-

AuthorSearch Results

-

January 10, 2025 at 10:14 am #17555

In reply to: Forex Forum

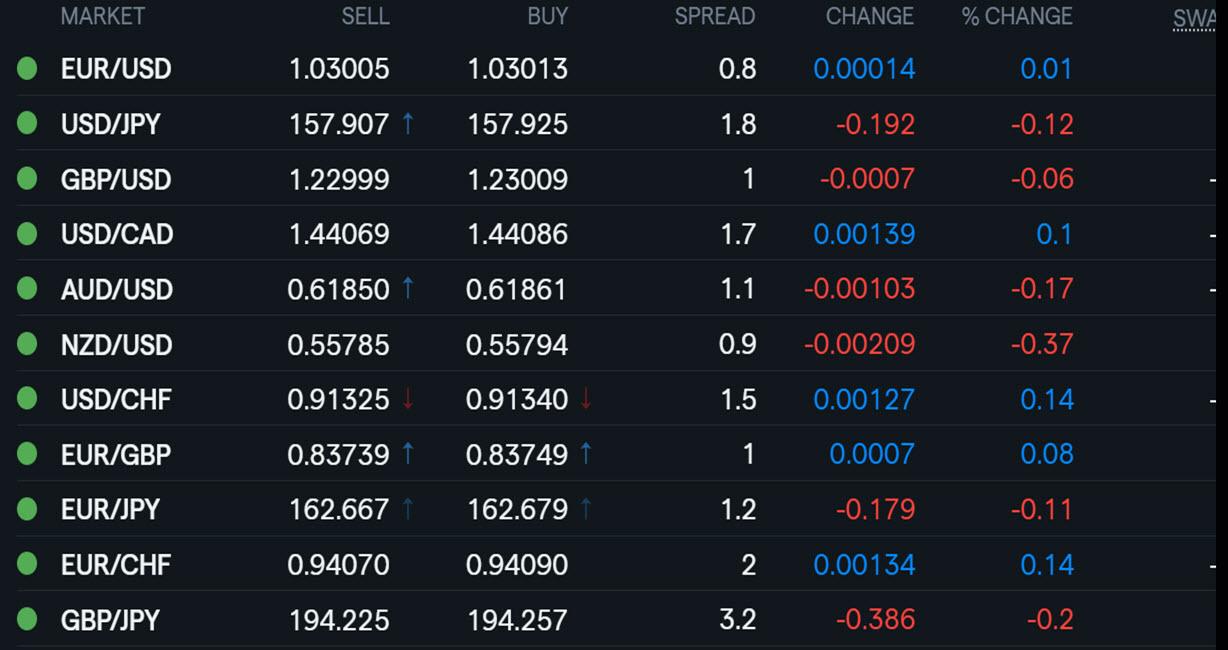

Using my Platform as a HEATMAP shows

Markets on hold awaiting the US jobs report in 3+ hours

GS and Citi calling for a weaker report …

But not showing up in bonds, where yields have edged higher

To keep it simple, watch big figures to guide the respective tones post-data

EURUSD 1.03

USDJPY 158** (traded 4 days in a row)

GBPUSD 1.23

USDCAD 1.44

AUDUSD .62**

**More significant big figures than the others

January 10, 2025 at 10:07 am #17554In reply to: Forex Forum

Anonymous10 January 2025

Tomorrow I shall be sober – French editionIn our lead story this morning, we write about a budget compromise in France – one that mostly ignores the fiscal trajectory agreed with the EU – the new stability is already dead on arrival; we also have stories on the logical fallacies behind Friedrich Merz’ economic strategy; on the fall of demand for electric cars in Germany; on the high degree of interconnectedness in the global gas markets; on Scholz’ veto of arms deliveries to Ukraine, and, below, on what appears to be an empty threat.

January 9, 2025 at 9:43 pm #17536In reply to: Forex Forum

EURUSD Daily

Downtrend is intact – so far so good.

Only thing that bothers me right now is a lack of a new low today – and it is easy to blame it on President Carters funeral ( he left us way too early…) , but I still don’t like it.

You might think that I am trying to find a needle in a haystack , but I know exactly what am I saying : Patterns are never wrong , and by current one we should see another test Up tomorrow – so be aware of that possibility!

Resistances : 1.03250, 1.03450 & 1.03850

Supports : 1.02850, 1.02500 & 1.02250

January 9, 2025 at 3:47 pm #17515

January 9, 2025 at 3:47 pm #17515In reply to: Forex Forum

January 9, 2025 at 3:28 pm #17510In reply to: Forex Forum

AnonymousJanuary 9, 2025 at 1:32 pm #17412In reply to: Forex Forum

January 9, 2025 at 11:27 am #17408In reply to: Forex Forum

NEWSQUAWK US OPEN

USD maintains strength ahead of Fed speak, Gilts briefly touched 89.00 but quickly pared

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mixed whilst US is away amid the National Day of Mourning in honour of President Jimmy Carter.

Pound under pressure as Cable hangs by a thread; DXY broadly firmer vs peers (ex-JPY).

Gilts gap lower and hit 89.00 but have since pared into an imminent parliamentary question, hefty European supply well received.

Subdued trade in energy but base metals tilt higher.

January 9, 2025 at 10:19 am #17403In reply to: Forex Forum

January 9, 2025 at 10:12 am #17402In reply to: Forex Forum

GBPUSD MONTHLY CHART – IS THE BOE IN

If I was the BOE I would be looking to slow the bond inspired sell-off by covertly intervening in GBPUSD.

The key level to defend is 1.2232 (and 1.22) as a firm break would expose 1.20

Low 1.2238… back above 1.23 is needed to slow the risk

Watch UK bonds nd EURGBP for clues

January 9, 2025 at 10:10 am #17401In reply to: Forex Forum

AnonymousEuropean Retail Sales come poor and below expectations

0.1% M/M (forecast 0.4%)

1.2 Y/Y(that, by the books of analysis, It is said Equities bearish)

It is very clear this market is manipulated by algos and capital players in accordance with the central banks.

And it is quite clear the liquidity is very poor there.

Most of the algorithmic liquidity trades is actually virtual, It is made by complex netting digital strategies. Generally in the old times this was called noise. Nowadays seem most don’t know…it appears as a narrative of it all, of the chart from yesterdays.. as to be news, as to be information.. its again just redundancy, a way to manipulate the reality that be

Its another algo program we follow as atomized goats…

there are no humans anymore making the pricing of markets.. Its the machines, and those don’t think

What will come with AI i don’t know… but bet will be very different, probably it already is

even in financial markets…

Not sure being in social media is a good idea then

It appears as a Technological Era, that of the first Internet culture has come to an end

Best wishes in this New Cosmo

January 9, 2025 at 10:02 am #17400In reply to: Forex Forum

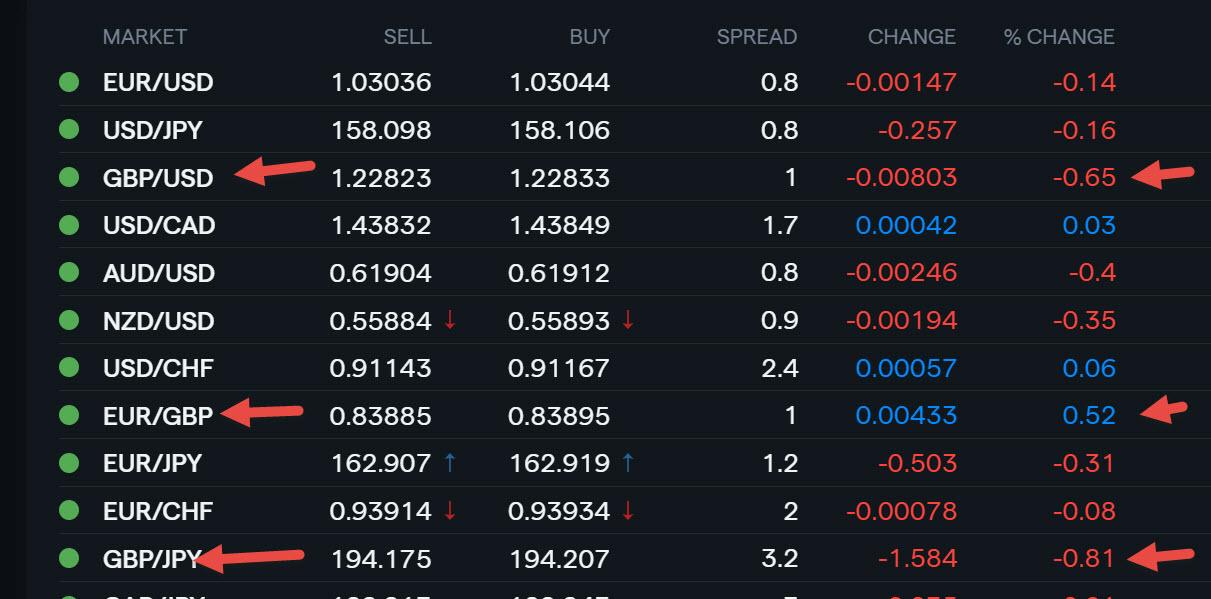

Using my platform as a HEATMAP

The attack on GBP continues although it has come off its lows. If I was the BOE, I would be in covertly to prevent a full-scale panic.

EURUSD continues to find support out of EURGBP but so far niot enough to get through 1.-320-25

…. And US jobs report is yet to come… NO US data today due to the Day of Mourning

Be aware that the start of a new year often sees false starts and choppy trading as markets slowly return to full

January 9, 2025 at 9:53 am #17399In reply to: Forex Forum

AnonymousActually European Equity Indexes are trading more alike the Chinese ever more – detaching, decoupling from the US ones.

Which is bad.Earlier German Inflation data, although holding the EURUSD little buoyed, surprised upwards. This is something that contradicts the latest ECBs Monetary tendencies.

All in all Central banks seem to loose credibility. There is no Monetary Policy!

All those speeches are more like a psychoanalytic therapy for the various investment funds and buy and holders.

Also most studies printed from the Think Tanks of sort are written by advertisers, more than professionals of once.If You see the GDP projection for 2025 of Europe Vs US it tells it all.

There are other things, but will not comment them – too long.Now upcoming are the retails sales in EU, which are a better indicator for the Eauity Markets.

Those are quite poor forecast, regardless of the number…if one reads in details it appears different to the average traders, investor or news writers that be..

e.g. 39.3% of the whole of the European Retail Sales is made up by Food Dings and Tobacco

So why be bullish European Equity Indexes

Sure there we were Months in some Harmonic Top in the making, now negated recently but this in very thin and small markets…. but european leaders are pushing inteventions as the chinese are…

but it the end as China falls so Its Europe…

Gonna see after Trump and after the German election all more clearly

for now its a game of very high level players that don’t print around over social media or elsewhere.Good Luck

January 9, 2025 at 8:58 am #17398In reply to: Forex Forum

January 9, 2025 at 8:49 am #17397In reply to: Forex Forum

January 9, 2025 at 5:03 am #17394In reply to: Forex Forum

AnonymousAs from https://www.eurointelligence.com/

Falling on ice in Greenland

With Greenland, Europe is running into a geopolitical disaster largely of its own making. It would have cost almost nothing for the EU to have made Greenland – and Iceland – an offer for membership, in return of which the EU would have obtained a foothold in one of the strategically most important regions.

It’s long forgotten, but Greenland was a member of the EU once when it was part of Denmark. With the departure of Greenland and the UK, the EU lost its two most northern Atlantic members. People tend to forget that neither Finland nor Sweden have access to the Arctic coastline.

Greenland formally withdrew from the EU in 1985. Today, Greenland is still part part of the Danish crown, but the 2009 autonomy acts give Greenland the right to secession through a referendum. So the statement by Mette Frederiksen, the Danish prime minister, that Greenland is not for sale is bunk. This is up to the seller. The seller is not Denmark, but the 59,000 inhabitants of Greenland. Neither Denmark nor the EU can stop this.

Last year, Ursula von der Leyen and Frederiksen visited Greenland because they were alarmed by plans of Chinese investment in Greenlandic mining. Greenland has reservoirs of natural resources including rare earth metals – a market China is keen to dominate because of its importance for batteries and other high-tech equipment. The Greenland prime minister, Múte Bourup Egede, told them bluntly that Greenland is a poor country that welcomed foreign investment, including from China. After treating Greenland with contempt and neglect for so long, it is unsurprising that the country prioritises its narrow economic interests over European security concerns. And this, we think, is how Donald Trump might get them.

In 2009, Iceland considered joining the EU, which would have been a strategic coup for the EU, because it could have paved the way of Greenlandic accession. But the Iceland accession failed over fishing rights. It is astonishing how much political capital the EU has spent on this subject. The EU and Greenland only have a friendship treaty, with some tuppence worth of support for sustainable development. Iceland’s new government is planning on holding a referendum on EU membership by 2027.

The Arctic has become geostrategically increasingly important. Russia is the Arctic superpower. The region also hold economically because of raw materials and because melting sea ice could open up new trade routes. It is also unsurprising that Trumps prioritises the acquisition of Greenland, Canada, and the Panama canal, using the language of mergers and acquisitions.

It should also come as a reminder that the US does not share Europe’s priority of Ukraine as its number one geopolitical issue of our time. For Trump, the security policy priority is to push back China away from the US’s own geographic neighbourhood, and to secure a strong presence in supplies of critical raw materials.

We are where we are because the EU ended it path towards political integration with the introduction of the euro, deluding itself into believing that soft power, diplomatic grand-standing, and control over regulation would prevail in the end.

January 8, 2025 at 2:31 pm #17348In reply to: Forex Forum

January 8, 2025 at 2:02 pm #17347In reply to: Forex Forum

January 8, 2025 at 1:49 pm #17346In reply to: Forex Forum

January 8, 2025 at 11:42 am #17335In reply to: Forex Forum

January 8, 2025 at 10:48 am #17328In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View