-

AuthorSearch Results

-

January 23, 2025 at 11:53 am #18270

In reply to: Forex Forum

NEWSQYAWK US OPEN”

USD flat & Bonds hold a bearish bias ahead of jobless claims and comments from Trump

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mixed, tech-heavy NQ slightly underperforms after SK Hynix highlights demand concerns.

USD flat with price action contained in quiet trade; markets await US President Trump at Davos.

Bonds hold a bearish bias into Trump though benchmarks bounced briefly on strong UK & French supply, but returned to session lows.

Crude a little firmer, Base metals continue to be subdued by Trump tariff threats

January 23, 2025 at 10:57 am #18267In reply to: Forex Forum

January 23, 2025 at 10:35 am #18264In reply to: Forex Forum

January 22, 2025 at 9:13 pm #18245In reply to: Forex Forum

DAX futures – FDAX1!

DAX Sets Fresh Record, Outperform European Peers

The DAX closed about 1% higher at a new record high of 21,259 on Wednesday, outpacing its European peers.The index was bolstered by Adidas’ strong earnings and optimism over massive AI investments proposed by US President Donald Trump, which helped offset concerns about his tariff policies.

January 22, 2025 at 9:04 pm #18244

January 22, 2025 at 9:04 pm #18244In reply to: Forex Forum

Light Crude Oil Futures – CL1!

Crude Prices Slip on Dollar Strength and Tariff Concerns

March WTI crude oil (CLH25) Wednesday closed down -0.39 (-0.51%), and March RBOB gasoline (RBH25) closed down -0.0286 (-1.35%).Crude prices came under pressure Wednesday after President Trump warned that he is considering a 10% tariff on all Chinese goods in retaliation for the flow of fentanyl from the country.

Wednesday’s monthly report from the Bundesbank signals weak energy demand in Europe’s largest economy and is bearish for crude prices after the report said, “In the first quarter of 2025, the German economy is unlikely to emerge from its long period of stagnation.”

January 22, 2025 at 8:18 pm #18238

January 22, 2025 at 8:18 pm #18238In reply to: Forex Forum

USDJPY 4 HOUR CHART – Waiting!

The wait is on for the BoJ’s expected rate hike and price action suggests it is already baked in the cake.

If you take 155-158 as a range then 156.50 will set the tone ahead of the BoJ.

Note the JPY was the underperformer Wednesday, both vs the dollar and on its crosses, most notably EURJPY..

January 22, 2025 at 7:08 pm #18235In reply to: Forex Forum

I am expecting US stocks to temporarily run into trouble in the next day or so and that should affect Euro’s performance as well. USD still has room to run but it is getting steep in the broader picture and so I think that is worth considering if holding positions. Eventually, but not anytime soon, I expect we see UsdChf 0850 again.

January 22, 2025 at 3:57 pm #18228In reply to: Forex Forum

A driving flow today remains EURJPY, which is close to testing the 162.89 level cited earlier.

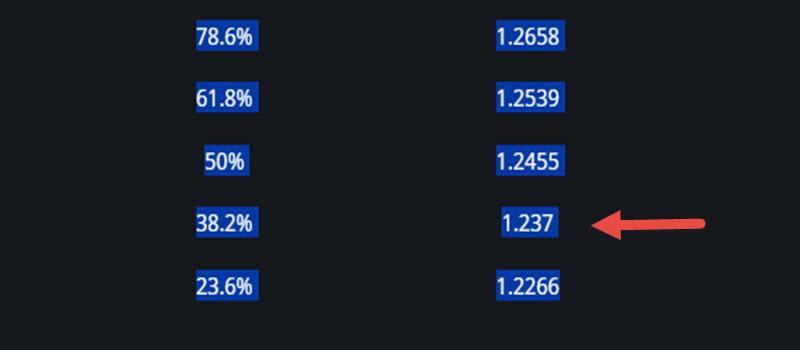

Unlike earlier, though, market is following the path of least resistance by pushing USDJPY higher as EURUSD lags. EURUSD lag is also coming from a firmer EURGBP, which is weighing on GBPUSD (after completing a 38,2% retracement earlier.

January 22, 2025 at 3:16 pm #18222In reply to: Forex Forum

January 22, 2025 at 2:23 pm #18219In reply to: Forex Forum

January 22, 2025 at 2:04 pm #18218In reply to: Forex Forum

EURUSD Daily

In line with what I said yesterday, so no need to repeat myself.

Now only remaining question is if EUR manages to close above that trendline tonight…

This is now the first signal that things are changing in EUR favour – It is a very early sign – 1.01800 held its ground, and more pull-push actions will be seen, with 1.02050 acting as a Major support.

This is a first time in awhile that I can see 1.06500 coming in play once again, but it will take some time so don’t expect any instant solutions.

We will continue following the developments on the Daily and Intraday basis as well – so stay tuned for more insights…

January 22, 2025 at 1:08 pm #18213

January 22, 2025 at 1:08 pm #18213In reply to: Forex Forum

EURJPY 4 HOUR CHART – TESTS RESISTANCE

Credit again to The Amazing Trader for highlighting this key resistance, which was the start of the move down to the 159.65 low.

Even if you do not trade EURJPY, it pays to keep an eye on it when you sewe the JPY move in the opposite direction of the EUR vs the dollar. ‘

The high in EURJPY coincided with the top in EURUSD at 1,0457.

January 22, 2025 at 12:32 pm #18211In reply to: Forex Forum

January 22, 2025 at 12:06 pm #18210In reply to: Forex Forum

A bit of a tug-of-war with USDJPY firming, JPY weaker on key crosses.

Not to pat myserlf on the back so I will give credit to The Amazing Trader for highlighting the EURUSD 1.0457 level.(scroll to see chart)

January 22, 2025 at 11:32 am #18207In reply to: Forex Forum

NEWSQUAWK US OPEN

NQ bid after Trump’s AI investment, NFLX +15% post-earnings, softer Dollar supports oil/precious metals

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses trade at best levels, Stoxx 600 makes a record high; NQ outperforms as President Trump announces a USD 500bln AI investment.

USD tilts lower as markets await further developments from the Trump administration.

USTs are a little firmer, Bunds bounce on ECB Lagarde remarks, who is seemingly not too concerned about US tariffs at this point in time.

A softer dollar supports oil and precious metals, but base metals trade mixed on tariff threats.

January 22, 2025 at 11:26 am #18206In reply to: Forex Forum

January 22, 2025 at 10:56 am #18204In reply to: Forex Forum

January 22, 2025 at 10:32 am #18201In reply to: Forex Forum

EURUSD DAILY CHART – What happened to parity?

Wasn’t the talk of parity just a few weeks ago and now 1.05 looms above.

You can see why 1.0457 is a key level, also a 4=week high. While 1,05 would likely prove tough, a move above 1.0457 would put it on the radar.

‘On the downside, 1.0435 needs to hold to keep a strong bod. Back below 1.04 would negate the upside risk.

January 22, 2025 at 9:29 am #18199In reply to: Forex Forum

January 21, 2025 at 7:56 pm #18177In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View