-

AuthorSearch Results

-

December 1, 2024 at 10:07 pm #15378

In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Monday kicks off with final PMIs for November, with Germany’s manufacturing PMI expected to remain at a weak 43.2 and the UK’s at 48.6. In the US, the ISM manufacturing index may edge up to 47.6, still signaling contraction as concerns about weak demand and policy uncertainty linger.

Tuesday, South Korea’s inflation is forecasted at 1.6% annually for November after a rate cut last week due to economic slowdown fears.

Wednesday’s PMI updates for France, Germany, and the UK are expected unchanged, while the US ADP report forecasts private payrolls rising by 165,000.

Thursday, Eurozone retail sales should hold steady for October, while the US trade deficit is expected to narrow to $75.4 billion. Canada’s trade deficit is projected at C$0.65 billion.

Friday, Japan’s household spending is predicted to drop 2.6% annually due to sluggish demand, while US nonfarm payrolls may rebound by 200,000, with unemployment ticking up to 4.2%. Canada expects a modest 30,000 job gain, with unemployment rising slightly to 6.6%.

Econoday

December 1, 2024 at 8:58 pm #15355In reply to: Forex Forum

There was a 2nd bite of the cherry with the EurJpy rally to 162 but the UsdJpy could not maintain 150 and so now there will be trapped longs in both pairs who will try to manage their positions Sunday night.

All I will say is “how is that working out for them?”

Now for those that either missed out or are looking for a bottom to buy I say

Beware of what you wish for

Latest USDJPY and EURJPY Updates From the Savvy Trader

December 1, 2024 at 7:32 pm #15352

December 1, 2024 at 7:32 pm #15352In reply to: Forex Forum

November 29, 2024 at 4:07 pm #15281In reply to: Forex Forum

November 29, 2024 at 2:22 pm #15276In reply to: Forex Forum

EURUSD Daily – Month end

As I mentioned yesterday, we have seen another Uptick today, but not even close to notorious 1.06100.

Next is to see where are we going to close tonight…

Two options :

– As long as it closes above 1.05300 pressure to the upper side will continue

– If eurusd manages to fall below 1.05050 and closes there – sharp move down on Monday

Supports : 1.05250 , 1.05050 & 1.04750

Resistances : 1.05950 , 1.06100 & 1.06600

November 29, 2024 at 1:37 pm #15274

November 29, 2024 at 1:37 pm #15274In reply to: Forex Forum

Yen and Euro futures are trending up in the broader picture. Anticipating a bit of selling in UsdJpy and EurJpy but there is no data and it is a Friday following a holiday and so it is difficult to expect much. Prices are also not in prime spots for entry so new entries at current levels are not optimum and subject to reversal. A bit risky with these pairs this morning if you are not already in positions.

November 29, 2024 at 11:49 am #15269In reply to: Forex Forum

Newsquawk US Open

USD knocked by a stronger JPY, EUR unreactive to Flash HICP

Good morning USA traders, hope your day is off to a great start!

Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses near unchanged while US futures are modestly firmer post-Thanksgiving

USD knocked by a stronger JPY. EUR unreactive to Flash HICP

Fixed benchmark in the green, OATs in focus awaiting a Le Pen decision

Crude diverges given the lack of settlement but benchmarks are at the lower-end of c. USD 1/bbl parameters

Metals in the green, gold gleans support from the USD and punchy language around Lebanon

November 29, 2024 at 10:40 am #15265In reply to: Forex Forum

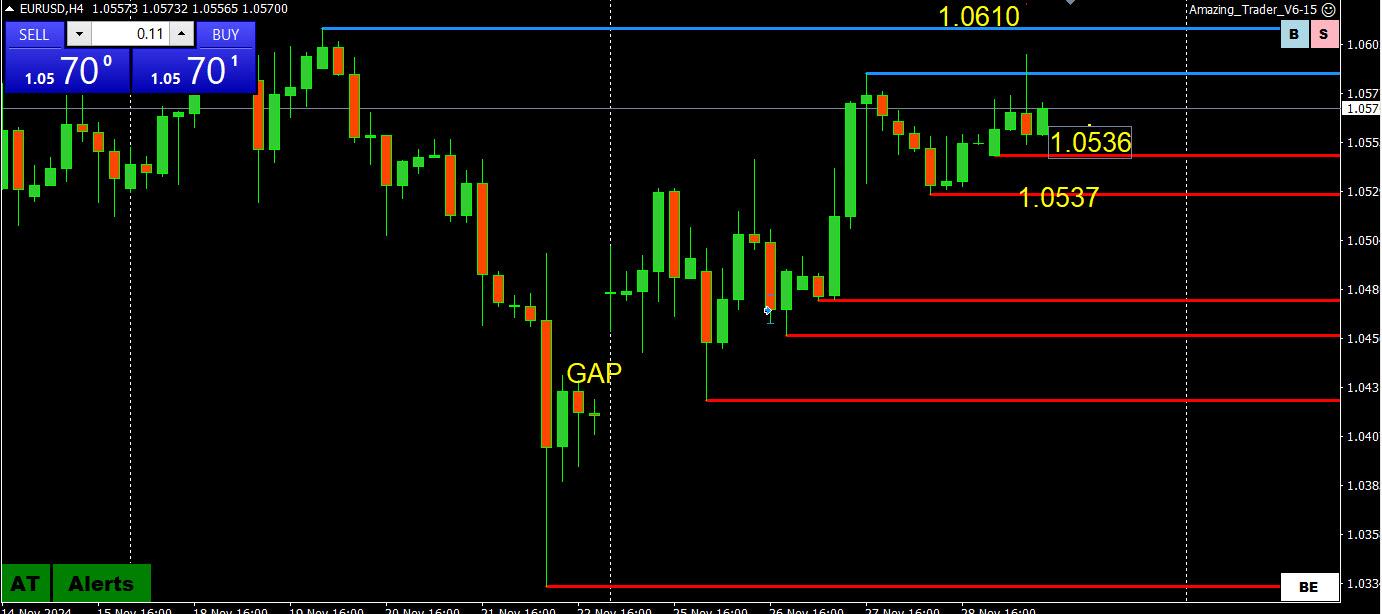

EURUSD 4 HOUR CHART – Month end

Finds a bid IF it can stay above 1.0550 but would need to break 1.0610 to make this more than a retracvement, note the word IF

Note this is month end (and not a normal one due to the US quasi holiday) where EURGBP flows are often an influence so keep an eye on this cross.

November 29, 2024 at 4:20 am #15262In reply to: Forex Forum

Selling EurJpy is working very well. I can find no fundamental reason to buy that pair for now. It has made me over 500 points since Sunday. It requires patience. That said, the sell wave is almost at the point where there is a rebalance in markets to the upside. It won’t last more than a few days.

I am a former CTA. I learned a thing or two. Buy wave pending. Sell it.

November 28, 2024 at 2:36 pm #15234In reply to: Forex Forum

November 27, 2024 at 7:02 pm #15215In reply to: Forex Forum

November 27, 2024 at 7:00 pm #15213In reply to: Forex Forum

November 27, 2024 at 6:53 pm #15212In reply to: Forex Forum

November 27, 2024 at 4:52 pm #15199In reply to: Forex Forum

Plan starts to come together

Notice how the rallette in EurJpy just got turned back down.

So despite the sell Usd day the Euro is therefore under performingI mlooking for a 147 handle in UsdJpy to take 20% profits whether thats today tomorrow or friday

Happy ThanksgivingProfit stops should for the under capitalised be set at nothing more than break even

November 27, 2024 at 1:56 pm #15192In reply to: Forex Forum

November 27, 2024 at 12:09 pm #15170In reply to: Forex Forum

EURUSD Daily

Supports and resistances are derived from Daily, & 4h charts

Supports : 1.04850 , 1.04250 & 1.03850

Resistances : 1.05400 , 1.5550 & 1.06100

I am always about Patterns and Formations, but this time I want to warn you about something in this very situation :

– Pattern is so visible to most of you – This might be the bottom forming

But is it ?

As I said yesterday – before it takes out 1.06100 it is not !

I have seen this same pattern going both ways many times ( take my word for it 😀

Unless we see a new high today or tomorrow – above 1.05450 , followed by a break of declining trend line at 1.05550 , we might have an Irish Story – sour, melancholic and gloomy….

Expect the unexpected – after all we have stepped into Holiday Season

November 27, 2024 at 11:58 am #15169

November 27, 2024 at 11:58 am #15169In reply to: Forex Forum

Newsquawk US Open

US Market Open: US futs mostly lower (RTY leads), USD outmuscled by JPY

US futs mostly lower (RTY leads), USD outmuscled by JPY

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European equities on the back foot with hawkish remarks from Schnabel weighing, US futures mixed into a packed data docket

JPY outperforms with the NZD a close second after the RBNZ, EUR lifted by Schnabel; DXY pressured as such

Fixed benchmarks in the green and towards highs though Bunds were dented by ECB speak, OAT-Bund yield spread at its highest since 2012

Crude benchmarks are modestly firmer but in narrow ranges awaiting updates around the ceasefire, US data and OPEC+; metals moving higher

Try Newsquawk for 7 Days Free

November 27, 2024 at 8:19 am #15168In reply to: Forex Forum

November 26, 2024 at 9:30 pm #15143In reply to: Forex Forum

November 26, 2024 at 6:19 pm #15134In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View