-

AuthorSearch Results

-

February 3, 2025 at 11:29 am #18932

In reply to: Forex Forum

LONDON (Reuters) – A look at the day ahead in U.S. and global markets by Alun John, EMEA breaking news correspondent, finance and markets.

Investors fled from stocks and rushed to dollars in Monday trading in Europe and Asia, as they scrambled to process the consequences of President Donald Trump putting larger-than-expected tariffs on top U.S. trading partners.

February 3, 2025 at 11:23 am #18930In reply to: Forex Forum

Trump tariffs trigger stocks slump, dollar rise on trade war fears

Key points:

· European futures drop as Canada, Mexico retaliate

· Trump slaps 25% tariffs on Canada, Mexico; 10% on China

· US dollar hits record high vs yuan

· Mexican peso, Canadian dollar tumble

· Hang Seng drops flat after holiday, mainland markets shut

February 3, 2025 at 10:55 am #18928In reply to: Forex Forum

February 3, 2025 at 10:30 am #18924In reply to: Forex Forum

EURUSD Daily

Jay’s sixth sense on Gaps materialised once again – over 100 pips down…

JP’s and mine wet dreams on future of EUR coming through as well…so what else one would want 😀

Support – 1.01800 – I was talking about that one for weeks, and probably seemed silly…so now you got silly…

Resistances : 1.02700, 1.03250 & 1.03550

February 3, 2025 at 10:12 am #18922

February 3, 2025 at 10:12 am #18922In reply to: Forex Forum

Using my platform as a HEATMAP shows

Tariffs -> Gaps => USD up, stocks down, bond yields down s

Those currencies of countries most affected, directly or indirectly, by Trump’s tariffs hit the hardest (red arrows)

JPY the outperformer, GBP second (weaker but not as much as EUR) as UK seems not to be on the tariff hit list

Watch for headlines as Trudeau (Canada) and Sheinbaum (Mexico) are due to speak with Trump today. Note tariffs go into effect on Tuesday.

February 3, 2025 at 1:01 am #18919In reply to: Forex Forum

EURUSD DAILY CHART –Next on the tariff hit liat

Big gap down puts 1.0177 back on the radar… if firmly broken, then there will be calls for parity although a pivotal 1.02 may be equally important in this regard.

Watch the headlines as this is news, not technically driven. Stay aware that Trump could announce EIU tariffs at any time, which should act as a cloud over the EUR. At a minimum, expect a limit on its upside as long as the opening week gap stays unfilled. ..

February 2, 2025 at 10:24 pm #18915In reply to: Forex Forum

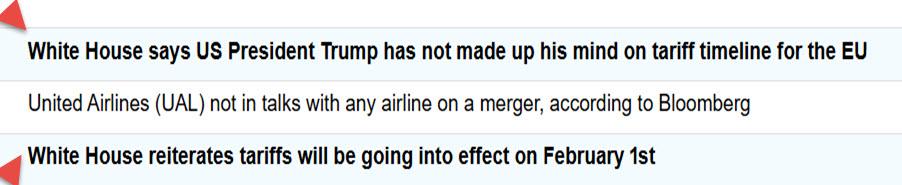

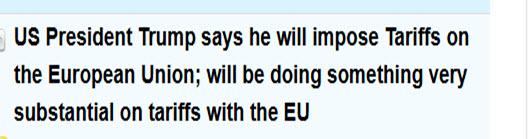

As I have been saying EU is on Trump’s tariff hit list.

Out earlier … another reason for a EURUSD gap

February 2, 2025 at 8:47 pm #18898

February 2, 2025 at 8:47 pm #18898In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Monday, the PMI manufacturing finals are expected to have no revisions from the flash across France, Germany, the Eurozone area, the United Kingdom and the United States. France is expected to post 45.3, Germany 44.1, Eurozone 46.1, the United Kingdom 48.2 and the United States 50.1.

Tuesday, US JOLTS are expected to have job openings pretty flat at 8.00 million in December.

Wednesday, the PMI composite is also expected to show no change in Germany. Germany’s composite is expected to be 50.1 and 52.5 for services while the United States PMI services is expected to be 52.8.

Thursday, the United Kingdom’s Bank of England is expected to announce a 25 basis point rate cut to 4.5 percent as the economy is stalling. Forecasters expect the BOE to signal more rate cuts ahead as the bank updates its economic forecasts.

Also, the United States productivity and costs first estimate for the fourth quarter is expected to show an annual gain of 1.8 percent compared with 2.2 percent in Q3. Unit labor costs are seen up 3.3 percent versus 0.8 percent in Q3.

Friday, Japan’s real household spending is forecast to post a fifth straight drop in December, down 0.3 percent on year, as flat growth in real wages amid elevated costs for food and other necessities continued squeezing consumers, following a 0.4 percent dip in November. Lower temperatures supported demand for winter clothing. Forecasts range widely from a 1.0 percent drop to a 1.5 percent gain. On the month, real average expenditures by households with two or more people are expected to fall 1.4 percent after edging up 0.4 percent in November, surging 2.9 percent in October and slumping 1.3 percent in September

Econoday

February 2, 2025 at 8:47 pm #18897In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Monday, the PMI manufacturing finals are expected to have no revisions from the flash across France, Germany, the Eurozone area, the United Kingdom and the United States. France is expected to post 45.3, Germany 44.1, Eurozone 46.1, the United Kingdom 48.2 and the United States 50.1.

Tuesday, US JOLTS are expected to have job openings pretty flat at 8.00 million in December.

Wednesday, the PMI composite is also expected to show no change in Germany. Germany’s composite is expected to be 50.1 and 52.5 for services while the United States PMI services is expected to be 52.8.

Thursday, the United Kingdom’s Bank of England is expected to announce a 25 basis point rate cut to 4.5 percent as the economy is stalling. Forecasters expect the BOE to signal more rate cuts ahead as the bank updates its economic forecasts.

Also, the United States productivity and costs first estimate for the fourth quarter is expected to show an annual gain of 1.8 percent compared with 2.2 percent in Q3. Unit labor costs are seen up 3.3 percent versus 0.8 percent in Q3.

Friday, Japan’s real household spending is forecast to post a fifth straight drop in December, down 0.3 percent on year, as flat growth in real wages amid elevated costs for food and other necessities continued squeezing consumers, following a 0.4 percent dip in November. Lower temperatures supported demand for winter clothing. Forecasts range widely from a 1.0 percent drop to a 1.5 percent gain. On the month, real average expenditures by households with two or more people are expected to fall 1.4 percent after edging up 0.4 percent in November, surging 2.9 percent in October and slumping 1.3 percent in September

Econoday

January 31, 2025 at 6:50 pm #18842In reply to: Forex Forum

January 31, 2025 at 6:39 pm #18840In reply to: Forex Forum

January 31, 2025 at 3:05 pm #18822In reply to: Forex Forum

January 31, 2025 at 2:55 pm #18820In reply to: Forex Forum

January 31, 2025 at 2:44 pm #18815In reply to: Forex Forum

EUR/USD is at 1.03754 and the market looks good for a sell. Mind you, in the past 2 hours market has been on a steady ascention. I have been expecting the decline until a perfect candle emerged. The long sell candle on the 15′ chart and the market took a tumble as expected. I will sell from its present position at 1.03754 and exit at 1.03623 for a small profit and then rest a while.

Mind you, taking few pips at a time ensures that you retain your capital and with good money Management skills you keep growing your Account. Just Trade 2-5% of your capital at most. Being consistent is the key.

I will make further analysis soon.THANKS,

TOPNINE.January 31, 2025 at 11:54 am #18804In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

As a hectic January ends, world markets continue to brace for U.S. import tariff rises as soon as this weekend – lifting the dollar in anticipation as interest rates in Europe tumble.

Morning Bid: Higher dollar braces for tariffs, Apple rallies

January 31, 2025 at 11:21 am #18802In reply to: Forex Forum

Newsquawk US Open

DXY mixed ahead of PCE, NQ bid with AAPL +3.5% pre-market, Bunds outperform on soft state CPIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain, NQ outperforms with AAPL +3.5% in the pre-market after strong growth in services segment.

USD mixed vs. peers ahead of core PCE; JPY underperforms.

Fixed benchmarks bounce on cool German State CPIs, which has led to outperformance in Bunds.

Crude pares initial premia awaiting updates from Trump regarding tariffs on Canada/Mexico oil.

January 31, 2025 at 11:21 am #18801In reply to: Forex Forum

Newsquawk US Open

DXY mixed ahead of PCE, NQ bid with AAPL +3.5% pre-market, Bunds outperform on soft state CPIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain, NQ outperforms with AAPL +3.5% in the pre-market after strong growth in services segment.

USD mixed vs. peers ahead of core PCE; JPY underperforms.

Fixed benchmarks bounce on cool German State CPIs, which has led to outperformance in Bunds.

Crude pares initial premia awaiting updates from Trump regarding tariffs on Canada/Mexico oil.

Try Newsquawk for 7 Days Free

January 31, 2025 at 10:55 am #18799In reply to: Forex Forum

EURGBP 4 HOIUR CHARTT – MONTH END

I have observed EURGBP being one of the more active flows at month end. So, keep an eye on this cross, not only by itself but its influence of EURUSD and GBPUSD, especially ahead of the 4PM London fix.

Charts show the retreat from a failure to reach .85 only sees minor support within .83-.84 so look for .8350 to be pivotal.

Note, looking ahead, the BOE is expected to cut rates by 25bps next week.

January 31, 2025 at 9:59 am #18797In reply to: Forex Forum

Using my platform as a HEATMAP

It’s month end and with stocks up this month, there should be some rebalancing of fx hedges. While I am not privy to such flows, given the surge in the DAX this month, rebalancing would see EUR selling and could account for some of the early EURUSD weakness.

Whatever the case, just be aware of month end erratic price action, especially heading into the 4PM London fix.

With US stocks up this month as well there could be some rebalancing of fx hedges here as well but so far any such flows have been adsorbed.

January 31, 2025 at 9:34 am #18796In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View