-

AuthorSearch Results

-

January 29, 2025 at 3:20 pm #18640

In reply to: Forex Forum

January 29, 2025 at 1:07 pm #18630In reply to: Forex Forum

EUR/USD (EURO) HAS CONSOLIDATED AND IS SET TO GO ALL THE WAY UP FROM ITS PRESENT PRICE AT 1.04024 AND IT WILL GO TO AROUND 1.0500, A MOVE OF OVER 100 PIPS. I SAW THIS PROPOSED MOVE YESTERDAY WHEN PRICE CAME DOWN TO 1.039 AREA.

MARKET CAME TO THAT SUPPORT AREA AND IS ABOUT TO RETURN UPWARDS. TODAY’S VOLATILE NEWS IS GOING TO PUSH THE EURO FAR UP. B.O.E GOVERNOR BAILEY’S SPEECH TODAY IS GOING TO SHAKE THE MARKET. WE ARE EPECTING THE ACTUAL OUTCOME OF THIS NEWS TO BE HIGHER THAN THE FORCAST AND THE PREVIOUS PREDICTIONS.

LET’S WAIT AND SEE AS TIME WILL TELL. THIS IS MY EURO PREDICTION FOR TODAY’S NEWS. THANKS, TOPE AJALA, FROM NIGERIA.

January 29, 2025 at 12:15 pm #18627In reply to: Forex Forum

USD firmer, CAD undecisive into policy decisions, blockbuster ASML results lift tech

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses mostly firmer, with Tech surging after blockbuster ASML bookings; NQ slightly outperforms.

USD is a little firmer ahead of the FOMC, CAD awaits BoC, AUD softer post-CPI.

Bonds are bid into the FOMC. BTPs & OATs attentive to domestic matters

Crude slides and metals trade mixed ahead of FOMC.

Try Newsquawk for 7 Days FreeJanuary 29, 2025 at 11:33 am #18623In reply to: Forex Forum

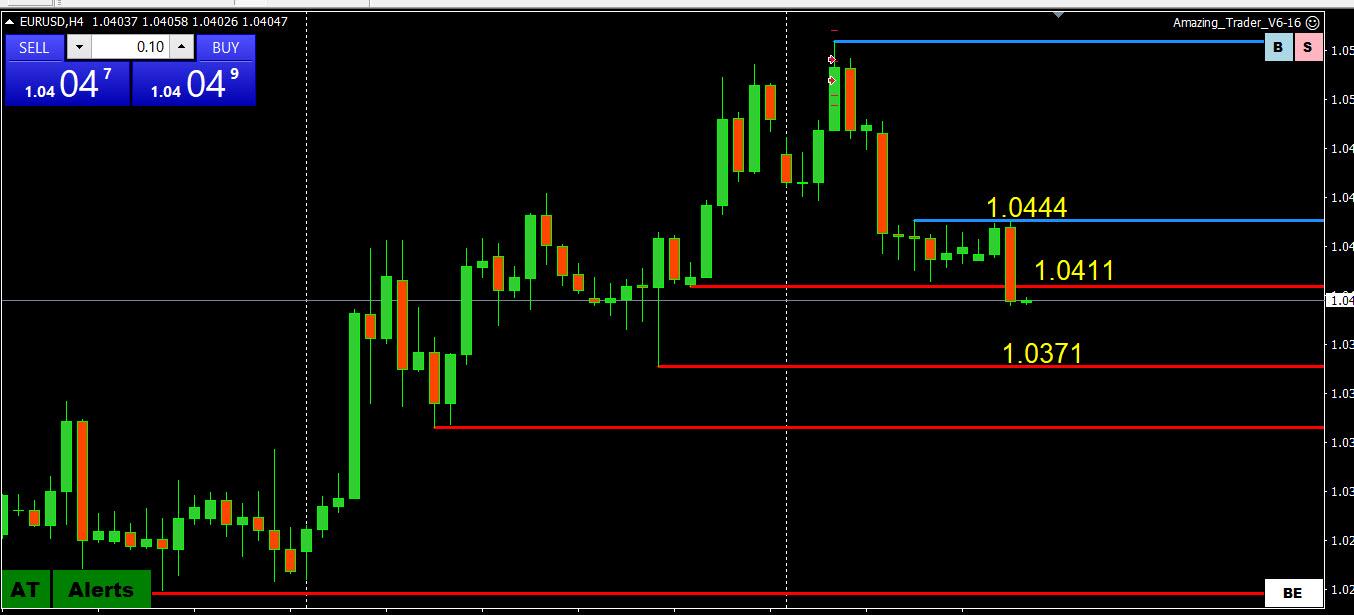

EURUSD 4H

Support – trend line taken out – important is how it is going to close this bar (in 2h).

Resistances : 1.04150, 1.04250 & 1.04400

Supports: 1.03900, 1.03700 & 1.03500 ( back to that pivotal level…)

As FOMC come tonight, levels can be breached, trendlines broken, but reaction of the market tonight is going to be wild…so everything is really possible at the end of the day.

I am treating it right now as a Bearish situation and unless I see decisive move back Up , I keep selling on smaller time frames.

January 29, 2025 at 10:41 am #18622

January 29, 2025 at 10:41 am #18622In reply to: Forex Forum

Insights you might now find elsewhere

This popular article in our blog is worth revisiting after looking at a EURUSD chart today

I first heard the term “feels bid in an offered market” on the Global-View.com Forex Forum many years ago. It was posted by one of our professional trader members, LA Mel, who used the term mainly for the EURUSD. However, it soon became apparent that it could be applied to all currencies and on both sides of the market (e.g. feels offered in a bid market and vice versa). I soon added to my trader toolbox and still use it today

What Does it Mean When a Currency Feels “Bid in an Offered Market?”

January 29, 2025 at 10:18 am #18614In reply to: Forex Forum

January 29, 2025 at 10:16 am #18613In reply to: Forex Forum

January 29, 2025 at 10:07 am #18612In reply to: Forex Forum

January 29, 2025 at 9:26 am #18608In reply to: Forex Forum

January 29, 2025 at 7:57 am #18606In reply to: Forex Forum

January 28, 2025 at 8:12 pm #18582In reply to: Forex Forum

January 28, 2025 at 8:05 pm #18581In reply to: Forex Forum

CAC40

CAC 40 Edges Lower on Tuesday

French lagging behind Deutch and Swiss – a lotThe CAC 40 slipped 0.1% to close at 7,897 on Tuesday, extending the prior session’s sharp selloff as pressure from DeepSeek’s launch of a low-cost AI model weighed on key equities.

Meanwhile, investors turned their attention to upcoming monetary policy decisions, with the Federal Reserve set to announce its decision on Wednesday, followed by the European Central Bank on Thursday, alongside the ongoing corporate earnings season.

Schneider Electric led losses, plunging 7.5% to its lowest level since September, while Stellantis fell 1.2%, and STMicroelectronics dropped 3.2%, offsetting broad based gains across luxury goods, financial services, and healthcare sectors.

January 28, 2025 at 7:27 pm #18575

January 28, 2025 at 7:27 pm #18575In reply to: Forex Forum

January 28, 2025 at 6:47 pm #18572In reply to: Forex Forum

January 28, 2025 at 5:58 pm #18571In reply to: Forex Forum

Euro is reacting to Treasury bonds lately fairly well. What looked like a possible breakout to the upside recently in Euro was not in the bonds. Various stock futures and indices have also been providing a clear window into flows. Stocks are up today but overall they are still experiencing sell side flows of weight. A bit stiff to not anticipate Euro sub 1.04 coming up even if temporary. Common sense might dictate pre-Wednsday positioning in play.

January 28, 2025 at 4:04 pm #18570In reply to: Forex Forum

EURUSD failed to test 1.0444 let alone 1.0450/57 but downside contained after a pauwe above 1.0411.

USDJPY trading well above 155 on the pop in stocks

XAUUSD above 2650 after finding support in my 2725-35 zone but still just consolidating.

NASDAQ The UP 1.1%

Now the wait is on for CB meetings or next Trump tweet.

January 28, 2025 at 2:36 pm #18566In reply to: Forex Forum

Uncertainties around U.S. policies could slow global economic growth modestly in 2025, according to major brokerages. They expect U.S. President Donald Trump’s likely plan to raise tariffs to fuel volatility in global markets, raising inflationary pressures, which could limit major central from easing their monetary policy.

Following are the forecasts from some top banks on economic growth, inflation and the performance of major asset classes in 2025.

Forecasts for stocks, currencies and bonds:

Brokerage S&P 500 target U.S. 10-year yield EUR/USD USD/JPY USD/CNY

January 28, 2025 at 2:32 pm #18565

January 28, 2025 at 2:32 pm #18565In reply to: Forex Forum

January 28, 2025 at 2:28 pm #18564In reply to: Forex Forum

The euro could rise slightly if the European Central Bank delivers a cautious tone about interest rate cuts at Thursday’s meeting, Bank of America analysts say in a note. “The market is already pricing two cuts for the next two meetings, and the ECB is unlikely to commit to more cuts beyond that right now.” This potential caution could provide some modest support to the euro given short positioning that bets against the single currency, they say. However, BofA remains cautious on the euro in the near term due to the risk of U.S. trade tariffs, which could add to the case for further ECB rate cuts. The euro falls 0.6% to $1.0432.

January 28, 2025 at 1:25 pm #18559In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View