-

AuthorSearch Results

-

December 10, 2024 at 7:06 pm #16024

In reply to: Forex Forum

December 10, 2024 at 5:21 pm #16022In reply to: Forex Forum

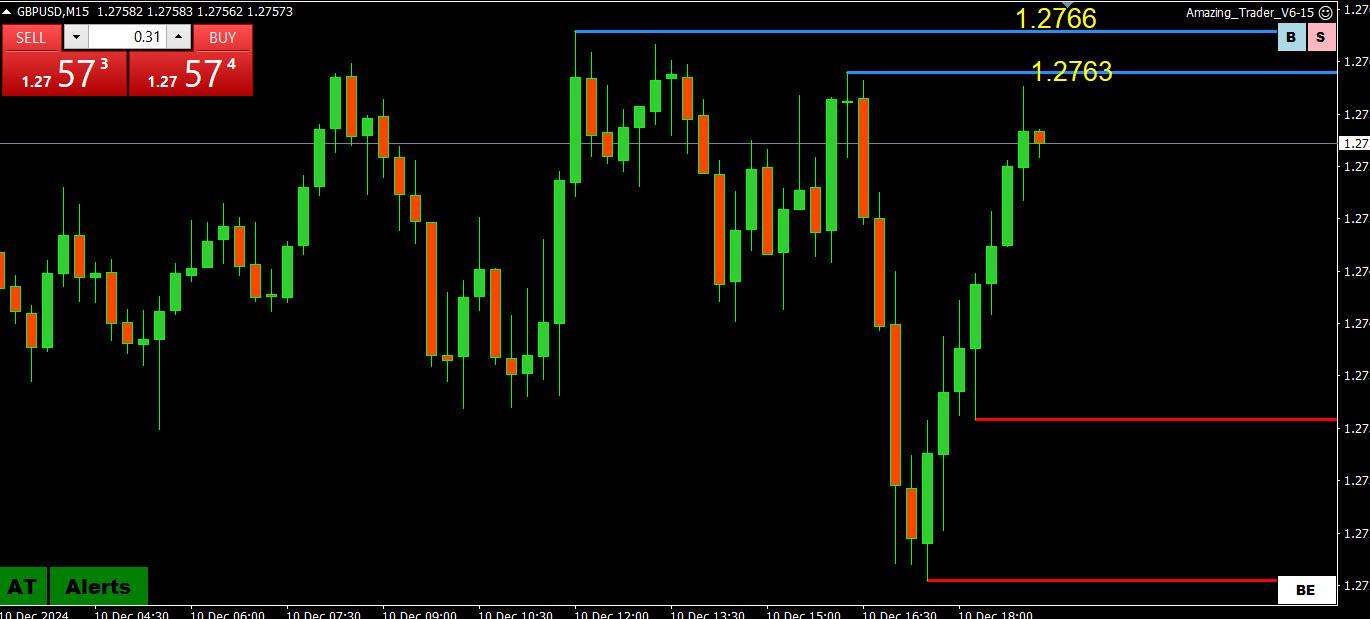

GBPUSD 15 MINUTE – EURGBP driving the bus

Another neat Amazing Trader chart

Algebra 101

EURUSD held 1.05 – for EURGBP to go lower, GBPUSD had to do the work.

December 10, 2024 at 4:55 pm #16020In reply to: Forex Forum

December 10, 2024 at 3:55 pm #16013In reply to: Forex Forum

December 10, 2024 at 3:40 pm #16011In reply to: Forex Forum

An aspect of price behavior I am perpetually dialed in on is what kind of valuations the market is presenting in the US session. Some weeks there are very good price levels presented and other weeks the optimum levels are presented in the European session, and at times the Asian session.

Two weeks ago there were optimum valuations presented in the US session all week long and your precision could be near perfection. Last week the condition remained good but was not optimum. So far this week the levels presented are gone before the US session.

Your participation has to take that into consideration. How do you approach that? Patience.

December 10, 2024 at 3:28 pm #16007In reply to: Forex Forum

The next near term cycle for Sterling, Yen, Aussie, Euro, Peso, and Franc futures should be the buy side. The level of conviction on that side I would not expect to be overly robust.

Yen is a bit different. The BOJ interest rate decision is on December 19th. Japanese 10yr rates are now sitting at early July highs and after attempting to go higher stalled at the same spot on November 11th.

So if it stalls here again that is three stalls. One might think this is the tail end of pricing in and reaction to the last action by the BOJ.

Therefore calling a bottom in Yen futures (buy side top of spot pairs) is a bit dicey since the rates could drop and Yen futures with it.

December 10, 2024 at 2:54 pm #16003In reply to: Forex Forum

December 10, 2024 at 1:30 pm #16000In reply to: Forex Forum

December 10, 2024 at 11:26 am #15993In reply to: Forex Forum

NEWSQUAWK US OPEN

European equities tilt lower, USD gains & AUD lags after RBA’s dovish hold

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly on the backfoot; US futures trade indecisively around the unchanged mark.

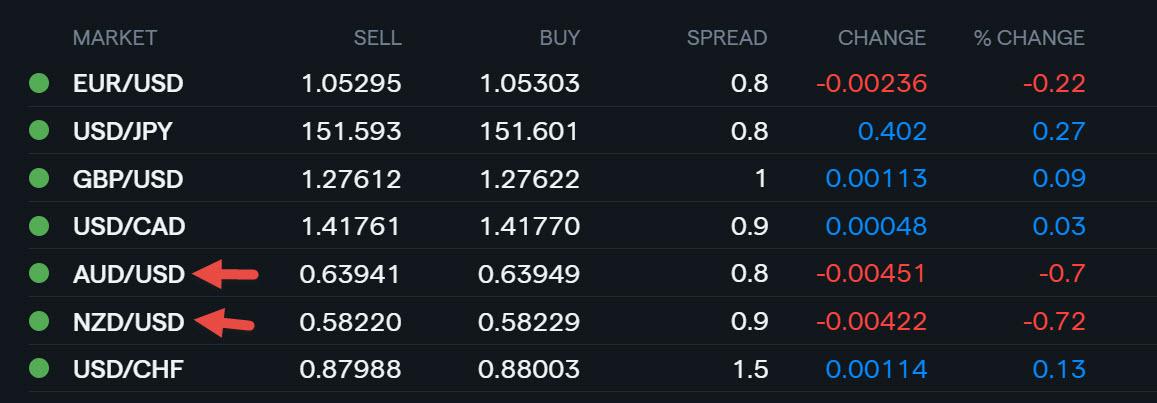

USD outmuscles peers, AUD lags after the RBA delivered a dovish hold.

Choppy trade for European paper, US awaits 3yr supply.

Crude edges slightly lower and base metals pare back recent strength.

December 10, 2024 at 11:05 am #15991In reply to: Forex Forum

December 10, 2024 at 10:30 am #15988In reply to: Forex Forum

Using my platform as a heatmap

USD is up as market seems to be biding its time ahead of tomorrow’s US CPI

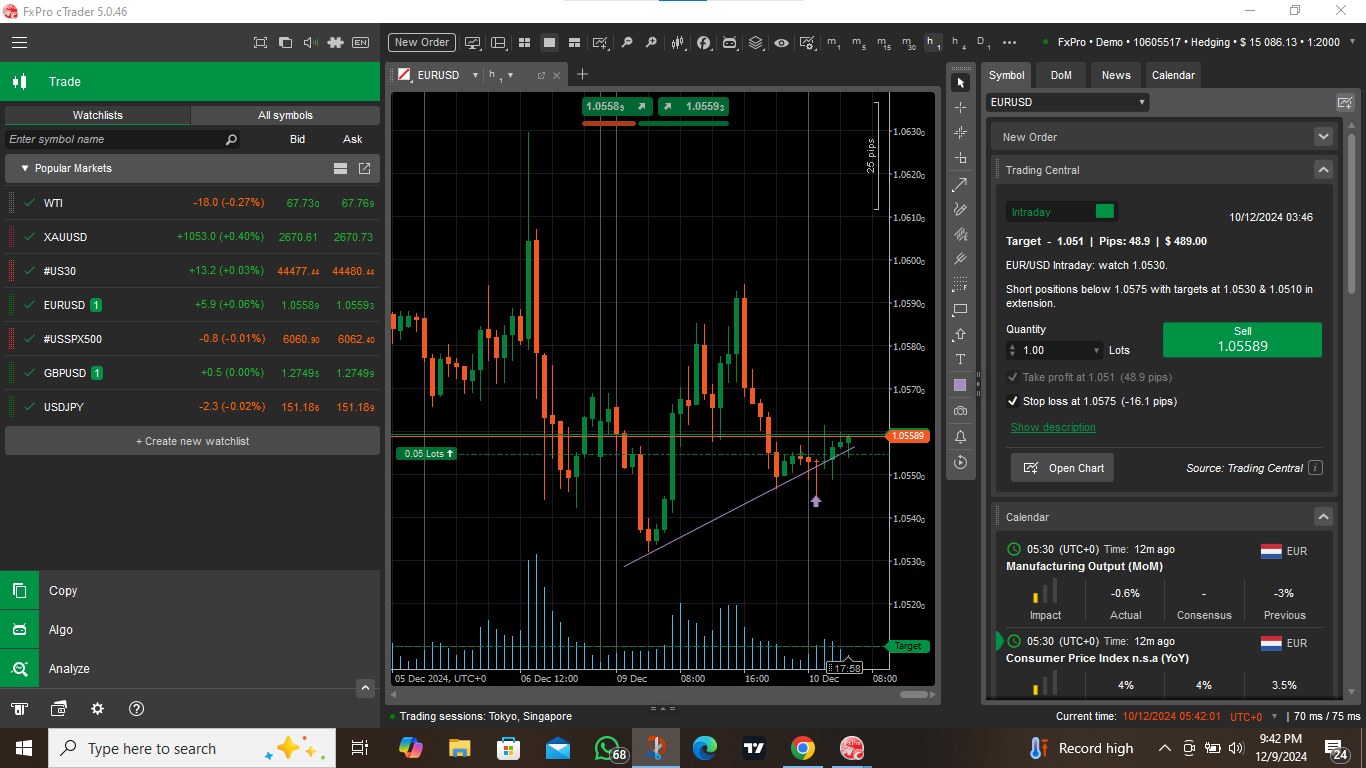

EURUSD still within 1.05-1.06 where Power of 1.0550 sets the bias

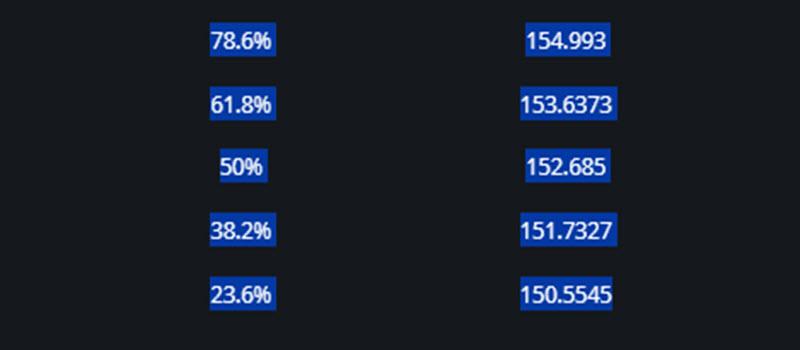

USDJPY found support above 150.77… needs to stay above 151.21 to keep a strong bid but t52 a potential obstacle

GBPUSD lagging… note weeaker EURGBP

USDCAD broke its 1.4178 key high but so far not following through

AUDUSD an underperformer (NZDUSD as well), falling after RBA but holding above Monday’s .6372 low

December 10, 2024 at 6:18 am #15986

December 10, 2024 at 6:18 am #15986In reply to: Trading Hot Line

December 9, 2024 at 9:31 pm #15969In reply to: Forex Forum

With EURUSD trading at 1.0550…

For those not familiar with this term or those who would like a reminder, see this popular articles in our blog

My Favorite Trading Secret: The Power of the “50” LevelDecember 9, 2024 at 9:30 pm #15968In reply to: Forex Forum

December 9, 2024 at 9:27 pm #15967In reply to: Forex Forum

EURUSD Daily

Supports : 1.05250 , 1.04600 & 1.04200

Resistances: 1.05950 , 1.06300 & 1.06950

Close tonight above 1.05550 would give another chance to EUR to push it Up.

Below 1.05400 things are going to start being quite unpleasant for EUR Bulls, but until 1.05250 taken out, it can still go back Up.

December 9, 2024 at 5:13 pm #15949

December 9, 2024 at 5:13 pm #15949In reply to: Forex Forum

December 9, 2024 at 4:32 pm #15946In reply to: Forex Forum

December 9, 2024 at 2:51 pm #15927In reply to: Forex Forum

December 9, 2024 at 2:44 pm #15926In reply to: Forex Forum

This may sound a bit ridiculous to some but I largely operate on a sine wave basis since I have a military background using sine waves to tune weapons systems and have been able to (somewhat) redesign algorithms to reasonably match it. You would be surprised how similar markets move in that fashion.

At present Euro is right in the middle of an intermediate wave and so it would be a roll of the dice either direction here. And since the Eurozone is under reconstruction fundamentally I definitely prefer the sell side on pull ups.

December 9, 2024 at 2:33 pm #15925In reply to: Forex Forum

UsdSingapore and UsdHong Kong are laboring and I believe it is due to money flowing into US stocks and out of Bonds since institutions expectedly took their shot in that one last week. For now.

Although Usd is laboring against those cross pairs I am not seeing carryover into EurGbp or EurChf like there is in the majors and so am not yet enthused about the buy side there. Would need to see more. Money is flowing into those two but the horizon is under pressure.

-

AuthorSearch Results

© 2024 Global View