-

AuthorSearch Results

-

December 19, 2024 at 10:01 am #16483

In reply to: Forex Forum

December 19, 2024 at 9:06 am #16476In reply to: Forex Forum

While the BoJ may be lurking pressure on the USDJPY upside is coming out of its crosses…

WHICH ARE WEIGHING ON THE USD ELSEWHERE, LED BY GBP, WHICH IS BID AHEAD OF THE NO CHANGE IN RATES EXPECTED FROM THE BOE IN A FEW HOURS (GBPJPY IS +2% ON THE DAY)… Note EURJPY is up 2% as well (helps explain the EURUSD rebound)

Hint: When you see a big move in USDJPY there is generally a cross flow(S) helping to drive the move.

Hint: When you see two currencies moving in opposite directions vs. the dollar it is a sign of real money order flow buying/selling a cross.

December 19, 2024 at 7:28 am #16470In reply to: Forex Forum

December 19, 2024 at 12:15 am #16467In reply to: Forex Forum

December 18, 2024 at 7:50 pm #16437In reply to: Forex Forum

December 18, 2024 at 4:36 pm #16428In reply to: Forex Forum

December 18, 2024 at 4:17 pm #16427In reply to: Forex Forum

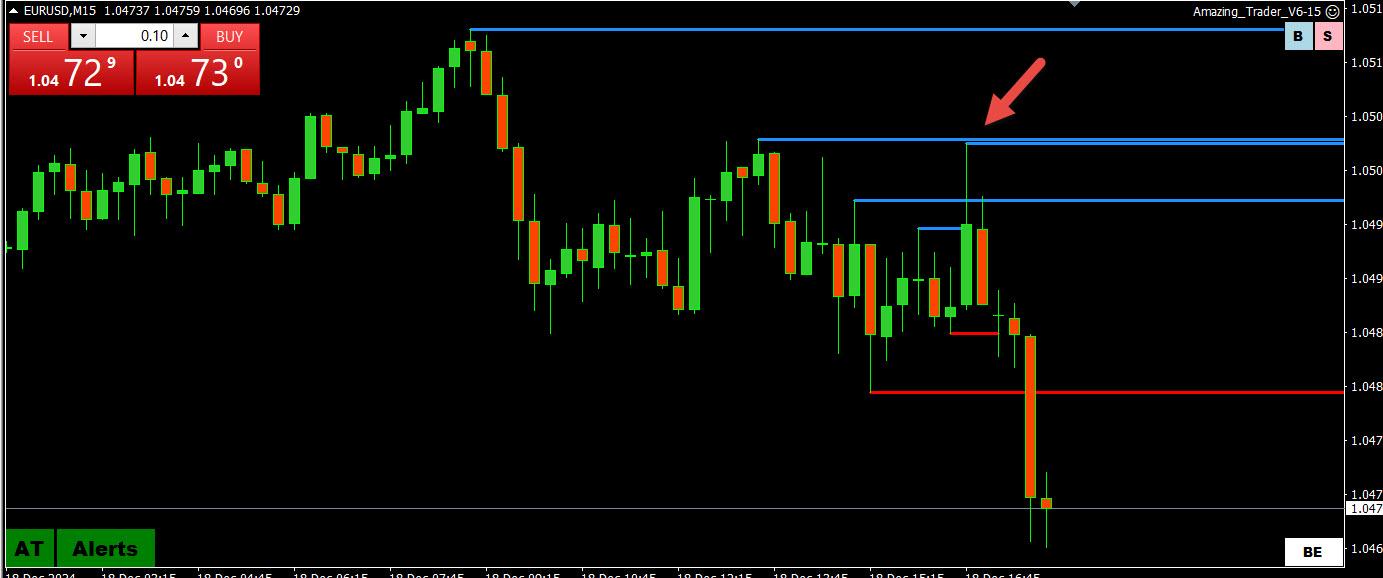

EURUSD 15 MINUTE CHART – The Amazing Trader

I am not sure how many of you had this line on your chart but what I am showing is not a coincidence.

There is a reason why this line was more important than the one broken below it and see what happened afterwards

This is why I named it The Amazing Trader

December 18, 2024 at 3:49 pm #16425In reply to: Forex Forum

December 18, 2024 at 2:36 pm #16421In reply to: Forex Forum

December 18, 2024 at 2:27 pm #16420In reply to: Forex Forum

December 18, 2024 at 2:03 pm #16419In reply to: Forex Forum

December 18, 2024 at 1:29 pm #16418In reply to: Forex Forum

AnonymousDecember 18, 2024 at 9:01 am #16406In reply to: Forex Forum

Using my platform, as a HEATMAP

A

AUDUSD trading at its lowest level for the year… 2023 low is at ,6270

USDCAD trading at a 4+ year high

EURUSD extended its trade around 1.05 to \7 days in a row… the longer it goes on the greater the risk of a directional move once it ends

Key focus today is the FOMC… a hawkish rate cut (i.e. pause in January) is expected… given the time of year it is hard to suggest a follow through reaction so watch the US bond market for a clue to how much is already discounted.

December 17, 2024 at 11:01 pm #16402In reply to: Forex Forum

December 17, 2024 at 8:00 pm #16391In reply to: Forex Forum

December 17, 2024 at 7:53 pm #16390In reply to: Forex Forum

December 17, 2024 at 5:05 pm #16389In reply to: Forex Forum

EURUSD Daily

A little tip/help to our competitors 😀

Close tonight below 1.04950 will indicate a Bearish move might be coming tomorrow

Close tonight above 1.05150 will call for a Bull attempt…

Borders of current rectangle : 1.04200 – 1.06300

Whatever the outcome , easy to place stops…

I use Daily to decide the direction and trade on smaller time frames.

December 17, 2024 at 4:47 pm #16386

December 17, 2024 at 4:47 pm #16386In reply to: Forex Forum

December 17, 2024 at 11:25 am #16365In reply to: Forex Forum

NEWSQUAWK US OPEM

GBP benefits from hot UK wages data, DXY bid amid a tepid risk tone ahead of US Retail Sales

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly in the red, but sentiment has improved a touch since the cash open; US futures modestly lower.

DXY back above 107.00, GBP posted early gains after hot wages data.

Gilts lag as UK wage data essentially removes any chance of a Dec. BoE cut ahead of CPI; USTs a little lower ahead of US Retail Sales.

Commodities succumb to the tepid risk tone and ongoing USD strength.

December 17, 2024 at 11:15 am #16363In reply to: Forex Forum

GBPUSD 4 HOUR CHART – Hot, Hot, Hot

GBPUSD getting a lift after hotter increase in wages in the monthly jobs report dampened expectations of a rate cut at Thursday’s BOE meeting.

To make this more than a retracement, 1.2788 would nheed to be taken out.

Watch GBP crosses, most notably a weaker EURGBP, as they are helping to give GBPUSD a bid.

-

AuthorSearch Results

© 2024 Global View

highs and take out liquidity

highs and take out liquidity