-

AuthorSearch Results

-

December 5, 2024 at 3:25 pm #15698

In reply to: Forex Forum

December 5, 2024 at 2:36 pm #15696In reply to: Forex Forum

December 5, 2024 at 2:28 pm #15695In reply to: Forex Forum

December 5, 2024 at 2:12 pm #15694In reply to: Forex Forum

EURUSD rebound coming after limited fallout from French vote in a markjet that factored in the worst which did not occur.

Key levels are at 1.0584/1.0596 and of course 1.0610 as we are BACK TO SQUARE ONE WHERE WE STARTED THE WEEK. .

It is hard to suggest a breakout ahead of US jobs but risk is on the upside while above 1.05509.

December 5, 2024 at 1:41 pm #15693In reply to: Forex Forum

December 5, 2024 at 12:28 pm #15690In reply to: Forex Forum

Newsquawk US Open

US Market Open: Bitcoin pushes past 100k & USD remains on the backfoot

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.4 Things You Need to Know

European bourses opened flat but started grinding higher shortly after the open despite relatively quiet newsflow; France’s CAC 40 shrugged off the vote of no confidence which played out as expected.

USD remains on the backfoot vs. peers following yesterday’s ISM-induced move in yields; EUR on a firmer footing vs. the USD with not much in the way of follow-through selling from the collapse of the French government.

Crude futures holding a modest upward bias after selling off in the US afternoon on Wednesday, which was later attributed to a bank offloading a large volume of US oil futures contracts ahead of today’s OPEC+ meeting.

Bitcoin climbed above the psychological USD 100k level for the first time ever and continued to advance with prices underpinned after US President-elect Trump picked crypto-backer Paul Atkins to lead the SEC.

December 4, 2024 at 8:49 pm #15635In reply to: Forex Forum

December 4, 2024 at 6:00 pm #15619In reply to: Forex Forum

December 4, 2024 at 2:05 pm #15607In reply to: Forex Forum

December 4, 2024 at 12:11 pm #15582In reply to: Forex Forum

NEWSQUAWK US OPEN

US futures tilt higher ahead of Powell & European paper awaits French no confidence vote

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly trading in positive territory; US futures tilt higher ahead of Powell and a busy data slate.

USD is broadly firmer vs. peers, AUD lags post-GDP, and GBP was weighed on by commentary from BoE’s Bailey who said he sees four 25bps cuts in 2025; a move which has since pared.

European paper awaits French no confidence vote at 15:00 GMT.

Crude holds an upward bias, WSJ reports that Saudi aims to keep oil prices elevated rather than chase market share; XAU/base metals are subdued amid the slightly firmer dollar.

December 4, 2024 at 11:18 am #15580In reply to: Forex Forum

December 3, 2024 at 11:48 pm #15572In reply to: Forex Forum

December 3, 2024 at 7:16 pm #15547In reply to: Forex Forum

December 3, 2024 at 4:25 pm #15518In reply to: Forex Forum

The caveat with Euro is the meltdown of France’s political system this week and the Geo conditions. My preference in that one remains short until we see Dow 4400 or lower, which I believe is pending. Unless we get something very positive fundamentally, because for now stocks have shifted to a stock picking environment.

December 3, 2024 at 4:13 pm #15514In reply to: Forex Forum

Larger picture I would be on the buy size of AudNzd from nearby levels for 1.1150 or better. These sells are the conclusion of an intermediate sell cycle in that pair and others, including Michael’s Euro view.

Due to the increasingly hair trigger Geo conditions I would not bet against Swiss Franc and am in the process of scaling positions in it.

December 3, 2024 at 4:01 pm #15511In reply to: Forex Forum

Michael – regarding your post on bias shift in Euro, not today in my view but I see growing conditions for that to filter in as soon as tomorrow, I posted this yesterday …. “I see some conditions that point toward EurGbp pulling up toward 8400 in coming days”.

The cross is doing it just not the major yet.

December 3, 2024 at 2:37 pm #15498In reply to: Forex Forum

December 3, 2024 at 2:37 pm #15497In reply to: Forex Forum

December 3, 2024 at 2:35 pm #15496In reply to: Forex Forum

Savvy trader so far looking savvy with his timely update.

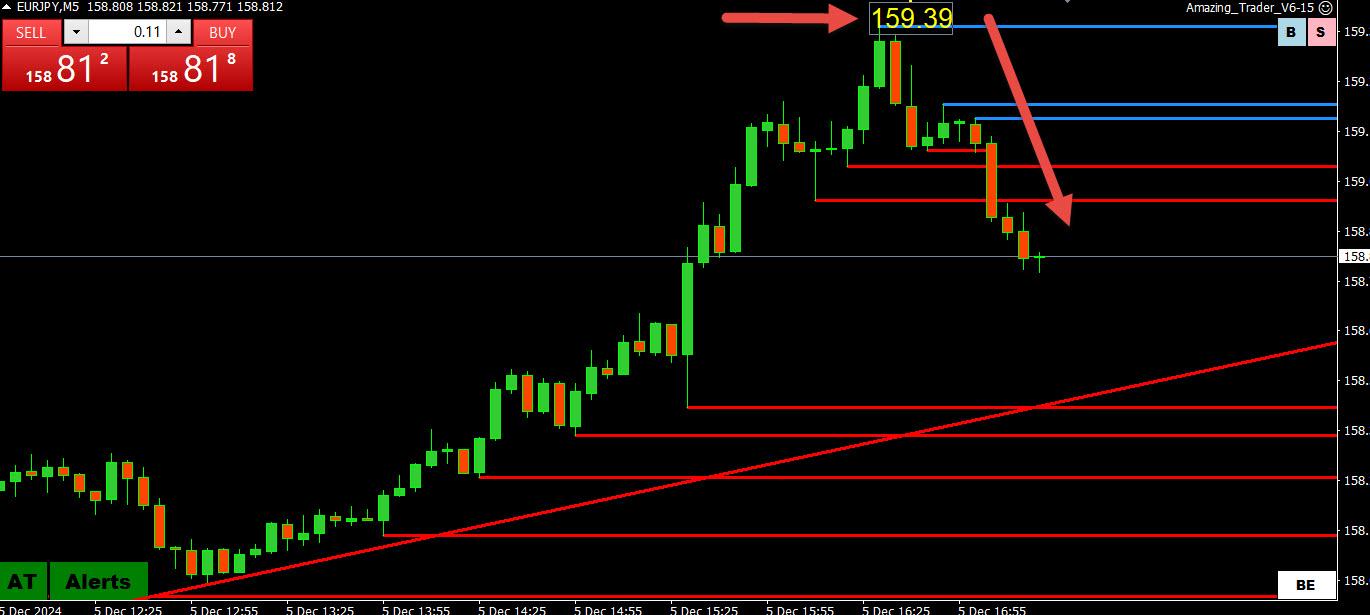

Latest USDJPY and EURJPY Updates From the Savvy Trader

December 3, 2024 at 2:27 pm #15495

December 3, 2024 at 2:27 pm #15495In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View