-

AuthorSearch Results

-

January 8, 2025 at 10:29 am #17326

In reply to: Forex Forum

AnonymousEUROPE – Very Strange

The German Dax is rising, but there is no economic-funamental reason there, except a DEXIT risk upon the upcoming German Election on February 23d.

In case of DEXIT it is said the EURO might loose 40% sharp, there will be problems in devalued assets all over and those not market to market might require huge capital inflows.

The New Deutsche Mark would rise 40%. So probably some German Equities are now considered partly a safe have. Just partly and just some.

All other EUROPEAN INDEXES WOULD CRASH

January 8, 2025 at 10:12 am #17325In reply to: Forex Forum

EURUSD 4 HOUR CHART – ON THE DEFENSIVE AGAIN

As I have been saying, how markets end the week is more important than how they start out.

In this regard, EURUSD failure to hold 1.04 has put last week’s 1,0224 low back on the table.

Two support levels stand in the way, 1.0307 (use 1.03 as well) and 1.0272 so damage not yet fatal.

In any case, expect a sell on blips while below 1.0360-80, stronger bias as long as 1.0350+ is not regained.

‘

January 8, 2025 at 9:45 am #17322In reply to: Forex Forum

AnonymousDEXIT – EUROPE

In view of the upcoming elections to the European Parliament, the President of the European Commission Ursula von der Leyen had clear words on the German AfD’s plans to leave the European Union. During a speech at the CDU federal party conference on May 8, 2024, von der Leyen said about the right-wing populist party: “A Dexit like the one the AfD chooses would mean a loss of prosperity of 400 to 500 billion euros per year for Germany. In Germany as an exporting country, an AfD Dexit would be associated with an immediate loss of 2.2 million jobs.” These claims are backed by studies.

January 8, 2025 at 8:42 am #17318In reply to: Forex Forum

AnonymousHaving lost all hope, the European Equity Indexes open with an extremely bullish tone.

That said, there are no fundamentals supporting It.

Hence algorithmic manipulation within low liquidity investment classes.

Long term, I don’t see nothing good in EU by March 2025 already. To some extent there’s nothing good there now already.

(Burn after reading, hahah)

January 8, 2025 at 7:57 am #17316In reply to: Forex Forum

January 7, 2025 at 11:28 pm #17314In reply to: Forex Forum

GVI Forex 6:34 that $350 bln deficit

–

donald said a LOT of things at his so-called presser. like a machinegun firing 3,000 rounds per minute.

and you, like an eagle eye, spot THAT one bullet.Is it tradeable ? IF y, which instrument and which way ?

I d have much rather heard trump spew fewer but more substantial bullets rather than the profusion. How many bullets out of 3000 do actually hit their target with devastating effect ? Is a sniper’s bullet more effective ?

BTW when donald was yakking about the 350 bln deficit it was in refernce to trade deficit with europe.

ps / past perforance is neither indication nor guarantee of future one.January 7, 2025 at 9:06 pm #17301In reply to: Forex Forum

AnonymousJanuary 7, 2025 at 8:12 pm #17294In reply to: Forex Forum

January 7, 2025 at 2:08 pm #17268In reply to: Forex Forum

EURUSD 4h

Last night’s scenario that I shared with you unfolded perfectly so far.

Now what we need to see – for continuation of the downtrend – is to go through 1.03500 and 1.03300 later on.

We can see on this chart a perfect Double Top, and probability of it going down is increasing.

However, if pair succeeds in closing tonight above 1.03800 – picture changes dramatically.

So watch those two supports closely….

January 7, 2025 at 12:04 pm #17264

January 7, 2025 at 12:04 pm #17264In reply to: Forex Forum

NEWSQUWK US OPEN

US futures gain modestly, USTs contained into data & supply

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mixed, US futures gain slightly.

USD remains soggy vs. peers, EUR digests CPI metrics, Antipodeans lead.

USTs are contained into data, EGBs lift slightly on HICP, Gilts lag.

A choppy start for crude while spot gold benefits from the broadly softer Dollar.

January 7, 2025 at 11:38 am #17263In reply to: Forex Forum

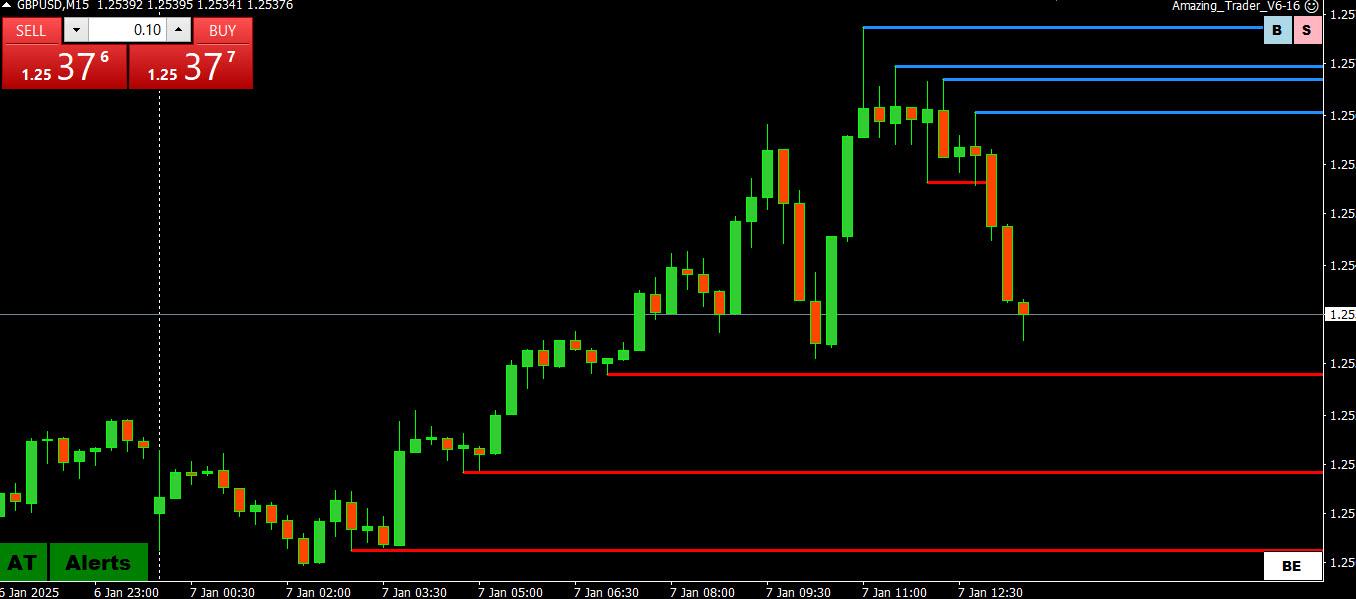

These Amazing Trader 15 mibute charts speak for themselve… both reacting to bearish patterns, and now approaching initial target supports.

EURUSD

GBPUSD

January 7, 2025 at 10:28 am #17261

January 7, 2025 at 10:28 am #17261In reply to: Forex Forum

EURUSD 4 HOUR CHART – Just a bounce?

I am not sure chart points from last month are relevant although technicians will treat them as asuch.

In this regard, 1.0437 (Monday’s high) is the key 2025 level,, so far untouched. Beyond there is 1.0458.

Taking a step back, 1.04 is the pivotal bias setting level. Only above 1.05 would suggest a low is in and the rebound has more to it.

January 7, 2025 at 9:22 am #17259In reply to: Forex Forum

AnonymousJanuary 6, 2025 at 9:25 pm #17251In reply to: Forex Forum

EURUSD Daily

Just to put things into perspective – this is a nice downtrend channel

Resistances : 1.04550, 1.05150 & 1.05350

Supports : 1.03750, 1.03350 & 1.02950

Not being able to cash in on this rally – to stay above 1.04250 indicates that next move should be down. Do not get surprised,or even worse – taken into frenzy – if it tries once again to get over it.

January 6, 2025 at 8:03 pm #17248

January 6, 2025 at 8:03 pm #17248In reply to: Forex Forum

AnonymousInflation, overbureaucratisation, migrants or decadence – why Rome fell

Source – Die Welt

In between the lines one can read of divisions of nowadays Europe that are somehow still well alive.

(the article is in German, but your browser can surely translate It enough well)

January 6, 2025 at 6:05 pm #17246In reply to: Forex Forum

AnonymousSince both Germany and France will have soon to vote I doubt any EURUSD clear reversal could be printed. Yet anything might happen, one never really knows.

But feeling in the more educated Europe is that the EU has been badly built upon some models too old inadequate to present times.

Also Europe is a dust of bad history put under too many rugs.

Since Its 80 years since the 2ndWW I believe It would be time Europe starts to make peace with Its own (dark) history.

The Netherlands seem to have started, see link

https://www.bbc.com/news/articles/cj6z3g0d3x3oJanuary 6, 2025 at 4:55 pm #17245In reply to: Forex Forum

January 6, 2025 at 4:18 pm #17238In reply to: Forex Forum

AnonymousI won’t comment the Markets colossal manipulation over a small liquid day.

Some guys at the top were preoccupied in losses?

Been reading somewhere about a recent visit from Jay Powell to the former President Bush. What did they say?! Is there anything We don’t know yet.All seem returning to a pseudo stability levels, for what stability has now long time gone. Central banks are loosing credibility, for control over markets was merely that of a psychologist over Its patients.

This while top notch economists calculated that the current US Fiscal Policy has still to push the whole of the US Yields at least 0.25% to 0.5% higher.

Good the article from Gasparino posted by GVI earlier upon the US rating in that sense.

What else

Since its 80 years since the 2nd WW some interesting articles are printed around. One I was reading, was upon an of once conspiracy theory, now reality.

And some might wonder upon the real motives behind the Credit Suisse recent collapse. (of note also First Boston, also some several Hedge Funds as also a world wide banking giant in general)

January 6, 2025 at 1:15 pm #17223In reply to: Trading Tip of The Week

Trading Tip 3A: Watch Out for Stops and Use Them to Your Advantage!

This is one of my favorite forex trading tips and the basis for much of my trading.

The forex market is driven by a constant quest to run stops. This may be just my opinion but it is as close to fact as I can tell.

I cannot emphasize enough how important this is to understanding how the forex market works.

While I am not privy to the way all of the algos work, I assume some are programmed to be on a seek-and-destroy mission, which is to probe for stops.

I am not talking about your stop but stops in general as they tend to be bunched around the same levels.

Master this concept and it may change the way you look at trading.

The point is once you recognize that the forex market is on a never-ending quest to run stops, you can put the price action in perspective.

Think about it.

If you have a feel for where the market will look to run stops, it can give you a clue which side of the market is more at risk.

This is true across all time frames but especially true for intra-day trading. You do not need an order book to get a sense of where stops may be resting. It is a skill you can develop over time.

When stops are run

When you see a large wick in a candle or an outsized long bar on a chart, more times than not it is caused by a run-through stops.

On the other hand, when you see an obvious level for stops that trades and quickly reverse without a large wick or long bar, it may, and I emphasize the word “may,” indicate either there were no stops or that they were easily absorbed.

When there are no more stops to run

When there are no stops left to run, a currency will either reverse the direction of trade sideways in a narrowing range. This may explain why the market tends to die off during the US afternoon as there are no stops left nearby to go after.

This is not to suggest basing your trading on guessing where stops are resting and hoping that they get triggered.

However, adding this to your trading mix should help you assess the risk and the strong side of the market at any point in time.

Addendeum:

Look at this EURUSD chart from Jan 6, 2025 to see wherestops were run on a news headline.

‘

January 6, 2025 at 10:33 am #17211

January 6, 2025 at 10:33 am #17211In reply to: Forex Forum

Using my platform as a Heatmap shows the USD lower vs all but the JPY, so you can see what cross flows are helping to drive the price action today.

To suggest anything more than typical start of year trading, EURUSD 1.0375 and/or GBPUSD 1.25+ would need to be regained.

USDJPY 158 remains pivotal as above it opens the door for 1.50.

US stocks up, bond yields up (ust a few bps) , GOLD down

How markets end tge week will be more important than how they start out.

-

AuthorSearch Results

© 2024 Global View