-

AuthorSearch Results

-

March 26, 2025 at 6:30 pm #21485

In reply to: Forex Forum

KIt’s the reaction to news that matters

EURUSD reacted to this

and ignored this

March 26, 2025 at 5:53 pm #21481

March 26, 2025 at 5:53 pm #21481In reply to: Forex Forum

March 26, 2025 at 3:47 pm #21476In reply to: Forex Forum

March 26, 2025 at 3:14 pm #21474In reply to: Forex Forum

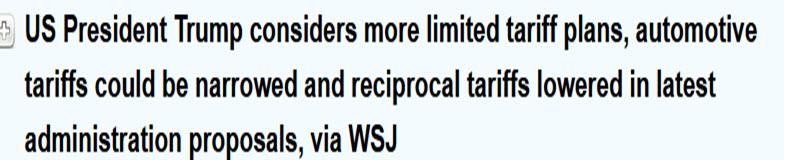

EURUSD 4h

Watch the close of this 4h bar!

If it manages to close above 1.07900, there will be a fair chance for the attack at 1.08250

I have to point something – this correction started 7 days ago, and it is kind of lame – so we might be seeing a change of a current intraday trend.

But as long as 1.08250 holds, more tests of supports are on cards.

March 26, 2025 at 2:25 pm #21467

March 26, 2025 at 2:25 pm #21467In reply to: Forex Forum

US Dollar Index

US Dollar index hasn’t been doing much lately. We just got the strong downward push triggered by the German defence spending news which saw EU-US yield differentials jumping in favour of the Euro. As a reminder, the US Dollar Index (DXY) is basically EUR/USD upside down as the Euro makes up for 60% of the index.

This is harder to square but the greenback will most likely be influenced by the risk sentiment following the catalyst as positive news should keep rate cuts expectations around two for this year, while negative news could push those to four or more.

March 26, 2025 at 2:17 pm #21463

March 26, 2025 at 2:17 pm #21463In reply to: Forex Forum

March 26, 2025 at 2:07 pm #21461In reply to: Forex Forum

March 26, 2025 at 1:16 pm #21458In reply to: Evaluation – Daily Trades

March 26, 2025 at 1:15 pm #21457In reply to: Forex Forum

March 26, 2025 at 12:38 pm #21447In reply to: Forex Forum

March 26, 2025 at 12:02 pm #21443In reply to: Forex Forum

US OPEN

US futures modestly lower amid tariff reports, GBP lags & EUR/USD attempts to reclaim 1.08

Good morning USA traders, hope your day is off to a great start!

Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

Tariffs in focus amid reports that Trump could implement copper tariffs in weeks, elsewhere reports that Canada could find some reprieve

European bourses opened firmer but have since slumped, US futures are in the red but only modestly so

GBP lags after UK CPI, EUR/USD attempts to reclaim 1.08, USD/JPY rebounded overnight but is off highs

Gilts gapped higher on data and extended but have retreated to opening levels into the Spring Statement, USTs softer while Bunds are firmer but only modestly so

Crude continues to inch higher with a handful of factors underpinning, TTF slips as talks continue, Copper soared on tariff updates but has since pulled back

March 26, 2025 at 11:43 am #21441In reply to: Forex Forum

March 26, 2025 at 11:35 am #21440In reply to: Forex Forum

Market Could Be Underpricing U.S. Tariff Risks For Euro

The market is underpricing the risk to the euro from U.S. reciprocal tariffs set to take effect on April 2, ING’s Chris Turner says in a note. “The EU (led by Germany) runs a large trade surplus with the U.S. and will likely, alongside China, be at the forefront of Washington’s reset on global trade.” The euro last trades flat at $1.0793 and ING expects it to fall to $1.05 by the end of the second quarter due to U.S. tariffs.

March 26, 2025 at 10:46 am #21438

March 26, 2025 at 10:46 am #21438In reply to: Forex Forum

EURUSD DAILY – 4 DAYS IN A ROW

1.08 has printed 4 days in a row… the longer this pattern goes on the greater the risk of a directional move once it is broken (note what happened at 1.09).

Key supports: 1.0777 (double bottom) , 1.0765

Key resistance: 1.0830

See JP’s timely post about EURGBP topping out and how EURUSD lost its bid after.

March 26, 2025 at 9:35 am #21437In reply to: Forex Forum

March 26, 2025 at 9:09 am #21435In reply to: Forex Forum

March 26, 2025 at 9:07 am #21434In reply to: Forex Forum

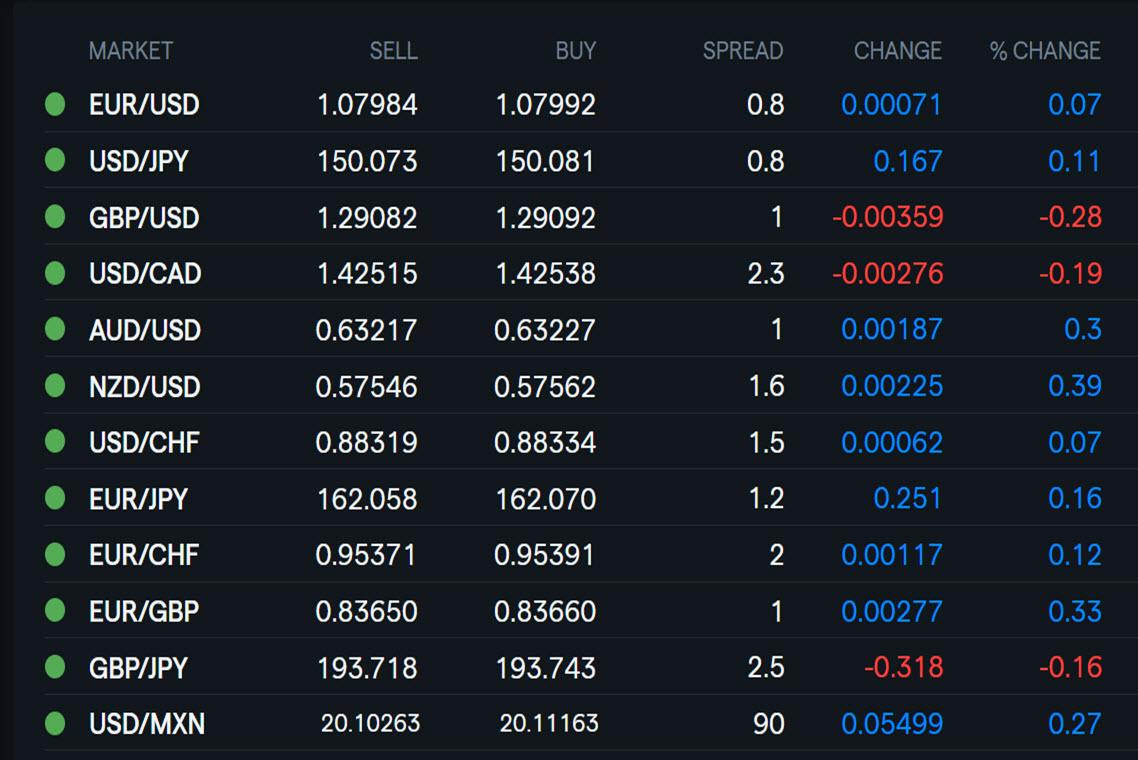

Using my platform as a HEATMAP shows

… uncertain markets looking ahead to quarter end and reciprocal tariff day on April 2

Mixed USD

EURUSD focus still on 1.08 after another test of 1.0777 (2-day double bottom)… support coming fro a firmer EURGBP and lesser extent EURJPY

GBPUSD lower after cooler UK inflation (EURGBP firms)

USDJPY back above 150 after holding above 149.49 yesterday

USDCAD a touch weaker dezpite tariff uncertainty

U.S. stocks a touch weaker

XAUUSD in a wait and see mode

Looking ahead… light US data calendar, awaiting next Trump headline

March 26, 2025 at 9:02 am #21432In reply to: Forex Forum

March 25, 2025 at 8:59 pm #21408In reply to: Forex Forum

March 25, 2025 at 8:56 pm #21407In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View