-

AuthorSearch Results

-

January 27, 2025 at 10:15 am #18470

In reply to: Forex Forum

January 26, 2025 at 10:29 pm #18454In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

The upcoming week features a mix of global economic data releases, with China kicking off Monday with its CFLP composite PMI showing flat manufacturing activity at 50.1 and a slight dip in services PMI to 52.1. Germany’s Ifo survey for January is projected to remain weak, with minimal changes in business climate and expectations compared to December. In the U.S., December’s new home sales are expected to show growth, despite 30-year mortgage rates exceeding 7%. Tuesday highlights include U.S. durable goods orders, forecasted to rise 0.8%, and consumer confidence, anticipated to rebound to 106.3 in January after a decline in December.

Midweek, the Bank of Canada is expected to slow its pace of monetary easing with a 25-basis-point rate cut, while the Federal Reserve is anticipated to hold rates steady amid strong economic conditions and persistent inflation. Thursday sees Japan’s inflation inching higher, while unemployment remains stable at 2.5%, reflecting labor shortages. Japan’s industrial production is forecast to rebound slightly, and retail sales are expected to show moderate growth. Meanwhile, Eurozone GDP for Q4 is projected to rise modestly by 0.2% on the quarter, with France stagnating, Germany contracting, and Italy posting a modest gain. The European Central Bank is likely to announce a 25-basis-point rate cut.

Friday wraps up with inflation data from France and Germany, with France’s CPI forecasted to rise to 1.5% annually and Germany’s to remain steady at 2.6%. Canada’s November GDP is expected to shrink by 0.1%, reflecting declines in key sectors like retail, wholesale trade, and manufacturing. The week’s data points underscore the mixed recovery across global economies, with inflation, labor conditions, and central bank policies taking center stage.

Econoday

January 26, 2025 at 9:21 pm #18453In reply to: Forex Forum

In our blog

Here is a question? Why has the EURUSD recovered and DAX at record levels given the risk of Trump tariffs. prospect of lower interest rates, an underperforming German economy and political uncertainty in Germany (and France)?

January 26, 2025 at 5:24 pm #18423In reply to: Forex Forum

January 26, 2025 at 5:06 pm #18419In reply to: Forex Forum

January 26, 2025 at 4:03 pm #18415In reply to: Forex Forum

Swiss stocks closed higher on Friday as the World Economic Forum in Davos comes to a close and markets shift their attention to next week’s key monetary policy decisions in Europe and the US.

The Swiss Market Index edged up 0.18% at the end of the trading day.

In corporate news, Baader Europe raised its price target on Sandoz SDZ to 46.6 francs from 44.2 francs, primarily driven by the Swiss pharmaceutical company’s strong growth in biosimilars and initiatives to improve margins. The stock was up 1.26% at closing.

Of course Swiss market index is lagging ( a lot) behind the DAX, but is more stable .

January 26, 2025 at 3:58 pm #18414In reply to: Forex Forum

With both – FOMC and ECB interest rate decision next week and not to forget BOC for those trading USDCAD, it is going to be a very exciting trading week.

I hope that the market will make a decision as well once it all passes and that we can have some clear direction midterm.

With all the Geopolitical shakings right now, Trump expressing some interesting ideas , coupled with European slow down we can expect two possible outcomes :

– Either the crisis increase to the unbearable levels or

– All settles down with some new (old) ways , in which case no one will be fully happy, but no one ever is.

We that work the markets have to be extremely sensitive to all of it , to be able to make it .

January 25, 2025 at 10:49 am #18393In reply to: Forex Forum

January 24, 2025 at 7:07 pm #18375In reply to: Forex Forum

January 24, 2025 at 5:21 pm #18373In reply to: Forex Forum

We saw new highs after long standing highs holding in some stock futures. This is about where the odds increase for a temporary pull back of non-dramatic proportion. I can see them lingering around current levels prior for a few days but we could just as well see a linear drop. Overall stocks in the US especially are receiving inflows. This of course will affect Eur/Usd behavior.

January 24, 2025 at 3:43 pm #18370In reply to: Forex Forum

January 24, 2025 at 2:08 pm #18363In reply to: Forex Forum

EURUSD Daily

Last night’s prediction : The pattern for tonight says : Up – so another leg up ( hope Mr. President doesn’t talk in his sleep…)

So Up it was…Pattern never ( or almost never) lies…

To explain something : when there is a proper angle of move, pattern hits it 96% of the time ( 4% someone talked in his/her sleep)

And how to spot the right angle and decide it is the Signal – well, that’s an art…

Resistance at 1.05350 is waiting.

Now another rule of the game : that broken trendline will act as a support from now on – yet again that 1.03500 is a level to keep in mind.

P.S. Am I gloating here ?? Nooo….not at all 😀

January 24, 2025 at 11:46 am #18344

January 24, 2025 at 11:46 am #18344In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

The dollar fell to its lowest of the year as the Bank of Japan delivered a long-awaited interest rate rise on Friday, euro business unexpectedly returned to growth and President Donald Trump’s latest comments gave China a lift.

Morning Bid: Dollar swoons as BOJ hikes, euro zone grows, yuan relieved

January 24, 2025 at 11:38 am #18343In reply to: Forex Forum

NEWSQUAWK US OPEN

DXY pressured by Trump remarks, EZ PMIs lift the EUR, BoJ hike as expected

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses mostly firmer, whilst US futures tilt a little lower; Burberry +15% post-results.

DXY in the doldrums as Trump waters down tariff rhetoric and calls for lower interest rates.

USTs a little firmer, Bunds pressured by EZ PMIs and BoJ Governor Ueda spurs JGB action.

Base metals soar amid Trump’s China commentary and a weaker dollar.

BoJ hiked rates by 25bps to 0.50%, as expected via an 8-1 vote with Nakamura the dissenter. Governor Ueda said the Board has judged that spring wage talks will result in strong hikes again this year. No preset idea on future adjustments. No preconceived ideas around the scope/timing of the next rate rise.

Next rate hike will depend less on economic growth but more on price moves.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

Cancel anytime – free for 7 days

January 24, 2025 at 10:15 am #18340In reply to: Forex Forum

EURUSD DAILY CHART – Damage not fatal

A new leg up but for damage to be fatal, EURUSD would need to break 1.0629 to produce an outside month.

Otherwise, focus is clearly on 1.05 as it would need to become support to extend the move or it will run out of steam.

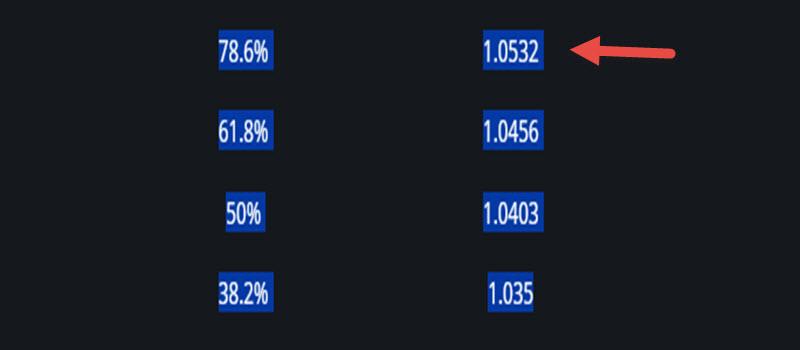

Support starts at1.0457 through 1.0411.

Note Fed and ECB meet next week, the latter is expected to cut rates,

Using FIBOS for 1.0629-1.0177

January 24, 2025 at 9:57 am #18339

January 24, 2025 at 9:57 am #18339In reply to: Forex Forum

Using my platform as a HEATMAP shows

A weaker USD but unless EURUSD can establish 1.05+ moves will lose steam. What also caught my eye ia USDJPY back above 155 after again failing to hold on another trade below it following the expected BoJ rate hike,

With all the talk about Trump comments about lower interest rates, 10-year yield is close to unchanged..

January 23, 2025 at 8:23 pm #18311In reply to: Forex Forum

EURUSD Daily

There is an old adage : Money talks – BS walks….or put your money where your mouth is.

The pattern for tonight says : Up – so another leg up ( hope Mr. President doesn’t talk in his sleep…)

Resistances : 1.04550, 1.04650 & 1.05350

Supports : 1.03950, 1.03700 & 1.03500

First target is at 1.06800

January 23, 2025 at 5:02 pm #18300

January 23, 2025 at 5:02 pm #18300In reply to: Forex Forum

January 23, 2025 at 3:20 pm #18292In reply to: Forex Forum

January 23, 2025 at 2:37 pm #18285In reply to: Forex Forum

EURUSD 4h

Fight is going on…

1.03500 still acting as a pivotal.

Downtrend resistance line is broken, but one lousy sentence can change it all within minutes.

Some of you might like Trump, some even hate him, but what I can’t stand is his need to let his tongue be faster than his brain….

These are those rare situations when technical analysis, charts, trendlines and indicators don’t mean much.

I am personally just observing the situation and not touching the trade.

-

AuthorSearch Results

© 2024 Global View