-

AuthorSearch Results

-

December 12, 2024 at 4:33 pm #16167

In reply to: Forex Forum

December 12, 2024 at 3:56 pm #16163In reply to: Forex Forum

December 12, 2024 at 3:27 pm #16161In reply to: Forex Forum

December 12, 2024 at 3:19 pm #16160In reply to: Forex Forum

December 12, 2024 at 2:43 pm #16157In reply to: Forex Forum

December 12, 2024 at 2:29 pm #16156In reply to: Forex Forum

December 12, 2024 at 1:42 pm #16155In reply to: Forex Forum

December 12, 2024 at 11:53 am #16150In reply to: Forex Forum

NEWSQUAWK US OPEN

SNB surprise with a 50bps cut, Euro steady ahead of ECBGood morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses are mixed into the ECB, SMI outperforms post-SNB. US futures are modestly softer.

SNB delivered a larger-than-expected 50bps cut and reiterated a willingness to intervene in the FX market as necessary.

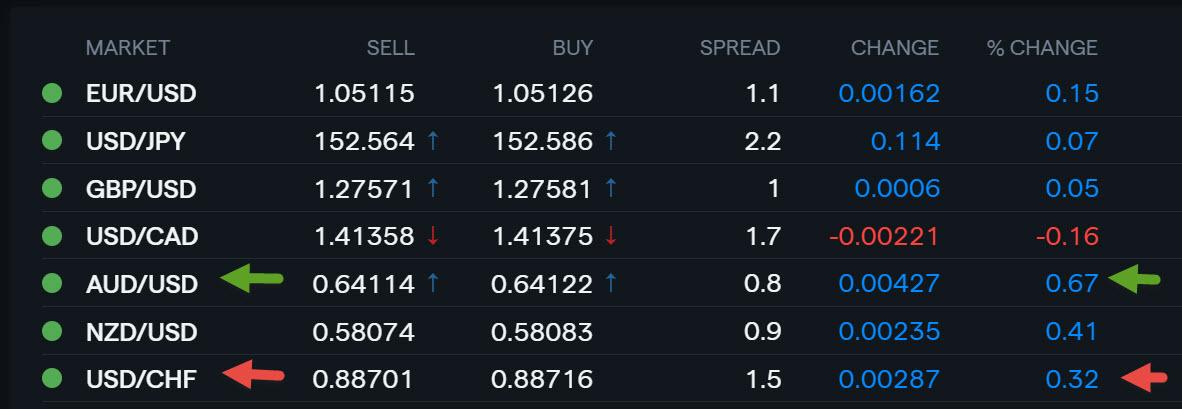

USD steady with peers and for the most part contained aside from CHF underperformance and Antipodean outperformance, AUD driven by jobs data.

Fixed benchmarks are at/towards session lows into the ECB and US data thereafter, stateside yields are bid and the curve steeper.

Crude in the green but only modestly so, base metals are little changed overall.

December 12, 2024 at 11:47 am #16149In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

With interest rates tumbling across the world and set to fall stateside again next week too, Wall Street stocks are sizing up one of the best years of the century so far.

The tech-laden Nasdaq surged again on Wednesday and closed above 20,000 for the first time ever – almost four times the peaks of the dot.com bubble in 2000 and up almost 35% for 2024 to date.

Morning Bid: Europe eases with Swiss surprise as Nasdaq clocks 20k

December 12, 2024 at 10:17 am #16145In reply to: Forex Forum

December 12, 2024 at 9:38 am #16142In reply to: Forex Forum

Using my Platform as a Heatmap

AUDUSD outperforming after strong jobs report although there are questions whether it is an outlier

CHF underperforming after the 50bps rate cuit (not a surprise)

US bond yields continue to creep higher, givimg USDFJPY som,e support (held 151.90-00 cited yesterday as support)… inside day so far

EURUSD 1.05 remains the pivotal point ahead of ECB,,, surprise would be a 50bps cut, 25bps expected

December 11, 2024 at 8:30 pm #16131In reply to: Forex Forum

EURGBP MONTHLY CHART – Indicator of EUR weakness

Those who have followed me have seen me say to watch EURGBP for clues if trading EURUSD and/or GBPUSD

Break of .8267 opens the door for the major level at .8200… As this chart shows, .8200 is a 7-year low.

Back above .8250-67 would be needed to postpone the risk

Minor support is at .8225, Wednesday’s low.

December 11, 2024 at 4:25 pm #16107In reply to: Forex Forum

December 11, 2024 at 2:38 pm #16091In reply to: Forex Forum

December 11, 2024 at 1:01 pm #16079In reply to: Forex Forum

December 11, 2024 at 11:24 am #16072In reply to: Forex Forum

NEWSQUAWK US OPEN

DXY bid on reports that China is considering allowing the Yuan to weaken in 2025; US CPI due

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses began the session entirely in the red, but sentiment has improved to display a mixed picture; NQ incrementally outperforms in the US.

Dollar bid as markets digest reports of China allowing a weaker yuan, JPY choppy amid BoJ sources.

China’s top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariff looms, via Reuters citing sources

Mixed performance for paper, US 10yr supply looms.

Crude initially hampered by Yuan-reports, but has since pared with crude now at session highs; metals on the backfoot.

December 11, 2024 at 9:42 am #16066In reply to: Forex Forum

December 11, 2024 at 9:13 am #16055In reply to: Forex Forum

Pivotal level day

EURUSD -.1.05 clearly pivotal after brief break below it (low 1.0488)

AUDUSD – .6350 is pivotal after brief break of major .6358 support (low .6340)

USDJPY 151.50 nand 152 are both pivotal, so far staying below it after trading above it yesterday

GBPUSD- Lagging EURUSD as EURGBP remain soft biut 1.2750 is pivotal here as well

December 10, 2024 at 9:12 pm #16034In reply to: Forex Forum

EURUSD Daily

Resistances : 1.05450 , 1.05950 & 1.06350

Supports : 1.04950, 1.04600 & 1.04250

There is still an Up angle , but this is not a real Up trend !

Momentum is nonexistent and we’ll have to wait for Thursday ECB Interest rates decision and a reaction to it

For now try to play within given parameters – 1.0550 is a pivotal right now.

December 10, 2024 at 7:11 pm #16025

December 10, 2024 at 7:11 pm #16025In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View