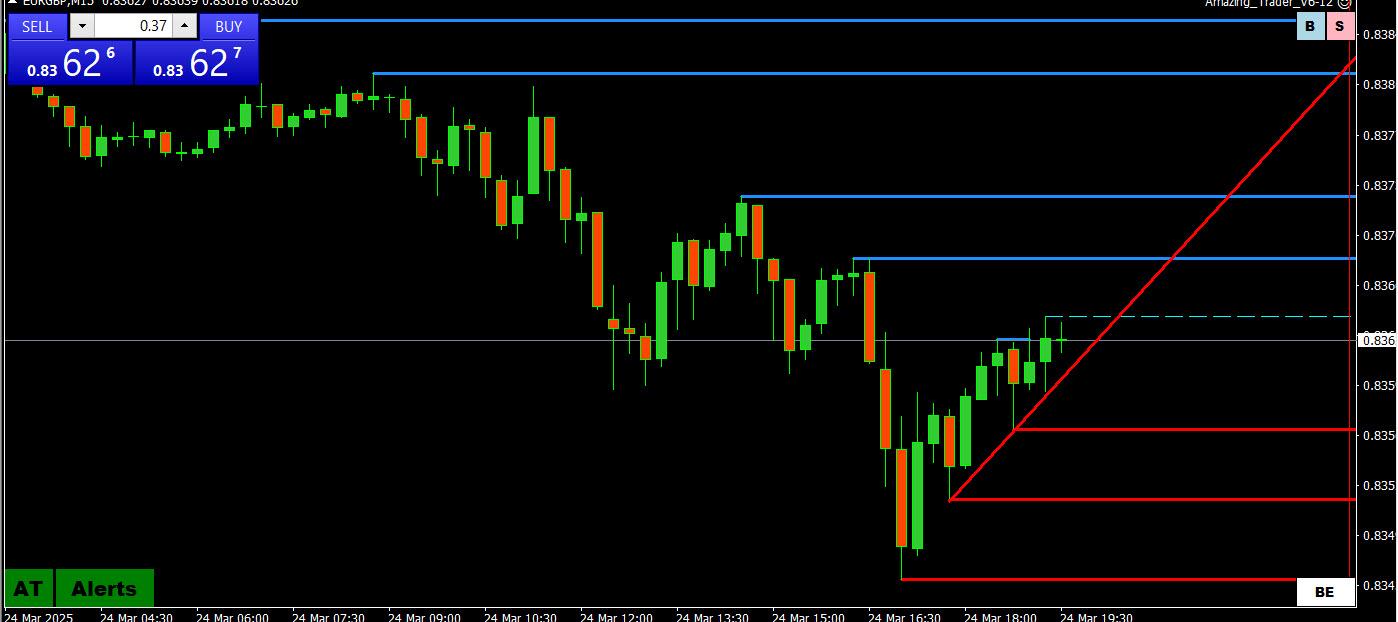

Note in the chart posted below how EURGBP found support, bounced and how GBPUSD, initially boosted by this selling of this cross, lost its bid.

March 24, 2025 at 3:37 pm #21312In reply to: Forex Forum

Notice how GBPUSD lost its bid after a sell order in EURGBP was filled.

EURUSD initially bounced on the bounce in EURGBP (last .8362 vs an .8345 low).

EURUSD has since followed GBPUSD lower with a lag, moving back below 1-08 so far holding above the earlier 1-0790 low.

Sojeep an eye on this crossw as you can see how crosses can give a clkue to what isa driving the spot market.

March 24, 2025 at 2:08 pm #21302In reply to: Evaluation – Daily Trades

March 24, 2025 at 2:07 pm #21301In reply to: Forex Forum

Futures buoyant ahead of data-driven week

S&P 500 futures rise over 1%

Traders brace for news on tariff barrage

PMIs, US PCE, China earnings in focus

Wall Street shares looked set to open higher on Monday and the dollar firmed at the start of a data-driven week, while the threat of U.S. tariff hikes made investors cautious in Europe.

S&P 500 futures ES1! were up about 1.2% and Nasdaq 100 futures NQ1! were 1% higher at 1218 GMT.

U.S. President Donald Trump’s administration is likely to exclude a set of sector-specific tariffs while applying reciprocal levies on April 2, according to media reports over the weekend that helped sentiment in early trading.

The pan-European STOXX 600 SXXP ticked down 0.1%, with most of the region’s indexes lower except for Germany’s DAX, which rose 0.2% after data showed manufacturing output there increased for the first time in almost two years.

This week’s data releases include global purchasing managers’ surveys, the U.S. Federal Reserve’s preferred inflation reading, inflation data in Australia and Japan, a budget update in Britain, and major earnings in China.

-

AuthorSearch Results

© 2024 Global View