-

AuthorSearch Results

-

January 31, 2025 at 9:24 am #18795

In reply to: Forex Forum

EUR/USD has just busted through a downward spiral at exactly 10am this Friday nigerian time. Market reach the highest price at 1.04129 today and has since been descending. Market was at 1.03818 by 10am before it busted in the bearish direction. Market has since been going down and i see a further sell to at least 1.0340 area as this movement is a strong one and may continue for a while.

There areno major news releases until 2:30pm nigerian time when the core price index news will come out with the Employment cost index. Let’s wait till then to see if the news will change the market’s direction.

January 30, 2025 at 9:15 pm #18768In reply to: Forex Forum

January 30, 2025 at 3:50 pm #18748In reply to: Forex Forum

So now that lagarde’s ECB burped as expected I am looking at

US 10-YR 4.512%

Bund 10-YR 2.503%

UK 10-YR 4.544%

and the diferencethen I also note that we are at month-end BUT so far I am not discerning any substantial shuffling of position mix

then I also note that president Trump may or not issue some spamkings to misbehaving Canada and arrogant Mexico

sooo, I am thinking degenerate traders are likely to wait n see over-the-weekend developmentsI am biased but this time around I prefer to be on the conservative side about eurdlr

as I dont see much of a bull rally seeing as every dick and harry (and mary) are loaded long dollar from here to yingyang. If anything I d prefer eurdlr loose say a 100 pips from the current 104.3xJanuary 30, 2025 at 2:19 pm #18740In reply to: Evaluation – Daily Trades

January 30, 2025 at 2:00 pm #18738In reply to: Forex Forum

January 30, 2025 at 12:22 pm #18729In reply to: Forex Forum

EURUSD Daily

EUR failed to close above1.04250 last night and lost possible momentum for more advance.

Now all eyes are on 1.03800

For me, 1.03450 is a point of no return – if taken out, we go back to full Bearish move.

In about an hour ECB – let’s see how this story ends….A Fairytale or Sad, Melancholic and Depressing Irish Story…

January 30, 2025 at 12:09 pm #18728

January 30, 2025 at 12:09 pm #18728In reply to: Forex Forum

NEWSQUAWK US OPEN

USTs bid and RTY outperforms post-FOMC, Big Tech results mixed; TSLA +2.5%, META +1.3%, MSFT -3.7%

Good morning USA traders, hope your day is off to a great start!

Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses hold an upward bias into the ECB; RTY outperforms post-FOMC.

Big-Tech results were mixed; META +2.4%, MSFT -3.5%, TSLA +1.7%

USD steady post-FOMC, EUR eyes ECB 25bps rate cut; USD/JPY below 154.50.

Powell props up bonds, weaker-than-expected EZ GDP spurred little reaction in Bunds ahead of the ECB.

Crude slips on tariffs and growth fears, base metals edge a little higher despite China being on holiday

January 30, 2025 at 12:00 pm #18727In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

With Federal Reserve policy likely paused until midyear and megacaps throwing up a mixed bag of results so far, stock markets stayed calm overnight as attention switches to European interest rates and a fourth-quarter U.S. GDP healthcheck.

Quarterly results from Microsoft (MSFT.O), opens new tab and Meta (META.O), opens new tab after the bell on Wednesday drew different reactions, with the artificial intelligence theme more broadly thrown into the flux this week by China’s DeepSeek revelation.

Morning Bid: Megacaps mixed as Fed pauses; ECB cut and GDP up nextJanuary 30, 2025 at 11:55 am #18726In reply to: Forex Forum

January 30, 2025 at 9:40 am #18707In reply to: Forex Forum

Using my platform as a HEATMAP shows

JPY outperforming… look no father than US interest rates, which peaked at 4.59% for the 10-year after the Fed announcement, then slipped back and were last quoted at 4.506^

Next up is the ECB decision, the 3rd in the CB trifecta, where a 25bps cur is widely expected, leaving the focus on the forward guidance. Given the lack of strong reactions to the other CB decisions yesterday, it is hard to predict one here.

EURUSD a touch softer, levels to watch

1.0371/92 – 1.0444/57

January 30, 2025 at 8:36 am #18706In reply to: Forex Forum

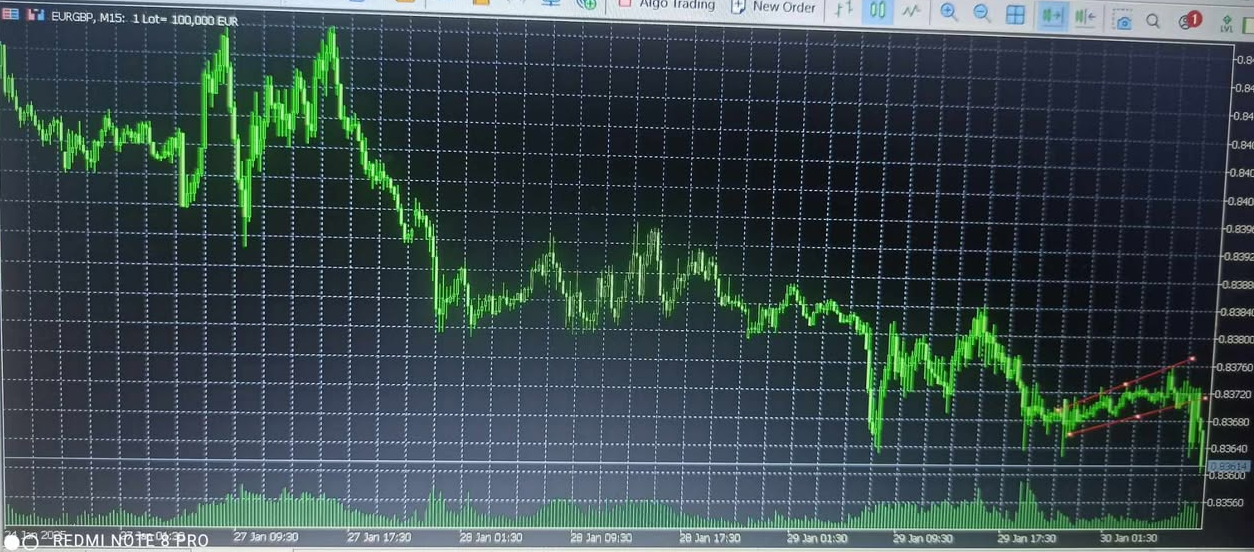

A good mornign to you guys from the capital city of Africa, Nigeria. This is 9:30AM and market is looking beautiful. I am on the EUR/GBP chart and market is about to break long (buy). Market was in a sideways range all yesterday before breaking short early this morning to the price area of 0.8362 Price then rose to the price of 0.8372 as we speak now, but if you look at the 15′ chart candle of the same pair eur/gbp, you will see an almost perfectly paired candles standing next to each other.

The prior bearish candle and the just formed bull candle on the 15′ chart are of same height and length. This signals a continuation of the just formed candle which is a buy in this case. So market will continue to go upwards but for a while. From the present price at 0.8372 i see a pull up to the area of price 0.8375 where I hope to exit the market.

It is not much but a little profit is good, just be consistent and don’t over leverage your Account.

Thanks,

TOPNINE.January 30, 2025 at 6:06 am #18705In reply to: Forex Forum

January 29, 2025 at 8:15 pm #18678In reply to: Forex Forum

EURUSD Daily

Well, day dreaming aside, EUR succeeded in holding above 1.04000 and even briefly went all the way till 1.03824 , but it will most probably close the day above.

Any close above 1.04250 will leave a chance for tomorrow to make another straight leg Up.

This is not a full blown Up trend, so we have more of a 50-50 situation on our hands.

Watch for overnight unfolding…

January 29, 2025 at 5:23 pm #18656

January 29, 2025 at 5:23 pm #18656In reply to: Forex Forum

Reading the tea leaves there are some ordinarily potent conditions in some of the more important barometers which show the likely behavior of Sterling, Euro, stocks, bonds, USD. Right now they point toward a drop in stocks, some bonds, and Euro and Sterling. It would take one of those manic two way shock and awe flows post-Fed or something else significant to change that.

January 29, 2025 at 4:36 pm #18653In reply to: Forex Forum

Europe is right now in the middle of Russian aggression on one side, self imposed sanctions on Russian gas and oil , lost in space after Trump became a President again, some crazy ideas on Green energy….just to mention a few….Member countries are having second thoughts on everything , Germany and France cannot solve the inner political situations…that mess.

January 29, 2025 at 4:05 pm #18649In reply to: Forex Forum

To join you in your biased view Mtl :

EUR has to go straight below 1.03 first, rebound to 1.04500 and fail , and then we go for a jugular – below 1.01800.

Otherwise we might be just day dreaming…even it is only logical – how can EUR get stronger in such a geo political mess we have right now , and all the problems each EU member country has….

January 29, 2025 at 3:56 pm #18647In reply to: Forex Forum

January 29, 2025 at 3:56 pm #18646In reply to: Forex Forum

Switzerland to Lift Protective Measure for EU Stock Exchanges in May

Switzerland will remove the European Union from its stock exchange protection list aimed at safeguarding the Swiss stock exchange infrastructure, effective May 1.With the EU revising the relevant legal basis in 2024 and lifting the restrictions on EU securities companies trading Swiss equities, the Swiss Federal Council deemed the protective measure no longer necessary, according to a Wednesday release.

January 29, 2025 at 3:48 pm #18645In reply to: Forex Forum

EURO 1.0413 as I type at 10.40nyt

–

with jerome having gotten himself into the corner ropes with his alleged dependence on data and his of fear of trump policies, the aggregate market view seems to be FED to remain flat AND that if any rate cutting is to come sometime long long time in the future would be slower than slow in light of FED’s magicianipulation to bring it to their 2% target not working swimmingly.Trade idea:

I am biased to go long DLR if n when it should spurt uP on Jerome’s wishi-washi unenthusiasm for cut and some yakiing about prudent for longer AND therefore relatively hawkish to other rate-cutting themed CBs.January 29, 2025 at 3:48 pm #18644In reply to: Forex Forum

DAX – GER30

DAX Hit New Record Peak

Stocks in Germany Hit All-time High

The DAX rose toward 21650 on Wednesday, hitting fresh record highs, in line with other European indices, fuelled by strong quarterly results from ASML. Market sentiment was also helped by easing concern over the impact of DeepSeek on AI demand.

Interesting technical fact : Previous Resistance line acted as a perfect Support to underpin this renewed Rally.

Now the sky is the limit – 22.200/400 might be in reach.

-

AuthorSearch Results

© 2024 Global View