-

AuthorSearch Results

-

January 28, 2025 at 1:11 pm #18558

In reply to: Forex Forum

January 28, 2025 at 1:08 pm #18557In reply to: Forex Forum

January 28, 2025 at 11:26 am #18547In reply to: Forex Forum

January 28, 2025 at 11:19 am #18544In reply to: Forex Forum

January 28, 2025 at 11:08 am #18541In reply to: Forex Forum

NEWSQUAWK US OPEN

NQ outperforms with NVIDIA +5% pre-market, USD gains on punchy Trump tariff rhetoric

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are on a firmer footing; NQ outperforms with NVIDIA +5% in pre-market trade.

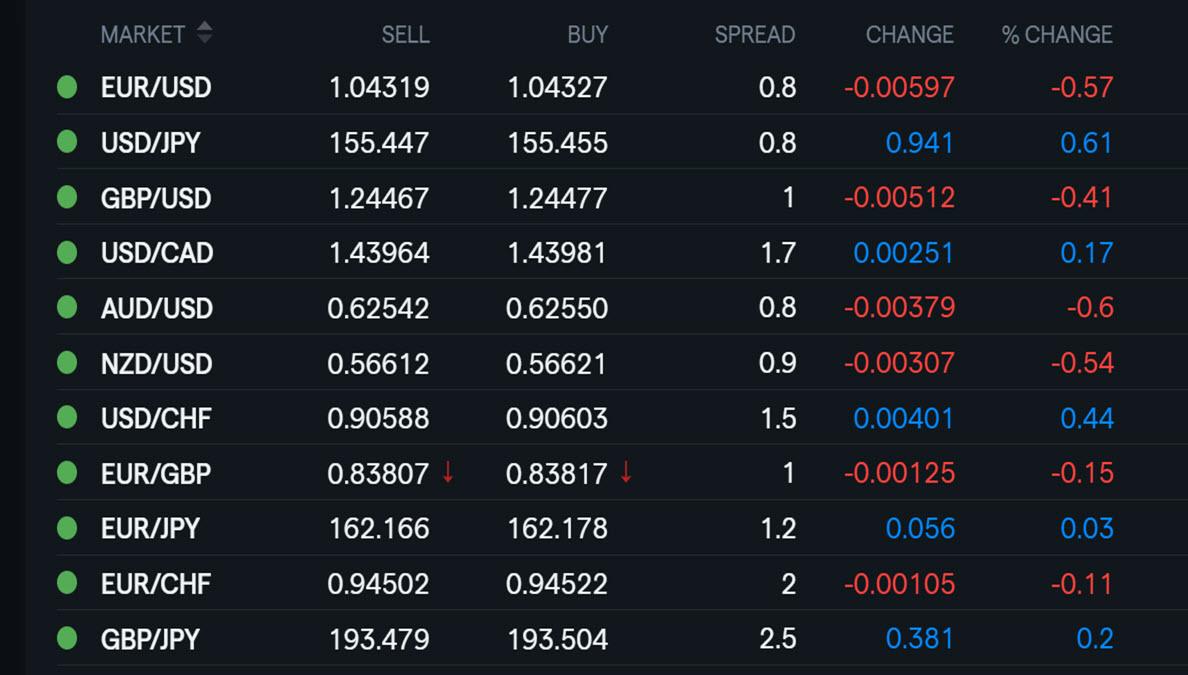

USD bounces back following punchy Trump tariff rhetoric; G10s broadly in the red.

Bonds continue to pullback from Monday’s largely tech-driven highs, supply in focus.

Energy is firmer but base metals are mixed amid tariff threats.

January 28, 2025 at 10:12 am #18538In reply to: Forex Forum

Using my platform as a HEATMAP shows

The day after an earthquake wher the damage was not as bad as initially thought but wary of aftershocks,

The dollar trading firmer after:reacting to Treasury Secretary Bessent’s tariff remarks (reaction to news is what matters)

Panic selling in equities at this time yesterday easing

USDJPY back above -155

EURUSD backing away from 1.05

Focus should shift to respective monetary policy meetings (BoC, Fed, ECB)

January 28, 2025 at 9:39 am #18537In reply to: Forex Forum

EUR/USD AT 1.04195 REACHED ITS CONSIDERABLE LOWEST POINT TUESDAY MORNING AND HAS RETRACED SINCE THEN. AS AT THIS TUESDAY MORNING OF 28TH JANUARY 2025, EURO HAS RISEN TO THE POINT OF 1.04429.

THE EURO IS ON AN UPWARD TREND. IT HIT 1.04940 MONDAY NIGHT AND A FURTHER UPWARD MOVEMENT WAS EXPECCTED BUT MARKET RETRACED OVERNIGHT IN A SHARP DOWNWARD SLOPE AROUND 12 MIDNIGHT NIGERIAN TIME LATE YESTERDAY.

I THINK THE MARKET IS STARTING TO MAKE AN RETURN TO ITS PREVIOUS LEVEL AT 1.04940 THOUGH PRESENTLY AT 1.04424. THE MOVEMENT UPWARD IS SLOW BUT STEADY. IN A FEW HOURS/ DAYS THE EURO SHOULD HAVE MADE A 100% RETURN TO ITS FORMER TREND.

THIS IS MY HONEST POSITION THIS EARLY TUESDAY MORNING AT ABOUT 10:40AM NIGERIAN TIME.

THANKS,

TOPE AJALA

FROM NIGERIAJanuary 27, 2025 at 6:18 pm #18519In reply to: Forex Forum

January 27, 2025 at 6:07 pm #18517In reply to: Forex Forum

EUR/USD 1-month implied volatility traded 7.55-7.6 on Monday after last week’s setback from the low 9’s to the low 7’s. Price action in spot and options is consistent with more upside potential toward 1.0900 if some key resistance levels can be overcome, although policy divergence will cap the extent of overall gains.

EUR/USD risk reversals are attracting some demand from their lower levels for EUR puts/USD calls as a way to hedge any renewed spot losses.

January 27, 2025 at 5:34 pm #18512

January 27, 2025 at 5:34 pm #18512In reply to: Forex Forum

This is obviously the temporary pause in stocks I felt last week we would begin to see either Thursday/Friday or today. Nothing dramatic. Could last up to 5 days before stabilizing. Could be less than that. Euro obviously is/will be impacted negatively to some extent with the risk off mood. So far it is just tempering gains. I do see some stabilization in Treasury Core Bonds and that is helping Euro. Wednesday holds the cards.

January 27, 2025 at 4:29 pm #18506In reply to: Evaluation – Daily Trades

January 27, 2025 at 4:00 pm #18503In reply to: Common Sense Trading

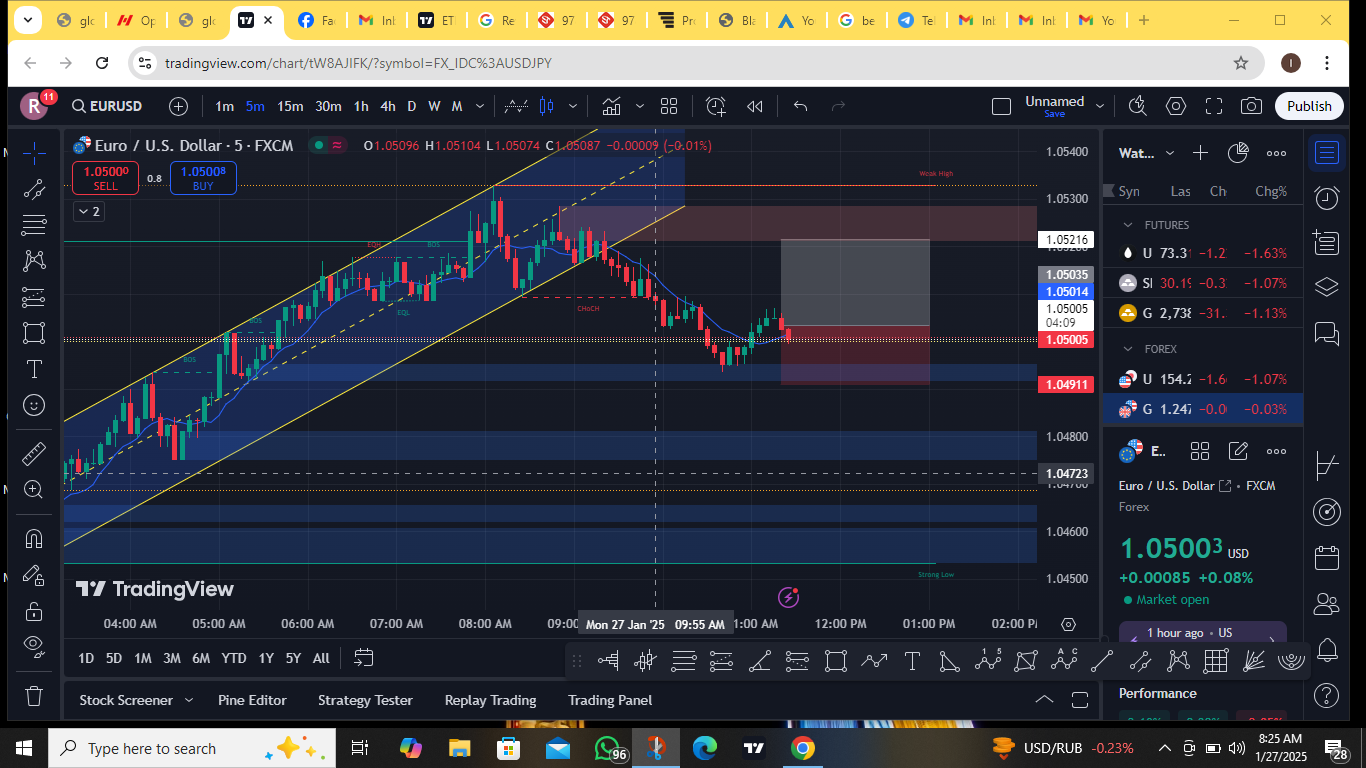

Take a look at these charts and then go to the Welcome Package in the Member Benefits page and watch the Day Trader’s Guide to Beating the Market video.

Look at this US500 chart after sell stops were exhausted and the low for the day was set.

Look at this EURUSD chart and the price action after buy stops were run and the high for the day was set.

January 27, 2025 at 3:42 pm #18498

January 27, 2025 at 3:42 pm #18498In reply to: Forex Forum

EURUSD profit target it…1.25:1. R/R

Join GTA (FREE) and request a half price Amazing Trader members only AT access

January 27, 2025 at 3:35 pm #18497In reply to: Forex Forum

EURUSD 15 MINUTE CHART – AT ALERT

This is the Amazing Trader pattern that triggered an AT sell alert at 1.05185/tp 1.04973/SL 1.05371

It is also the pattern that indicated a potential top and change in directional risk

January 27, 2025 at 1:29 pm #18494In reply to: Forex Forum

January 27, 2025 at 1:26 pm #18493In reply to: Forex Forum

January 27, 2025 at 11:59 am #18491In reply to: Forex Forum

Newsquawk US Open

NQ down 5% & NVDA -11% pre-mkt as Chinese startup DeepSeek threatens US AI dominance

Good morning USA traders, hope your day is off to a great start! Here are the top 6 things you need to know for today’s market.

6 Things You Need to Know

Risk sentiment hit by DeepSeek threatening US AI dominance, NQ -4.8% & ES -2.7%; NVDA -13.5% in premarket trade

European bourses are also mostly in the red, Tech lags with ASML -10.6% while Energy names are hit on this and numerous other factors

Additionally, disappointing Chinese PMI data overnight, Trump’s tariff announcement on Colombia and reports around MXN & CAD also weigh on the risk tone.

DXY is at session lows with 107.00 coming into view, havens lead with USD/JPY probing 154.00 to the downside.

Fixed benchmarks benefit from the above and partially on better-than-expected German Ifo; Central Banks coming into focus

Crude is now modestly in the green, as the USD provides support and offsets initial bearish action on the above and Saudi/US discussing lower prices; Metals lower across the board

January 27, 2025 at 10:52 am #18483In reply to: Forex Forum

Orders and hedges offer clues for the EUR/USD outlook

EUR/USD has staged a decent recovery from 2-year lows at 1.0177 on Jan 13. Customer orders and price action in forward looking FX option markets might now offer clues about subsequent EUR/USD expectations.

EUR/USD’s recovery from 1.0177 peaked at 1.0523 on Friday and subsequent setbacks have met demand in the mid 1.04’s. Dealers say there are now more dip buyers, while others prefer to keep their powder dry to sell the USD if it comes under renewed pressure.

January 27, 2025 at 10:49 am #18481In reply to: Forex Forum

Europe’s technology sector led the pan-European STOXX 600 index SXXP lower, down 0.7%, while the blue-chip Euro STOXX 50 STOXX50 dropped 1.4% in early European trading.

The STOXX Europe 600 technology index (.SX8P) fell as much as 4.6%, its biggest one-day drop since mid-October.

Futures on the tech-heavy Nasdaq Composite NQ1! in the U.S. tumbled over 3.1% and S&P 500 futures ES1! sank 2%.

January 27, 2025 at 10:44 am #18480In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View